Fintech company Square, whose stock has rallied sharply over the last year, was trading lower in US premarket trading today after the company released its fourth quarter earnings that showed a mixed performance.

Square released its fourth quarter earnings yesterday after the markets closed. The company’s revenues rose 141% in the quarter to $3.16 billion. However, despite the stellar growth they fell slightly short of what analyst were expecting. In the full year 2020, the company’s revenues more than doubled to $9.50 billion.

Square’s fourth quarter earnings beat estimates

Meanwhile, Square reported an adjusted EPS of $0.32 in the quarter which was ahead of the $0.24 that analysts were expecting. The company also revealed a $170 million investment in bitcoins. Last year, the company had invested $50 million in the cryptocurrency.

“The investment is part of Square’s ongoing commitment to bitcoin, and the company plans to assess its aggregate investment in bitcoin relative to its other investments on an ongoing basis,” said the company in its release. Bitcoins now account for 5% of Square’s total assets at the end of 2020.

Bitcoin prices have tumbled

Bitcoin prices have tumbled this week from their record highs. Earlier this month, Tesla also announced a $1.5 billion investment into bitcoins. It also intends to allow it as a payment mode in the future. The announcement by Tesla catapulted both its stock as well as bitcoins to a record high.

However, as bitcoin prices tumbled, which could partially be also due to Musk’s tweet suggesting that the cryptocurrency is gotten too far, Tesla stock has also fallen. That said, there is more to Tesla’s troubles than its investment in bitcoins. While the company has invested only $1.5 billion in bitcoin, it has lost over $120 billion in market capitalization from its recent peaks.

Square’s bet on bitcoin

While bitcoin could be a speculative bet for Tesla, the scenario is different for Square. The company allows trading in bitcoin in its platform whose volumes have been growing steadily. Some of the crypto mining companies like Marathon Patent have also invested in bitcoins. For Square also, investment in bitcoins doubles down on its bet on the digital currency.

That said, the regulatory environment could tighten for cryptocurrency looking at the recent comments from Janet Yellen as well as the Indian central bank. Lax regulations and anonymity have helped propel bitcoin prices higher. More regulatory scrutiny could play a dampener for bitcoin trading.

Wall Street is getting bullish on Square stock

Wall Street analysts have been getting bullish of late on Square stock. Evercore ISI’s Rayna Kumar, who correctly predicted that Square would beat its fourth quarter earnings estimate, calls it the “most disruptive company in payments and banking.” She has an outperform rating on Square stock with a price target of $304.

Wolfe Research’s Darrin Peller is also bullish on Square stock. He has an outperform rating and a $335 price target on the fintech company. “Square stands out as a material share gainer across its businesses, solidifying its status as a global leader,” said Peller. He expects the stock to “grind higher over the next several months.”

Deutsche Bank also issued a bullish note on Square last week. “Although benefits from the first round of stimulus have started to fade, Cash App should benefit from the second smaller round starting in 1Q21,” said Deutsche Bank analysts as they assigned a $330 price target to the stock.

Mizuho also issued a bullish note on Square

Just before Square’s fourth quarter earnings, Mizuho analyst Dan Dolev issued a bullish note on Square stock and called it “simply undervalued.” “With <3% penetration of a $165bn TAM, enhanced momentum with Bitcoin’s ascent, and an inflow of equity traders post-GameStop, SQ is barely scraping its full potential, in our view,” said Dolev.

Dolev expects Square’s Cash App to generate a gross profit of over $30 billion by 2023. The company had 36 million cash App users at the end of 2020—up from 30 million that it reported at the end of June 2020.

In its earnings release, Square said that in the fourth quarter more than 3 million people traded in bitcoin on its Cash App. In January, 1 million people on its platform brought bitcoin for the first time. Commenting on its focus for 2021, Square said that “We’re also going to double down on our commitment to Bitcoin and continue to look for new ways to connect our product lines within the Cash App.”

Square Seller App

Commenting on its seller business, Square said that “we will continue to focus on growing our omnichannel capabilities, expand globally and increase our financial service offerings to sellers of all sizes.” In the fourth quarter, Square’s gross payment volumes from merchant customers were $32 billion—up 92% from the corresponding quarter in 2019. However, the volumes were slightly short of the $32.1 billion that analysts were forecasting.

Should you buy Square stock?

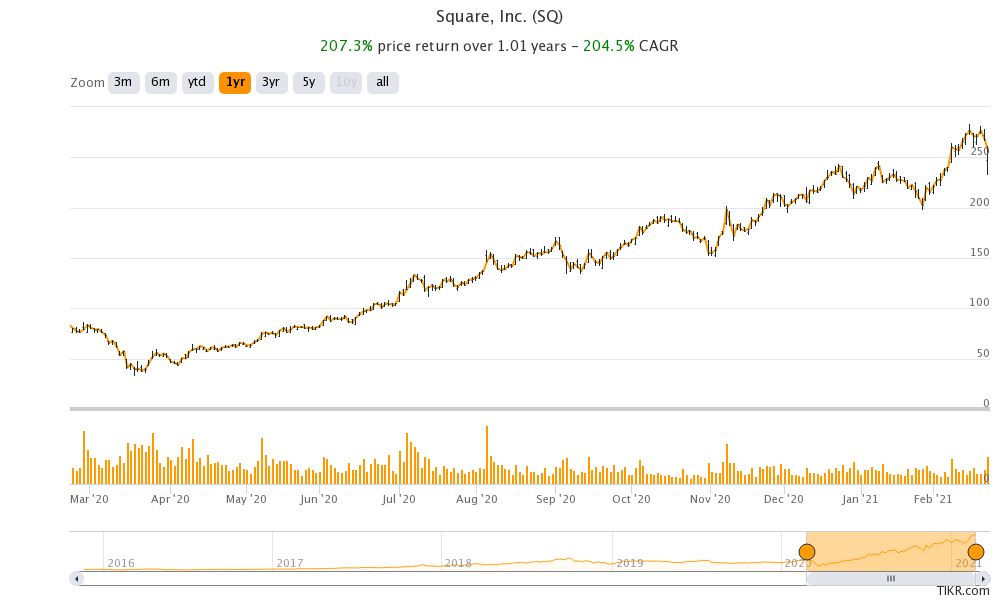

Square stock lost 4.3% in regular trading yesterday and was trading 3.7% down at $247.09 in US premarket trading today. The stock has gained 207% over the last year and has outperformed the markets by a wide margin.

The outlook for fintech companies like Square looks quite bullish. Newly listed fintech company Affirm is trading at exorbitant valuations. Chamath Palihapitiya’s SPAC Social Capital Hedosophia Holdings V (IPOE) is also trading at a premium before its merger with fintech company SoFi.

JP Morgan Chase, the largest US bank, is also bullish on the fintech space. The bank’s analysts called “fintech innovation and increased demand for digital services are the real Covid-19 story with the rise of online start-ups and expansion of digital platforms into credit and payments.” They added, “Competition between banks and fintech is intensifying, with Big Tech possessing the most potent digital platforms due to their access to customer data.”

You can trade in Square and other fintech stocks through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account