Best Instant Approval Credit Cards in 2020

If you’re currently in the market for a credit card that will approve your application instantly – irrespective of your underlying financial profile, then it’s likely that you are in possession of less than ideal credit. The reason for this is that instant approval credit card providers market their products to those with poor to bad credit, or those with little to no credit history at all.

However, most of these cards require you to put up a security deposit upfront – which is how providers are able to give you an instant decision, regardless of your credit score. With that being said, if you’re looking to obtain a financing product of this nature, be sure to read our comprehensive guide on the Best Instant Approval Credit Cards in 2019. Within it, we list the top 5 providers, alongside a detailed overview of how an instant approval credit card actually works.

What is an instant approval credit card?

As the name suggests, an instant approval credit card is a type of credit card that approves the vast majority of applicants instantly. In other words, as soon as you have gone through the online application process, you’ll be approved straight away. However, the term ‘instant approval’ is often misunderstood in the online lending space, as it essentially refers to two different things.

First and foremost – irrespective of the type of credit card that you are applying for – the vast majority of providers now give you an instant decision on whether or not you have been approved for the credit card. In fact, this is also known as a ‘pre-approval’ offer, as the loan offer is based on the details you entered within your application. In the context of this guide, this is not the type of instant approval we are referring to.

On the contrary – an instant approval credit card typically refers to a credit card provider that will accept your application, regardless of how good or bad your credit score is.

How does an instant approval credit card work?

Although an instantly approved credit card can be offered to the vast majority of US consumers, it is important to note that lenders will still run a full credit check on you. Don’t be alarmed by this, as the purpose of running a credit check is for two key reasons.

✔️ APR Rates: On the one hand, although the credit card provider might guarantee that they’ll give you a card regardless of what your credit profile looks like, they will still need to determine how much interest to charge you. As you might already know, APR rates are typically based on your creditworthiness. As such, this is why the credit card provider in question might need to run a credit check on you.

✔️ Identity Verification: The second key factor that might see the credit card provider run a full credit check on you is to verify the information you provide within your application. Alongside other third-party sources, the lender will attempt to confirm your identity remotely.

What credit limit will I get with an instant approval credit card?

If will probably come as no surprise to learn that the amount of credit available on an instant approval card is significantly lower than what a conventional credit card will offer. This does make sense when you consider the risks of approving a credit card instantly.

However, in the vast majority of cases, you will be in full control of your own credit limit. Known as a ‘Custom Credit Limit’, we’ve explained how the process works below.

Custom Credit Limit

In its most basic form, a custom credit limit refers to the amount of credit that you are able to use on your card. However, the specific amount is determined by you, insofar that it will typically match the security deposit that you put on the card.

💳 You are instantly approved for a new credit card that comes with a custom credit limit.

💳 As the card requires a security deposit of at least $500, you transfer $500 to the credit card provider

💳 This means that your newly obtained card now has a credit limit of $500

💳 As soon as you reach $500, you will either need to pay some of your balance off, or alternatively, put more money up as a security deposit.

As you will see from the above example, you are essentially in control of your own credit limit. However, the key point here is that you will not have any access to the security deposit that you put up until you cancel the credit card agreement. The reason that lenders keep this money is in the event that you default on your repayments.

Using an instant approval credit card to improve your credit score

One of the overarching benefits of obtaining an instant approval credit card is that it has the potential to improve your credit score. The reason for this is that every time you make a repayment on time, the credit card provider should report the payment to the main three credit reporting agencies.

Here’s an example of how you can best utilize an instant approval credit card.

- You obtain an instant approval credit card

- You put $250 on the card as a security deposit

- This means your credit limit is also $250

- Every month you use your credit card for the first $250 that you spend on groceries

- As soon as you receive your statement, you repay the $250 in full

- You repeat the above process each and every month

As you will see from the above example, you used your instant approval credit card on groceries – which is something that you would have purchased with cash or a conventional debit card anyway. However, the key difference is that by using your credit card and paying back the money on-time, you will slowly but surely improve your credit score. In fact, you’ll likely start seeing results within 3-6 months!

Who is suitable for an instant approval credit card?

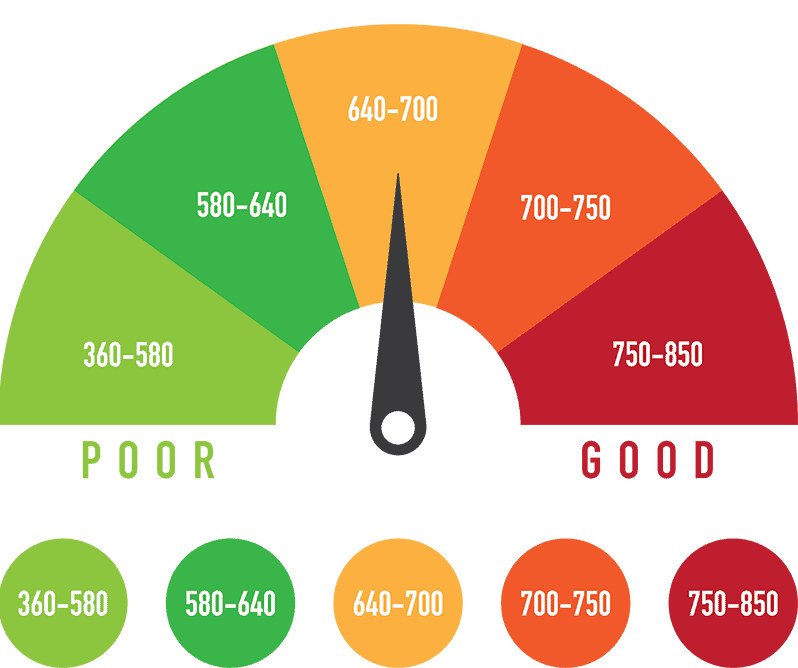

As we briefly noted earlier in our guide, instant approval credit cards are typically for people that don’t have good or excellent credit. As those with an above-average credit score will be accustomed to competitive APR rates, there would be no benefit in taking out a specialist instant approval card.

As such, there are two types of borrowers that are likely to find an instant approval card useful:

💡 No Credit History: If you are relatively young, or you’ve only recently become a US resident – then you’ve probably got no credit history at all. This means that it is near-impossible to obtain financing from traditional lenders.

In fact, people that have previously taken credit and defaulted are potentially more likely to get financing, because at the very least they have a credit-based track-record! As such, obtaining an instant approval credit card can allow you to begin building a credit profile from scratch.

💡 Bad Credit Score: If you are in possession of a bad credit score, then you might have no other option but to obtain an instant approval credit card. In doing so – and always making your repayments on time, you stand a very good chance of rebuilding your damaged credit score.

The Pros The Cons

Criteria used to rank the best repair credit cards

❓ How much interest you will need to pay

❓ How much of a security deposit you need to put up

❓ Whether your credit limit is matched like-for-like with the security deposit

❓ Whether the lender reports on-time payments to main credit agencies

❓ Minimum eligibility requirements

❓ If you need to pay any fees

The number one instant approval credit card in our view is that of the OpenSky Secured Visa. First and foremost, the credit card issuer does not perform a credit check when you initially apply, meaning that it is essentially a no credit check provider. Moreover, not only are you not required to have a bank account to apply, but as long as you meet its minimum income requirements, you should be instantly approved. In terms of your credit limit – as is the case with the vast majority of instant approval cards, this will match your security deposit like-for-like. The minimum security deposit is $200, and interest is charged at 19.64% APR. However – and perhaps most importantly, not only can you avoid interest full-stop by always clearing your balance on-time each month, but each payment is reported to the main three credit agencies. [one_half] Key Points: 💳 19.64% APR 💳 No cashback or rewards 💳 $35 annual fee 💳 No credit checks 💳 No bank account required

We really like the Credit Builder Secured Visa, not least because the card was developed exclusively to help those with bad credit. Although you are required to have a credit score of at least 300 – this is actually the lowest FICO credit score that you can get. As such, this is merely a mechanism to verify your identity so that the provider can approve your application instantly. Nevertheless, backed by the Armed Forces Bank – the Credit Builder Visa allows you to set a credit limit of between $300 and $3,000. Essentially, the specific limit will be dictated by the security deposit that you put up. If you are able to use your card to when paying for everyday expenses, and you repay the balance in full each month – you stand the chance of building your credit score very quickly. In terms of the fundamentals, unpaid monthly balances come with an APR of 23.24%, and you’ll need to pay an annual fee of $35. [one_half] Key Points: 💳 23.24% APR 💳 No cash back or rewards 💳 $35 annual fee 💳 Bad credit scores considered 💳 Your credit limit will match your security deposit

Much like in the case of the Credit Builder Secured Visa, the Green Dot Primor Visa allows you to set your own credit limit. However, the card goes one step further – by allowing you to set-up a credit limit of up to $5,000 – which is huge. Although you will, of course, be required to put up a security deposit like-for-like, it’s a useful limit to have if you have the means. In terms of the specifics, you’ll once again need to have the minimum credit score of 300, and the card costs $49 per year. However, you will only pay 9.99% in APR, and all repayments are instantly reported to the main three credit agencies. [one_half] Key Points: 💳 9.99% APR 💳 No cash back or rewards 💳 $49 annual fee 💳 Credit scores of 300 or more considered 💳 Limit of up to $5,000

If you’re looking for an instant approval credit card that comes with no fees, then you might be best off going with the DCU Visa Platinum. As the name suggests, the card is backed by the Digital Federal Credit Union. Although this means that you will need to have an account with the institution, you can do this in just a matter of minutes during the application. As is the case with all the other cards we have mentioned thus far, your credit limit is based on your security deposit. This means that you’ll likely have your application approved instantly. Once it is, you won’t be accustomed to any annual fees. In terms of the card’s APR, this averages 13.75%, which is actually very good. [one_half] Key Points: 💳 13.75% APR 💳 No cash back or rewards 💳 No annual fee 💳 Bad credit scores considered 💳 Your credit limit will match your security deposit

Last, but most definitely not least on our list of instant approval credit cards, is that of the Discover It Secured. As the name suggests, you’ll need to put up a security deposit, which starts at just $200. This is great if you don’t have the ability to tie up too much cash. On the one hand, the card’s APR rate of 24.99% is super expensive, especially when you consider that you are only offered a credit limit that is equal to your security deposit. However, as long as you repay your balance each month (which you should anyway), you’ll avoid paying any interest. Nevertheless, not only does the card come with no application or annual fees, but you will be offered a very competitive 2% on monthly purchases – upto a maximum of $1,000 in spending. [one_half] Key Points: 💳 24.99% APR 💳 2% cashback rewards upto $1,000 in spending 💳 No annual fees 💳 Credit scores of 300 and above considered 💳 Required to put up a $200 security deposit

FAQs

What is an instant approval credit card?

What is the minimum credit score to get an instant approval credit card?

What if I have no credit score?

What is a secured credit card?

What credit limit will I get on an instant approval card?