Costco stock was trading almost 2% higher in early trading today even as the S&P 500 was trading down almost 1%. We’ve two news about Costco today which are on the opposite poles.

Firstly, Costco has declared a special dividend of $10 per share. At current prices, it comes to around a 2.5% yield. The yield is pretty healthy and is more than the S&P 500’s annual dividend yield.

Warren Buffett exits Costco

On the other side of the spectrum, Berkshire Hathaway has revealed that it has fully exited its stake in Costco that it was holding for almost two decades. To be sure, the Warren Buffett-led company had only about a $1 billion stake in Costco that hardly moved the needle either for Berkshire Hathaway or Costco.

That said, we typically see a rise in share prices when a big asset manager like Warren Buffett buys a stake. On the other hand, stocks tend to fall when large asset managers disclose that they are selling the stock. Many investors tend to follow big asset managers into companies.

However, this time we have a mixed performance after Berkshire Hathaway disclosed its stakes. While Pfizer and Bristol-Myers Squibb are trading down today, T-Mobile, Merck, and AbbVie are trading with gains after Berkshire Hathaway revealed new stakes in the companies.

Costco stock defies pessimism

Meanwhile, markets have shrugged off the pessimism over Buffett exiting his stake fully in the company. Firstly, the stake was quite old and passive. Also, it was a very small position for Berkshire Hathaway.

More importantly, Costco’s special dividend is getting a thumbs up from the markets. While many companies have either lowered their dividends or suspended them altogether due to the COVID-19 pandemic, Costco has announced a special dividend.

Retailers have cut dividends this year

Notably, the brick and mortar retail is among the worst affected sectors from the COVID-19 pandemic. Footfalls at retail stores have fallen due to lockdowns. Its creating problems for mall operators as well as retail companies that don’t have buoyant eCommerce operations.

Estee Lauder, Dick’s Sporting Goods, Nordstrom, and Macy’s are the retailers that have suspended dividends this year. J.C. Penney’s had to file for bankruptcy as the COVID-19 pandemic amplified its woes.

However, sales at Costco and Walmart have boomed this year. Amazon stock has also soared to record highs as more consumers shifted to online shopping.

Costco management on the dividend

Costco’s special dividend has a record date of 2 December and would be paid on 11 December. Costco would spend around $4.4 billion towards the special cash dividend.

“This special dividend, our fourth in eight years, is our latest step to reward shareholders. Our strong balance sheet allows us to pay this dividend, while preserving financial and operational flexibility to continue to grow our business globally,” said Richard Galanti, Costco’s chief financial officer. He added, “Costco will continue to be in a financial position to take care of our employees, enhance the value of the Costco membership, and create shareholder value over the long term.”

Price action and valuation

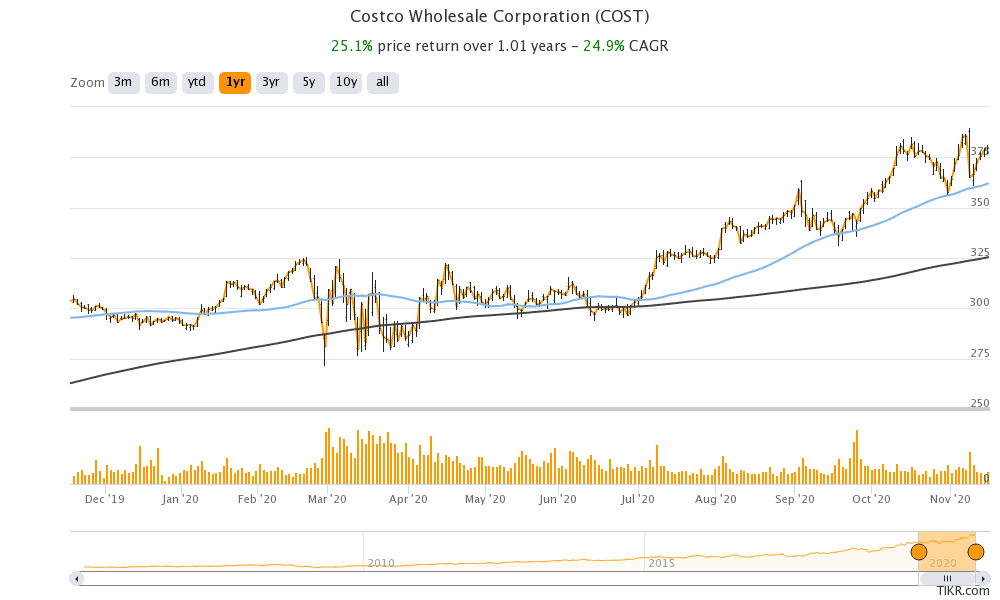

Costco stock is up almost 30% so far in 2020. Its valuation might look somewhat streched with an NTM (next 12-month) price to earnings multiple of 39x. That said, investors have been willing to pay a premium for quality growth companies like Costco this year.

For more information on trading in stocks, please see our selection of some of the best online stockbrokers. We’ve also compiled a handy guide on how to short stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account