Berkshire Hathaway chairman Warren Buffett bought $340m of Bank of America shares in five days between 31 July and 4 August, adding to purchases he made last month.

The billionaire investor bought $813m of Bank of America shares in the third week of July. Berkshire Hathaway now holds almost 11.9% in the Main Street bank making it the largest shareholder. Vanguard Group is the second-largest shareholder with a 7.3% stake.

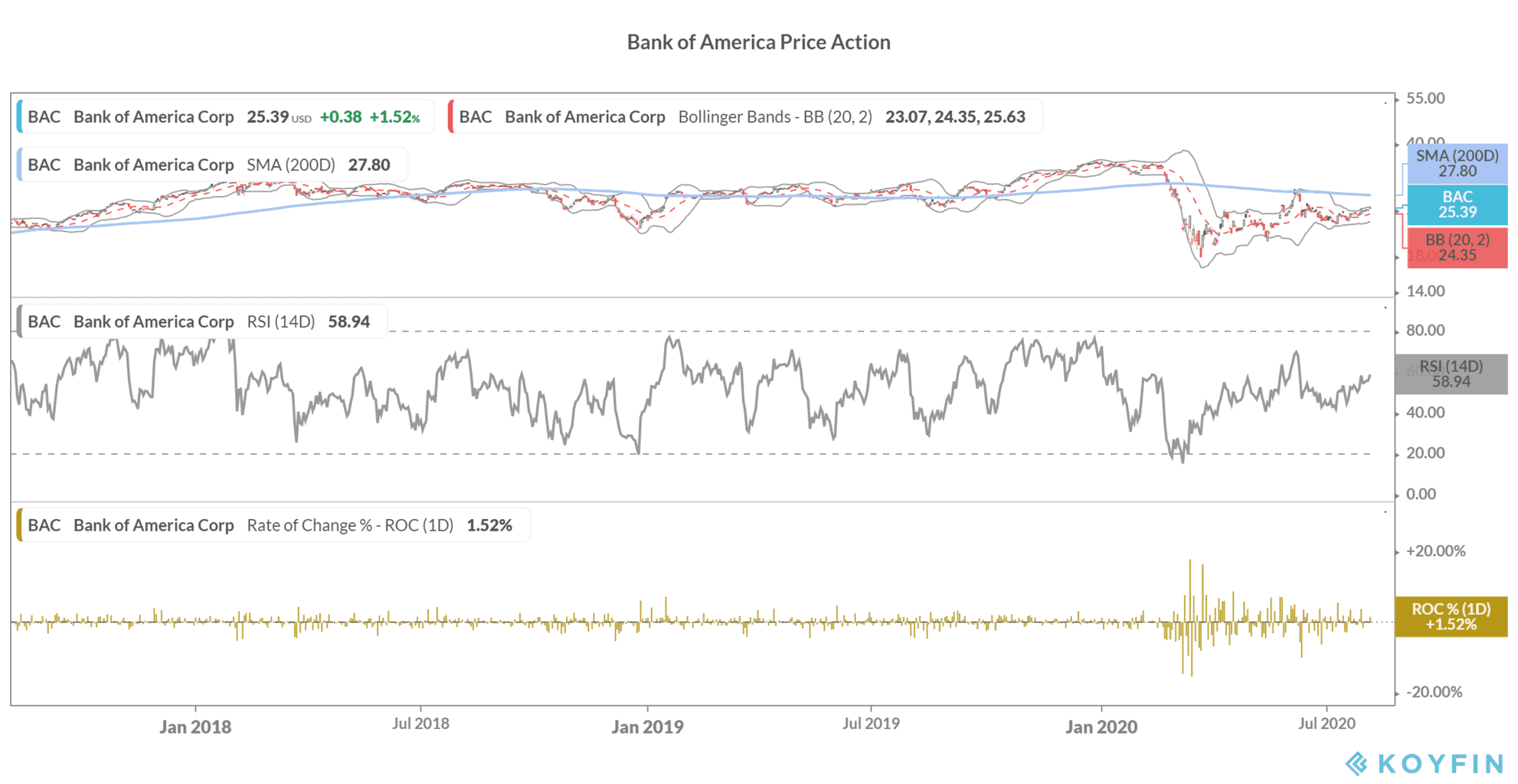

Warren Buffett and Bank of America

Buffett has previously tried to keep his holdings in banks below 10%, as holdings in banks above this mark attract regulatory scrutiny from the Federal Reserve. Between 2018 and 2019, Berkshire Hathaway sold Wells Fargo shares to keep its stake below 10%.

However, last year, Buffett applied for permission with the Federal Reserve to purchase more Bank of America shares. Generally, asset managers disclose changes to their holdings in their quarterly 13F. However, since Berkshire Hathaway holds more than 10% in Bank of America, it has to disclose the transactions before the 13F.

The world’s most famous investor has a flair for banking and financial stocks and five of Berkshire Hathaway’s top 10 holdings are in this sector. Bank of America is now Berkshire Hathaway’s second-biggest holding, behind Apple.

“I feel very good about the banks we own,” Buffett told CNBC in February . “ They’re very attractive compared to most other securities I see.” However, in the first quarter, Berkshire Hathaway trimmed its stake in JP Morgan Chase whose shares it had been buying since 2018.

Banking stocks have been under pressure this year. Bank of America shares are down almost 27% this year. Wells Fargo, another bank stock in Berkshire Hathaway’s portfolio is down 55% for the year and is among the top 20 losers in the S&P 500 this year.

Are Berkshire Hathaway shares a buy?

Berkshire Hathaway stock has also underperformed the markets over the last couple of years. After underperforming the S&P 500 by over 20% in 2019, Berkshire Hathaway’s returns are trailing the S&P 500 by a similar quantum this year also.

However, Berkshire Hathaway stock looks a good long term buy. Warren Buffett is understood to have repurchased $5bn of shares last month. Warren Buffett repurchases Berkshire Hathaway shares when he finds shares undervalued.

Value stockpickers such as Berkshire Hathaway have, in general, underperformed the markets this year. It is tech and growth stocks like Amazon, Apple, and Tesla that have catapulted the Nasdaq to record highs.

However, value investment strategy might stage a comeback as growth stocks’ valuations have started to look expensive. With a cash holding of $137bn at the end of the first quarter, the Oracle of Omaha, as Buffett is known, has a lot of dry powder to make more attractive deals. Warren Buffett ended his deal drought and acquired Dominion Energy’s natural gas assets for $10bn in July.

You can buy Berkshire Hathaway stock through any of the best online stockbrokers. We’ve also compiled a handy guide on how to short stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account