Connecticut Payday Loans Lender 2020

Are you a resident of Connecticut and looking for short-term financing? Unfortunately, payday loans in the state are no longer legal, so your options are going to be extremely limited. With that being said, a number of other financing products – both long-term and short-term, might be suitable for your requirements.

This includes personal loans – and depending on your individual credit profile, Tribal loan companies. Crucially, lenders in the state of Connecticut cannot charge more than 12% APR in interest, which is very competitive.

Nevertheless, if you’re wondering what your financing options are, we would suggest reading our in-depth guide on Connecticut Payday Loan Lenders in 2020. We cover everything you need to know – such as the types of financing permitted in the state, how much you can borrow, lending terms, and more.

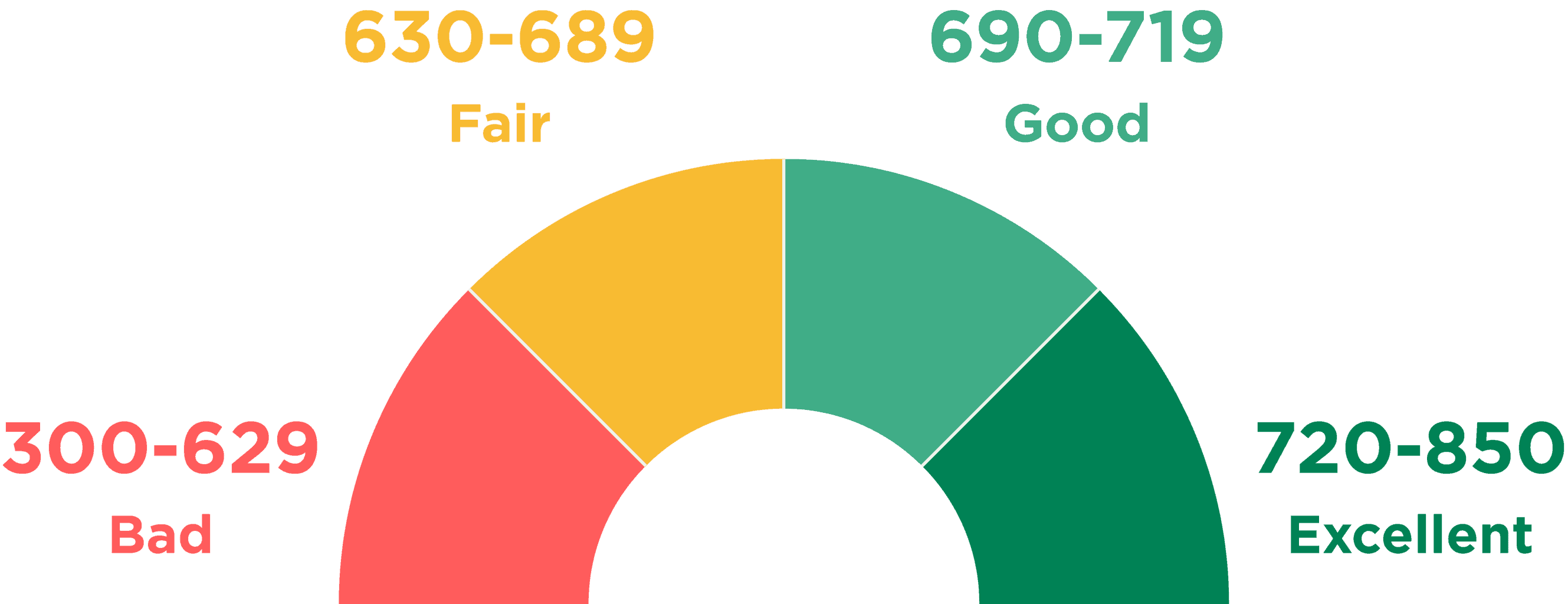

Connecticut is one of the toughest states in the US when it comes to financing. When state legislators decided to step in a number of years ago, they virtually eliminated payday loan companies overnight. The reason for this is that state regulators wanted to put a stop to unethical lending practices – something that was prevalent before the ban. As such, you will need to consider an alternative source of funding if you’re a resident of Connecticut. At the core of lending laws in Connecticut is a cap on the interest that loan providers can charge. This stands at a maximum APR rate of 12%, which is very low. On the one hand, this is good news for you as a consumer, as you’ll be accustomed to super-competitive interest rates. However, it is also important to note that your chances of obtaining a loan with bad credit are unlikely. This is because of the Risk vs Reward conundrum faced by lenders in the state. Ordinarily, loan companies in Connecticut were happy to consider applications from those with bad credit, as they could simply reflect the increased risk in the form of higher APR rates. This is no longer an option for lenders. As a consequence, lenders will simply turn you away if your credit profile is less than ideal. With that being said, you might come across an alternative option in the state – Tribal loan companies. Although state legislators have stated that Tribal lenders are illegal in Connecticut, this hasn’t stopped them from offering payday loans. This is because such firms operate under their own Tribal laws, as opposed to state regulations. As such, they are known to charge extortionate fees to Connecticut residents. With state lenders capped to an annualized interest rate of 12%, you won’t have too many options in your search for short-term financing. Even if you do find a loan product being offered by a Connecticut lender, this doesn’t necessarily mean that you’ll be eligible. Nevertheless, below we have outlined the main loan types that you have at your disposal in Connecticut. The best option available to you in your search for financing is likely to be a personal loan. Also referred to as an installment loan, personal loans allow you to borrow a fixed amount of money over a number of months or years. This is in stark contrast to conventional payday loans, which usually require you to repay the money when you next get paid. Moreover, personal loans are usually for much larger amounts. For example, while payday loans often allow you to borrow just a few hundred dollars, personal loan providers in Connecticut can facilitate loans in the thousands of dollars. However, the total loan size cannot exceed $15,000 in the state, unless it is to finance the purchase of a property. In terms of the interest on personal loans, this can never exceed 12% APR. As such, if you’re eligible to get financing, you’ll be doing so at a very competitive rate. While we are on the subject of eligibility, you will likely need to have a FICO score of at least ‘good’ to qualify. Similarly, the lender will want to see that you have a steady form of income and a history of always repaying your debts on time. Pros: Cons: Unless you have a healthy credit profile, the only other option that you will have on the table in Connecticut will be to use a Tribal loan company. As we briefly noted earlier, such companies are actually prohibited by state legislators in Connecticut. However, Tribal firms are not required to abide by state financing laws, which is why they operate anyway. As such, you’ll be able to obtain a payday loan from a tribal lender even if your credit rating is poor. In terms of how Tribal loans work, they resemble that of a conventional payday loan. You’ll be able to borrow a few hundred dollars, and most lenders will ask that you repay the money when you next receive your paycheck. Moreover, you’ll likely receive the loan funds on a next-day basis – sometimes sooner. However, you should be prepared to pay a hefty rate of interest when opting for a Tribal loan. This is because Tribal loan firms are not hindered by the 12% APR rule. Instead, they often charge three-digit interest rates. This is especially the case if your credit profile is damaged, as Tribal companies know that you have nowhere else to turn to obtain financing. Pros: Cons: If you’ve read our guide up to this point, then you’ll know that just two loan types are available in the state of Connecticut – personal loans and Tribal loans. As such, the loan type that you opt for will depend on your credit profile and financial standing. To clarify, if your credit is ‘good’ or ‘excellent’, and you have a steady form of income, then the personal loan route is probably your best option. Alternatively, if your credit score is bad, and you’ve got a history of missing loan repayments, then you might need to use a Tribal lender. Nevertheless, we’ve listed the main requirements that lenders in Connecticut typically ask for to be eligible for financing. Regular Source of Income Regardless of the type of loan that you’re after, you will need to have a regular source of income. Personal loan firms in the state will likely ask that your income comes in the form of full-time employment. You might also need to meet a minimum monthly income amount, although this will vary from lender to lender. At the other end of the spectrum, Tribal loan companies will often consider applicants that get their income from other means – such as benefits or a pension. Minimum FICO Score As noted above, some lenders in Connecticut will ask you to meet a minimum FICO score. If opting for a personal loan, you will likely need to have at least a ‘good’ score, which is 690 and above. Many Tribal loan companies do not perform credit checks, so even if your FICO score sits within the ‘bad’ range, you might still be eligible. Connecticut Resident and 18+ You will need to be a US citizen, and a resident of Connecticut to be eligible for a loan in the state. Furthermore, whether it’s a personal loan or a Tribal loan, you will need to be aged at least 18 years old. This is a Federal law, meaning that even Tribal loan companies need to abide by it! Once you have determined your preferred loan type, you will then need to choose a lender that meets your needs. With so many operating in the Connecticut lending scene, this can make it a difficult task to know which loan company to go with. As such, be sure to look out for the following metrics: Licensing and Reputation You should first assess whether or not the lender is licensed to operate in Connecticut. If it isn’t, then you are likely using a Tribal lender. You should also perform some research on the lender to see whether any negative reviews are present in the public domain. Loan Size You will also need to evaluate the size of the loan being offered by the Connecticut lender in question. On the one hand, you don’t want to choose a lender that isn’t prepared to offer you enough money to cover your financing requirements. Similarly, you should never borrow more than you actually need. Loan Tern The term of the loan is also an important metric to consider when choosing a lender in Connecticut. For example, if opting for a personal loan, then some lenders will facilitate a loan term of no less than 12 months. At the other end of the pectrum, Tribal loan companies operate much the same way as a conventional payday loan company – meaning that you’ll be asked to repay the money when you next get paid. APR If you’re opting for a personal loan, then you don’t need to concern yourself with lending rates in Connecticut – as the most you’ll be charged is 12% APR. However, if using a Tribal lender, you need to assess the types of interest charged by the firm. The easiest way to do this is to check the lender’s platform to see what representative rate they advertise. Funding Time It is also important to ascertain how quickly the lender is able to distribute your loan funds. Most Tribal loan companies in Conneticut will transfer your funds as soon as the loan is approved. This is ideal if you have a financial emergency that needs funding straightaway. However, personal loans will often take 1-2 working days to fund, as loans are typically for much higher amounts. Are you based in Connecticut and looking for financing today? If so, we would suggest reading the step-by-step guidelines we have listed below. First and foremost, you will need to choose a loan type that is available in Connecticut. Once again, this will either need to be a personal loan or a Tribal loan. If opting for the former, you will first need to ensure that you meet the eligibility requirements outlined by the lender. You can review the key eligibility requirements that Connecticut lenders look for in the section above. Once you have determined the best loan type for your individual needs, you will then need to choose a lender. The easiest way to do this is to review the factors we outlined earlier in our guide. This includes metrics like APR rates, financing times, and the length of time you have to repay the money. Once you have selected a Connecticut lender, you will then need to get the application process started. Head over to the lenders’ platform, and enter the amount of money you wish to borrow and for how long. You will then be taken to the main application page. This will ask you a range of questions about your identity and financial standing. This will include: Once you submit your application, the Connecticut lender will check your data with third-party sources. If the lender is able to validate the information without needing further documentation – and it deems you to have a suitable credit profile, you will be pre-approved on the spot. If you are, you will be able to review your personal lending terms. This includes the amount of interest you need to pay on the loan, and what repayments you need to make. If you decide that the loan terms offered to you meet your financing needs, you will be asked to enter your bank account details. This is for two separate purposes. Firstly, the loan funds will likely be transferred into your US checking account. Secondly, lenders prefer to take your monthly repayments directly from your bank account. To set this up, you will need to authorize an electronic debit arrangement. Finally, you will need to sign a digital loan agreement. This will outline the terms of your loan, so be sure to re-check them before signing it. Once you do, you might receive the loan funds later that day. When it comes to US states with the strictest lending laws, it doesn’t get more restrictive than Connecticut. Not only are payday loans now banned in their entirety, but interest rates have been capped to 12% APR. Moreover, the state has also implemented a maximum loan size of $15,000. While at first glance these restrictions might appear favorable for Connecticut residents, this does make it extremely difficult to obtain financing if you’re credit is less than ideal. This is because lenders can no longer offset the risks of lending to bad credit profiles with higher interest rates. With that said, an umber of Tribal loan companies are still active in the state. As such firms abide by their own Tribal laws – and not state lending regulations, Connecticut borrowers have been known to be charged three-figure APR rates. Ultimately, if you are going to use a Tribal lender for your short-term financing needs, make sure you can afford to repay the money on time. Apply for a Payday Loan Now! | Best Payday Lender 2020 Our Rating Payday loans are no longer legal in Connecticut, as state legislators outlawed them as a means to protect consumers from unethical lending practices. However, a number of unlicensed Tribal lenders are still active in the state. This depends. On one hand, if you have a firm understanding of how much the loan is going to cost you, and you meet your repayments on time, then you should have no issues with a Tribal lender. With that said, the problems arise when you fall behind on the loan, as Tribal companies can charge as much as they want in late payment fees. ’As long as you are using a licensed firm, lenders in Connecticut cannot charge more than 12% APR on loans. The most that you can borrow from a lender in Connecticut is $15,000. Kane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications. WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site. Copyright © 2026 | Learnbonds.com

Why are Payday Loans Banned in Connecticut?

Best Connecticut Alternatives to Payday Loans in 2020

Alternatives to Payday Loans in Connecticut

Personal Loans in Connecticut

Pros and Cons of Personal Loans in Connecticut

Tribal Loans in Connecticut

Pros and Cons of Tribal Loans in Connecticut

Am I Eligible for a Loan in Connecticut?

How do I Choose a Lender in Connecticut?

How can I get a Loan in Connecticut Today?

Step 1: Decide Loan Type and Choose a Connecticut Lender

Step 2: Apply Online

Step 3: Review Loan Terms

Step 4: Bank Details and Digital Loan Agreement

Conclusion

FAQs

Can I apply for a payday loan online if I live in Connecticut?

Is it safe to use a Tribal payday loan company in Connecticut?

How much interest will I pay on a loan in Connecticut?

How much can I borrow from a Connecticut lender?

Kane Pepi