LonghornFX Review 2021 | Platform, Fees, Pros and Cons

LonghornFX is a new multi-asset online broker that offers trading on a variety of markets and products including foreign exchange currency pairs, digital assets, stocks, and indices. As a true ECN/STP broker, its platform was designed to offer all level of traders forex and CFD trading through a completely transparent, fast, and accurate trading order execution.

In this review, we will explore LonghornFX’s platform, including the account types, spreads and fees, regulation and security of funds, platform and trading tools, pros and cons, and more.

-

-

LonghornFX: Trade with up to 1:500 Leverage

Our Rating

- Leverage up to 1:500

- Supports MetaTrader4

- Transparent pricing

- Low commission

There is no guarantee you will make money with this provider.

There is no guarantee you will make money with this provider.What is LonghornFX?

Launched in 2021, LonghornFX is an ECN/STP online trading broker that offers investors to trade on more than 150 assets across multiple markets. As the broker applies ECN/STP model to orders’ execution, it is able to provide traders with fast and direct access to the world’s most liquid markets using both Straight Through Processing (STP) and an electronic communication network (ECN) execution models. This essentially means that LonghornFX operates as NDD (No Dealing Desk) and thus, traders’ orders are forwarded directly to the interbank market without being processed by the dealing desk.

Overall, LonghornFX aims to provide an innovative trading experience for both newbies and experienced traders alike. It allows users to trade financial assets via CFDs (contracts-for-differences) on the popular MetaTrader4, using a high leverage ratio of 1:500. Additionally, as LonghornFX functions as a third-party broker, it is responsible to execute clients’ orders through top liquidity providers such as large retail investment firms and banks. This means that your funds are safe and secure.

The company has one office located on the First Floor, First St Vincent Bank Building, James Street, Kingstown, St. Vincent and the Grenadines.

What are the Pros and Cons of LonghornFX?

Pros:

- A true ECN/STP broker

- Offers a high leverage ratio of up to 1:500

- A selection of more than 150 financial assets

- Supports the MetaTrader4

- Free demo account is available – no time limit

- 24/7 support via live chat, phone call or email

- Low trading fees and tight spreads

- Lightning-fast order execution

- Offers innovative methods to protect clients’ funds

Cons:

- Not available in the United States

- Does not offer ETF’s

What can you Trade at LonghornFX?

LonghornFX offers a decent range of different markets and products for trading CFDs. Those include:

- Over 35 cryptocurrency trading pairs

- 55+ forex trading pairs (major, minor and exotic pairs)

- 64+ stocks from various stock exchanges

- 11 indices

- Commodities – gold, silver, platinum, palladium, natural gas, UK and US oil.

Fees, Costs, and Charges at LonghornFX

If you are looking for competitive trading costs, LonghornFX is a great choice of broker. As this forex broker is connected to top liquidity providers, it has the ability to offer traders with extremely tight spreads. The spreads at LonghornFX are variable (also known as floating), meaning that they tend to be high during extreme volatility, however, on average, variable spreads tend to be significantly lower than fixed spreads.

Generally, LonghornFX also eliminates other trading and financing costs such as inactivity fee, swaps fees, and deposits and withdrawal fees. Instead, the broker makes money from the spread of the buy and sell of the transaction. There’s however, a fee of 0.0005BTC if you decide to fund your account with bitcoin.

LonghornFX Account Types

LonghornFX keeps things simple with one real live account type for all types of traders, and a demonstration account for those who want to practice their trading skills and test the platform. This means that LonghornFX allows novice and beginner traders to benefit from tight spreads and advanced trading tools. The minimum deposit requirement in order to open an online CFD trading account is $10.

Which Regulators Govern LonghornFX?

Being a new broker in the industry, it does not come as a surprise that LonghornFX is not yet regulated. As regulation takes a very long time to set up, meanwhile this CFD broker maintains some restrictions on trading and complies with laws and regulations of St. Vincent and the Grenadines. More importantly, LonghornFX aims to prevent any Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) activities on its platform.

In terms of the safety of funds, LonghornFX client funds are stored safely on an offline cold-wallet, meaning funds are safe from all online threats. A two-factor authentication is also available and is very important in enhancing users’ security.

Trading Platform and Tools

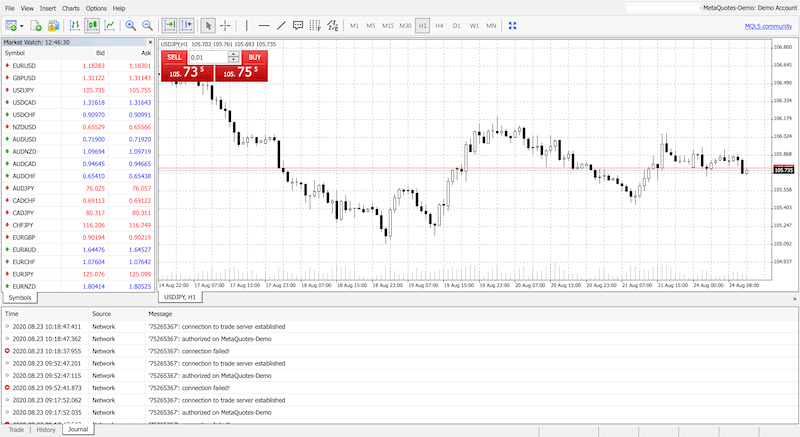

LonghornFX offers its clients to trade on one single platform, the MetaTrader4. The MT4 is not only one of the most complete trading platforms in the market with many features, indicators etc, but it is also compatible with Windows, Mac, Android, iPhone, iPad, and other tablets. Traders can also trade on the Web Trader platform that runs on any web-browser you choose.

Though LonghornFX does not currently offer many proprietary trading tools, the MT4 is equipped with vast array of features that include an advanced charting package, the built-in MQL4 editor, a large number of technical analysis indicators, Expert Advisors (EA), and live news. On top of that, you can install many useful plugins into the system. One of the strongest features of MetaTrader4 is that it enables you to develop, backtest test and apply algorithmic trading by using the Expert Advisor (EA) feature, so you can set predefined parameters for potential trades and let the software run automatically.

For those of you that want to trade on the move, LonghornFX offers a fully-fledged MT4 mobile app that is available on Google and Apple Store.

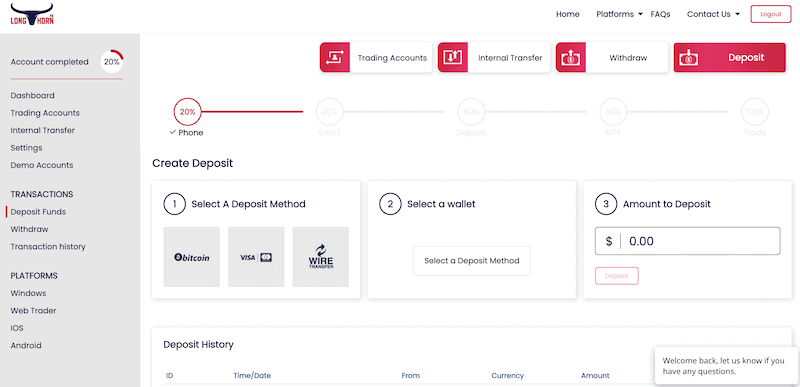

To manage your account, LonghornFX has developed a trading dashboard where you can see your account balance, deposit and withdraw funds, view your transaction history, and switch between the demo and real live account.

Payment Methods at LonghornFX

LonghornFX has an innovative approach to payment solutions. As such, the primary deposit method on its platform is Bitcoin but investors can also fund their account using a debit/credit or bank wire transfer.

If using bitcoin as a payment method, LonghornFX enables rapid access to your funds, with same-day withdrawals. The minimum deposit with bitcoin is $10 and $50 when depositing via credit/debit card. BTC deposits and withdrawals carry a fee of 0.0005BTC that equates to around $5 and is fixed no matter what is the size of the transaction.

Education

Users of LonghornFX have access to educational resources that enable them to learn basic and complex skills and strategies on various topics. On the website, you will be able to find a decent number of articles and guides on a variety of topics for all levels of investors and traders.

For a more practical tutorial a live demo is also available. In that sense, it’s worth mentioning that unlike the majority of brokers in the industry, LonghornFX allows you to use your demo account for as long as you wish and the account never expires. This is a great add-on to traders that wish to automate their trading and backtest different trading strategies.

Customer Support

One of the areas that LonghornFX excels is in its customer service support. The broker does not make it difficult to get in contact with its customer support team with a 24/7 support offered by an experienced team of professionals. You cant reach them via live chat, phone call, or email. It is important to note that while the industry standard in the online brokerage space is 24/5, this broker operates on a 24/7 basis.

On top of that, you can find a useful FAQ section on the broker’s website, which is divided into topics that include Trading Account & General Information, Bitcoin & Cryptocurrencies, MetaTrader4, Transactions & Payments, and LonghornFX Affiliate Program.

Getting Started with LonghornFX

To start trading with LonghornFX, the first step you need to take is opening an online trading account. Fortunately, creating an account with LonghornFX is straightforward and easy but like many other online trading platforms, you will have to meet certain conditions before opening an account with LonghornFX. Nevertheless, if you want to get started, follow these four simple steps:

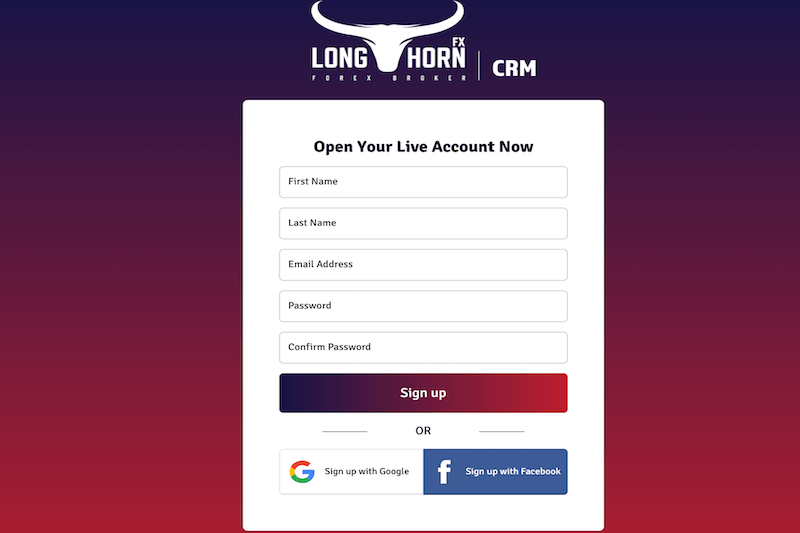

Step 1: Open an Online Trading Account

First, you will have to sign up for an account at LonghornFX. As the broker offers one account type, the procedure should not be complex. All you need to do is to visit Longhorn’s homepage and click on the ‘Sign-Up’ button. Then, fill in your personal details or sign up using your Google or Facebook accounts.

Step 2: Verify Your Account

In order to prevent money laundering and terrorist financing taking place on the company’s platform, LonghornFX requires all clients to verify their identity. The broker sends a confirmation code to your mobile phone as well as a verification email. Once you have completed these steps and your account has been approved, you can fund your account.

Step 3: Fund Your Account

The final step that you need to take before trading at LonghornFX is to deposit some funds. While the primary payment method at LonghornFX is bitcoin, you can also fund your account with a debit/credit card or bank wire transfer. If opting for bitcoin, the funds will be transferred into your account within one to six hours.

Step 4: Start Trading

That’s it. Once you have funded your account you can start trading. As previously mentioned, you will get to choose the preferred method to trade forex and CFDs on the MT4 – Desktop, mobile, or on your web browser. If opting for the MT4 WebTrader, simply click on the WebTrader on the left side menu on the trading dashboard. We remind you that you can trade on a demo account anytime even after you open a real live account.

Conclusion

In summary, LonghornFX offers a superior trading platform to all types and levels of traders. It has not only built an innovative dashboard that makes the trading experience easy to use, but also created a transparent and reliable trading connection with top-tier liquidity providers. Another factor that makes this broker appealing is the fact that it provides low spreads on all tradable assets and low commission with no extra costs.

As a true ECN broker, LonghornFX does not intervene in order execution prices, and allows users to trade a decent range of assets with a high leverage ratio on the best trading platform in the market.

LonghornFX: Trade with up to 1:500 Leverage

Our Rating

- Leverage up to 1:500

- Supports MetaTrader4

- Transparent pricing

- Low commission

There is no guarantee you will make money with this provider.

There is no guarantee you will make money with this provider.FAQs

How much does it cost to trade at LonghornFX?

LonghornFX does not charge any commissions when trading forex and CFDs rather than the buy and sell spread. There are no additional trading fees and opening an account is completely free.

Is LonghornFX regulated?

No, LonghornFX is not currently regulated. Yet, it complies with the domestic law of St. Vincent and the Grenadines and has a strict anti-money laundering policy.

What are the requirements in order to open an online trading account at LonghornFX?

In order to ensure the safety of funds of all clients on its platform, all traders at LonghornFX must pass a verification process. Further, you will have to meet a minimum deposit requirement of $10.

What payment methods can I use at LonghornFX?

LonghornFX allows you to deposit and withdraw funds with bitcoin, debit or credit card, or bank wire transfer.

What trading platform does LonghornFX offer?

LonghornFX offers the popular MetaTrader4, which is available on your desktop, mobile phone or any web browser.

See Our Full Range Of Forex Brokers Resources – Brokers A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up