Saxo Bank Review for 2020 | Platform, Fees, Pros and Cons

Saxo Bank is a Denmark based investment bank that offers online trading services to both retail and institutional investors. Across more than 40,000 tradable instruments, the platform covers everything from traditional share dealing services, to CFDs, forex, futures, ETFs, and mutual funds.

Thinking about using Saxo Bank for your online trading needs? In this article, we cover the ins and outs of what the platform offers. This includes key metrics surrounding fees, spreads, commissions, tradable assets, regulation, and more.

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.What is Saxo Bank?

Launched in 1992, Saxo Bank is an investment bank based in Denmark. The firm specializes in online investment and trading services, with tens of thousands of financial instruments hosted at the platform. This includes more than 19,000 traditional equities across 37 different stock exchanges.

Short-term traders are also catered for, with the platform allowing you to buy and sell thousands of CFD and forex instruments. Saxo Bank is also behind a number of more sophisticated trading products like futures and options, so the platform is potentially suited for traders of all shapes and sizes.

Saxo Bank works pretty much like any other broker in the online trading space, insofar that you will be responsible for choosing your own investments. With that said, the platform also offers managed portfolios – meaning that an experienced team of Saxo Bank traders will buy and sell assets of your behalf. With no lock-in period on the managed accounts, you can withdraw your balance at any time.

In terms of safety, Saxo Bank is regulated by multiple licensing bodies. On top of the UK’s FCA, this also includes regulators in France, Switzerland, Italy, Singapore, Japan, and Australia. On the flip side, it is important to note that Saxo Bank has a minimum deposit amount of £500. As such, the platform might not be right for you if you are looking to start off with super-low stakes.

What are the Pros and Cons of Saxo Bank

Pros:

- More than 40,000 tradable assets

- Invest in traditional stocks and shares

- Short-term traders catered for via forex, CFDs, futures, and options

- Mutual funds supported for those without any prior investment experience

- Regulated by multiple licensing bodies

- No deposit or withdrawal fees

- Fully-fledged mobile app

Cons:

- A minimum deposit of £500

- The lowest commissions require a minimum account balance of £200,000

- No live chat facility

What can you Trade at Saxo Bank?

One of the main reasons that so many investors choose Saxo Bank is because of its extensive trading arena. In fact, the platform is now home to more than 40,000 financial instruments across a vast range of asset types. This ensures that both short-term and long-term investors are catered for.

Below we discuss some of the main asset classes that you can trade at Saxo Bank.

Share Dealing

If you’re looking for an online investment platform that gives you access to traditional stocks and shares, Saxo Bank has you covered. The broker is home to more than 19,000 equities across 37 different stock exchanges. This includes hundreds of companies listed on the London Stock Exchange, and virtually every publicly-listed firm on the New York Stock Exchange and NASDAQ.

Outside of the traditional UK/US markets, you’ll also have access to companies listed in Japan, Germany, Hong Kong, France, Italy, and South Africa. By purchasing stocks via the Saxo Bank platform, you will be entitled to dividends if and when they are distributed.

Bonds

For those of you looking to make long-term passive income in the form of fixed securities, Saxo Bank lists more than 5,000 bonds. This includes corporate bonds from Europe and the US, as well as a number of emerging nations. You can also purchase government bonds at highly competitive rates.

ETFs

Exchange-Traded Funds allow you to diversify across a group of assets via a single trade. Saxo Bank is home is more than 3,000 ETFs across several international markets. You will also have access to exchange-traded notes (ETNs) on alternative assets like Bitcoin and Ethereum, as well as exchange-traded commodities like gold and silver.

Managed Portfolios

If you have little to no experience of buying and selling assets on your accord, it might be worth considering the managed portfolio service offered by Saxo Bank. This is where you invest money into the platform and a fund manager chooses which investments to make on your behalf. Once you choose your preferred risk level, Saxo Bank will then create a highly diversified portfolio.

CFD and Forex Trading

If you’re looking to invest on a day trading or swing trading basis, Saxo Bank offers thousands of financial instruments that can be bought and sold at the click of a button. This includes asset classes such as stocks, indices, commodities, options, and bonds; all of which are packaged in the form of CFD trading instruments.

This then allows you to apply more sophisticated trades, such as applying leverage or short-selling We should also note that Saxo Bank has one of the most extensive forex departments. This stands at more than 182 currency pairs across the majors, minors, and exotics.

Futures and Options

Saxo Bank is also suitable for those of you that wish to trade futures and options. Regarding the former, this includes 200 futures markets across 23 international exchanges. And the latter, you’ll be able to trade over 1,200 options markets across 23 exchanges.

Payments at Saxo Bank

When it comes to getting money into your Saxo Bank account, the platform accepts most major debit and credit cards. This includes Visa, Visa Electron, MasterCard, and Maestro. Limits are extremely high when using your debit/credit card, as Saxo Bank permits deposits of $100,000 per transaction and $160,000 per month.

If you are using a debit or credit card issued in the EEA (which includes the UK), you will not need to pay any fees. If you are using a non-EEA card, then you will be liable for a deposit fee that can range from 0.51% to 2.86% depending on the country of issue.

Best of all, debit and credit card payments at Saxo Bank are credits instantly. There is no support for e-wallets like Paypal and Skrill, so the only other option is to use a bank account. This typically takes 2-5 working days for the platform to credit the funds.

In terms of account minimums, the Classic account requires a deposit of £500 or more. On top of free deposits, there is no fee applied to withdrawals. Saxo Bank accepts 26 major currencies in total, and no conversion fee applies if your deposit currency matches your account location. For example, if you are based in the UK and depositing with GBP, then no conversion will apply.

Fees, Spreads, and Commissions at Saxo Bank

The fees that you pay to trade at Saxo Bank can vary wildly. Not only is this determined by the asset you are buying or selling, but also the account type you are on. With that said, unless you looking to meet a minimum deposit of £200,000, you will put on to the Classic account.

With that in mind, all of the fees, spreads, and commissions outlined below are based on the Classic account.

Spreads

If you are looking to trade on a short-term basis, then you will need to make some considerations regarding the spread. Once again, the specific spread that you pay will depend on the CFD product you are trading. So, we’ve listed some examples below to illustrate whether or not Saxo Bank is competitive enough for your individual trading requirements.

- If you want to trade stock CFDs listed on major markets like the London Stock Exchange or NASDAQ, you won’t pay any spreads. Instead, you’ll be charged a trading commission – which we cover further down.

- Stock market indices like the S&P 500 come with a competitive spread of just 0.5 pips. The FTSE 100 is more expensive at 1 pip, and the Australia 200 at 1.50 pips.

- Some commodity CFDs at Saxo Bank come with competitive spreads. For example, US crude oil and gold come with a spread of 0.05 pips and 0.60 pips, respectively.

- At the other end of the spectrum, platinum and silver will cost you 1.7 and 3.5 pips, respectively.

- If you want to trade forex at Saxo Bank, the platform simply adds a mark-up on the wholesale rates it is able to get itself. For example, EUR/USD comes with a super-low mark-up of just 0.0002%.

Take note, the above examples are based on minimum spreads, meaning that they can increase during the trading day. You will likely find that the spreads are much higher outside of standard trading hours.

Trading Commissions

Much like the spread, Saxo Bank has a somewhat confusing commission policy which will vary depending on the asset class.

For example:

- If you want to trade stock CFDs, you will need to pay a trading commission. The US stock markets are charged at $0.02 per share, at a minimum of $10.

- Other stock markets come with a variable commission. For example, exchanges in the UK, Germany, and Norway come with a commission of 0.10%.

- Depending on the specific exchange, you will need to meet a minimum commission.

- If trading commodities or futures, commissions start from $1 per lot and $3 per lot on ETFs. Listed options are slightly cheaper at $0.85 per lot.

Share Dealing Charges

If you simply want to buy traditional stocks and shares, Saxo Bank will charge you 0.10% on most major exchanges. This stands at a minimum of £8 if buying companies listed in the UK. So, if you purchased £8,000 worth of Barclays stocks, this would equate to the minimum commission of £8.

But, if you instead purchased just £500 worth of stocks, this would still cost you £8. In real terms, this would amount to a commission of 1.6%, which is huge. With this in mind, although Saxo Bank is competitive at a commission of 0.1%, this is only the case if you are able to trade larger amounts.

If you’re more interested in buying US-listed stocks like Apple, Facebook, and Microsoft – then the commission structure operates differently. You’ll need to pay $0.02 per share, at a minimum of $10. This means that unless you are buying 500 individual shares, you will always pay $10. Again, this is somewhat problematic if you are looking to invest smaller amounts. For example, at a stock price of $122, buying 500 IBM shares would require a $61,000 investment.

Managed Portfolio Fees

If you’re looking to utilize the Saxo Bank managed portfolio service, the exact fee will depend on the type of basket that you wish to build. For example, while a defensive strategy in government securities and bonds will come with the lowest fee, an aggressive basket that targets the emerging market will be more costly. With that said, all managed portfolios come with an annual maintenance fee.

Saxo Bank notes that this averages 0.95%. This is actually more expensive than going direct with a fund provider like BlackRock or Vanguard. On the flip side, Saxo Bank does not implement a minimum redemption period, meaning that you can withdraw your funds out whenever you want. In terms of minimums, managed portfolios at Saxo Bank start at £10,000, rising up to $30,000.

Inactivity Fee

Saxo Bank has a strict inactivity fee that will kick in if you do not place a single trade in the previous calendar quarter. For example, if you don’t place a trade in April, May, and June then £25 will be deducted from your account. This is unlikely to be the case if you have long-term holdings such as traditional stocks, or a managed portfolio. With that said, you are best to check this with Saxo Bank, as the platform’s inactivity fee policy varies depending on your country of residence.

Leverage and Margin Trading

Saxo Bank offers fully-fledged margin accounts for those of you with a higher appetite for risk. Although leverage of up to as 200:1 is offered, this is only for professional traders. If you are classed as a retail client – then you will be capped by the limits imposed by the European Securities and Markets Authority (ESMA). This might not be the case for UK residents once a trade deal on Brexit is eventually reached, but for the time being ESMA regulations still apply.

As such, you’ll be capped by the following leverage limits at Saxo Bank:

- 30:1: major FX pairs

- 20:1: non-major FX pairs, gold and major indices

- 10:1: non-gold commodities and non-major equity indices

- 5:1: stocks

- 2:1: cryptocurrencies

Unless you can provide that you are a professional client (prior experience, minimum net worth, etc.), then the above limits will apply on your Saxo Bank margin account.

Which Regulators Govern Saxo Bank Markets?

As a fully licensed investment bank, it will come as no surprise to learn that Saxo Bank is an extremely safe online broker to use. In fact, the platform is in possession of brokerage licenses from several states and regions. If you’re from the UK, you will be protected by the Financial Conduct Authority (FCA).

UK – FCA & FSCS

Not only does this force Saxo Bank to keep your funds in segregated bank accounts, but you will also be protected by the Financial Services Compensation Scheme (FSCS). This means that was Saxo Bank to go bankrupt, investments of upto £85,000 per person would be covered.

Europe – EDIS

If you based in a European country other than France, Switzerland, or Italy, you will fall within the remit of the European Deposit Insurance Scheme (EDIS). This means that were Saxo Bank to go under, your funds would be protected up to the first €100,000.

France – Bank of France

French residents using Saxo Bank benefit from the protections of the Bank of France. This protects your investments up to the first €100,000 in the event of a collapse.

Italy – CONSOB

Italian traders at Saxo Bank are covered from the Commissione Nazionale per le Società e la Borsa (CONSOB). This protects your investments up to the first €100,000 in the event of a collapse.

Switzerland – Swiss Federal Banking Commission

Swiss traders are covered by the Swiss Federal Banking Commission, which protects the first 100,000 francs.

Other Licensing Bodies

If you do not fall within the remit of the above regions, you will not benefit from a deposit protection scheme. With that said, Saxo Bank does hold a number of other regulatory licenses, which in itself, comes with several safeguards.

This includes:

- Monetary Authority of Singapore

- Japanese Financial Services Agency

- Securities and Futures Commission in Hong Kong

- Australian Securities and Investments Commission

Getting Started with Saxo Bank

Like all online trading platforms, you will need to go through an account opening process at Saxo Bank. Not only does this require some personal information from you, but you’ll also need to verify your identity.

Below we outline the step-by-step process that you will need to take to get started with Saxo Bank today.

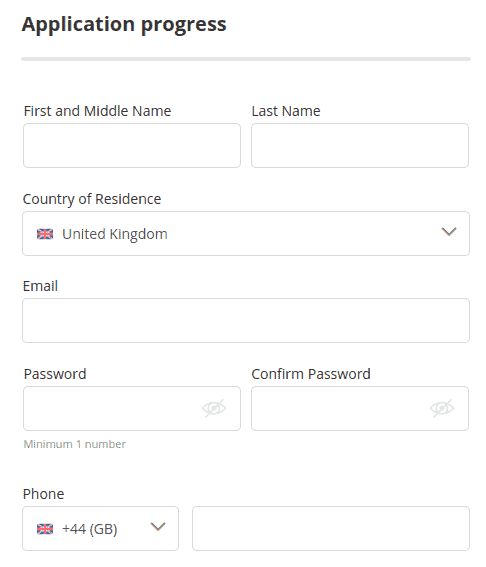

Step 1: Open an Account

You will first need to visit the Saxo Bank homepage and elect to open an account. Initially, you’ll need to supply your first and last name, country of residence, email address, and a strong password. After confirming your email address, you will need to provide some additional information about who you are.

This includes your:

- Home address

- Date of birth

- National insurance number (or tax identification number)

- Telephone number

After that, Saxo Bank will need to collect some information about your financial standing. This is to ensure that you are suitable for an investment account at the platform and that you do not attempt to trade more than you can afford. As such, you’ll need to enter your net worth, annual income, and historical trading experience.

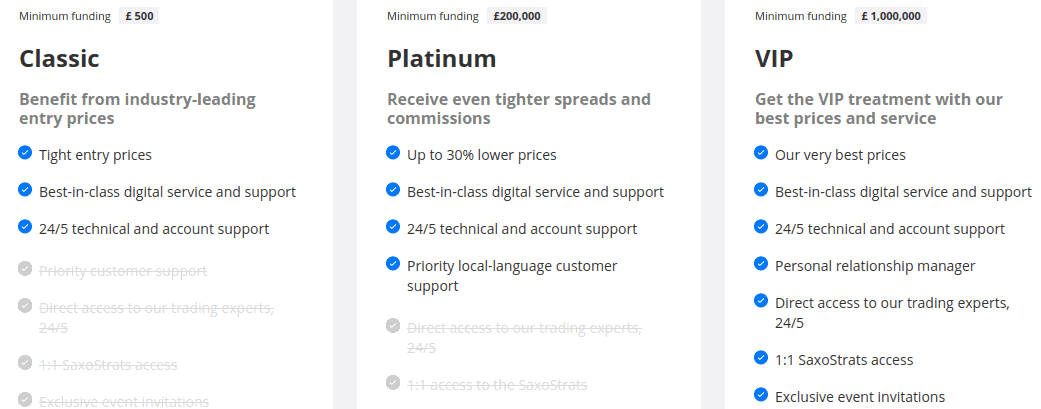

Step 2: Choose Account Type

Saxo Bank offers three account types. Unless you are looking to deposit £200,000, you’ll need to opt for the Classic account. This comes with a minimum funding amount of £500. The Platinum and VIP accounts come with a minimum deposit of £200,000 and £1 million, respectively.

Step 3: Upload ID and Proof of Residency

Saxo Bank is a heavily regulated investment platform, so it is required to ask for some identity documents from you. This includes a valid government-issued ID, which is either a passport, driver’s license, or national identity card.

You will also need to prove your residency status. This requires two separate documents from the following options:

- Bank statement

- Tax statement

- Utility bill

- Statement from local mayor office or municipality

Unlike new-age investment platforms like eToro or Robinhood, Saxo Bank will need to validate your documents manually. This means that you might need to wait 1-2 working days before your account is activated.

Step 4: Fund Your Account

Once your account has been verified by Saxo Bank, you can then deposit some funds. As noted earlier, you can choose from a debit/credit card for an instant deposit or a bank account. If opting for the latter, expect to wait 3-5 working days before the funds who in your account.

Step 5: Trade

Once your deposit has been credited, you can then make an investment. You’ll have 40,000 financial instruments to choose from across a wide range of asset classes. Once you find an asset that you wish to trade, you will need to set up an order.

This works much the same as any other investment platform, meaning that you will need to choose from a buy/sell order, and enter your stake. You’ll also be asked to choose from a market/limit order, and whether you wish to set up a stop-loss and/or take-profit order.

Platform Features

So now that you know how to get started with Saxo Bank, we are now going to discuss some of the platform’s main features and benefits.

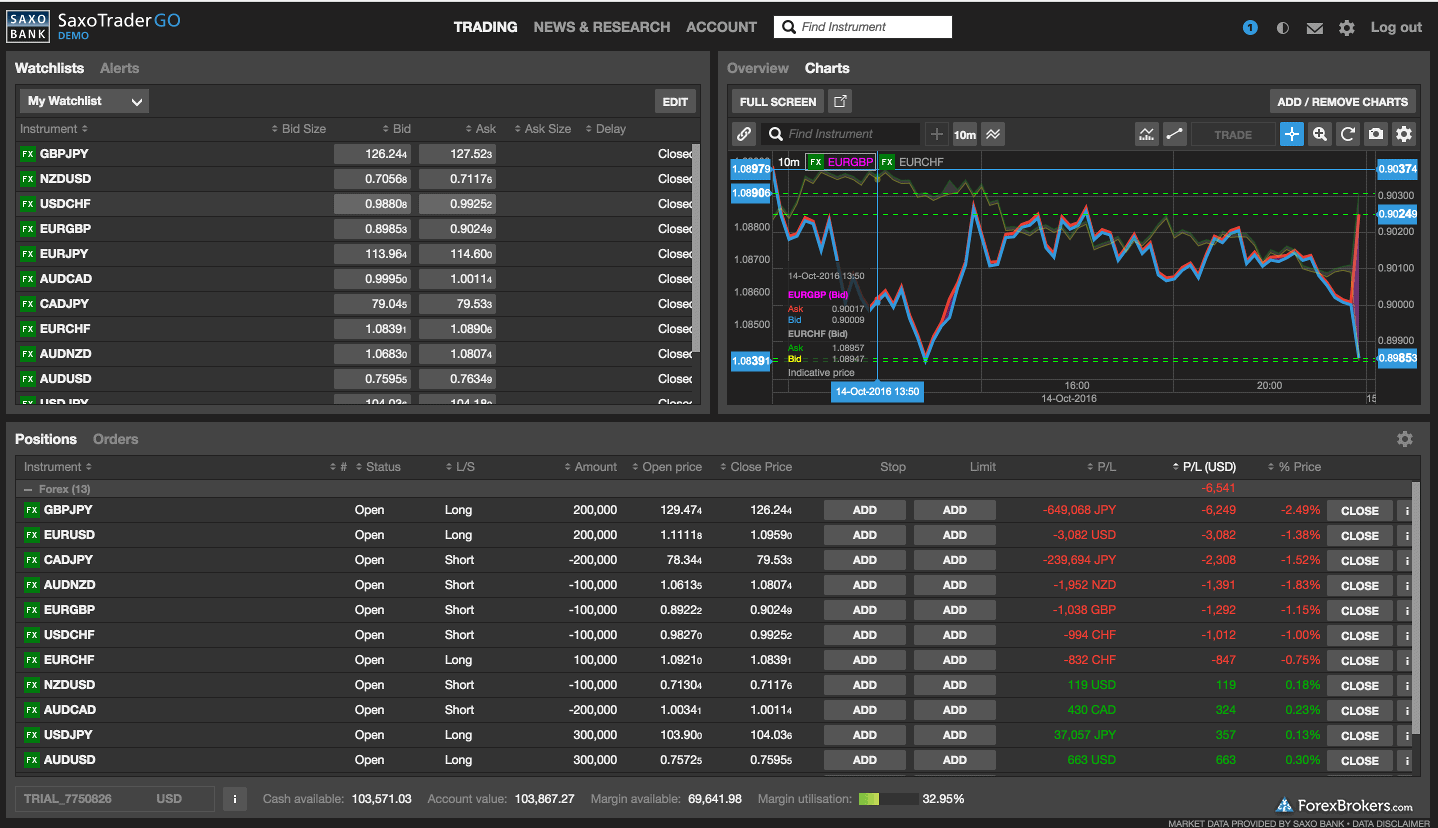

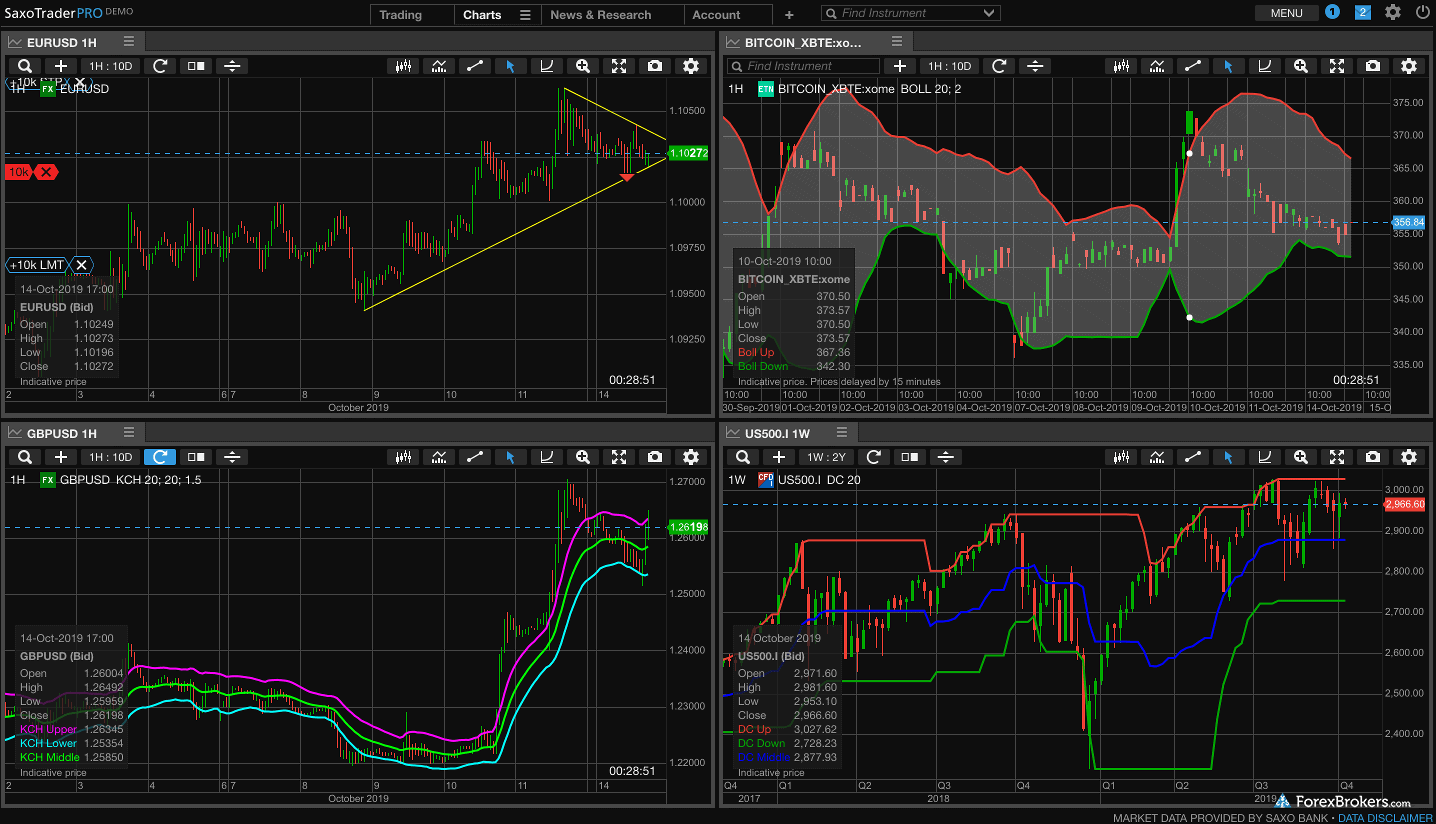

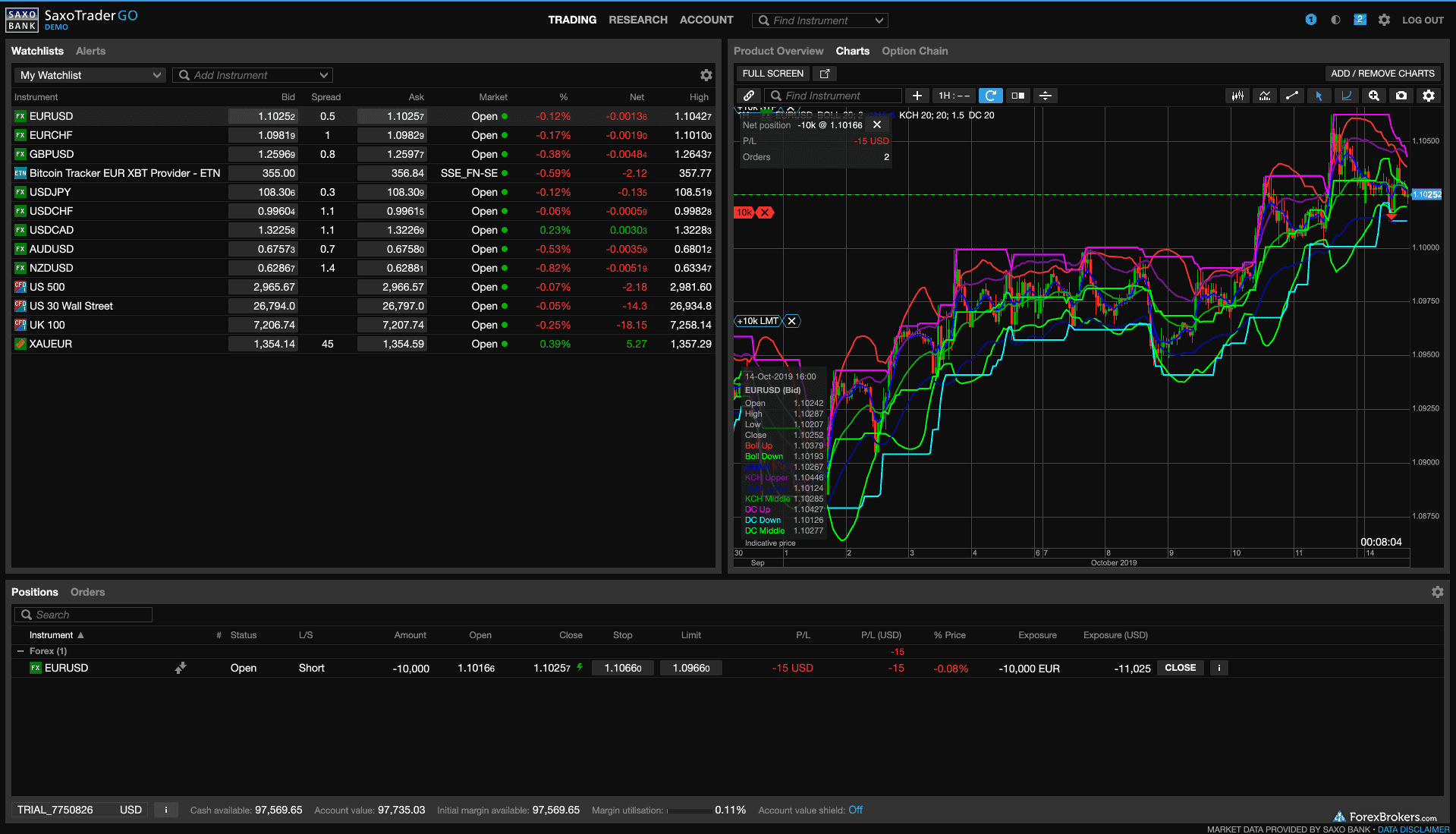

Trading Platforms

Saxo Bank utilizes its own in-house trading platform that was built from the ground-up. As such, there is no support for third-party platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Known as SaxoTraderGO, the platform can be accessed from your standard desktop web browser. Although SaxoTraderGO comes with a plethora of trading features, the broker also offers a more advanced platform, SaxoTraderPRO.

This allows you to fully customize the platform to meet your individual trading requirements. In fact, you’ll also be able to set up algorithmic orders. as well as options charts. The SaxoTraderPRO also allows you to download historical reports for accounting purposes, so this is the option to go with if you are looking to trade on a full-time basis.

Mobile Trading

If you have a tendency to trade on the move, you’ll be pleased to know that Saxo Bank offers a fully-fledged mobile app. The application is available on both iOS and Android devices. We found that most account features available on the main desktop platform are also supported on the app.

This includes the ability to deposit and withdraw funds, check your portfolio, and place orders. You can also set up mobile alerts and notifications. In terms of security, the Saxo Bank mobile app allows you to set up biometric authentication.

Although the mobile trading platform comes with all of the same bells and whistles as the desktop site, it might not be suitable for advanced order placements. This is because the platform isn’t overly user-friendly, especially when you are trying to perform technical analysis.

Order Types

Regardless of whether you decide to trade via the main desktop platform or mobile app, you will have access to a wide range of order types. In terms of the basics, this includes the usual offering of limit, stop-limit, and trailing orders. For those of you looking to place more sophisticated traders, Saxo Bank supports orders in the form of one-cancels-the-other (OCO), good-till-cancelled (GTC), immediate or cancel (IOC), and good-till-date (GTD).

Research

Saxo Bank excels in the research department across both the technicals and fundamentals. The SaxoTraderGO and SaxoTraderPRO platforms come jam-packed with advanced chart reading tools, which covers dozens of technical indicators. In terms of the fundamentals, Saxo Bank provides an in-depth analysis of a range of asset classes.

This is especially the case with blue-chip stocks listed on the US markets. On the flip side, you will need to subscribe to get access to the full suite of fundamental data, which is somewhat unusual for an online broker. We also like the trading ideas that Saxo Bank publishes. Although this shouldn’t be taken as financial advice, it does at the very least give you a number of angles to consider.

Alerts and Notifications

Saxo Bank allows you to set up a range of customized alerts, which you can receive via your mobile phone or email. This includes pricing alerts, and crucially, a notification when your positions are opened and closed. This is handy in the event you have orders live in the market, and you want to know when they are executed. You can also set up alerts on portfolio changes and margin calls. You’ll need to install the app if you want the alerts to pop-up on your mobile device.

Demo Account and Education

If you’re used to conventional trading platforms like MT4/MT5 or you simply have never traded before, it might ve worth starting off with the Saxo Bank demo account. The platform works in exactly the same way as the main trading arena, albeit, you will be buying and selling assets with paper money.

To complement the demo account facility, Saxo Bank also offers a full range of educational materials. This includes handy step-by-step guides on how to place orders at the platform, as well as explainers on key financial terms. The broker also offers free webinars, which gives you the opportunity to post questions to an experienced in-house trader.

Customer Support

The Saxo Bank help centre is highly extensive, with most account queries and potential issues covered. However, if you need to speak with an agent directly, you can do so via the phone. Existing customers based in the UK should call 0207 151 2000. Local toll numbers are also available for other countries.

Alternatively, you can email the customer service team at [email protected]. Unfortunately, Saxo Bank does not offer a live chat facility. In terms of opening hours, the support team works Monday to Friday, between 9 am and 5.30 pm.

If you have a Professional account, you will get your very own account manager. Bear in mind that this requires a £200,000 minimum deposit.

Conclusion

In summary, Saxo Markets offers one of the most extensive trading platforms in the online brokerage space. Across 40,000 financial instruments, you’ll have access to virtually every asset class imaginable. Whether you’re looking to buy traditional stocks and ETFs, or trade CFDs, forex, or futures, Saxo Bank likely has you covered. The broker is in most cases competitively priced, and its proprietary in-house trading platform comes highly rated.

Similarly, we also like the platform’s research, analysis, and educational offering, which covers traders of all shapes and sizes. With that being said, Saxo Bank is probably more suited for those of you that are looking to trade larger volumes. Not only will you need to meet a £500 minimum deposit threshold, but you’ll likely run into a minimum commission fee if you attempt to trade with small amounts.

Other than that, Saxo Bank ticks most boxes in the online investment arena, especially in terms of regulation and safety.

Our Recommended Stock Broker - 0% Fees

Our Rating

- 0% Commission on Stocks

- Trade Stocks, Forex, Crypto and more

- Only $200 Minimum Deposit

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

How much does it cost to trade at Saxo Bank?

Saxo Bank has a somewhat complex fee structure, as your trading charges will depend on a number on variables. This includes the type of account you are on, and the specific asset class you are looking to trade. You may or may not need to pay trading commission, and some assets come without a spread. All in all, although trading fees at Saxo Bank are largely competitive, this often isn’t the case if you are looking to trade smaller amounts.

Is Saxo Bank regulated?

Yes, Saxo Bank holds regulatory licenses in several jurisdictions. On top of the UK’s FCA, this includes bodies in France, Japan, Switzerland, Australia, Singapore, and the wider European Union.

Do I need to upload ID to trade at Saxo Bank?

Yes, the KYC (Know Your Customer) process at Saxo Bank is very stringent. Not only will you need to upload a vopy of your government-issued ID, but also two documents that confirm your residency status. This can include a bank statement, tax statement, or utility bill

What payment methods can I use at Saxo Bank?

Saxo Bank supports debit/credit cards or a bank wire. We would suggest opting for the former, as your deposit will be credited instantly.

What trading platforms does Saxo Bank offer?

Saxo Bank has built its own in-house trading software that is available via your standard web browser, or through the iOS/Android mobile app.

See Our Full Range Of Forex Brokers Resources – Brokers A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Launched in 1992, Saxo Bank is an investment bank based in Denmark. The firm specializes in online investment and trading services, with tens of thousands of financial instruments hosted at the platform. This includes more than 19,000 traditional equities across 37 different stock exchanges.

Launched in 1992, Saxo Bank is an investment bank based in Denmark. The firm specializes in online investment and trading services, with tens of thousands of financial instruments hosted at the platform. This includes more than 19,000 traditional equities across 37 different stock exchanges.