Fast Invest Review 2020 – High Yield P2P Lending Platform

High Yielding P2P lending platforms have been experiencing substantial growth in the number of investors and borrowers over the past couple of years. The opportunity for investment in alternative assets permits investors to diversify their asset portfolio. In addition, the double-digit returns from these platforms appear safe compared to the high risk associated with stock and other financial markets. The digital investment process along with safe deposit and withdrawal methods are adding to these platforms growth potential.

Despite all these positive factors, the ability to generate maximum and safe returns depends solely on what platform you select for P2P investments. Choosing the right platform is significantly important in P2P markets. This is because some platforms are offering innovative features such as buyback guarantee, access to secondary markets and auto investment features.

In order to help you with that, we review Fast Invest, which is one of the best-emerging platforms in the peer-to-peer lending industry.

What is Fast Invest?

Fast Invest is a peer to peer investment platform that permits investors to invest in loans with the potential to generate double-digit returns. It is working on the strategy of connecting investors with loan originators. These loan originators have extensive experience in consumer loans industry; they offer interest rates in the range of 9-16% with buyback guarantee.

The platform runs its operations from an office in Kaunas, Lithuania. It has 24 employees. They also have small offices in Italy and the UK as well.

What are the Pros and Cons of Fast Invest?

Fast Invest Pros:

✅Low minimum investment requirement

✅Money buyback guarantee

✅Buyback guarantee on borrowers default

✅Easy deposit and withdrawal methods

✅Simple and intuitive interface

✅Good and fast customer support

Fast Invest Cons:

❌ Lack of diversification

❌ Available in European Union and the U.K

❌ No detail about loan originators

How Fast Invest Works?

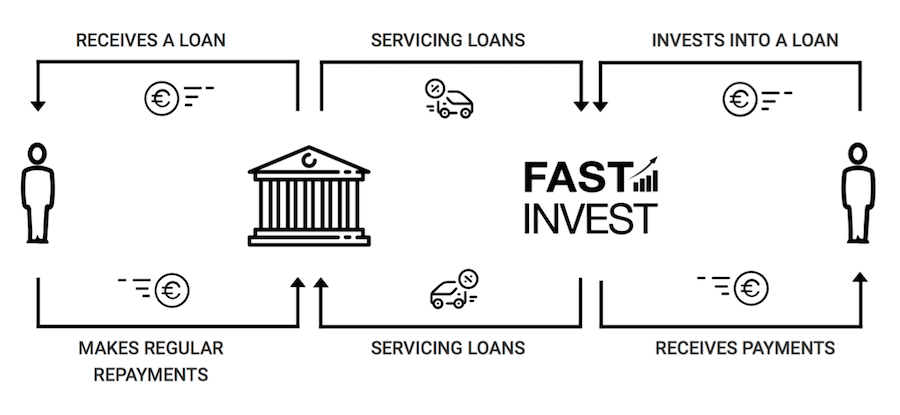

Fast Invest is among those platforms that give significant focus on borrower’s loan repayment potential to reduce risk to investor’s money. They don’t let people apply through their platform. Indeed, the individual has to apply for a loan from a lending institution. This lending institution is responsible for preparing all the essential documents and complete the application process. The experts of that lending institution check these documents along with credit score and risk factors.

After that, experts from Fast Invest check the loan application. Once the Fast Invest approves the creditor’s conditions, the loan is then added to its Loan List. The repayment process is safe; the borrower is liable to make monthly repayments according to the agreed payment schedule. Once the platform receives that payment, they transfer the amount to investors based on their schedule.

The platform also permits investors to use its auto investment tool to reinvest the money that they receive from borrowers.

What is the Registration and Investment Process of Fast Invest?

The investors are required to register on the platform to start investing. The registration process is simple and short. It is composed of four small steps:

- First Step – In order to start investing through this platform, the investor is required to create a free account and fill up the registration form. This process does not take more than five minutes. You need to visit their website where you can easily find the “Registration” tab. If you click on the registration tab; the website will show the registration form immediately. The platform will ask you to provide basic information such as email address, name, ID card number and other details. Once you submit the registration form, they will take a few minutes to verify your identity. They will send the confirmation link to your email address.

- Second Step – Once you have created a verified account, you are required to add funds to Fast Invest account. The investors are eligible to add as little or as much money according to investment goals. The investors can add funds through a bank account. They do not accept other payment methods such as credit card and electron wallets. The minimum investment amount is just €1.

- Third Step – Once funds are available in your Fast Invest account, you are free to invest in any loan that is available on the website. The investor can easily find the list of loans by visiting the Loan List tab at the top of the home page. On the other hand, the investors are also eligible to use an Auto Invest tool, which will automatically invest your money into loans that meet the criteria you set.

- Fourth Step – Once you selected the loan and invested the money, you need to wait to receive back the money in installments according to the terms of the contract. They have created an interesting and attractive interface and dashboard for investors – where an investor can review information about investments.

What Products Fast Invest Offers for Investment?

This platform only offers consumer loans. All the loans are available in the “Loan list” tab. Its loans are mostly short to medium term – with the interest rate standing around 9% to 16%. Once you have created an account and deposited funds, the next step is to select the loan that you feel fits with your investment criteria. The investor can also filter out the best loans. The platform allows you to filter the loan by using keywords such as amount, country and interest.

Once you selected the loan that suits your investment criteria and you must have sufficient funds in the account, you just need to click on the “Invest” button. The platform will then show you all the information related to loan such as loan terms, interest rate, payment schedule, etc. After reading and understanding all the terms of the agreement, you once again need to click the Invest button.

Fast Invest has developed a user-friendly and innovative platform. The investors can easily track all the information related to his investments. You can review all the information related to your portfolio on the dashboard. Below are the main items of its dashboard?

- The Balance Section – You can also easily view the Balance section. You have two free accounts in this section Euros (EUR) and Polish Zloty (PLN). There are also two types of funds. Reserved funds show any funds you have held in reserve. Invested funds will show you the total that you have invested in FAST INVEST since joining.

- My Investment Section – My Investments section is another important item of its dashboard. The investors will find a list of all the investment portfolios they have successfully invested in.

- Auto Investment Tool – This section shows the highlights of your auto investment portfolio. This section works only for investors who have selected auto investment option. Its auto Invest tool permits investors to define their investment preference; the platform will then be applying these preferences automatically to all the loans available on its list.

- Account Statement – The Account Statement section helps investors in understanding all the information about the flow of their funds.

What Countries are Accepted on Fast Invest Platform?

Unlike other P2P lending Platforms, Fast Invest permits investors from all over the world. In order to be eligible, the investor should need to be at least 18 years old and email address along with mobile phone number, a bank account in the European Union. It also permits investors from few Arab States and Asia & Pacific region. Below is the list of few countries that are accepted on this platform:

- Austria

- Belgium

- Bulgaria

- Croatia

- Italy

- Netherlands

- Norway

- Poland

- Cyprus

- Czech Republic

- Denmark

- Finland

- Greece

- Hungary

- Ireland

- Malta

How Fast Invest Auto Investing Tool Work?

It’s auto investing tool permits investors to develop custom investment portfolio according to their set criteria. The investor is required to describe the investment preferences. The investor doesn’t need to evaluate each investment opportunity when they select its auto investment tool. Their auto investment tool will make the investment in multiple loans to maximize returns and minimize risk.

The investor is eligible to pause, cancel or resume the auto investment function at any time. Their auto invest tool has the potential to filter loans that suite with your investment preference. It’s also not necessary that the auto invest tool would use all of your funds. They will only invest in loans that perfectly match your criteria. Otherwise, your excess funds will remain in your Investor’s Account.

The platform also offers Repayment option. This feature will permit the platform to automatically reinvest the profits and principal amount that you receive back on other loans.

What is Fast Invest Money Back Guarantee?

The majority of P2P lending platforms don’t offer Money Back Guarantee. This is a unique type of money back guarantee. The investor is eligible to cancel the investment in the loan before the defined period. The platform permits the investor to get back their invested money at any time during the contract period. Fast Invest return investors money in one day.

Once you decided to close the investment in the loan before the maturity time, all you need to do is log into your FAST INVEST account and click on the My Investment section. You then need to select the loan you’d plan to sell. Once you selected the loan, you just need to click the “sell” button. You need to wait for a few hours as the Account Management Support team will give approval before refunding your money.

How Fast Invest Buyback Guarantee is Different from Money Back Guarantee?

Yes, the buyback guarantee is different from money back guarantee. The buyback guarantee starts working in the case of borrowers default or late payment. In the case of late payment, the platform will pay to the investor and then it collects the money from the borrower. The platform also offers buyback guarantee in the case of borrowers default. This makes your investments free of any risk.

What is the Cost Structure of Fast Invest?

Fast Invest helps in connecting investors with loan originators. They like to give facilities to investors. Therefore, they don’t charge a fee to investors. Below are the actions that are free of charge on this platform:

- Opening Fast Invest investor’s account

- Servicing fee

- Loan sale via MoneyBack Guarantee

- Withdrawal to a bank account

- (Bank commissions may apply)

- Identity verification

- Adding a bank account.

Is Fast Invest Safe?

Fast Invest is safe. This is because the platform is regulated and licensed from respective authorities. In addition, the substantial growth in investment is the indication of investors’ confidence in this platform. They also offer two types of buyback guarantees which make this platform safer for investors. In the case of borrowers default, the platform pays you principal and interest payments. However, when you sell investments before the expiry date, you are only eligible to receive the principal amount. It is important to remember that investing always comes at a risk and you should never invest money you are not prepared to lose.

Is Fast Invest Customer Support good?

Fast Invest has created strong customer support platform to help investors on various issues related to account settings and general queries. They respond to investors queries within a business day. They have also created strong customer support page on the website. They have created different tabs related to FAQ. The investors can contact the support team through a phone call and email.

Fast Invest Review: Verdict

Fast Invest is one of the best P2P lending platforms. This is due to its innovative features and strong evaluation process. The borrower has to pass several layers before the loan gets listing on Fast Invest website. In addition to the evaluation process, the platform offers two types of guarantees to investors. These guarantees make investments safe. It has also created an attractive website and investor’s dashboard. The dashboard permits investors to watch and track all the activities in their portfolio. Fast customer support and double-digit returns add to investors confidence.

FAQ:

What strategy Fast Invest use to offer favorable terms?

What Fast Invest investors do if a borrower is late with repayments?

Does Fast Invest deduct taxes on investments?

Are companies also eligible to register and invest through Fast Invest?

What is the procedure for transferring funds to a Fast Invest account?

What are the Fast Invest minimum and maximum limitations on investment?

What is the procedure to withdraw money from Fast Invest?

What currencies does Fast Invest support?

What are Fast Invest additional costs related to using Auto Invest?