Market Volatility: Risks and Opportunities for Novice Traders

Most “buy and hold” investors love to see a market chugging along smoothly, plotted on a chart from lower left to upper right, with the occasional spike or dip. However, traders love volatility – whether you hold your positions for a few days, or someone that trades shorts nimbly, jumping in and out of the market throughout the day, a lot of money can be made trading on volatility. Volatility breeds opportunity. However, if you don’t have the right mindset, and if you aren’t supported by exceptional tools and features from your trading platform, there are hidden risks in volatility – especially for those just planning to venture into stock trading.

Fear & Greed: Two Sides of the Same Coin

If you are new to trading, two emotions might keep you away from optimizing your trades. And, unless you equip yourself with the knowledge and tools to deal with them, you may never succeed as a trader.

- Fear: As you monitor the markets, especially when they are as frothy as they’ve been over the past several months, you’ll see immense price swings on both sides of a trade. Do you jump in now? Wait for a pull back? Short a stock…or just pass this trade and wait for another opportunity. They say only the brave are rewarded with fortune…but bravery is also a leading cause of martyrdom!

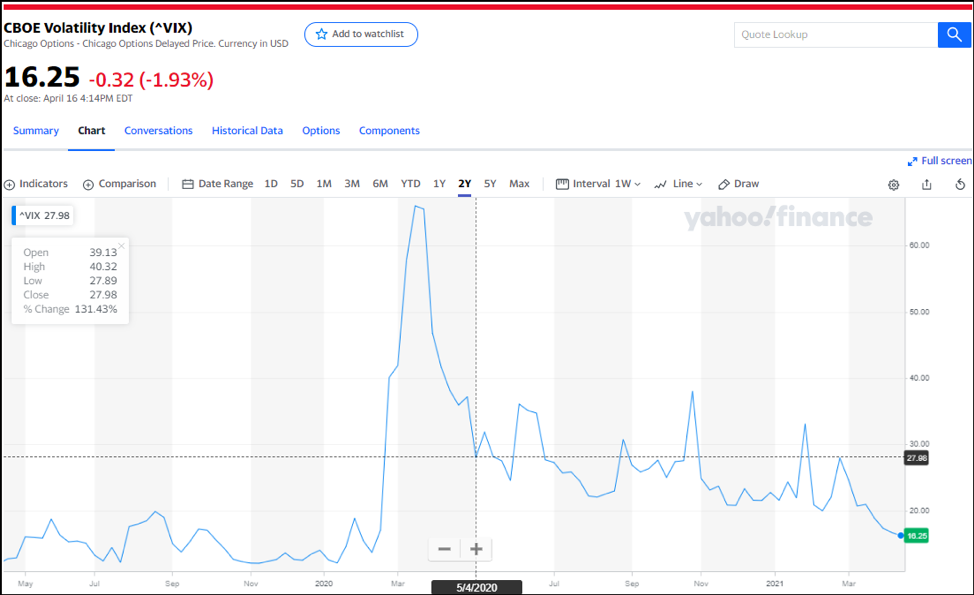

Investors typically use The CBOE Volatility Index (VIX) as a measure of volatility and stress in the market. Paradoxically, the VIX is also known as the “Fear Index”. One look at the 2-year VIX chart tells a story of exceptional volatility. Traditionally, a VIX value less than 20% indicates a healthy market. Higher than that, and you are in an uncertain and fear-filled market. The chart above has seen VIX values higher than 65%. As a trader, fear may save you from catastrophic losses, but that same emotion can hold you back from colossal gains.

- Greed: There’s an old saying on Wall street that goes something like this: “Bulls make money. Bears make money, but Pigs get slaughtered…” Sometimes, especially when you are new to the world of trading, it’s hard to know when to quit. Making that decision is especially difficult when you’re on a winning spree. It might seem like your next trade will net you an even bigger profit, but if you are too greedy (and don’t take profits and step back to rethink your next move!), it’s likely your next trade may be your unwinding!

How you deal with fear and greed may ultimately determine whether you are a good trader or not so good at it. And, while taming your emotions have much to do with whether you profit or loss in a trade, your choice of a trading platform may have much more to contribute to putting you on the winning side of a trade. Now may therefore be a good time to do your research on the best trading platforms for beginners, and evaluate all the options available to you.

Think Beyond Trading Fees

One way to deal with fear and greed is by using intelligent trading tools. When you shop around for your trading platform, don’t just measure their suitability based on a comparative of trading fees among peer platforms. Yes, trading fees do matter, and, over time, they may add or shave-off several basis points to/from your trading profits.

Some trading platforms may offer attractive sign-up bonus plans, but what more are you getting for your money? For instance, are you supported with exceptional training content that offer you all the information, tips and tricks to make the best use of the platform? Do they offer courses on how to analyze market conditions so you might optimize your trading decisions? As well, look for “freebies” – such as eBooks and other trading resources that can potentially make you a better trader.

An informed trader is most certainly a better trader, and your platform should play a vital role in making you a more informed trader. Look for what a platform offers on these counts as well. Do they have a well-stocked knowledge base repository that you can turn to when you need additional support? Can you access the latest economic indicators that traders so often need to make informed trading decisions?

One platform that checks all these boxes, and much more, is easyMarkets, whose team has been delivering honest, transparent trading products and services to its clients since 2001. With so much going on in the markets today, traders need all the help they can get – and teaming-up with a platform with a proven track record is a great first step to help yourself get on the winning side of a trade.

Insist on Good Trading Value for Money

The world of online trading is extensive, and volatility can sometimes overwhelm even the most battle-hardy trader. Some trading platforms offer little or minimal trading support – sometimes just the App is all you get! This pushes novice traders into the deep end on the get-go. Many investors, like Millennials or Gen-Z’eders, who are new to trading, may therefore prefer to execute their retail trading activity on platforms that offer better tools and greater support.

It is more convenient to use a trading platform with a history of innovation and a track record of bringing value to its customers. Online trading is often a volatile, turbulent world. Look for platforms that provide unique features, such as the ability to temporarily “insure” each trade against potential losses.

In a fast-paced trading world, even the minutest “leg up” can make the difference between huge gains and scathing losses. One feature to look for, in a trading platform, is their policy on spreads. Most platforms offer variable spreads, which makes it hard to count your profits (or tally your losses!) until the deal is done. In a volatile trading world, a great way to infuse transparency in your trading is fixed spreads – regardless of volatility or liquidity, your trading spreads remain unchanged.

Volatility also impacts the price at which your trades execute, which might differ significantly from the price at which you placed the trade. To safeguard your portfolio from slippage impact, look for a platform that offers Zero-slippage features. The price you see is the price you get. Now that’s definitely getting trading value for your money!

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account