Learn about Municipal Bonds

There is still enormous demand for the debt of Puerto Rico however, for four reasons:

- With yields hovering around 4% for 10 year maturity dates, the yield is high compared to other states, which offer around 2%.

- Income from Puerto Rican Bonds is triple tax free regardless of what state you reside. While a New Yorker might have to pay state and city income taxes on a municipal bond issued in Texas, they do not on Puerto Rican debt. This feature greatly increases the tax-equivalent yield of Puerto Rican bonds.

- The constitution of Puerto Rico requires that debt holders be paid before any other expenditures. In theory, bondholders get precedence over paying government workers and pensioners. I don’t think this has every been tested in practice.

- There is a notion that the Federal government would step in to make payments, if the the government of Puerto Rico could not. However, when major municipal governments faced loan defaults in the past like the City of New York, no federal aid was forthcoming.

There have been a number of great articles written recently which dive deeper into the numbers which I have included links to at the bottom of this article. I would also like to highlight 3 facts that I think deserve particular attention from investors.

- Puerto Rico is running a budget deficit (the difference between revenues and expenditures) of around $1.5 billion dollars per year. The government disputes this number. They argue the number is closer to $600 Million, once you take out one time items like refinancing maturing debt.

- Puerto Rico has amassed about $50 billion in debt and forward obligations (pension liabilities) which is over 100% of the state’s Gross National Product (GNP). This is over 5 times the amount of most states. If every dollar of state government revenue went to repaying debt, and the state did have any expenses, it would take over 8 years to repay the debt, and that doesn’t even include interest costs.

- The economy of Puerto Rico is stagnant. They are not on path to eliminate the budget deficit which will continue to add to their debt burdon.

Puerto Rico is completely dependent on the continued willingness of investors to lend it more and more money every year. At some point, the appetite of investors will turn away from their bonds, which become increasingly more risky every year as their debt load increases. Until then, investors will enjoy after tax yields that are over twice as much as other Municipal bonds.

Relevant Articles on Puerto Rico’s Finances:

Cate Long, Governor Fortuna, and Puerto Rico’s Debt Saga

An Open Letter Puerto Rico Governor Fortuno

Rochester Funds Likes Puerto Rico Municipal Bonds

BlackRock Head of Municipal Bonds Says Avoid Puerto Rico

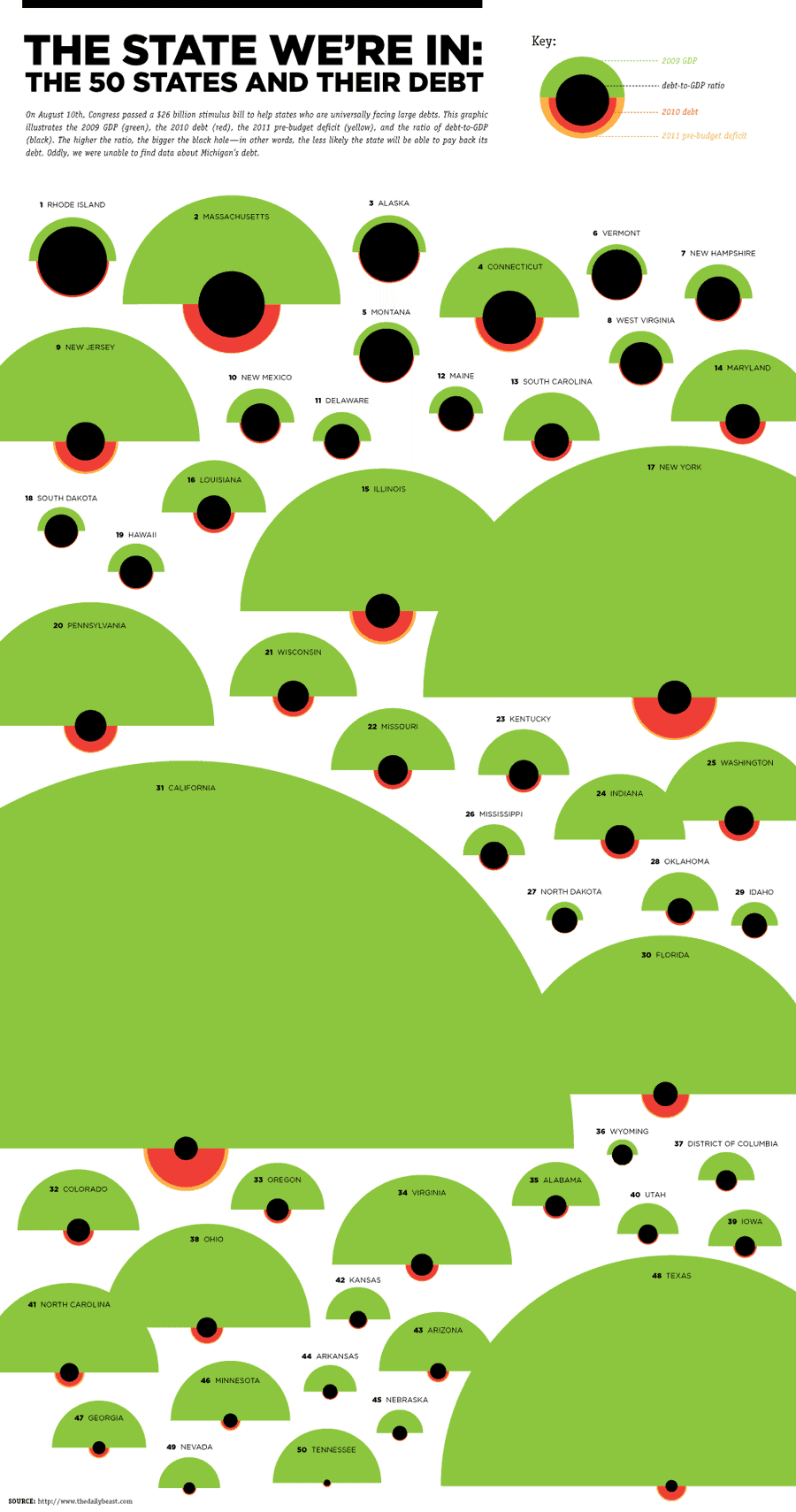

While slightly dated, the following infographic for Credit Loan gives a great sense of the relative debt burdens of states (not including PR) based on debt to GDP. Puerto Rico’s Debt to GDP is the neighborhood of 67%.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account