South Carolina Payday Loans Lender 2020

Are you currently in the lookout for short-term financing in South Carolina? Unlike a number of other states in the US, payday loans in South Carolina are perfectly legal. However, state lending laws are still somewhat strict.

For example, you can only borrow up to $550 through a payday loan, and the longest-term permitted is 31 days. Moreover, payday loan companies in the state cannot charge more than 391% APR on the loan, with financing charges capped to 15% of the loan amount.

Nevertheless, if you’re looking for more information on how to get a payday loan in the state, be sure to read this guide. Within it, we cover the ins and outs of what state lending laws you need to be made aware of, as well as how you can apply for a South Carolina payday loan today.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

-

-

Note: You can only take out one payday loan at a time in South Carolina. This is to prevent vulnerable consumers from taking out additional loans to cover the costs of outstanding debts.

What are the Laws Surrounding Payday Loans in South Carolina?

In the midst of the financial crisis in 2008, a number of US states decided to outlaw payday loans in their entirety. Although this wasn’t the case in South Carolina, state legislators still decided to step in to tighten the laws surrounding unethical lending practices. As such, lenders wishing to service customers must hold a financing license.

In terms of what the 2009 legislation states, this places a cap on the amount of money that you can borrow through a payday loan to $550. Anything more than this and you will need to consider an alternative funding source – such as a personal loan. Nevertheless, state lending laws in South Carolina also restrict payday loan terms of more than 31 days. This means that you will be required to repay the loan in full when you next receive your salary.

You can also only take out one payday loan at a time in South Carolina, and lenders are not able to offer you an extension or rollover. When it comes to APR rates, South Carolina’s laws have also placed restrictions on the amount of interest that payday loan lenders can charge. This stands at a maximum APR of 391% annually. Lenders are also capped in what they can charge in financing charges.

This includes the likes of origination and late payment fees. With the limit set at 15% of the total loan amount, this means that the maximum financing charge on a $550 loan is $75. All in all, borrowers are well looked after by state legislators when it comes to payday loans. The overarching concept is that while payday loans should remain legal, consumers should not enter into financially crippling arrangements that they cannot afford to repay.

Note: If you come across a payday loan lender in South Carolina that charges more than the state limits, this is likely to be a Tribal loan company. Such firms operate under their own codes of practice, as opposed to state lending laws. As such, they have the remit to charge as much interest as they like.Pros and Cons of Payday Loans in South Carolina

Pros:

- Payday loans capped to a maximum of $550

- Terms cannot exceed 31 days

- Lenders will consider credit profiles of all shapes and sizes

- No rollovers or extensions allowed

- Funds often transferred on a same-day basis

- Some lenders allow you to view your APR rates on a soft credit check basis

- Complete the entire application process online

Cons:

- Not suitable if you need to borrow more than $550

- Tribal loan companies operating in the state do not abide by state lending laws

Best Online Payday Loan Companies in South Carolina 2020

Reviewers Choice

Viva LoansRatingAvailable Loan Amount$100 - $5,000Available Term Length3 monthsRepresentative APR5.99% to 35.99%Product Details- Appeals most to individuals looking for fast loan processing

Pros- Considers all types of credits in loan processing

- Available throughout the country

- Low interest rate to high credit score borrowers

- Hard inquiry may hurt your score

Key Facts- Fast loan application and approval process

- Highly responsive customer support

- Connects borrowers to a wide range of lenders

Loan SoloRatingAvailable Loan Amount$100 - $1,000Available Term Length6 - 9MonthsRepresentative APR200% - 2290%Product Details- Best for on-phone payday loan application processing

Pros- The huge number of lenders increases your chances of qualifying for a loan

- Fast application processing with next business day disbursement

- Maintains competitive loan interest rates

- Maintains a relatively low maximum loan limit - $1,000

- Some lenders will pull out your credit report

Key Facts- Specializes in different types of loans – including payday loans

- Matches your loan request with numerous low-credit lenders

- Processes both online and on-phone loan applications

Extra lendRatingAvailable Loan Amount$100 - $ 3,000Available Term Length6 months - 2 yearsRepresentative APR4.99% - 1386%Product Details- Best for the protection of the borrower’s persona information

Pros- Borrowers with relatively attractive credit scores benefit from competitive loan APRs

- It’s a loans marketplace and thus higher chances of qualifying for a loan

- Most lenders will only conduct a soft check of your credit history

- Huge loan amounts and competitive interest only available to good credit borrowers

- One may consider the $3,000 loan limit quite low

Key Facts- Specializes in advancing installment loans

- Fast loan application and processing with next business day funding

- Lends to all borrowers regardless of the credit score

CashUSA.comRatingAvailable Loan Amount$500 - $10,000Available Term Length6 monthsRepresentative APR5.99% to 35.99%Product Details- Best for borrowers looking to boost their success rate by seeking loans from numerous lenders

Pros- High number of lenders increases your chances of succeeding

- Advances high loan limits – up to $10,000

- Encourages extended repayment periods – up to 5 years

- Not a lender but an intermediary

Key Facts- Fast loan approval and processing times – 48hours

- Lends to all types of credit borrowers

- Easy to use interface

My credit advanceRatingAvailable Loan Amount$ 100 - $ 5,000Available Term LengthVaries with the lenderRepresentative APR4.99% - 1386%Product Details- Best personal loans specialist

Pros- Helps you rebuild your credit report by reporting repayment progress to reference bureaus

- Advances high loan limits of up to $5,000 to borrowers with attractive credit scores

- Presents your loan application to a wide range of lenders

- Its hard to qualify for high loan limits and competitive interests

- Fines borrowers for late payments

Key Facts- Lends to all regardless of credit score if they earn a minimum $1,000 per months

- Maintains relatively fast loan application and funds disbursement process – within 24 hours

- Wholly online loan application and e-signing processes

How to Choose a Payday Loan Lender in South Carolina?

Although state lending laws govern how much you can borrow and at what interest rate, you still need to make some considerations regarding your chosen payday loan company. For example, if you need access to fast emergency funding, then you’ll need to use a payday loan company that offers a same-day transfer. Similarly, the maximum APR rate of 391% is still expensive, so you’ll want to find a lender that is cheaper than the limits permitted.

To help you along the way, we’ve listed some of the key metrics that you need to look out for prior to choosing a payday loan lender in South Carolina.

No Visit Required

You should stick with payday loan companies that operate 100% online. The reason for this is that you will be able to complete the entire end-to-end loan application from the comfort of your home. In doing so, not only will you avoid the need to visit a branch to hand in documents or sign the loan agreement, but you’ll be able to assess your lending terms in less than 10 minutes.

Representative APR Rates

It is notable that South Carolina lenders cannot charge more than 391% in interest. However, if your personal rate is close to this figure, you’re paying a lot of interest. As such, you need to stick with payday loan firms that offer more competitive interest rates.

Note: Even if the representative rate looks competitive, there is no guarantee that you will get this rate. On the contrary, the representative rate is merely the interest rate that the lender chooses to advertise on its platform. As such, you could pay much more.On the other hand, you won’t know the exact APR rate until you go through the online application process. However, you should still review the lender’s platform to see what representative rate is published. If the rate is good, then you stand a much better chance of keeping your interest to a minimum.

Funding Times

You also need to assess the length of time that the lender requires to complete the loan process. Some payday loan lenders in South Carolina will forward your loan funds as soon as you are approved. This is ideal if you have an urgent need for financing, and need access to the cash on a same-day basis.

However, if the lender is known to ask for supporting documentation, this can delay the funding process by a couple of days. As such, go with a lender that has the capacity to process loan applications electronically.

Loan Size and Term

Although lenders in South Carolina have the legal remit to offer payday loans of up to $550, this won’t always be the case. Instead, some lenders will offer a much lower amount, so make sure the lender is able to meet your financing needs. Similarly, you also need to check the loan term. Once again, although lenders are able to offer a maximum term of 31 days, you might need to repay the money sooner. In fact, you’ll likely need to repay the loan when you next receive your salary.

How can I get a Payday Loan in South Carolina Today?

Are you based in South Carolina and looking for a payday loan today? If so, follow the quickfire guidelines outlined below.

Step 1: Choose a Payday Loan Lender

You will first need to choose a lender that offers payday loans in South Carolina that meets your personal needs. The easiest way to do this is to follow the information outlined in the section above on choosing a lender. This should include the lender’s APR rates, funding times, and eligibility requirements.

If you don’t have time to perform your own research, it might be worth considering some of the recommended lenders we have listed on this page. Each lender has been independently reviewed by our in-house team to ensure it meets our stringent criteria.

Step 2: Apply Online

Once you’ve found a suitable lender that operates in South Carolina, you will then need to submit an online application. Firstly, you’ll need to enter the amount that you wish to borrow, and for how long. Next, you’ll then be asked a range of questions about your identity and financial standing. This is to ensure that the lender knows who you are and that you have the financial means to repay the loan on time.

This will include:

- First and Last Name

- Home Address

- Date of Birth

- State ID Number

- Contact Details

- Income After-Tax

- Name and Address of Employer

- How Long You Have Lived at Current Address

Step 3: Review Loan Terms

Once you’ve gone through the application process and submitted the loan request, the South Carolina payday loans lender will then cross-reference your information electronically. It will likely extract data from the main three credit bureaus – meaning that the search could be posted to your credit file.

Note: Some payday loans in South Carolina allow you to check your interest rates via a soft credit check. This means that irrespective of whether or not you are approved, the search won’t impact your credit score.You should receive a decision in less than a minute. If approved, you will be shown your personal lending rates and the date in which you need to repay the money. The loan terms might also include a financing fee, so be sure to look out for this. The maximum fee that can be charged is 15% of the loan amount.

Step 4: Bank Details and Digital Loan Agreement

The final stage of the payday loan application process will require you to enter your bank account details. This needs to be a valid US checking account, which is where the funds will be deposited into. The lender will need to take your repayment from the same account, meaning you’ll need to set up an electronic debit agreement. To complete the loan process, you will now need to sign the digital loan agreement, but before you do, make sure you read through it thoroughly.

Am I Eligible for a Payday Loan in South Carolina?

Tight lending regulations in the state of South Carolina does, of course, come with its pros. Not only are you protected from unethical lending practices, but the amount of interest that you can pay is capped at 391%. However, such a restrictive lending space also comes with a key flaw – eligibility requirements are slightly higher in South Carolina in comparison to pre-2009.

This is because loan providers can no longer offset the risks of lending money to bad credit profiles with higher interest payments. Instead, they are capped to 391%, meaning they might reject your application if your credit score is really hampered.

As such, below we have listed the typical criteria that payday loan lenders in South Carolina will ask for.

Regular Source of Income

Most payday loan companies operating in South Carolina will ask that you have a regular source of income. If the lender states a minimum income amount, you will need to meet this to be eligible. With that said, some lenders will consider income in the form of benefits or a pension, so you won’t necessarily be turned away if you’re unemployed.

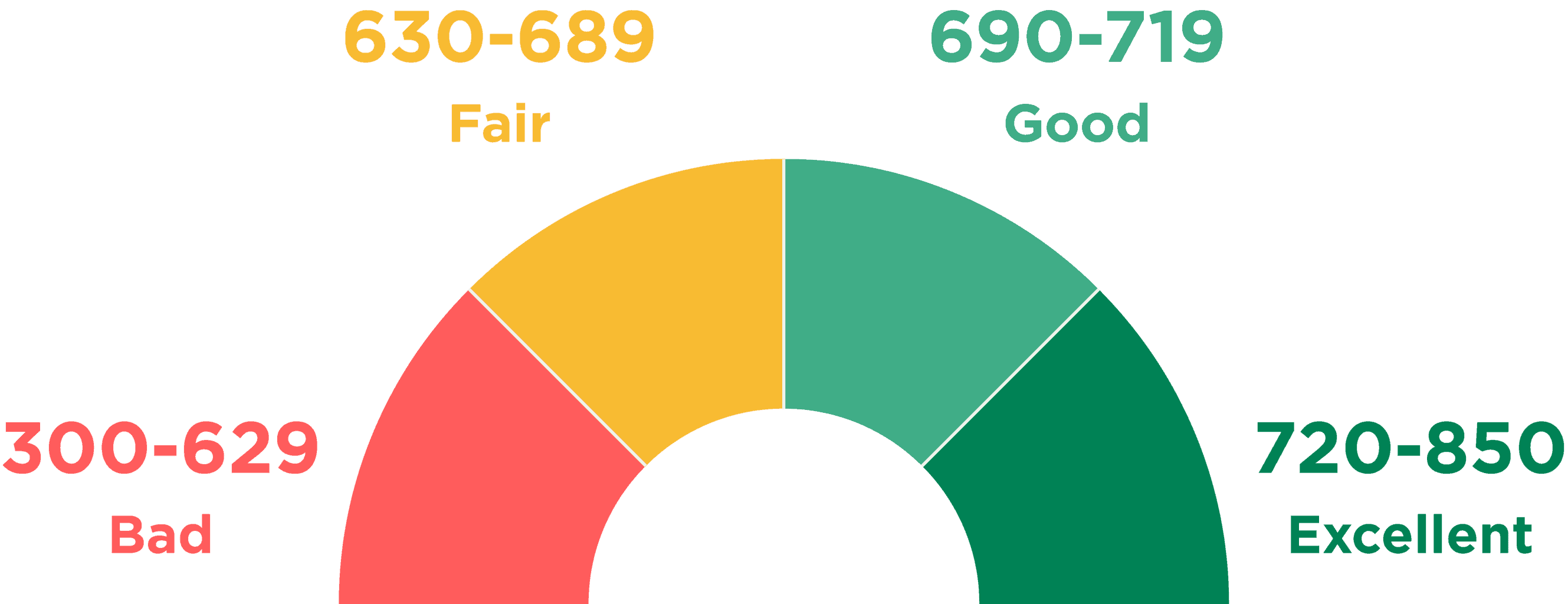

Minimum FICO Credit Score

You might also need to meet a minimum FICO score to be eligible for a payday loan. If this is a requirement, the lender will need to run a full credit inquiry on you to extract your current score.

Depending on the type of lender you go with, you might need to possess a score of at least ‘Fair’ to get a loan. This amounts to a minimum FICO score of 630.

History With Repaying Debt

Payday loan companies operating in South Carolina will be most interested in your historical relationship with debt. By extracting your data from the main three credit bureaus, the lender will be able to see how responsible you are with credit. If you’ve previously missed payments or defaulted on a loan arrangement, this will show up and possibly hinder your chances of being approved.

South Carolina Resident and 18+

You will also need to be a resident of South Carolina to get a payday loan and be aged at least 18 years old.

Alternatives to a Payday Loan

Are you looking for financing in South Carolina, but need to borrow more than $550? Or, do you need longer than 31 days to repay the money? If so, you might need to consider an alternative funding source. At the forefront of this is a personal loan. Not only will you be able to borrow a much larger amount than payday loans permit, but you can also repay the money over a number of years.

Reviewers Choice

Fundsjoy – Personal LoansRatingAvailable Loan Amount$100 - $5,000Available Term Length2 weeks to 12 monthsRepresentative APR4.99% - 1386%Product Details- Best loan marketplace with hundreds of verified personal and institutional lenders

Pros- Maintains high maximum loans limit – up to $5,000

- Gives loans to poor credit score borrowers and others with no credit history

- Fast loan application process

- Imposes punitive fees and charges on late payments

- One may consider their interest rates quite high

Key Facts- Lends to all types of credit rating borrowers

- It’s a loans marketplace and not a direct lender

- Doesn’t pull your credit history in making credit decision

Marcus By Goldman SachsRatingAvailable Loan Amount$3,500 - $40,000Available Term Length3-5 yearsRepresentative APR5.99% – 28.99% (variable)Product Details- Best for individuals looking for a lender with a variety of loan options

Pros- Soft credit inquiry on loan application doesn’t hurt your score

- Embraces a fully automated loan application process

- No penalties for late payments or prepayment

- Unsecured nature of all Marcus loans makes them expensive

Key Facts- Doesn’t impose extra charges on the lending process or penalties for late payment

- Appeals to above-average borrowers

- Offers unsecured loans dedicated to salaried employees

LightstreamRatingAvailable Loan Amount$5,000 - $100,000Available Term Length2 to 7 yearsRepresentative APR3.5% to 16.8%Product Details- Best for borrowers with good credit who need cash immediately

Pros- Offers same-day cash in your bank account

- Extremely low starting interest rates

- Requires strong credit

Key Facts- Owned by SunTrust Bank

- Stands behind application process with a $100 guarantee

- Will match the APR from another lender

Avant CreditRatingAvailable Loan Amount$2,000 - $35,000Available Term Length2-5 yearsRepresentative APR5.99% – 28.99% (variable)Product Details- Appeals most to individuals with an average credit score and low-income earners

Pros- Embraces a highly transparent loan pricing model with transparent fees and charges

- Considers more than just the credit score in awarding loans

- Straightforward loan application and fast processing

- Imposes high administration fees and late payment penalties

Key Facts- Loans available to anyone with a minimum annual income of $20,000

- Overlooks poor credit history in advancing loans

- Greater flexibility in interest rate calculation i.e low interest for high monthly payouts

Brigit Loan App LoanRatingAvailable Loan Amount$10 - $250Available Term LengthVariesRepresentative APR0%Product Details- A mobile device platform that allows you to have access to credit to help you before you become overdrawn on your account

Pros- Due date extensions available

- Overdraft predictions

- Monthly fee at $9.99

- No joint bank accounts

Key Facts- No fees apart from the monthly subscription.

- No late payment fees.

- The app notifies you 24 hours before the due date.

Conclusion

By reading our guide all of the way through, you should now be able to make an informed decision as to whether or not a South Carolina payday loan is right for your financing needs. Although such loans are perfectly legal in the state, a number of restrictions remain in place. Crucially, this limits the amount of interest that South Carolina lenders can charge you. At 391% APR, this will keep your lending costs under control. Limits are also in place on financing charges, which is capped at 15% of the total loan size.

However, strict lending laws also mean that you will be unable to borrow more than $550, nor can you borrow the funds for more than 31 days. You won’t be able to apply for a rollover or extension either. As such, if you need to borrow more than the $550 limit permits, you’ll need to consider an alternative funding source such as a personal loan. Ultimately, regardless of how you intend on arranging your loan requirements, just make sure you have the means to meet your repayments on time.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQs

Can I apply for a payday loan online if I live in South Carolina?

Payday loans are perfectly legal in the state of South Carolina. With that, certain restrictions remain in place on the amount you can borrow, for how long, and at what interest rate.

How much interest can payday loan companies charge in South Carolina?

Interest rates in South Carolina are capped at 391% APR. In terms of financing charges, this is limited to 15% of the total loan amount..

How much can I borrow on a payday loan in South Carolina?

’As per state lending laws, you cannot borrow more than $550 from payday loan companies operating in South Carolina. If you need to borrow more than this, you’ll need to consider an alternative loan type.

How long can I take out a payday loan for in South Carolina?

You won’t be able to borrow the funds for more than 31 days. Moreover, payday loans in South Carolina cannot be rolled over or extended, so do bear this in mind.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Reviewers Choice

Reviewers Choice