The S&P 500 has staged a remarkable rebound, gaining almost 50% from its late-March lows and is just short of the all-time high it hit in February. What are strategists watching as the S&P 500 is just 1.5% away from its record level?

Its been a volatile year for US stock markets. In March, US stock markets entered into a bear market territory. It was the swiftest bear market on record and it took only 16 trading days for the S&P 500 to fall 20% from its peaks.

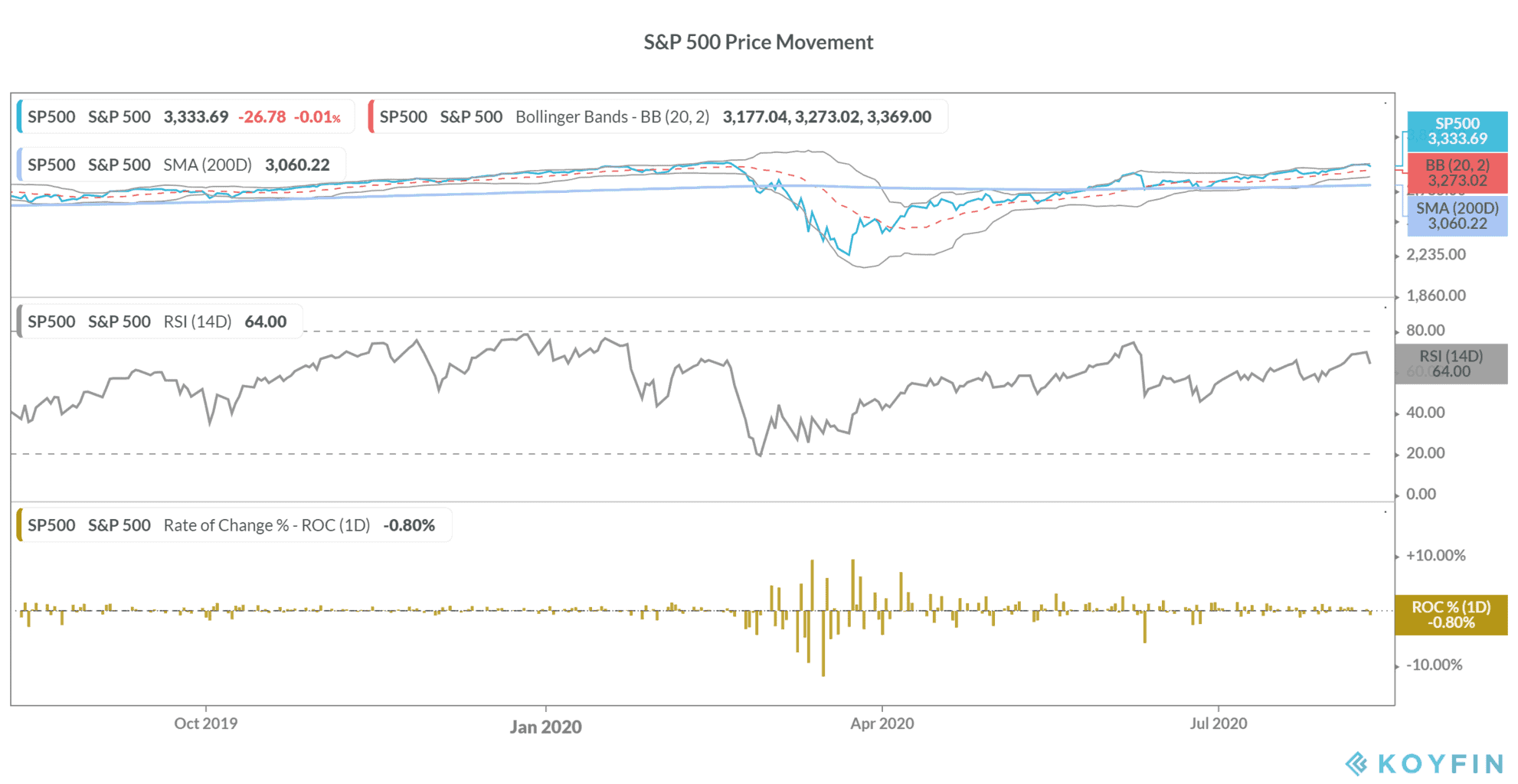

S&P 500 in 2020

The recovery has been equally swift. The Nasdaq 100 Index is up 25% for the year and has made new record highs. The S&P 500 is also a tad short of its all-time highs, having risen 46.5% from the March lows.

According to Kathryn Rooney Vera, head of research and chief markets strategist at Bulltick Capital Markets, government stimulus was the key reason markets rallied back from their March lows.

However, she cautioned in a note: “If we don’t get an additional fiscal stimulus, then I think it will be ugly for the markets going forward.”

Vera added: “Let’s face it: we’re … very close to all-time record highs, and the main driver of that appreciation in the S&P 500 has been stimuli, both fiscal and monetary. … The combination of variables that we have right now is very fortuitous for the markets, which is why they continue to move higher.”

The US Federal Reserve has infused unprecedented liquidity while the Federal government has announced over $3tn in stimulus to propel the US economy from the coronavirus-induced slump.

The stimulus comes with consequences

The stimulus boosted the US economy and helped the S&P 500 move higher but it has come with its own share of costs. US fiscal deficit is expected to surge to the highest level since The Second World War.

While famous investor Warren Buffett applauded the Fed for its swift actions he warned of “consequences” from the massive easing.

The US dollar has been a casualty of the massive easing and is trading near its two-year lows with analysts expecting further falls.

“From there on … what we need to see is some [retraction] of the fiscal stimuli because, really, what we’re seeing now makes the Lehman Brothers reaction seem like child’s play,” said Vera.

Vaccine would help

She also pinned hopes on a vaccine for the virus. Vera said: “What I think is the bullish case here is the potential for a real vaccine. Maybe it’s not the Russian one, but potential for a real vaccine in the course of the next six months.”

She added: “If that’s the case, then we have the fundamental base, which is that nascent growth in US consumption solidified. And if that happens, then this V-shaped recovery that we’ve seen thus far really has legs.”

Expectations of a V-shaped have helped the S&P 500 recoup its 2020 loses. However, the July Bank of America Bank of America Global Fund Manager Survey showed that only 14% of those asked expect a V-shaped recovery in the economy, down from 18% of respondents in June.

Sam Stovall, CFRA’s chief investment strategist of US equity strategy also echoed similar views.

While Stovall believes that there would be another stimulus package, he added: “I think that because of the disagreement going on so far, that implies that we are not likely to get an additional package beyond this. So, I think that we are seeing a bit of a rally in anticipation of a final passage.”

Talks between lawmakers have been stuck, and that prompted President Trump to sign four executive orders including a weekly $400 enhanced employment benefit on Sunday.

Goldman Sachs: Focus on long term growth

David Kostin, Goldman Sachs’ chief US equity strategist is advising to focus on long term growth and built a case for tech stocks.

He said Goldman Sachs expects US gross domestic product growth at 6.2% in 2021 as compared to consensus forecasts of 3.9%. “And the idea of better growth still rests with technology,” wrote Kostin in a note.

He added: “So … in terms of the day-to-day rotation maybe we’ve seen today or the last couple of days I think is maybe missing the fundamental issue that rates, interest rates, are likely to stay extremely low. … But the idea of better growth longer term is what characterizes the technology stocks more than anything else and the longer duration, the better growth long term, is more valuable, is more prized, in a low-rate environment.”

US interest rates look set to remain benign for quite some time. Federal Reserve chairman Jerome Powell summed the policy perfectly. “We’re not thinking about raising rates,” Powell said in June. “We’re not even thinking about thinking about raising rates.”

Nasdaq has outperformed S&P 500 on gains in tech shares

Meanwhile, the valuation of tech stocks is a hotly debated topic. While many draw comparisons with the dot com boom years, Rick Sherlund vice chairman of technology investment banking at Bank of America feels that tech stocks are not in a bubble and hold long term potential.

The tech-heavy Nasdaq Index has jumped by almost 21% this year, outperforming the S&P 500 and Dow Jones this year on strong gains by platform stocks.

By investing in an S&P 500 ETF, you can get returns that match the underlying index after accounting for the fees and other transaction costs. We’ve prepared a handy guide on how to trade in ETFs. You can also refer to our selection of some of the best online stockbrokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account