L Brands, the owner of Victoria’s Secret and Bath & Body Works, is expected to report a fall in revenues and a net loss when the fashion retailer reports next Wednesday as lockdowns continue to weigh on its outlets.

But despite falling revenues, L Brand shares are up sharply for the year as investors give the thumbs up to its plans to separate the group.

Victoria’s Secret owner: Second-quarter earnings estimate

Analysts surveyed by Refinitiv expect L Brands to post revenues of $2.2bn in the second quarter, down 23% from the same quarter in 2019. It is expected to post a net loss of $131m in the quarter, as compared to a net profit of $67m in the second quarter of 2019.

However, L Brands is expected to report better results than the first three months of the year as the lockdown restrictions eased in the second quarter. Its second-quarter revenues are expected to rise 34% as compared to the first quarter while the net loss is expected to narrow from $275m to $131m.

In May, L Brands announced a ‘go-forward strategy’. “As part of this strategy, the company remains committed to establishing Bath & Body Works as a pure-play public company and is taking the necessary steps to prepare the Victoria’s Secret Lingerie, Victoria’s Secret Beauty and PINK businesses to operate as a separate, standalone company,” said the company in a release.

New strategy

In July, L Brands provided an update on the new strategy and said that it expects to deliver annualized cost savings of $400m “through its profit improvement plan for Victoria’s Secret and actions to decentralize and streamline shared corporate and other functions.”

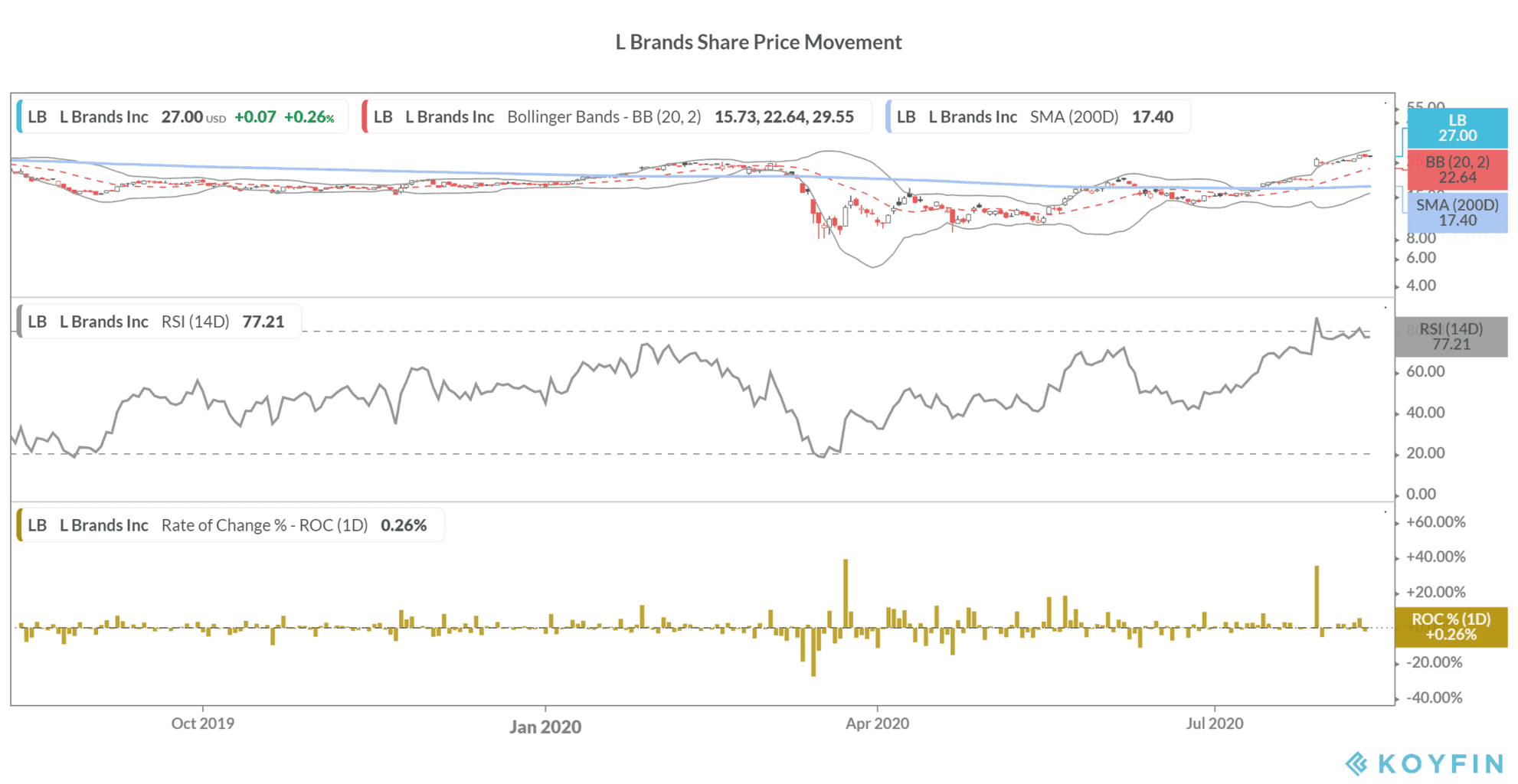

L Brand shares have been volatile this year. Shares hit a bottom of $8 per share in the March sell-off. However, they have bounced back sharply and are currently up almost 50% for the year. L Brand shares rose 63% in July alone and are currently up 10.6% in August.

While the coronavirus pandemic has taken a toll on L Bands’ earnings, investors have liked its business plans aim of unlocking value.

L Brands: Valuation and technicals

Meanwhile, after the recent surge, Wall Street analysts expect the stock to fall. L Brands has a mean consensus price target of $22.68, a discount of almost 16% over current prices.

Eight analysts surveyed by Refinitiv have a buy or higher rating on L Brands while 16 have given it a hold rating. The remaining three analysts have rated it as a sell or lower. The stock is valued at a 2021 price to earnings multiple of 17 times.

L Brands has a 14-day RSI (relative strength index) of 77.2 that signals that it is overbought. RSI values above 70 signal overbought levels while levels below 30 signal oversold positions.

You can trade in L Brands shares through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account