Investors are likely to think of the high-yield portion of the bond market as a small, specialized space reserved for only the very risk tolerant. While there certainly is elevated risk in loaning money to companies with not-so-stellar credit, junk bonds have become much more than a niche investment option. Current figures place the total value of domestic junk bonds somewhere between $1.5-2 trillion.

What Is A Junk Bond?

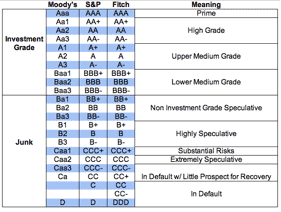

Technically speaking, a junk bond is a fixed-income security that has received a rating of Baa3 or less from Moody’s and/or BBB- from Standard & Poors, commonly referred to as S&P. Moody’s and S&P are the two main credit ratings agencies. Similar to stock analysts, the credit agencies analyze corporate balance sheets, cash flows, and business models in a attempt to ascertain relative ability to pay back obligations.

On a more general level, junk debt is any bond that is deemed to carry substantial risks. Of course when we look at the chart here, a bond rated BB+, while technically a junk bond, is only an upgrade away from being considered investment grade. On the flip side, a bond rated BBB- by S&P is only one step away from falling into the high-yield category.

Why Buy A Junk Bond?

Given the perception for a junk-rated company to run into financial difficulties and/or default on its debt, investors receive a higher rate of interest for taking on that risk. For instance if an investor is looking to buy a 10-year bond from an investment grade entity, it’s possible that they may receive only 2-4%, depending on the company’s debt that is selected. If, however, the same investor looks at junk-rated bonds with 10-year maturity, the reward jumps to a range of 4-7 percent.

So the main benefit to junk debt is the higher rate of interest that it offers. Of course this is no free lunch – high-yield issuers do default from time to time, which has varying consequences on an investment, none of which is generally positive.

And though the default rate continues to run at a multi-year low – Moody’s places it now below 2% – investors should not become complacent that that will continue infinitum. Indeed, if we look back to the financial crisis a little over five years past now, defaults spiked to the low double digits, which provided for a lot of sleepless nights for those that overweighted the space.

Strategy Session

If you’ve read this far, you still may think junk debt is right for a portion of your overall investment pie. But how much? Generally, I don’t think high-yield products, equity or fixed-income, should make up a large portion of a portfolio. Unless you are a seasoned credit analyst, are highly risk tolerant, or have reason to otherwise believe that junk bonds are a slam dunk, I think less than 10% allocation is in most cases prudent. For those that are risk intolerant, the allocation should even be lower, with perhaps a ceiling of 5 percent.

While I’m generally not a fan of bond funds, in the case of junk debt, I make an exception. Given the instant diversification and professional credit management that a fund affords, I think a high-yield fund is a solid, core idea for the average retail investor. There are many ETFs that track the junk market. For those looking for value, and/or a more aggressive way to play the space, there are leveraged closed-end funds trading at discounts to net asset value that can yield upwards of 10 percent.

Once you have a core position, then I think it may make sense to tippie-toe into individual issues. Still, I don’t think investors should get cute in high-yield land with a somewhat uncertain global and domestic macroeconomic situation still evolving. I would opine that things can turn on a dime in this environment, which would add fuel to being respectful, if not fearful, of junk risk.

Click here to learn more about best forex brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account