US initial jobless claims are expected expect to fall to 920,000 on Thursday, and if correct would only be the second time during the pandemic that claims have come in under one million.

The date covers the week ended 22 August, according to the consensus estimates compiled by Trading Economics.

Last week, US jobless claims surged above 1 million providing a boost to safe-haven gold.

US jobless claims have been very volatile

Over the last 21 weeks, over 57 million Americans have filed for initial jobless claims, according to the Department of Labor.

Claims gradually fell in every week after peaking at 6.9 million in the last week of March.

In the week ended 8 August, they fell below 1 million for the first time during the pandemic. However, the trend reversed next week and claims unexpectedly rose above 1 million again.

Prior to the week ended 8 August, US initial jobless claims were above a million for 20 consecutive weeks.

Commenting on last week’s jobless claims data, Gus Faucher, chief economist of PNC Financial Services said “The amount of unemployment in the U.S. economy is gradually falling, but is still very high and the pace of improvement is slowing.”

“It is too soon to tell if the expiration of bonus unemployment insurance payments of $600 per week at the end of July has had any impact on the labor market,” added Faucher.

“The modest jump is a stark reminder that claims will likely encounter some turbulence as they fall rather than gliding in for a soft landing,” said Daniel Zhao, senior economist at Glassdoor.

Michelle Holder, a labor economist at John Jay College in New York added: “The labor market isn’t bouncing back—it’s clawing back in fits and starts.”

Gold rose on last week’s worse-than-expected claims

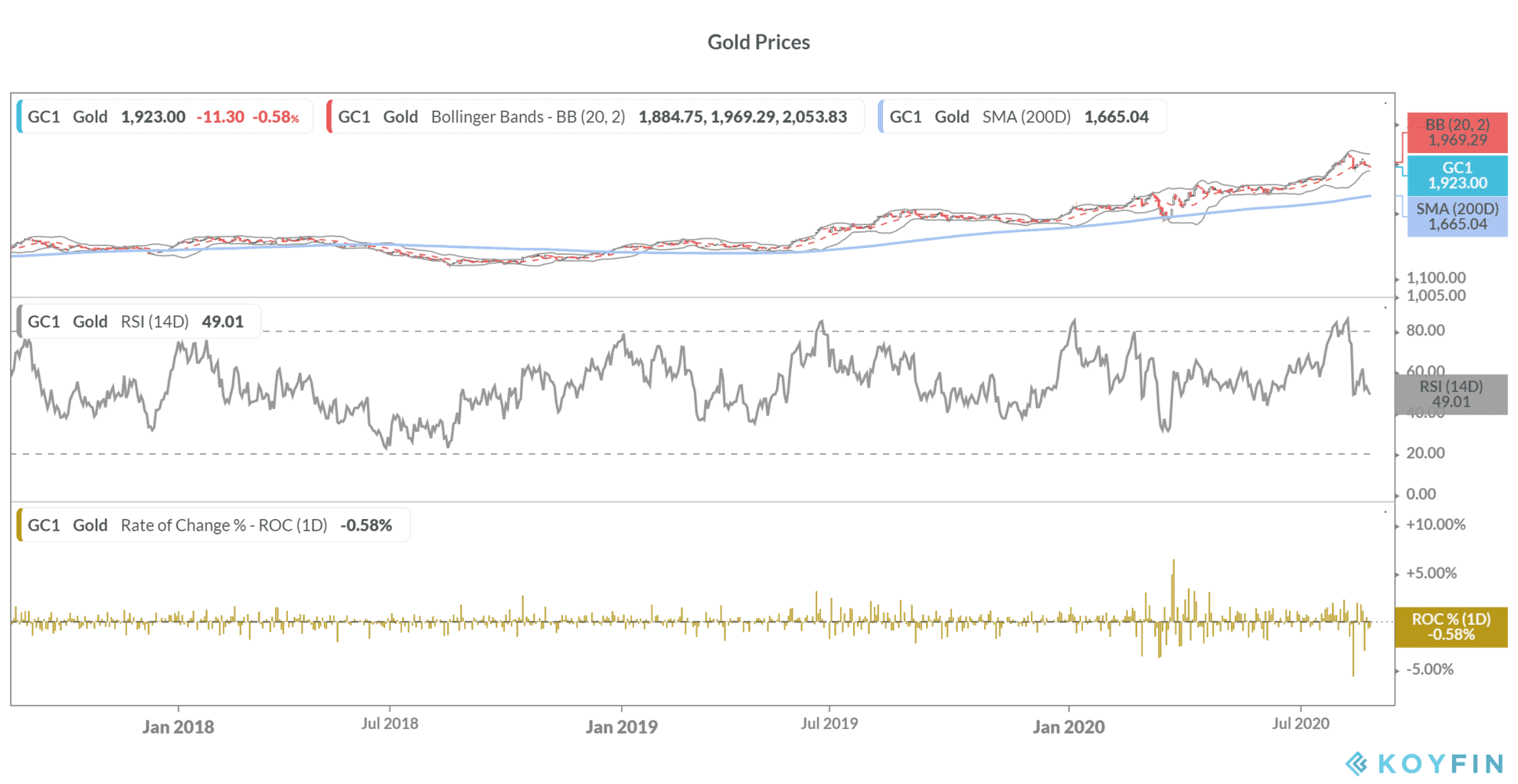

Gold prices, that had fallen over 3% last Wednesday, rose 0.5% on Thursday after US jobless claims rose above the one million mark. As a safe-haven asset, gold prices tend to well in periods of economic uncertainty.

Earlier this month, gold prices hit their all-time highs, breaching the previous highs they hit in 2011. However, gold prices are now down 6.8% from their all-time highs of $2,063 per ounce.

While the Nasdaq index, the S&P 500 both hit record highs last week — but some point out that Main Street is not as healthy as Wall Street.

Gold could rise amid uneven economic recovery

Faucher said: “Initially businesses were recalling a lot of workers as state restrictions were lifted. Now businesses are dealing with the reality that there’s a lot lower demand than there was at the start of the year.”

The uneven economic recovery could support gold prices. Most analysts are positive on gold especially given the expected fall in the US dollar.

Frank Holmes, chief executive at investment firm US Global Investors expects gold prices to rise to $4,000 per ounce, doubling from the current levels. Goldman Sachs and Bank of America also expect gold prices to rise from these levels.

You can buy gold through any of the reputed brokers for gold. You can also trade in gold through CFD (Contract for difference). We’ve compiled a list of some of the best CFD brokers

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account