NEO Finance Review 2020 | P2P Pros & Cons | Learbonds

P2P lending platforms have been gaining popularity over the last couple of years amid higher yields from alternative investments along with easy borrowing facility for individuals and businesses. Consequently, the market has witnessed substantial growth in the number of P2P lending platforms. These online platforms are snatching a huge chunk of customers from big banks. This is because of a lack of involvement of paperwork and inconveniences that borrowers face in getting a loan from banks.

Similar to the brokerage industry, choosing the right P2P lending platform is essential when it comes to investing your hard earned money. The majority of P2P lenders are retail investors. Therefore, these investors always seek to invest through a platform that offers higher returns but with low risk.

In order to help you with that, we review NEO Finance – which is popular for offering higher returns along with low risk.

-

-

This Lithuania based P2P lending platform has generated massive growth in issued loans and revenues in the past couple of quarters. This is because of browsers and investors increasing confidence in this platform. The average returns of 12% for investors along with several safety features such as buybacks and provisional funds are enhancing returns and minimizing risks.

What is NEO Finance?

The fintech startup NEO Finance manages and administers P2P lending and investing platform. Although it does not offer business loans and crowdfunding projects, the NEO Finance platform is famous for offering one of the best consumer loans up to 15000 EUR. The interest rate for borrowers starts from 6% while historical annual returns for the lender’s averages around 12.00%.

NEO Finance is eligible to operate all over the European Union as it holds an Electronic Money Institution (EMI) license. This license has been issued by the Financial Supervisory Authority (FSA) of Lithuania, i.e. the Bank of Lithuania.

What are NEO Finance Pros and Cons?

NEO Finance Pros:

✅Various types of consumer loans

✅Availability of buybacks

✅Provision funds

✅licenses to operate in the entire European Union

✅Auto investing feature

NEO Finance Cons

❌ Lack of diversification

❌ Only European investors are acceptable

How Does NEO Finance Work?

Like other P2P lending platforms, NEO Finance helps in connecting borrowers with lenders. The platform only offers investment opportunities in various types of consumer’s loans. It’s auto investing feature is best for those investors who don’t have enough time to handle investing activities. The platform generates revenue by imposing fees on borrowers and lenders. Its revenue grew 112% year over year in fiscal 2019.

This platform has successfully enhanced investor’s confidence due to its safety features and in-depth assessment of loans before placing them on the website. This is evident from a quarter over quarter growth in loans. In addition, the platform has been outperforming the market trends.

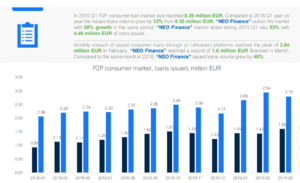

The overall P2P consumer loan market size stood around 8.39 million EUR in the first quarter of 2019, representing a volume growth of 33% from a year ago period. NEO Finance, on the other hand, topped market trends by generating 50% growth in issued loans in the same period.

The platform permits borrowers to place loan requests. Its management team is responsible for accessing the risk and reward related to the loan and sets an interest rate for the loan. Once the loan request approved, the investors are free to fund the loan according to their investment strategy.

The registered lenders jumped 63% in the first quarter of 2018 while the number of active lenders grew 56% from the year-ago period.

Although the platform applies best practices in accessing the loan, its recovery system is also strong in case of delays from borrowers. During 2019 Q1, it recovered a record amount of 90 thousand EUR and distributed that amount to lenders.

What Types of Investment Opportunities NEO Finance Offer?

NEO Finance only deals with P2P consumer finance. It does not offer diversification of investments in alternative assets when compared to Envestio, Sofi and GruPeer.

Consumer Loans:

Instead of offering big loans to borrowers, the platform allows borrowers to get a loan up to 15000 euros. Smaller loans always have better repayment structure along with lower default rates. The interest rate on each loan is set based on the level of investor demand and risk factor. They categorize each loan and borrower into three types: A, B, and C. The interest rate and risk is higher when lending the money to C category borrowers. The interest rate drops and risk factor declines when lending money to A category borrowers.

The loans supply is also abundant. NEO Finance platform has been investing significant money in marketing to make sure excessive supply of loans both for new and established investors. Investors are also open to some risks (a partial buyback guarantee exists).

However, investors could receive higher returns if they take extra risk. In addition, the platform offers extensive information about the borrower and the purpose of the loan. The investors can see at least 12 different data fields related to borrower including income, other liabilities, assets owned, previous debts repaid, and credit score.

The investor can invest in the following categories of consumer loan through NEO Finance platform:

- Home Repair Loan

- Car Loan

- Weeding Loan

- Credit card refinancing

- Personal loan

- Other types of consumer loan

What is Consumer loan? A consumer loan is a type of loan that is typically tied to the purchase of a specific item that should not be related to business purpose. Consumer loan could be secured or unsecured loans.How does NEO Finance Auto Invest Feature Work?

Like other P2P lending platforms, NEO Finance also offers auto investing feature which is specifically established to help investors in generating profits.

The automatic investment feature permits the investor to select the investment preferences and goals. NEO Finance will robotically make loan agreements when the suitable offers appear on behalf of the investor. Consequently, the investor does not need to continually review each loan application. It’s auto investing feature automatically invests in loans when the new loan offer appears. Whereas investors who select manual investing can only make investments in the remaining amount of the loan (sometimes there is nothing left).

In order to use the auto invest feature, the investor is required to selects the automatic investment along with filling the questioner that includes several questions such as your investment goals, risk tolerance, preferred returns, creditworthiness rating (one or several), loan maturity (exact or from – to) and the maximum investment amount into one loan.

Thus, when the platform identifies the loan that suits your requirements, the platform will automatically conclude the agreement on behalf of the investor.

What is NEO Finance Account Creation and Investing Process?

The account opening process is simple and totally free. You need to provide the basic information related to an email address, name, phone number, and a few other things. It’s also not necessary to be 18 years old to create an account on this platform. NEO finance permits account opening on the name of a person who is younger than 18 years of age; the individual need to provide information related to his legal representatives. The registration to the investing process is composed of 4 steps:

- Register in the account provided for the investors.

- Perform the identity verification process in the system.

- Open a NEO Finance electronic money account.

- Deposit money into it.

Once you are registered on the platform, you need to deposit funds to start investing. Unlike other platforms, adding money to your account is amazingly fast. It takes almost 30 minutes to transfer funds to the NEO Finance account. This is because the NEO Finance offers you a personal IBAN number to add your money into.

Once you fund the account, it’s up to you how you want to invest that money through this platform. You can select one of two investment methods:

- If you want to invest manually, select the loans into which you want to invest from the list of the borrower applications. The investor will find various type of information regarding the loan recipient such as obligations, income, credit worthiness rating, previous debts, a position held at the workplace, etc.

- If you select to invest manually, you are required to set the investment amount for each loan along with information like maturity, risk tolerance, the creditworthiness ratings of the loan recipients and the size of the interest.

The account holder is free to invest with/without provision fund along with other manual and auto investing options.What is the Provision Fund of NEO Finance?

In order to reduce the risk to investments, NEO Finance is offering the paid service of the Provision fund to investors. The investors are free to invest with or without provision fund. When you choose to invest with provision fund, you are required to sign the surety agreement with “NEO Finance”. With this agreement, the platform itself undertakes to provide a complete surety for the repayment of invested capital along with agreed interest.

This means that if borrower delays payment for even a single day, the platform will make payments to you and then itself recovers the amount from loan recipient later.

However, when you select to use this service, you are liable to pay additional charges. The fee is correlated to the loan maturity and the creditworthiness rating. The fee could stand in the range of 0.44% – 22.91% of the investment amount. All fees are accumulated in the fund, and in the case of delay, payments are covered from the funds accumulated in the Provision Fund.

In the case of early repayment of loan or termination, the fee would also decline to improve investor’s returns and make sure that the investor does not incur a loss.Who can Invest Through NEO Finance Platform?

The platform does not accept clients from around the world. This is due to regulatory restrictions and compliance with anti-money laundering policies. The clients from only European Union with valid Id cards are acceptable on this platform. Below are the countries that are accepted on this platform:

[one_fourth]- Austria

- Belgium

- Bulgaria

- Croatia

- Italy

- Netherlands

- Norway

- Poland

- Cyprus

- Czech Republic

- Denmark

- Finland

- Greece

- Hungary

- Ireland

- Malta

Does NEO Finance Offers Buyback Guarantee and Secondary Market?

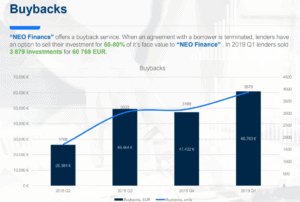

Yes, NEO Finance offers buyback guarantee. Some firms allow investors to sell their investment anytime to the platform or sell it when the borrower defaults. In the case of NEO Finance, the investor can only sell back investments to platforms when the borrower fails to pay. NEO Finance will buy bad loans from investors at 50-80% of the total loan value. This means that you will not lose your money when the borrower fails to pay.

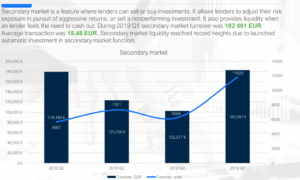

The platform also permits investors to sell their investment to any other user on this platform. They charge a fee for selling or buying any investment in the secondary market.

What is the Fee Structure at NEO Finance?

The fee structure is clear and transparent. Anyone can review their fee structure by visiting the website. The account creation process is free of cost. The platform also does not charge additional fees in case of debt recovery. The platform will charge you when you select investing with the provision fund, which depends on the maturity period and nature of the loan. The investor is liable to pay a fee when they buy or sell investments in secondary markets. There is no fee on deposits but the platform could charge wire transfer fee on withdrawal of funds.

Is NEO Finance Safe?

NEO Finance is safe. This is because of its authorization and licenses from multiple authorities. NEO Finance is eligible to operate all over the European Union as it holds an Electronic Money Institution (EMI) license. This license has been issued by the Financial Supervisory Authority (FSA) of Lithuania, i.e. the Bank of Lithuania.

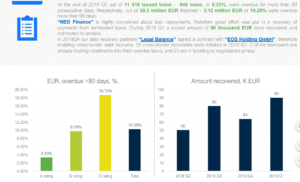

In addition to licenses, the platform offers completely safe investment opportunities. The default rate and outstanding loans are low. In addition, the company has the potential to recover the amount from borrowers. The chart below clearly indicates the rate of outstanding amount along with the recovered amount from borrowers.

NEO Finance Review 2019 – Verdict

NEO Finance is one of the best P2P lending platforms. It offers investment opportunities in various types of consumer loans. The platform permit borrower to get a loan up to 15000 Euros. It’s auto invest feature is also significantly strong. The platform only requires your investment preferences and then it will automatically invest your fund according to your requirements. They also give the edge to investors who choose auto invest feature.

The provisional fund is another guarantee that this platform offers to investors. The investors are eligible to sell investments in the secondary market along with using buyback guarantee in the case of default. On the negative side, this platform doesn’t offer significant diversification. Investments in business loans, mortgages, and development projects are not available.

FAQ:

What to do if the investor forgets the password?

You can easily recreate the account password. Just click on the Forgot password link and enter the required information. The platform will immediately send a new password to your email address or mobile phone.

Is it possible to create a user account on behalf of a child below 18 year age?

Yes, it is possible to create an account on the name of a child who is under 18 years. The legal representatives of that child are liable to make a registration in NEO Finance office instead of online registration. The representative should also provide the following documents: 1. The identity documents of parents and the child. 2. The birth certificate. 3. Parents also must be NEO Finance account holder. 4. The consent for the investment on behalf of the person under the age of 18. 5. Information about the child.

How much an investor can Invest in NEO Finance?

The minimum investment requirement stands around 10 euros in each loan while the investors are eligible to invest the maximum amount of 500 Euros in one loan recipient for 12 months.

What investor does if the loan is not repaid?

It depends on the nature of the investment you choose. If you are manually investing without provisional fund, you are only eligible to get buybacks in the range of 50 to 80% of invested capital. When you invest with the provisional fund, you are eligible to get the entire invested amount along with interest payment.

When NEO Finance Transfer the money received from the monthly installment to investor account?

When the platform receives the money in the form of installments, they immediately transfer that amount to investors account.

What is a VIP investor and when do investors become VIP account holder?

The platform awards lenders with different status. Below are the types of status that this platform provides to investors. 1. VIP Bronze: Active investment portfolio contains more than € 5,000; 2. VIP Silver: Active investment portfolio contains more than € 15,000; 3. VIP Gold: Active investment portfolio contains more than € 50,000; 4. VIP Platinum: Active investment portfolio contains more than € 125,000. The platform offers several benefits to VIP investors. These benefits include low fee structure along with getting priority over others. The platform also permits VIP investors to sell the delinquent loans with the coefficient that is 10% higher than non VIP investors.

Peer 2 Peer – A-Z Directory

Siraj Sarwar

Based in Saudi Arabia, Siraj has a strong understanding of and passion for accounting and finance. He has worked for international clients for many years on several projects related to the stock market, equity research and other business, accounting and finance related projects. Siraj is a published financial analyst on the world's leading websites including SeekingAlpha, TheStreet, MSN, and others.View all posts by Siraj SarwarWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up