IG Review for 2021 | Platform, Fees, Pros and Cons

If you’re in the hunt for a new online broker, you might be considering IG. The UK-based platform allows you to trade thousands of financial instruments across a number of asset classes. Not only does this include CFDs and forex, but a fully-fledged spread betting facility, too.

In this IG review, we cover everything you need to know to determine whether the broker is right for your personal trading needs. This includes metrics surrounding fees, regulation, tradable assets, spreads, customer support and more.

-

-

What is IG?

Launched way back in 1974, IG is an established online broker that serves retail clients from most countries. Based in the UK, the platform is home to thousands of tradable assets. This includes everything from forex, stocks, indices, commodities, and cryptocurrencies.

Launched way back in 1974, IG is an established online broker that serves retail clients from most countries. Based in the UK, the platform is home to thousands of tradable assets. This includes everything from forex, stocks, indices, commodities, and cryptocurrencies.IG allows you to trade these asset classes via CFDs (contracts-for-differences) or spread betting. IG also offers share dealing services to those based in a select number of countries. This includes more than 10,000 equities, funds, and investment trusts listed on several stock markets.

As IG is a third-party broker, the platform is responsible for executing your trades – as opposed to buying and selling assets on your behalf. In other words, you will need to choose the financial instruments that you wish to invest in, as IG cannot give you any investment advice. In terms of the fundamentals, IG is regulated by several tier-one licensing bodies.

This includes the FCA, AISC, FINMA, and the NFA. This means that your money is safe at all times. You can easily get cash into and out of the broker via a debit/credit card or bank account, although e-wallets are no supported. Minimum deposits start at $300, and it takes just minutes to get an account open. As a heavily regulated broker, you’ll need to upload some ID before a withdrawal is permitted.

What are the Pros and Cons of IG

Pros:

- More than 17,000 tradable assets

- Comprehensive education resources and tools

- Offers forex, CFDs, spread betting and share dealing services

- Very competitive spreads on most asset classes

- Heavily regulated

- Established in 1974

- Easily deposit funds with a debit/credit card or bank account

- Fully-fledged mobile app

Cons:

- Account opening process takes longer than other online brokers

- Fundamental research department is a bit weak

- High fees for share CFDs

- High spreads

What can you Trade at IG?

IG offers one of the most comprehensive trading arenas in the online brokerage space. If there’s a specific financial instrument you’re looking to buy or sell, the likelihood is that IG offers a marketplace.

With that said, we need to break the broker’s trading department down into four main sections – forex trading, CFDs, spread betting, and share dealing.

Forex Trading

IG is home to more than 80 different forex pairs that can be traded 24 hours per day. This includes all major and minor currency pairs like EUR/USD, EUR/JPY, and GBP/USD. Spreads on some pairs can be traded from just 0.6 pips, which is very competitive. You can also trade a good number of exotic currencies, although the spreads will be much higher.

CFD Trading

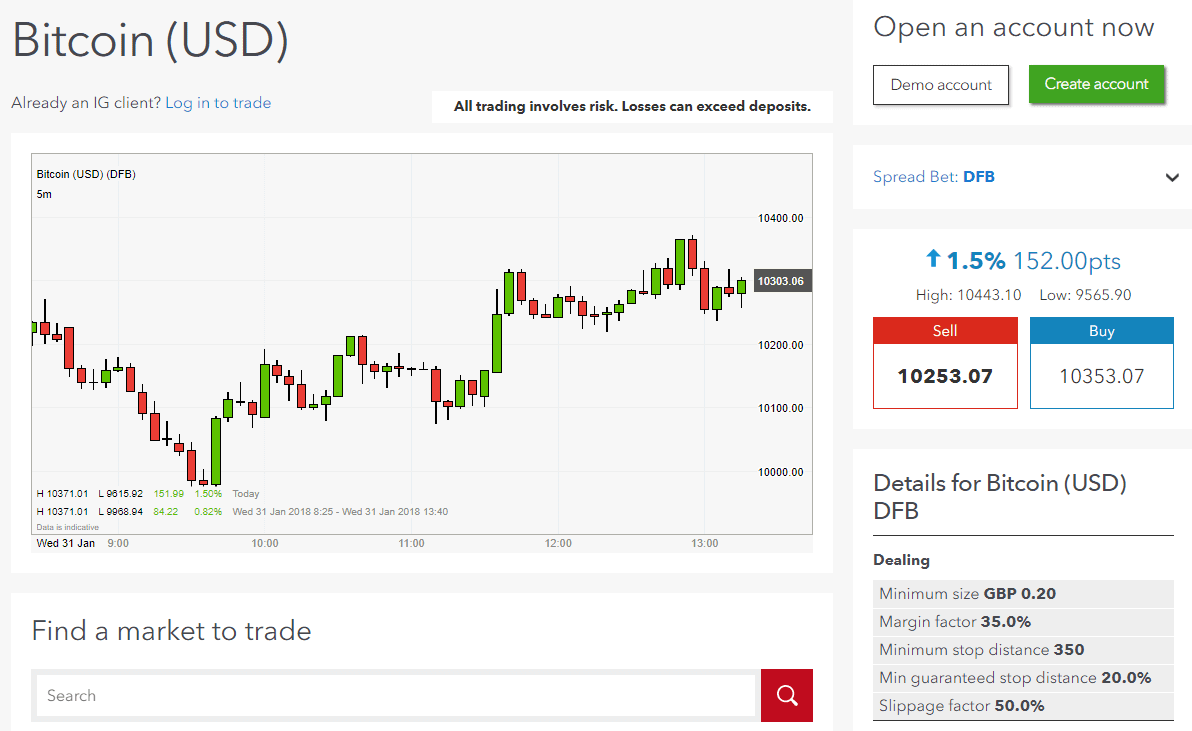

The CFD department at IG is the most extensive, with thousands of instruments hosted. This includes virtually every asset class imaginable. Whether it’s a market on gold, oil, gas, stocks, indices, or Bitcoin – you’ll find it at IG. You will have the option of going long or short on your chosen CFD asset, as well as having the ability the apply leverage. In terms of limits, this will depend on the asset you are trading and your location.

When it comes to spreads, this will vary widely depending on the asset class. For example, if you decide to trade major indices like the S&P 500, you can get the spread down to just 0.1 pips. This is also the case with share CFDs. Commodities and cryptocurrencies are higher, at 0.3 pips and 1 pip, respectively.

Spread Betting

The spread betting department at IG gives you access to more than 17,000 markets. In fact, all of the markets available in the platform’s CFD and forex department can be traded via its spread betting facility. The benefit of going this route is that in some countries, spread betting is not liable for capital gains tax.

In the UK, for example, this is because spread betting falls within the remit of gambling. IG is also known for its small margin requirement when spread betting. For example, the margin on forex stands at just 3.33% for retail traders, and 5% on indices.

This means that a £10,000 trade on the FTSE 100 indices would require a margin of just £500. Interestingly, you can get your spread on cryptocurrencies down to just 0.1 pips when spread betting at IG. As noted earlier, this stands at 1 pip if opting for a more conventional CFD.

Share Dealing

IG also offers share dealing services for those of you that wish to buy stocks in the traditional sense. By this, we mean you will actually own the underlying asset, so you will be entitled to dividends. There are more than 10,000 shares listed at IG, which includes the main UK and US market.

We like the fact that prices are denominated in your local currency, as opposed to the currency of the exchange your chosen stock is listed on. For example, if you’re based in the US and you wish to buy shares listed on the London Stock Exchange, IG will display market prices in USD, and not GBP.

In terms of fees, this depends on the number of trades you make throughout the month. If placing more than 3 trades in the prior 30-day window, you’ll pay no commission on US stocks, and £3 per trade on UK shares. If you drop below 3 trades per month, you’ll pay £10 and £8 per trade on US and UK stocks, respectively.

Payments at IG

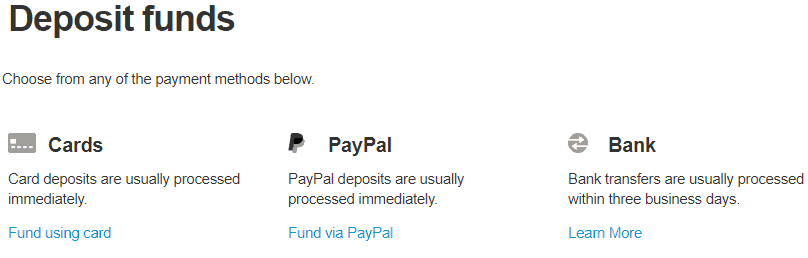

So now that you know the different account types available at IG, you then need to start thinking about payments. In terms of getting money into your IG account, you can choose from a debit/credit card or a bank transfer.

Neither payment method attracts any deposit fees, although bank wires can take a few days before the funds arrive in your account. As such, you are best off using your debit/credit card if you want the funds credited instantly. It is also notable that IG does not charge any withdrawal fees.

With that said, minimum deposits start at $300, which is a bit higher than some of IG’s competitors. Although it appears that IG previously accepted Paypal deposits, this is no longer the case.

When it comes to getting money out of your IG account, withdrawal requests are typically processed within 1-2 working days. Once they are, expect to wait a further 1-5 working days for your respective debit/credit card or bank account provider to credit the funds.

Fees, Spreads, and Commissions at IG

One of the most important metrics that you to need to assess before joining a new online broker is that of its fees. As we noted in the section above, you won’t pay any fees to deposit or withdraw funds at IG. However, there are a number of other trading-related charges that you need to be made aware of, which we’ve outlined below.

Spreads

The spread is the difference between the buy and sell price of your chosen asset, and it can vary widely depending on the financial instrument you are trading. Overall, IG is very competitive on most of its asset classes, with spreads starting at just 0.1 pips.

- Major forex pairs like EUR/USD and AUD/USD come with a minimum spread of 0.6 pips.

- USD/JPY is also competitive at 0.7 pips, while EUR/GBP and GBP/USD are slightly higher at 0.9 pips.

- If trading indices or shares in the form of CFDs, you can get this down to an industry-leading 0.1 pips. Commodities are also competitive at just 0.3 pips.

- Cryptocurrencies via CFDs are expensive at a minimum spread of 1 pip. However, you can get this down to 0.1 pips if spread betting cryptocurrencies at IG.

Crucially, the above examples are the ‘minimum’ spreads offered by IG, and not based on averages. As such, trading outside of standard market hours will result in a higher spread.

Trading Commissions

Attempting to understand the trading commission structure at IG is somewhat difficult at first glance, as there are so many variables to take into account. At the forefront of this is the type of asset class you are trading.

The good news is that you will not pay any trading commissions when buying and selling non-stock CFDs or forex. This is also the case when spread betting. Instead, it’s just the spread that you need to look out for, which is how IG makes its money.

When it comes to stock CFDs, the commission is based on the exchange that you wish to trade.

For example:

- Shares listed on the London Stock Exchange come with a 0.10% commission per side, at a minimum of £10. So, unless you the value of your buy or sell order is higher than £10,000, you will always pay £10.

- If the shares are listed on an exchange in Australia, Belgium, Eire, Finland, France, Germany, Italy, Netherlands, Portugal or Spain – you’ll also pay 0.10% at each side of the trade. This stands at a minimum of $8 AUD or €10, depending on which exchange you are trading.

- If you want to target stocks listed on the New York Stock Exchange or NASDAQ, then you’ll pay 2 cents per share, at a minimum of $15.

This does make stock CFD trading expensive at IG if you are planning to trade smaller volumes. For example, let’s say that you buy £500 worth of BT stocks – which are listed on the London Stock Exchange. Although commissions stand at 0.10% (£0.50), you will need to pay the £10 minimum. In real terms, this amounts to a commission of 2%, which is huge. After all, you need to pay the minimum fee when opening a trade, and then again when you close it.

In the case of US stocks, although 2 cents per share sounds cheap, when you factor in the $15 minimum, this amounts to 750 shares. For example, let’s say that you wanted to buy 100 shares in Ford Motors at $5 per share. This amounts to a total order of $500 ($5 x 100). As the $15 minimum commission applies, this works out at a real term fee of 3%!

Financing Fees

Although we cover leverage in more detail further a bit later on, it’s worth us quickly noting the financing fees that this will attract. For those unaware, when you buy or sell an asset on leverage, you are effectively borrowing the additional capital from the broker. In return, the broker will charge you interest on the leveraged funds.

This is why leveraged trading is best suited for short-term holdings, as the fees can very quickly add up. In the case of IG, the fees once again vary considerably depending on the financial instrument. With that said, you get to view the overnight financing fees in your local currency when you set up a trade. As such, you can determine whether or not this works for you prior to placing the order.

Inactivity Fee

As is the case with all brokers active in the online space, IG will charge you an inactivity fee is your account is flagged as dormant. Although this costs $12 per month, it will only kick in if you fail to use your account for two years. If it does, the $12 monthly fee will be deducted from your account balance until it goes to zero.

Leverage and Margin Trading

Each and every asset classes available at IG can be traded on margin. This means that you can trade with more than you have in your account. The maximum leverage available at IG is 200:1. This means that a $100 account balance would allow you to place a buy/sell order up to $20,000.

However, you likely won’t get a limit this high if you’re a standard retail client. Instead, it’s likely that you will be capped by the limits imposed by ESMA – even if you’re not based in Europe. For those unaware, this stands at 30:1 on major forex pairs and gold, and 20:1 on minor/exotic pairs and major indices. After all, it’s 10:1 on non-gold commodities and non-major indices.

Finally, you’ll get a maximum of 5:1 and 2:1 on stock CFDs and cryptocurrencies, respectively. If you want to trade with more leverage than you are initially offered at IG, you will need to open a professional account. This will require you to submit documents outlining your net worth and historical trading experience.

Which Regulators Govern IG Share Dealing Markets?

When it comes to the safety of your funds, IG is as solid as it comes in the online broker space. First and foremost, the broker was launched back in 1974, so you’ve got an established track record of than four decades at your fingertips. Similarly, IG itself is listed on the London Stock Exchange, with the company falling within the remit of the FTSE 250.

As a publicly-listed firm, IG is required to publish quarterly earnings reports, which outlined the health of its balance sheet and operating income. On top of a rock-solid reputation and PLC status, IG is licensed by heaps of regulatory bodies.

Financial Conduct Authority

The Financial Conduct Authority (FCA) is a UK regulator that oversees the country’s financial industry. Notably, the FCA regulates all financial institutions to ensure that they uphold all laws that affect their activities. Further, the FCA ensures that institutions play by the rules such that consumers are protected at all times. The UK is an important player in the world of the financial industry, with London being the preferred location for head offices of numerous financial institutions, including the world’s biggest banks. Further, the UK has the Financial Services Compensation Scheme (FSCS) that protects consumers in the event an institution like IG Markets collapses. The FSCS compensates consumers up to £50,000 (about $66,000).

Monetary Authority of Singapore

The Monetary Authority of Singapore (MAS) is an eminent regulator in the Asia-Pacific region. Besides governing all financial institutions in Singapore, MAS provides significant legitimacy to institutions that would want to inspire trust in consumers across the entire APAC region. Notably, MAS requires institutions like IG to deposit funds belonging to traders into trust accounts in banks with operational licenses issued in Singapore. As such, IG is under an obligation not to use clients’ funds to meet unrelated obligations.

Australian Securities and Investments Commission

The Australian Securities and Investments Commission (ASIC) regulates IG in three countries, which are Australia itself, South Africa, and New Zealand. Like the MAS, ASIC obligates IG to hold clients’ funds in a separate trust account. However, ASIC does not provide a procedure for compensation in case IG goes under. Instead, consumers have access to a procedure for legal reprieve based on the laws and stipulations of Australia.

One of the main protections that this presents is a requirement to hold segregated bank accounts. By keeping your investment funds separate from its own working capital, this acts as a major safeguard in the event IG collapsed.

Getting Started with IG Share Dealing

Like all other online trading platforms, one needs to satisfy certain conditions before opening an account with IG. First, the customer must be able to identify himself or herself satisfactorily. It entails providing correct personal details together with valid supporting documents. The second requirement that the customer must satisfy is financial status. To this end, IG requires new customers to provide a recent copy of bank statements that are duly certified. Also, IG requires new customers to answer some questions to determine whether they have some knowledge about the financial industry. Answers to the questions also help IG to determine the risk profile of the new customers.

Step 1: Choose a Trading Account

Your first port of call will be to open an account. Unlike other brokers in the space, you need to determine the type of trading account that you wish to open. Your options include a CFD/forex account, spread betting account, or share dealing account. If you want to one two or three account types at once, this is fine.

However, some account types are reserved for select countries. For example, while you can open all three account types as a UK resident, only the CFD/forex option is available to those in Malaysia.

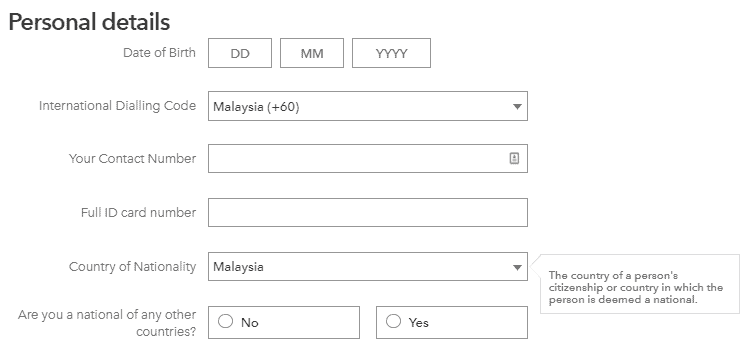

Step 2: Enter Personal Information

Once you have your selected your preferred account type(s), IG will then ask you to enter some personal information.

This includes your:

- Full Name

- Nationality

- Home Address

- Date of Birth

- National Tax Number

- Employment Information

- Contact Details

You will also need to choose a strong password, and then confirm your email address. As IG offers a number of sophisticated investment products, the broker will also need to ask you some questions about your prior trading experience. This includes the types of assets you have previously bought and sold, and the average volume of your trades.

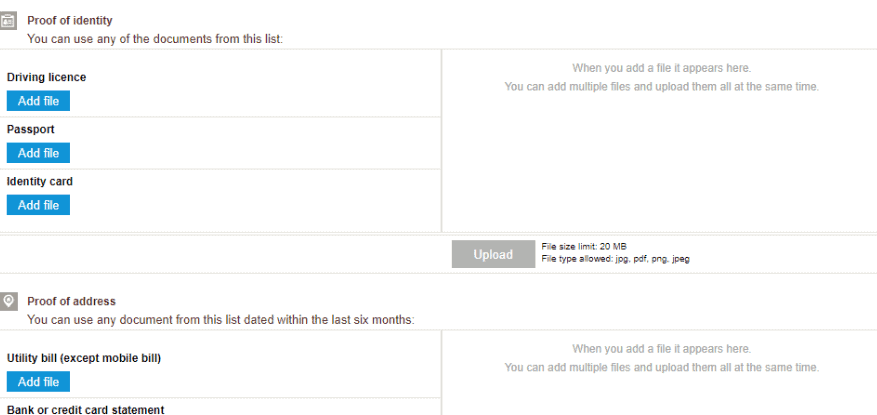

Step 3: Upload ID and Proof of Address

IG is a heavily regulated broker, with trading licenses in multiple jurisdictions. As such, you will be required to upload some identity documents before you can deposit funds.

This includes:

- Government-Issued ID: Passport, Driver’s License, or National ID Card

- Proof of Address: Bank Statment or Utility Bill

Both copies need to be clear and in colour. The proof of address needs to have been issued within the last three months.

Step 4: Fund Your Account

The final step that you need to take before trading at IG is to deposit some funds. You’ll get to choose from a debit/credit card or bank transfer. The former is more convenient, as deposited are credited instantly. If opting for a bank transfer, this can take a few days to settle.

Step 5: Trade

And that’s it – once you have a fully funded IG account, you can then start trading. As a side note, if you decide that you want to open a difficult account type, you can do this via the main dashboard. For example, if you opened a CFD account, but you also want access to the broker’s spread betting facility, simply submit the request.

Platform Features

Having seen how you can register for an account on the platform, it is time you understand how to navigate your way around. In this section, we will review the platform as well as highlighting key features.

IG Markets is rich in features. Notably, the platform is designed in a way that users can have the best experience during their trading activities. Some features focus on convenience while others focus on helping the trader to maximize earnings. Some of the features include:

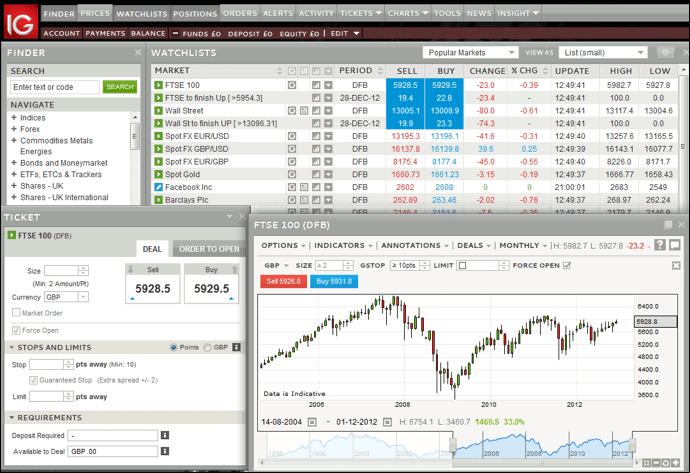

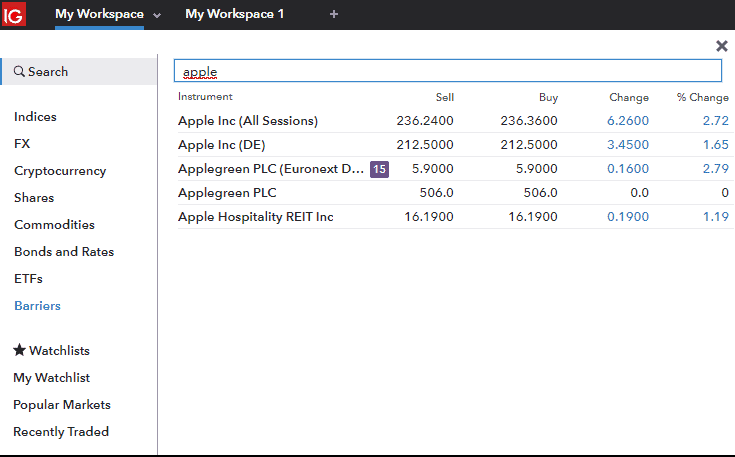

Workspaces

You can enter or exit trade positions from this window. The window has a search function to make it easy for you to get the instrument that you wish to buy or sell. When you enter a search term, all possible results are displayed in the workspace. Besides the search function, there are tabs on the side where you can choose the products you want to trade.

For example, there is the ‘Indices’ tab, ‘FX’’ tab, Cryptocurrency’ tab, and so on. Farther down, there is a ‘Watchlists’ tab, ‘My Watchlists’ tab, ‘Popular Markets’ tab, and ‘Recently Traded’ tab. The essence of the tabs is to streamline navigation within the platform. For example, you can view the most popular markets to find out opportunities that you can exploit. At the same time, the ‘My Watchlists’ tab enables you to keep abreast of all your instruments even as you do other things.

Watchlists

The Watchlists window puts together all the instruments that you have traded or wish to trade. For example, the Watchlists window below shows many instruments, including the FTSE 100, and so on. The instruments in the Watchlists could also be popular markets. Keeping track of popular markets makes it easier for you to spot opportunities to enter or exit positions.

Charts

IG has powerful charting tools that facilitate market research activities. Similar to the live account, traders have access to charts and other tools in the demo account. Notably, the charts come with a drawing toolbar that contains 20 drawing tools. For example, you can draw arrows on the chart to illustrate strategies, the Fibonacci retracement to refine strategy, and so on.

Trading Platforms

IG offers a number of different ways to trading at the platform. In terms of proprietary software, you can choose from IG’s in-house platform, or Meta Trader 4 (MT4). Regarding the former, IG claims to run at an average order execution speed of 0.014 seconds. This translated to more than 86 million individual trades in 2019.

The IG trading platform offers heaps of advanced charting trading tools and technical indicators, and you’ll be able to customize your trading screen however you see fit. If opting for the MT4 route, you can download the software on to your desktop device.

For those of you that wish to trade on the move, IG offers a fully-fledged mobile app. The application is available to download free of charge and is compatible with iOS and Android devices. The IG mobile app is ideal if you are looking to for market notifications, as an alert will pop up on your phone when your pre-defined price is triggered. You can also elect to receive an alert when an asset is going through a period of short-term volatility

Research Tools and Analysis

IG is generally very good in the research and analysis department.

This includes:

Technical Indicators: Dozens of technical indicators across both its in-house trading platform and MT4

News-Flow: IG gives you access to important news developments as and when they arise

Trading Ideas: The team of in-house analysts at IG will publish the odd trading idea for you to consider. This is not trading advice, but just an overview of some potential trading opportunities.

Fully Customizable Charts: You can customize your on-screen charts at IG with easeThe only drawback in the IG research department is that it does not post fundamental data – such as employment figures or monthly oil outputs.

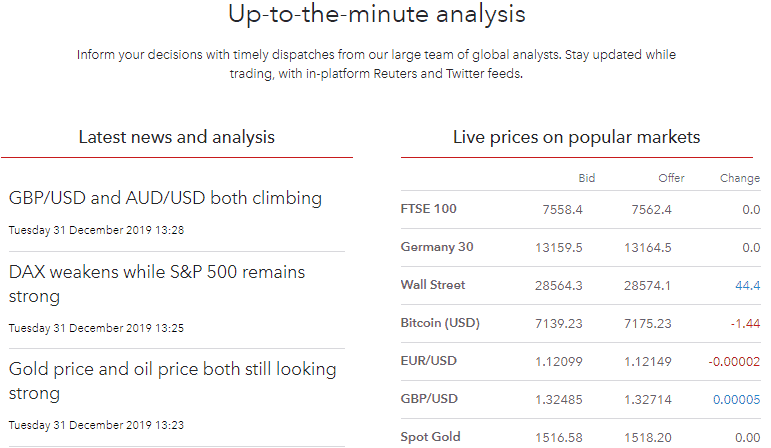

Market Analysis

The financial industry is a collection of traders who react to every latest development in the market. As such, a successful trader must stay informed by the minute about the goings-on in the market. The information is crucial when deciding to enter or to exit trade positions.

Fortunately, IG Markets trading platform users have access to the up-to-the-minute news and market analysis. Notably, IG Group has a group of analysts stationed in various parts of the world whose job is to watch the news and to make sense of them. IG Markets acknowledges the inability of many traders to join the dots using the information in the current headlines. For example, the trading platform informs its clients about the direction of currency pairs, indices, commodities, and so on based on the latest headlines. That way, traders can design profitable trading strategies.

Besides market analysis and digestion of recent news for the traders, the platform provides a steady stream of the latest underlying prices of all tradable instruments. In addition to capturing the ‘Bid’ and ‘Offer’ prices of the assets, the platform computes the spread to give traders an idea of the profits they can make from their trade positions.

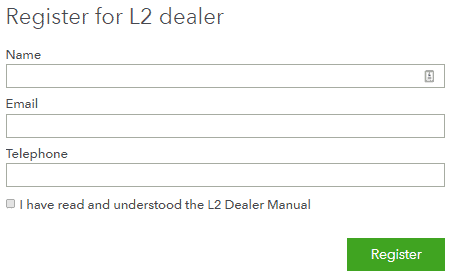

How to Get the L2 Dealer

Step 1: You must be an IG customer; that is, you have to create a CFD account on IG Markets trading platform.

Step 2: Through your CFD account, you will register for the L2 Dealer by providing your details. The details include your full name, email address, and telephone number.

Step 3: Once you have registered for L2 Dealer, you will be directed to the link from which you will download the platform.

Besides the installer for the L2 Dealer, you will also be able to download a user manual in pdf format.

Once you go through the steps and have downloaded the L2 Dealer, you can access the platform using the details submitted when signing up for the CFD account.

System Requirements

Your computer must have the Microsoft .NET Framework 2.0 pre-installed before running the L2 Dealer. However, you do not have to worry much because the installer will perform the check and install the framework before completing the installation process.

Trading through APIs and Terminal

With the IG trading platform, you can trade through supported terminals and APIs. Notably, the company provides for traders who want to automate their activities through a trading API based on the web. With the web API, traders can conveniently access historical prices, market data, and they can even execute trades against their accounts. The API supports all programming languages that interoperate with HTTP.

Additionally, IG has IG Labs, a platform through which traders can design and create their APIs. IG Labs provides developers with sample apps to guide them through the development process. With IG Labs, developers can stream their APIs as well as REST trade.

Besides supporting self-created APIs, IG provides a FIX API that is secure and convenient for traders. Traders can access pricing information as well as stream the figures of their account balance. In addition, DMA platform users can also leverage the trading algorithms in the FIX API to maximize their earnings from the market. Notably, the FIX API is also available for OTC traders. The traders have access to a live and up-to-the-second feed of prices of the available instruments.

Apart from the API support, the IG trading platform supports the Bloomberg EMSX terminal. The terminal is fully compatible with the execution systems of the IG trading platform. However, traders must configure their EMSX terminals to interoperate with the execution systems before sending orders.

Glossary of trading terms

As part of IG’s quest to educate its customers, the platform maintains a glossary of terms that are common in the trading market. Most of the terms are financial, but they are of massive significance to traders’ understanding of their activities. The collection of terms is rich, having been started 45 years ago when IG Index began to operate. Notably, IG not only defines the terms but also explains them in a very understandable manner. For example, look at the definition of the word ‘Acquisition’ and how IG has described it.

Customer Support

Although the industry standard in the brokerage space is 24/5, the customer service team at IG operates on a 24/6 basis. As such, the only times that you will be unable to get real-time assistance on your account is between 10 pm on Fridays and 8 am on Saturdays.

This includes phone support, live chat, and email. Waiting times can vary considerably at IG depending on how busy the team are. In most cases, you should be connected to a live chat agent in less than 5 minutes.

Conclusion

In summary, it’s clear to see why IG has amassed an excellent reputation in the brokerage arena. With more than four decades in the space, IG has since attracted more than 178,000 clients worldwide. At the forefront of the broker’s success is its substantial trading arena. This includes more than 17,000 financial instruments across heaps of asset classes.

Account types cover the CFD/forex and spread betting segments, and in certain countries, you can also access the broker’s share dealing offering. In most parts, fees are very competitive at IG. This includes spreads that start from just 0.1 pips, and no commissions on non-stock CFDs. On the flip side, IG can be expensive if you plan to trade shares in the form of CFDs, not least because it employs a high minimum commission model. Other than that, IG ticks most boxes.

Further, traders have access to a wealth of educational resources that enable them to stay sharp and to create the best strategies in the market. IG Markets has a robust communications strategy where users can reach the support team via various avenues, which are always active. The IG Community is also an excellent platform where traders share their experiences and answer questions about a range of issues.

FAQs

How much does it cost to trade at IG?

The trading fees that you pay at IG will vary depending on what you are trading. With that said, the platform does not charge any commissions when trading non-stock CFDs. The spread betting department is also commission-free. If trading stock CFDs, you’ll need to pay a variable commission that averages 0.10%. However, there is a minimum trading commission to consider. For example, buying and selling less than £10,000 worth of UK stock CFDs will attract a minimum fee of £10, which is expensive.

Is IG regulated?

Yes, IG is heavily regulated, with licenses from heaps of jurisdictions. This includes the licensing bodies in the UK, US, South Africa, EU, Australia, UAE, and New Zealand.

Do I need to upload ID to trade at IG?

Yes, to ensure that IG remains fully compliant with its licensing bodies, all traders at IG must pass a verification process. This will require you to upload a copy of your government-issued ID, as well as a proof of address. This can be a recently issued bank account statement or utility bill.

What payment methods can I use at IG?

IG allows you to deposit and withdraw funds with an everyday debit or credit card. Alternatively, you can also deposit funds with a bank account, although it takes a few days for the funds to clear. IG used to accept Paypal, but it appears that this is no longer offered.

What trading platforms does IG offer?

You will have the option of using IG’s in-house trading software, or Meta Trader 4 (MT4). You can access both of these trading platforms via the main desktop website, or via your mobile device. MT4 can also be downloaded to your desktop device.

See Our Full Range Of Forex Brokers Resources – Brokers A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up