Berkshire Hathaway revealed in its second-quarter filing it had repurchased a record $5.1bn of its shares, begging the question for many investors, should they follow Warren Buffett and buy the conglomerate’s stock?

The previous quarterly record for Berkshire Hathaway’s repurchases was $2.2bn in the fourth quarter of 2019 taking its yearly total to $5bn. The company, led by chief executive Buffett, repurchased only $1.7bn of its shares in the first quarter.

The repurchase of $5.1bn in the second quarter, Berkshire Hathaway topped all of its 2019 repurchases in just one quarter.

Edward Jones analyst Jim Shanahan estimates that the company continued its repurchases in July and brought back around $2.4bn of its shares last month.

Warren Buffett and his share repurchase policy

Until 2018, Berkshire Hathaway’s repurchase policy was based on the price to book value and the company repurchased shares at a price to book value below 1.2 times. However, in 2018 the company moved to a discretionary dividend policy that gave the management discretion to repurchase shares based on their projection of the company’s fair value.

Although in an interview in May last year, the billionaire investor said that the company may one day even repurchase $100bn worth of its shares, Buffett and vice chair Charlie Munger have not resorted to big repurchases despite Berkshire Hathaway’s soaring cash pile.

Buffett has been conservative with buybacks as well as buying shares. The company even sold shares in the first quarter even as the US stock markets crashed. Its net sales or the difference between the value of stocks sold and brought was a record $13bn in the second quarter.

Despite spending $5.2bn on buybacks, Berkshire Hathaway’s cash pile rose to a new record of $146.6bn, up from $137bn at the end of the first quarter.

In the second quarter, Berkshire Hathaway also took a $9.8bn impairment on its investment in Precision Castparts. It had acquired Precision Castparts that manufacturers aircraft components for $37.2bn in 2015, the last major acquisition for the company.

To be sure, Warren Buffett has ended his deal drought and last month announced the acquisition of Dominion Energy’s natural gas assets. He has also been raising the stake in Bank of America.

Should you buy Berkshire Hathaway stock?

Some investors tend to follow the strategy of famous investors like Warren Buffett. If the Oracle of Omaha, as Buffett is known as, is repurchasing record number of Berkshire Hathaway shares, it would look intuitive to buy shares for your portfolio also.

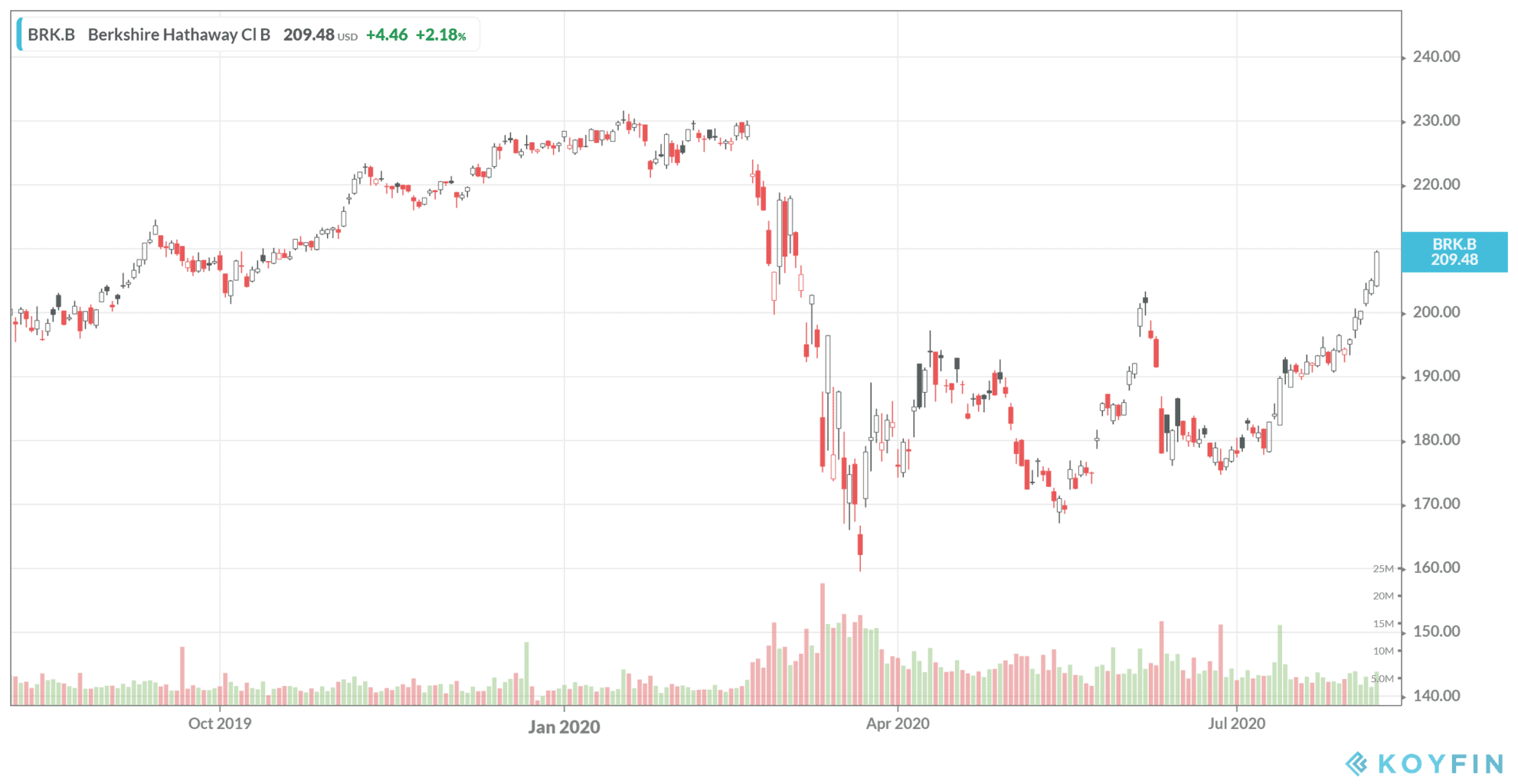

Berkshire Hathaway shares have underperformed the S&P 500 by sizeable margins over the last two years. It underperformed the S&P 500 by over 20% each in 2019 and the first half of 2020. While the S&P 500 is up around 3.8% for the year, Berkshire Hathaway B shares are still down 7.5%.

However, the fall in Berkshire Hathaway shares looks overdone. Value investment strategies, that Buffett epitomizes have underperformed growth strategy over the last decade and the gap has widened over the last two years.

However, the value investment strategy should stage a comeback as the valuations for growth stocks are getting a little too high for comfort. Warren Buffett has also signaled with the Dominion Energy and Bank of America buys that he is back in the buying game.

“Even though we don’t know how long it’s going to be and how much it’s going to permanently affect people’s behavior, we think Berkshire Hathaway is in a really good position to survive,” said Bill Smead, chief investment officer at Smead Capital Management. The company owns $1.5bn as assets including investments in Berkshire Hathaway.

You can buy Berkshire Hathaway stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account