Firstrade Stock Broker Review 2021

Are you on the lookout for a stock broker you can begin your trading adventure with?

Firstrade is a low-fee brokerage firm that offers a wide array of assets like stocks, ETFs, mutual funds, options, etc. for aspiring traders. It also offers low-risk trade opportunities with maximum security for traders.

Read on to have a firm grasp of the services offered by Firstrade, its trading platform’s specific features as well as the fees it charges.

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.What is Firstrade?

Founded in 1985 in Queens, New York, Firstrade was first known as First Flushing Securities. It aims to satisfy the needs of its local community, particularly Chinese immigrants, by offering discounted brokerage services.

Founded in 1985 in Queens, New York, Firstrade was first known as First Flushing Securities. It aims to satisfy the needs of its local community, particularly Chinese immigrants, by offering discounted brokerage services.Firstrade boasts an aesthetic trading platform that encompasses all investment needs – stocks, options, ETFs, mutual funds and fixed income products. It complements these with an incredible list of features and amazing customer service.

Many competitors have withered off, but Firstrade continues to improve, earning notable recognition from major industry publications like Forbes, Barrons, and SmartMoney.

Pros and Cons of using Firstrade

Pros:

- Free stock, exchange-traded funds, options and mutual fund trading

- Productive research tools

- Low trading fees

- No deposit fee

- No minimum deposits

- High-level investor protection

- Educational videos

- Regulated by top-tier regulators

- SIPC protection of up to $500,000

Cons:

- Slow account opening

- No credit/debit deposit option

- Single markets (US)

- No demo account

- No two-step account verification

- No negative balance protection

- High wire transfer fee

How does Firstrade Work?

Firstrade’s philosophy has long been to provide discounted brokerage services and security of assets to traders and it has managed to do both. It offers a wide range of investment products and discount brokerage services.

When you have an account with this firm, you gain access to powerful research tools that will help you build a solid investment portfolio. You will know about new IPOs, get access to stock reports, real-time streaming watchlists, economic indicators, rating changes, splits and more.

Existing primarily as a stock broker, it also provides different investment opportunities that can help you leverage your investments with competitive margins. Without extra charges, you can also have your dividends automatically reinvested to maximize your earnings.

With Firstrade, you can choose an account that works for you from a pool of different brokerage accounts. When you open an account here, you get to trade stocks, mutual funds, ETFs and options for free. This is a feature unique to only a handful of providers.

If you already have an account with another stock broker, Firstrade charge zero fees when you make a switch. Even more remarkable is the fact that if your existing stock broker charges you for switching, Firstrade will send you a refund of up to $200.

Getting Started on Firstrade

Opening an account with Firstrade is pretty straightforward for US residents.

You can choose from its list an account that meets your needs, whether it is an investment account or a retirement account. You don’t need to make any deposit or pay any fee during the account opening process. Since it is a member of the Securities Investor Protection Corporation (SIPC), up to $500,000 worth of your assets are covered after account opening.

If you are not a resident of the United States, you can still open accounts provided that your country of residence is allowed. Foreign residents seeking to open an account must submit a W8-BEN form, sign an Online Service Agreement and make all deposits in US Dollars. However, residents of Canada cannot open an account with Firstrade at this time.

To transfer your account to Firstrade, you will need to provide the name and account number of your existing brokerage firm. Additionally, it requires you to provide an existing account with the stock broker that matches the account you wish to have with the Firstrade.

Tradable Assets on Firstrade

- ETFs

- Funds

- Bonds

- Options

Types of Accounts on Firstrade

Regular Investing Account

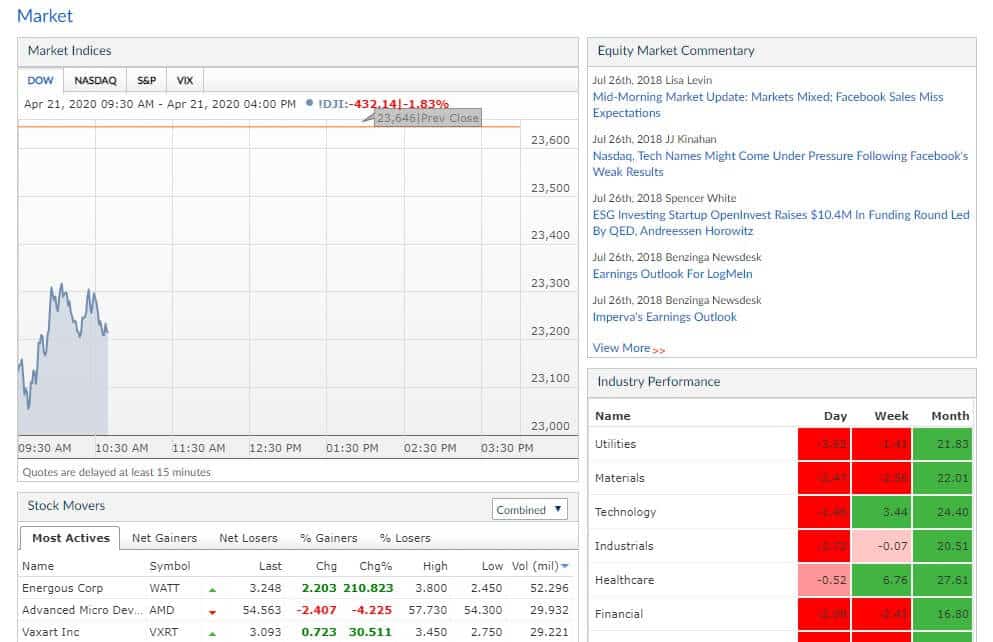

This is the regular or typical investment or trading account available on most brokerage platforms. With this account, you can monitor and review real-time market movements in all the indices. These include the Dow Jones Industrial Average, the S&P 500 and NASDAQ. This account allows you to monitor equities, their losses and gains.The user dashboard poses a sleek design that enables you to perform multiple functions without interrupting basic functions.

IRA Retirement Account

A major highlight of this account is that it helps you save taxes, and with an IRA, you can accumulate retirement savings. When you open this account you get to choose from different plans that meet your needs. The available plans are:- Individual Retirement Account

Under this type of account, you can grow your income on a tax-deferred basis. In order to do so, you will use an Individual Retirement Arrangement (IRA) created by the US government to enable US workers to save up to $6,000. The account can run on either of the available IRAs, and these include Traditional, Roth and Rollover IRA.

- Small Business Retirement Plans

When you open an IRA Retirement account with Firstrade, you have the option of running the account on this plan as a small business owner. The plan offers a tax advantage for the self-employed and also small businesses. This advantage is enabled by either the Simplified Employee Pension (SEP) IRA or the Savings Incentive Match Plan for Employees (SIMPLE) IRA.

On the IRA Retirement account, you get access to vital educational articles on investing, retirement savings, taxation and budgeting. You will learn how to switch investment strategies depending on different tax liabilities.

International Accounts

Specifically designed for foreign residents that intend to invest in the US market, this account provides you with the opportunity to tap into the riches in the US markets. Additional benefits include tax breaks for foreign investors, low commission costs and added insurance.Business Accounts

The Firstrade business account is designed to meet the investment needs of corporate organizations. So, regardless of the business you operate, you can enjoy the benefits of the account by choosing from Investment Club, Partnership, Sole Proprietorship Corporate LLC accounts.ESA Education Planning

If you intend to invest in your child’s future by saving for their education, this plan is for you. It helps you save by offering tax-free deposits and withdrawals provided that you meet certain government requirements. It can either run on Coverdell or Custodial accounts.Custodial Account

A custodial account exists under the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA) depending on your state of residence. Despite the difference in nomenclature, they serve the same purpose. When you open a custodial account for a minor with Firstrade, you will be able to manage assets and trade stocks, mutual funds and ETFs on their behalf. It also comes with a gift tax advantage.Firstrade Cash Management Account

The cash management account offers unparalleled flexibility with regards to cash management and stock trading. With this account, you will be able to access your funds for personal or business expenses and carry out trades. It comes with travel/accident insurance and personalized service to match your financial needs while ensuring you have a great experience.Features of Firstrade

Trading Platforms

- Online Platform

On the web platform, you can conveniently carry out trades, easily monitor the market movements and keep track of activities on your account. The trading platform’s user dashboard is designed to make trading and research a seamless activity.

- Mobile Platform

With smartphones becoming a sensation in this digital age, Firstrade continues to take advantage of modern-day technology to offer the best experience.

Traders who have an account here can trade stocks with an app available on iOS and Android operating systems. Possessing a sophisticated design with a responsive user interface, the app makes it possible for you to trade on the go with extra layers of security.

Broker Assisted Trading

Unforeseen challenges might make it impossible for you to place trade orders through the web or mobile platforms. This is why Firstrade provides traders with the opportunity to directly place orders by contacting the firm’s representatives.

With this incredible service, you can carry out rewarding trades and will no longer lose out on beneficial trades that will benefit your financial goals and plans.

Extended Hours Trading

This is one of the amazing features that rank Firstrade as a leading stockbroker in a competitive industry. With the extended hours of trading, you will be able to trade stocks before the opening bell and after the closing bell. Thanks to this feature, you get the chance to take action based on new information regardless of whether the market is closed or open.

This can be greatly beneficial as decisions capable of making a significant positive difference can come when the market is closed.

Account Protection Guarantee

Safeguarding your assets is a critical factor in making sure you are able to achieve your personal and financial goals. This is why Firstrade, through the Securities Investor Protection Corporation (SIPC), gives your assets reliable and worthy protection. The firm also provides an extra layer of protection with Apex Clearing Corp.

Free Trading

When you have an account with Firstrade, you get to enjoy free trading. Online orders of stocks, options or mutual fund trades are free. There are no commissions. Thus, you get to keep more money and will be able to reinvest so you can accumulate more gains.

Who does Firstrade Clear Through?

There is a common practice in the industry where clearing firms lend stocks to other financial institutions in the industry. The aim of the practice is to either aid short selling or meet other settlement purposes or collateral requirements.

It gives you the chance to earn more when you lend certain stocks to Apex Clearing Corp, which is Firstrade’s clearing firm. As a result, you will be eligible to receive daily interests, which are paid to you on a monthly basis based on annualized rates.

It serves as another means to earn more if you are looking to maximize your income without any risk.

Real-time Streamline

With the real-time streaming feature, you can live stream indices, including the Dow Jones, S&P 500 and NASDAQ. The feature also enables you to stream real-time quotes, auto-sync platforms and view up to 50 symbols on a single page.

With this tool, you will not only have access to information that can impact your trade decisions, but you will also get them in time. By virtue of this feature, you will no doubt be able to make decisions that will benefit your investments and your portfolio.

Firstrade Fees

Firstrade has low trading fees which set it apart from other brokerage firms in the industry. These low fees are great if you are new to trading and have a tight budget or if you trade frequently. Below is a breakdown of its trading fees.

Stocks and ETFs:

Firstrade charges $0 in commission fees for stocks and ETFs. However, broker-assisted trades come with a $19.95 charge.

Options:

When you trade options on Firstrade, you will pay $0 for commission or contract fee, while broker-assisted trades come with a $19.95 + $0.50 per contract charge. Exercise and assignment fee is also $0.

Mutual Funds:

If you decide to trade mutual funds, Load Funds, No-Load Funds and No Transaction Fee (NTF) Funds are offered for free.

Fixed Income:

Fees for Treasury Bills, Notes & Bonds, Municipal Bonds, Agency Bonds, Zeros & Strips and Secondary Market CDs are charged on a ‘Net Yield Basis’. This means the bonds are subject to the markup or a markdown, as Firstrade acts as a principal. $30 is charged for Primary Market CDs.

Deposits, Withdrawals and Supported Payment Methods

Firstrade requires all deposits to be made in US Dollar (USD), and this applies to all account owners whether local or foreign.

There are four methods for depositing funds into your Firstrade account. Unfortunately, it does not offer a debit/credit card depositing method at this time, though it compensates for that with the other available options. The following are the available deposit methods.

- Electronic Funding – With the ACH electronic funds transfer system you can electronically make deposits from your bank account to your account on the site. You will be required to set up your ACH profile.

- Wire Funds to Firstrade – You can fund your account by initiating a wire transfer. However, the service does not accept third-party wire transfers.

- Account Transfer – Using this transfer method, you can move assets between brokerage firms and even accounts on the platform. Funding an account has never been easier, as you can make deposits from another brokerage firm to your account provided the accounts match. You can also transfer funds from one Firstrade account to another.

- Checks – All checks should be payable in US Dollar. The checks must be redeemed through a bank in the United States.

There is no minimum deposit set for brokerage accounts. However, if you intend to open a margin account or day trading account, you will be required to make a minimum deposit of $2,000 and $25,000 respectively.

When withdrawing from your account, you will not be charged any fee for withdrawals regardless of the frequency. Account owners can only make withdrawals through bank transfers.

Research and Education

Firstrade has research tools that are very productive and educative materials readily available when you open an account with the brokerage firm. These tools and materials are available on all of the platforms including its web and mobile app.

Also, Firstrade produces a series of video discussions that host independent market analysts, who exchange great ideas and share thoughts on different topics. Discussions are based on the latest market reports, trending industry and economic activities and events. The discussions take place daily, weekly and quarterly.

With the frequently updated calendar, you will get notifications on earnings announcements, dividends, rating changes and splits. You will also get information about IPOs and economic indicators which can greatly impact your investments.

The platform has a tool for screening investment choices. It’s called the Advanced Screener and by using this tool, it is easy to narrow down investment options using filters like large cap growth stocks, bargain basement small caps and high yielding quality stocks. These options allow you to redefine your investment options according to your needs.

It also has market 5-star ratings by MorningStar and comprehensive reports from market analysts. Market performance charts across different sectors are also available to help you make informed investment choices. Firstrade’s Market Heatmap also enables account owners to visualize bullish and bearish stocks.

How Safe is Firstrade?

As an industry player that has existed for decades, Firstrade has vast experience in security and defending orchestrated attacks. It protects your investment information, personal data and assets by regularly conducting system checks to ensure the platforms are not susceptible to attacks.

Moreover, it educates account owners on how to web-proof themselves and it has a tool for accessing cyber-attack vulnerabilities. The service is also regulated by to- tier regulators like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority, Inc. (FINRA). These regulators ensure stock brokers play fair and abide by rules designed to protect traders’ interests and ensure their assets are well-protected.

As a member of the Security Investor Protection Corporation (SIPC), Firstrade has taken extra measures to ensure that your assets are secured. When you open an account with Firstrade, you enjoy the protection of your assets worth up to $500,000 and cash protection that amounts to $250,000. Apex Clearing Corp provides additional protection for your assets.

Customer Support

The Firstrade customer service team can be contacted via several media including email, telephone, fax, live chat and mail. The following are the contact details:

Telephone:

U.S. Toll Free: 1-800-869-8800

Overseas: 1-718-961-6600 (Mon – Fri, 8:00am – 6:00pm ET)

Email – [email protected]

FAX – 1-718-961-3919

The customer service team is incredibly knowledgeable and has built a reputation for providing answers and finding solutions to customer challenges. You can also access the live chat feature on the customer service page.

Firstrade Review – The Verdict

Firstrade is a firm that has been in existence for decades and has been offering discounted brokerage services since its inception. As a firm regulated by top-tier regulators, you are assured of the security of your assets. The firm offers free stock, mutual fund, ETF and options trading and it doesn’t charge you for account opening or inactivity.

It doesn’t provide many options for withdrawing funds from your account, as traders can only withdraw using the bank transfer option. However, the brokerage firm offers a wide array of options for funding trading accounts.

There are lots of tools and materials available on the platform to help you make the best investment decisions. The firm has a secure platform that makes trading easy, and to cap it all, it has amazing customer service to support and assist account owners.

Lastly, Firstrade is a discount brokerage firm that boasts an extra layer of security and support for account owners. It is a great brokerage firm that you should definitely check out today.

Glossary of Trading Platform Terms

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Does Firstrade offer account protection?

As a member of the investor scheme SIPC, account owners have protections for their assets. The protection covers up to $500,000 and $250,000 in cash.

What is the minimum amount required for opening a Firstrade account?

Firstrade does not require any amount or fee to open an account.

What are the fees for trading stocks, mutual funds, options and ETFs?

Unlike other brokerage firms, Firstrade offers free stock, mutual fund, ETFs and options trading.

Can a non-US resident open an account with Firstrade?

Yes. As a foreign resident, you can open an account with Firstrade. Unfortunately, residents of Canada cannot open accounts at this time.

What are the available platforms for trading stocks?

You can place orders and modify orders using the web platform or the mobile app. Brokers in the firm can also assist you if you are unable to use other platforms.

See Our Full Range Of Broker Reviews – Broker Reviews A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up