The dollar, which fell to multi-year lows on Monday, is set to crash further as the Federal Reserve keeps the easing taps open, according to Wells Fargo

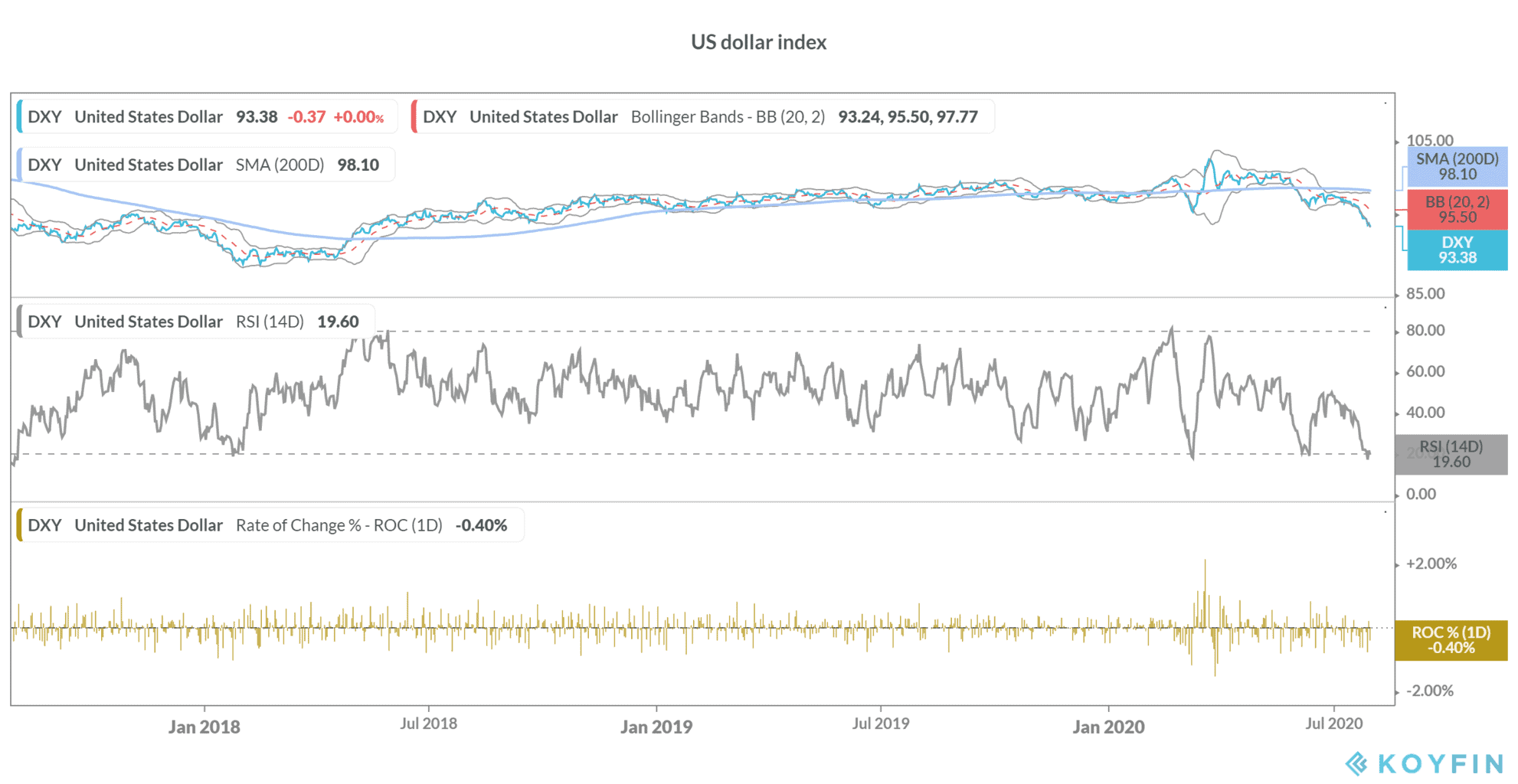

The US dollar index, that measures the greenback’s value against six major currencies including the euro, pound, and yen is currently at 93.38, not far ahead of its 52-week low of 93.18. The dollar index is down 9.0% from its 52-week highs of 102.99 and is trading at the lowest level since June 2018.

Wells Fargo expects US dollar to crash further

Meanwhile, Wells Fargo expects the US dollar could fall more amid the Federal Reserve’s dovish monetary policy. “The currency market has been very sensitive to this sort of thing while whereas the Treasury market just sits,” Michael Schumacher (pictured), Wells Fargo Securities’ head of macro strategy told CNBC’s Trading Nation.

He added: “The currency markets have been much more influenced, and we think that’ll remain the case for the next few weeks.”

The analyst said: “The dollar could conceivably get a little bit of a bounce. But if you look for, let’s say, a trade for the next four to five months, we think it’s dollar weakness.”

Stephen Roach expects greenback to crash 35%

To be sure, Schumacher is not the only analyst warning of a crash in the greenback. In June, US economist and former Morgan Stanley Asia chairman Stephen Roach warned that the US dollar would plunge 35% against other major currencies by the end of 2021.

While the US Federal Government’s $3tn stimulus and the Federal Reserve’s unprecedented easing and bond purchased have helped the US economy in the short-term, it comes with an inevitable long-term cost. A weaker dollar is among the casualties of the massive easing and stimulus. While famous investor Warren Buffett applauded the Fed for its swift actions he warned of “consequences” from the massive easing.

US treasury yields have plummeted.

The yields on US treasuries have also slumped and the yield on the benchmark 10-year treasury closed at 0.577% on Wednesday. The 10-year yield on US treasury bonds has been below 1% since March. However, Schumacher expects a breakout. He said: “We’ve had this call for a while. [It] hasn’t worked out yet. It’ll top 1% by the end of the year. I know it seems almost crazy.”

Looking at the technicals, the US dollar looks oversold with a 14-day RSI (Relative Strength Index) of 19.60. RSI value below 30 indicates that a security is oversold while RSI values above 70 indicate overbought levels.

We’ve made a list of some of the best online forex brokers. You can also trade in currencies using binary options.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account