Flender Review 2021 – No.1 Irish P2P Lending Platform

P2P lending platforms have been offering better returns when compared to stock and bond markets.  In addition, the high level of risk and volatility related to stock markets make them risky investments. P2P lending, on the other hand, offers a lower risk. This is because the investor will get predefined returns. In addition, the level of risk is also low, thanks to buyback guarantees – which mean the P2P lending platform will pay to investors if the borrower fails in making repayments. Above all, these P2P lending platforms offer double-digit returns to investors.

In addition, the high level of risk and volatility related to stock markets make them risky investments. P2P lending, on the other hand, offers a lower risk. This is because the investor will get predefined returns. In addition, the level of risk is also low, thanks to buyback guarantees – which mean the P2P lending platform will pay to investors if the borrower fails in making repayments. Above all, these P2P lending platforms offer double-digit returns to investors.

Choosing the right P2P investment platform is significantly important. This is because these platforms offer various types of innovative investment and safety features. The expected returns and level of risk are depending on what platform you choose for investment purpose.

In order to help you with that, we review Flender, which claims to offer an average return of 10% on invested capital with buyback guarantee in the case of borrower default or late repayments.

What is Flender?

Established in Ireland, Flender is working on the strategy of connecting borrowers with lenders. The platform only permits businesses from Ireland to borrow money through this platform. On the other hand, they accept lenders from all over the world. Consequently, the investor will get the opportunity of investment in Irish businesses only. Its loans are characterized by high-interest rates along with a deep credit checking process. The investors can easily invest in loans with the minimum investment of €50.

What are Pros and Cons of Flender?

Flender Pros

✅It offers double-digit returns

✅The default rate is low at 0.2%

✅Free of charge

Flender Cons:

❌ No buyback guarantee

❌ No secondary market

❌ Needs improvement in website

How Flender Works?

Flender is one of the fastest growing P2P investment platforms. The platform is working on the strategy of enhancing the Irish economy by offering business loans and crowdfunding platform. In addition, the platform has also been providing attractive investment opportunities in the Irish economy – which is one of the strong economies to support businesses according to the World Bank report. Flender platform has over 7000 active investors and it has helped in raising almost +10.2M Euros to businesses against an average return of 10.4%.

Although the platform does not offer a buyback guarantee, the default rate stands very low at 0.2%. This is due to its strong loan selection criteria. Their management and credit analysis team closely evaluates each loan request before listing it on website.

The interest rates for investors stand in the range of 8% and 12% for less risky loans while the interest rate increase to 16% on V category (riskier) loans. The duration for most of the loans stands between 6 months to 3 years.

The platform is working on the following three key strategies to expand business and growth opportunities for both lender and borrower:

- Customer First: The company seeks to offer ease of use. This means they are making a user-friendly platform. In addition, the P2P platform cares about their investors and borrowers to get positive feedback and repeat customers.

- Speed of response: The Platform likes to work actively on all fronts to ease the lending and borrowing process. Their customer support team responds as soon as they can to sort out customers issues.

- Openness: The platform doesn’t hide anything from customers. Their fee structure is transparent and they do not charge a hidden fee. Transparency and integrity is their first priority.

Unlike other platforms, they offer several payment and withdrawal options. They have also not been relying on external loan originators. They permit investors to fund the project or loan request after an in-depth risk analysis. They handle the process of providing and listing loans, as well as debt collection, without any third-party involvement. Instead of offering a buyback guarantee, the platform takes collaterals and guarantees from borrowers to protect investor’s money.

Account Creation and Investment Process

P2P platform always tries to make a simple account opening process. It’s simple and easy to create an investor and borrower account on this platform. In fact, the account opening takes not more than a couple of minutes. You just need to click the “Get Started” tab – which is placed at the top of the home page. Once you click that button, the new screen will appear where you will see an option to start working on this platform either as a lender or borrower.

If you are investor, you need to click on start investing; the borrowers should click on Flender loan. Once you click on start investing, you will be directed to a new page where you have to fill up a short registration form. They will ask you to provide simple information such as user name and email address.

Once you provided all the information, the platform will send you the confirmation link. The investor is required to click on that link to complete the account creation process.

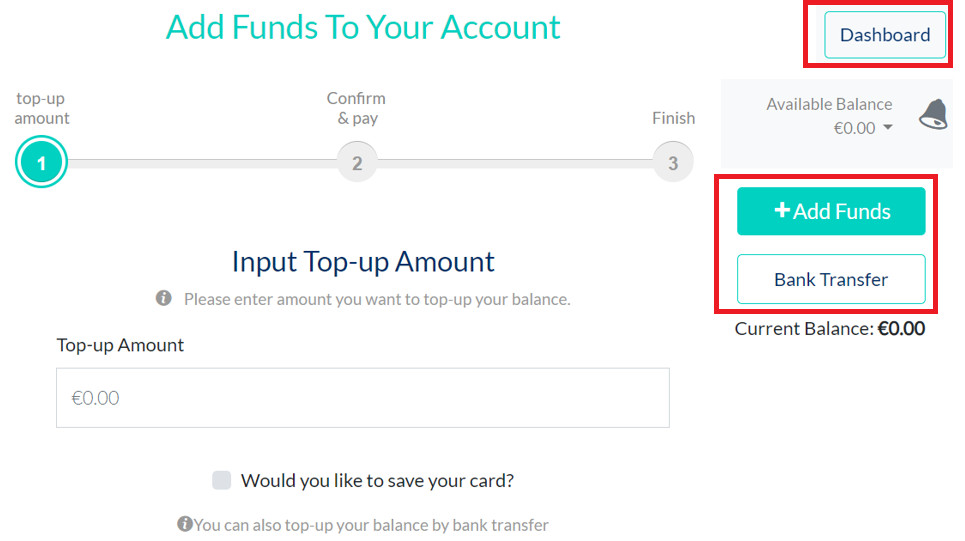

After the verification, the investor will get access to the dashboard where they see several options. However, for investing, you always need to add funds.

The “Add Funds” button is situated at the right top in the dashboard. The investor can deposit money through credit cards and bank account. Once you deposited the funds, you are free to invest in various types of business loans and crowdfunding projects.

The platform also permits investors to choose the auto investment feature if you don’t have enough time to evaluate each investment opportunity.

What Types of Investment Opportunities are Available on Flender?

Once funds are available in your Flender account, you are free to invest in various types of loans and projects. Flender does not offer consumer loans. They only offer business loans. Its products are easily accessible through the website. They have created a separate page for available investment – which is called Marketplace.

It offers loans to companies, partnerships, and sole traders only in Ireland. Loans range starts from €10,000 to €150,000. The platform does not involve external evaluators. Its own analysts and banking experts evaluate loans. It evaluates each loan request based on previous credit score, accounting data, and the business loan. They also obtain information from Stubbs Gazette and Equifax. The platform gauges information of cash flow of business and VAT return analysis. In addition, all business loans are secured by deposits and personal guarantees.

Does Flender Offers Buyback Guarantee?

The buyback guarantee is one of the most important tools for investors when it comes to P2P lending. The platforms offer this guarantee to protect investor’s money. This guarantee also enhances an investor’s confidence in lending platforms. This guarantee works in the case of borrowers default or late payment. If the borrower defaults on a loan and makes delays in payment, the platform itself pays to lender and then recovers that amount from the borrower. Unlike other platforms, Flender does not offer a buyback guarantee – which is one of the biggest drawbacks of this platform.

What is Flender Secondary Market?

The secondary market always has significant importance when it comes to investing. Secondary markets allow investors to sell their investments to other investors. In the P2P lending, secondary markets help in liquidating investments. Although secondary markets for P2P investments are limited, some platforms allow investors to sell investments to other investors who are registered on their platform. In the case of Flender, they do not allow the investor to sell investments. Once entered into a contract, the investors cannot sell the investment to other investors.

How Flender Sets Loan Grade System and Interest Rate?

Flender is very cautious and strict when it comes to approving each loan request. The platform strictly assigns a credit grade to each loan. The grade stands between A+ and V. The platform analyzes loan request using the following points for the grading system.

- Affordability: This means that the loan applicant should run businesses that have the capacity to afford the loan amount and returns.

- Liquidity: This means that the business must have a sale value. In the case of bankruptcy, the business should have enough assets to fulfill creditor’s loss.

- Equity base: Business with a strong equity base receives a high grade and low interest.

- Business age: The business must have a history in the business and relevant industry.

- Director’s experience: The directors should have the experience to run the business.

- Credit history: Business with a strong credit history always get a loan on better terms.

What is Flender Fee Structure?

Flender is transparent about the fee structure. They do not charge a hidden fee to investors. Indeed, this platform is free for investors. They do not charge any account opening fee. The deposit and withdrawal process is also free of charge.

| Grade | Interest rate |

| A+ | 9.1% |

| A | 9.6% |

| B+ | 10.1% |

| B | 10.5% |

| C+ | 10.9% |

| C | 11.9% |

| D | 12.9% |

| V | 15.9% |

What is Flender Pension Account?

In order to generate tax benefits and safe returns with lending, Flender has created a Pension Account to satisfy the needs of defensive investors. Flender Pension Account is significantly different from its standard accounts:

- The minimum investment requirement is €20,00.

- They charge a 2.5% fee on an initial deposit.

- The minimum bid size of €500 is applicable to pension accounts.

- Agents of your trustee company can access & view activity 24/7.

- Agents of your trustee company can access real-time reports on your investment activity 24/7.

Anyone is eligible to open Flender Pension account if fulfills following critaria:

- You already must have self-administered pension arrangements in place; SSAS, PRB, AmRF or ARF.

- The Independent Trustee Company (ITC) should already be working with Flender.

Flender pension account opening process is simple. You need to fill an online Pension Account application. You are also required to download the Pension Account authorization document. The document should also be signed by your QFA.

Is Flender Customer Support is Good?

Flender’s customer support team is strong. The platform believes in satisfying customers quires. The company seeks to offer ease of use. In addition, the P2P platform cares about their investors and borrowers to get positive feedback and repeat customers. When you visit the website, you will immediately see the chatting feature – where the customer support agent has always been available to solve your issues. They also respond to customers queries through email.

What is Flender Auto Investing Feature?

Like other platforms, Flender also offers auto investing feature. AutoFlend permits investors to automatically participate in live campaigns. The user is required to activate AutoFlend feature to start auto investing.

This feature is particularly designed to participate in the lending process with the predefined investment criteria that you have shared with Flender through questioner foam. Investors can set loan grades and terms themselves and then use AutoFlend to spread their funds across a range of business loans that meet these criteria. The AutoFlend feature would not invest your all money in a single project. Indeed, the platform helps investors in creating a diverse loan portfolio to broaden risk across a range of loans.

Is Flender Safe?

The investments through Flender are safe considering its licenses. It is a registered platform and complying with regulatory requirements. Your money in Flender account is also safe as they hold investors funds in a separate account.

However, it’s important to understand that every investment carries risk. Investment through P2P lending platforms is risky. All of the loan applications undergo a precise credit evaluation process. The experienced underwriters review every application in full before it can be posted on Flender. Despite all this, some borrowers fail to pay the loan and the loan turns into bad debt. In the case of Flender, the risk level is high. This is because of a lack of buyback guarantee in the case of default.

Flender Review 2019 – Verdict

Flender is one of the best platforms in the P2P lending industry. The platform offers double-digit returns to investors. The average return for investors stands around 10% with the default rate of only 0.2%. This platform is quite easy to use and their dashboard shows all the information related to portfolio activity. The deposit and withdrawal methods are safe. It also permits investors to add funds through credit cards. The majority of P2P platforms only accept bank transfers. On the negative side, Flender does not offer a buyback guarantee which is significantly important in this industry.

FAQ:

Who can become the lender on Flender?

How much an Investor can lend?

What is the interest rate?

Who is a borrower on Flender?

What Procedure does Flender adopt to prevent borrower fraud?

Is reinvestment of funds are available on Flender?

Does Flender deduct tax from income?