Charles Schwab Review 2021 : Platform, Fees, Pros and Cons

Charles Schwab is among the oldest brand names in the brokerage world. It is considered a good choice for online stock brokers and traders at all levels. For advanced users, it seeks to offer the right mix of sophisticated tools. For beginners, it has plenty of learning resources.

As a full-service investment company, it ranks highly in the industry for various reasons which we will discuss in greater detail in the course of this Charles Schwab review. Thanks to its focus on the customer, the service provider offers a wide range of trading options and competitive rates.

But in addition to its numerous highlights, it has its demerits too. Read on to find out everything you need to know before using Charles Schwab.

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.What is Charles Schwab?

Often considered as the pioneer of the modern-day discount brokerage model, Charles Schwab has been around longer than most. It was founded in 1975 and has its headquarters in San Francisco.

According to the official site, the company exists with the objective of helping “People achieve better financial outcomes.” In order to achieve this, it offers investors a full-service approach to investment, combining the best of what technology and investors have to offer.

As an iconic brand in the industry, it currently boasts over $3.5 million in total client assets. It caters to 11.6 million active brokerage accounts, about 1.7 million participants in retirement plans and 1.3 million in banking accounts.

It came into existence a short while following the deregulation of commission prices. At the time, its key objective was to offer much lower commissions than other players in the industry. Over the years, it has sought to uphold that strategy.

In line with that, it has always consistently slashed fees on ETFs, mutual funds, account fees and lowered base commission to become one of the least expensive options in the industry.

Special Features

The stockbroker’s mantra is “Seeing the world through clients’ eyes.” With that in mind, it prioritizes the delivery of the products and services that the customers want. It also claims to lead rather than follow industry trends.

- Low Rates and No Account Minimum

For instance, when it slashed base commissions to $4.95, it triggered an industry-wide price reduction. It is also renowned for its $0 Charles Schwab account minimum, robust trading platform, advanced tools, variety of research offerings and affordability.

- Versatility

Apart from the low Charles Schwab commission, the platform is as good for newbies as it is for active traders. For users who don’t feel overwhelmed by having limitless options, the hundreds of services on the platform cover every base.

- Wide Range of Services Supported

Being a full-service provider, Charles Schwab broker provides a full suite of services and products. These include:

- Stock trading

- Options trading

- Bonds

- Futures trading

- Mutual funds

- Advisory services

- DRIPs

- Retirement and fixed income guidance

Currently, there is no support for Charles Schwab forex trading, and for futures trading, users must conduct trades on its StreetSmart Central platform. This means that users cannot place futures trades on the main website or the StreetSmart Edge platform.

Promotions

There are some offers for various user activities. Consider some:

- Get up to $500 Charles Schwab bonus with a qualifying deposit

- Referral award for first-time customers

- 500 trades commission-free for the first two years with a qualifying deposit of $100,000

Account Minimum

Charles Schwab operates on $0 account minimum for US residents. However, non-US clients have to have a $25,000 account minimum.

Supported Countries

Like in the case of Robinhood and TD Ameritrade, Charles Schwab trading is available internationally for users who want to trade stocks on foreign markets. Currently, it supports trading in over 30 global markets.

In order to access this functionality, users need to sign up for the Schwab Global Account. By doing so, you can be able to access online stocks trading in 12 of the top foreign markets. Each of these will have real-time quotes when trading during market hours.

Some of the countries in which the service is available include:

- United States

- United Kingdom

- Germany

- United Arab Emirates

- Singapore

- Malaysia

- Australia

- China

- Hong Kong

- India

Languages Supported

At the moment, the site supports English and Chinese, and also offers some documentation in Spanish.

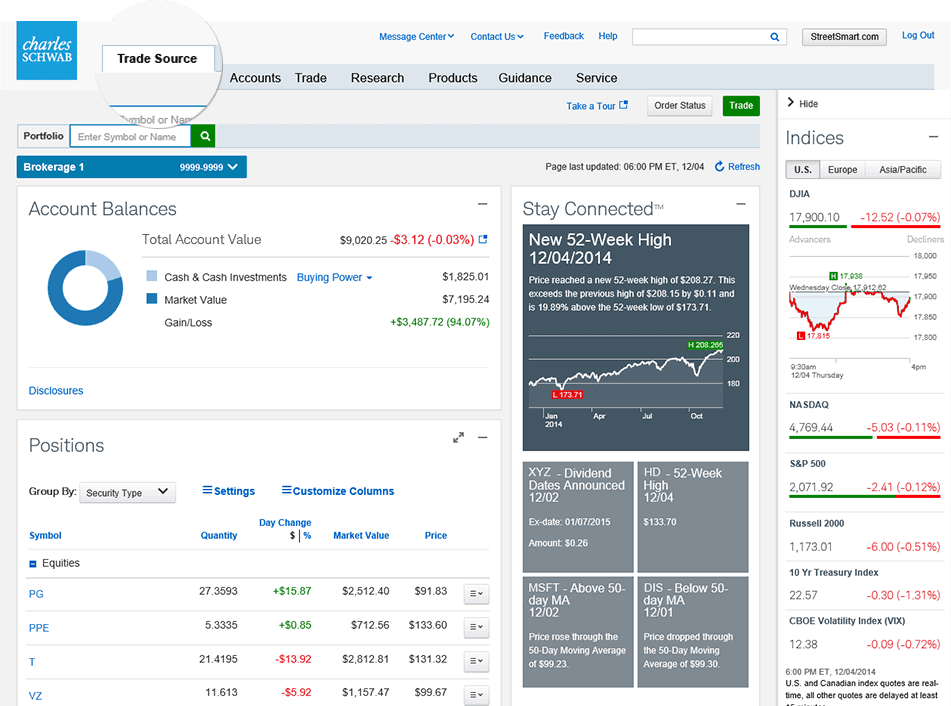

Trading Platforms

At the moment, the Charles Schwab trading platform offers access to three main platforms for its different users. These are:

- com – a web-based platform that targets everyday investors

- StreetSmart Edge – a desktop-based platform specifically designed for active traders

- StreetSmart Central – a web-based platform for Charles Schwab futures trading

Its platforms cover most of the crucial aspects users need and want with one major omission, paper trading. Paper trading is an important feature for beginners as it allows them to trade using virtual funds. However, none of the platforms offer it.

In as far as stock charts are concerned, Charles Schwab offers a good experience though there is still room for improvement. Basic users may find them satisfactory, but for advanced traders, the absence of some technical indicators is a major drawback.

Moreover, though the Edge platform is easy to learn and has most features, it has a reputation for being slow. Thus, a trader wanting to stream multiple stock charts across several monitors may find it challenging.

Fees and Limits

Charles Schwab fees are among the most competitive in the market. Noteworthy too is the fact that the service offers a transparent fee system – what you see is what you get. There are of course a few catches here and there, but overall, Charles Schwab’s cost is friendly.

Let us take a look at some of the key Charles Schwab trading fees and limits:

Feature Fee Minimum account deposit $0 Per trade stock trade fee $4.95 ETF trade fee $4.95 Options base fee $4.95 Mutual fund trade fee $49.95 Options per contract fee $0.65 Broker assisted trades fee $25 Trades using Schwab automated phone system $5 (fee added to order) IRA annual fee $0 IRA closure fee $50 Returned ACH fee $25 Returned wire fee $25 Stock certificate processing fee $100 Domestic wire fee $25 International wire fee $25 Paper statement fee $0 Paper confirmation fee $0 Note that even though for the transaction fee mutual funds, the Charles Schwab cost is $49.95, the charge only applies for the initial purchase. There will be no additional charge for selling.

When it comes to trading fees and commissions, the miscellaneous account fees on the platform are transparent and competitively priced. They are in fact among the lowest compared to other online discount brokers.

There are no Charles Schwab fees for penny stocks. Moreover, there are no Charles Schwab withdrawal fees.

Margin Rates

Margin Balance Interest Rate Less than $25,000 9.575% $25,000 – $49,999 9.075% $50,000 – $99,999 8.125% $100,000 – $249,999 8.075% $250,000 – $499,999 7.825% $500,000 – $999,999,999 6.575% More than $1,000,000 6.25% From the above chart, it is evident that Charles Schwab margin rates are relatively higher than those of most online discount brokers.

Mininum Deposit and Maximum Withdrawals

There are no minimum deposits or maximum withdrawals on Charles Schwab.

Account Types

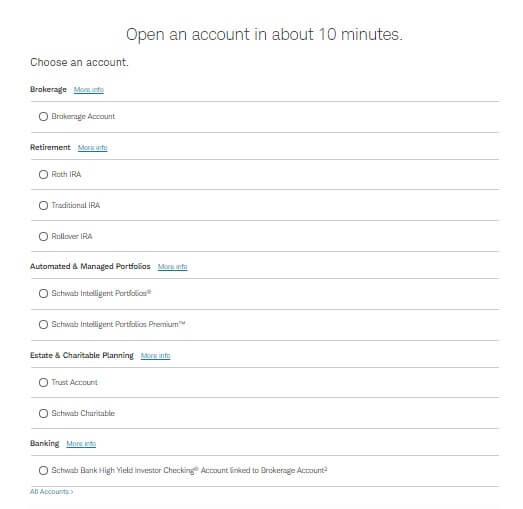

There are currently five types of accounts on the platform. They include:

- The Charles Schwab stock broker account

- Retirement account – these include the Traditional IRA, ROTH IRA and Rollover IRA

- Automated and managed portfolios – these are the Schwab Intelligent Portfolios and the Schwab Intelligent Portfolios Premium

- Estate and charitable planning – choose between a Trust account and a Schwab charitable account

- Banking – this is the High-Yield Investor Checking account which is linked to users’ brokerage accounts

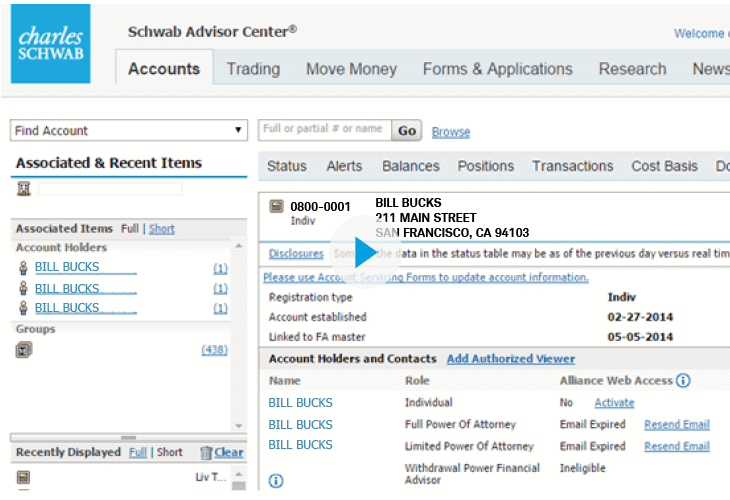

How to Sign up on Charles Schwab

Charles Schwab sign up is straightforward and can be done on phone on the Charles Schwab app, online or in any one of the physical branches. Here are the steps you need to follow to get a Charles Schwab account:

- Open your account

Firstly click here to open your account. On the top right side of the home page, click “Open an Account”

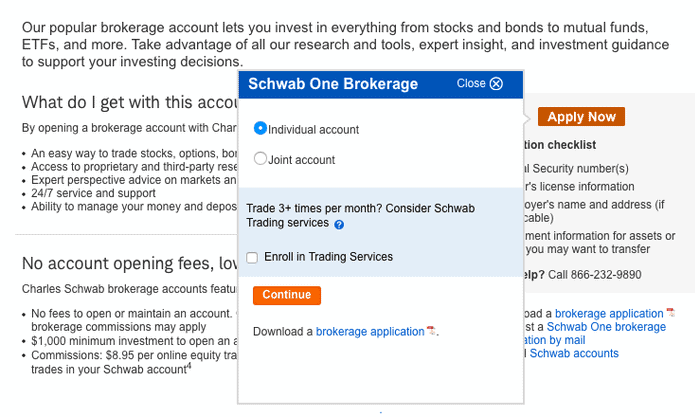

2. Choose your account type

You will then have to choose the account you want to open from the list that appears then click “Continue”. Select whether it’s an individual or joint account and once again click “Continue”

You will get a list of the things you need which include a US permanent address, Social Security Number or Tax Identification Number and if applicable, your employer’s name and mailing address. At this point, you will also be asked if you already have Charles Schwab login ID or if you need to create one. Choose the relevant option.

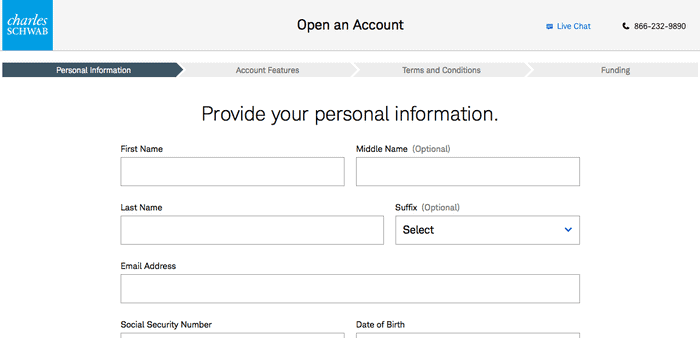

3. Fill in your personal details

Next, you will get a form which you need to fill out with personal information

4. Select your account features

Once you are done, click “Next” then select the desired account features. Accept the terms and conditions then specify your funding method

5. Fund your account

After you complete the application process, you can fund your account and start investing. There are no minimum account deposits but if you deposit $10,000, you’ll get $100 cash bonus.

How to Buy and Sell Stocks on Charles Schwab

To start trading Charles Schwab stocks, you first need a Charles Schwab brokerage account. If you do not already have it, create one by following the steps for account creation. Once the account has been approved, you need to fund it.

Next, you can use the Charles Schwab mobile app or go to schwab.com to start placing trades online. Alternatively, you can use the StreetSmart Edge platform to buy and sell stocks.

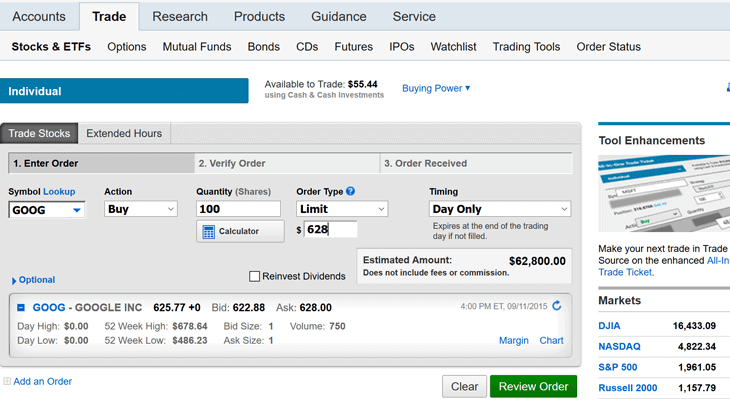

Here are the steps for trading stocks:

1. Choose an execution method

You will be able to choose whether to execute your order on phone, mobile app or online.

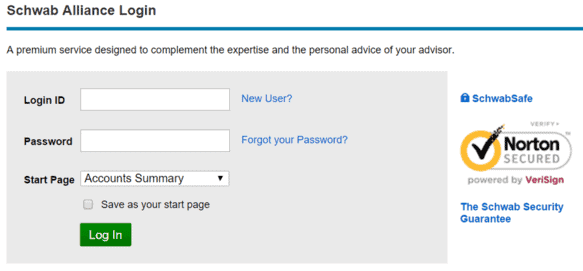

2. Log in to your brokerage account

3. Select the stock you want to buy

Click on the stock or type in the name of the security to get a live quote

4. Click on “Trade”

You will then have to click on “Trade” or “Trade Multiple Stocks”

Then, simply enter the desired information then click “Sell/Buy”

4. Review Your Trade and Place your Order

Then click on “Review Trade” before placing the order. When satisfied, click on “Place Order”.

How to Configure Your Trading Account

In configuring your trading account, you will need to add the specific features you require from the type of account you choose.

- Margin and Options Trading

You can add options trading and margin trading by checking the relevant boxes. However, note that these are best used by seasoned traders.

- Funding Options

You will also need to select how to fund the account. Options include bank transfer or transfer from another brokerage account.

How to Withdraw Funds

To withdraw funds from your account, here are the steps to follow:

- Log in to your account

- Click “Transfers & Payments”

- Select your withdrawal method of choice

- Enter your account in the “Transfer From” tab

- Enter the account you want to withdraw in “Transfer to”

- Enter the amount

- Initiate your withdrawal

Safety and Regulation

For security purposes, the account offers 2FA. During initial login, you need to register the device. You will get a code via phone, email or text. From here on, you will only need your login ID and password to access the account.

Schwab is subject to FDIC and SIPC, both of which protect funds from unauthorized access. It limits the number of employees who can access any individual client’s information.

The platform is also regulated under the SEC and the FCA. Therefore, if you are wondering ‘is Charles Schwab safe?’ well, it has the security of regulatory oversight. But it does not have negative balance protection.

Education, Research and Data

Charles Schwab research and education is highly in-depth and comprehensive. In fact, it provides one of the highest quality in-house research studies prepared by staff experts. Consider some of the market research experience it covers:

- Stocks – research and screener

- ETFs – research and screener

- Mutual funds – research and screener

- Pink sheets/OTCBB – research

- Fixed income – research

- Bonds – research

In Charles Schwab stocks research, it goes beyond conventional third-party ratings, using its own proprietary equity ratings to add value to the experience. It offers live streaming events as well as market commentary and daily broadcasts. However, its research design is intuitive in spite of providing a comprehensive feature offering.

Under the Charles Schwab ETF, offerings from third-party providers such as Morningstar cover virtually every important aspect. Similarly, the Charles Schwab mutual fund research base has lots to offer courtesy of Morningstar.

Customer Service

Like other trusted platforms such as Firsttrade, Charles Schwab customer service is reliable. In fact, the company has over 340 branches in 46 states across the United States. This means that account holders can access in-person help when necessary, a unique provision that only a handful of discount brokers offer.

Moreover, the service provider has excellent customer support on phone, available 24/7. Note that clients who have more than $500,000 in their Charles Schwab account qualify for Premier Support, as do those who trade over 36 times annually. They thus get a direct connection to customer care reps when they place calls.

Those who do not qualify for the package may have to wait on hold whenever they make calls. The company’s chat support is also good and is a convenient way to get immediate assistance on your Charles Schwab complaints and problems. Overall, the customer support team is professional and informed.

For users who would like to get complete account management, the company offers Schwa Intelligent Portfolios, a robo-advisor. And thanks to their acquisition of OptionsXpress in 2011, users can also get enhanced services in portfolio managing and stock loans.

However, their email support is not as good as phone support and users consistently report a poor experience.

Charles Schwab vs. Fidelity

Just like Charles Schwab, Fidelity is a veteran discount brokerage firm. Both charge $4.95 commissions but Fidelity is more suited to the advanced trader while Schwab caters to both newbies and pros.

Schwab also has an advantage in the sense that it offers access to more international markets than Fidelity and also offers futures trading, which is not available on Fidelity. On the other hand, Fidelity’s trading platform, Active Trader Pro is more efficient when it comes to speed and performance.

Overall, the two are tough competitors, with each one offering distinct benefits for different target groups.

Charles Schwab Pros and Cons

Pros

- Low commissions

- Zero account minimums

- Beginners can learn the ropes using the simple yet robust StreetSmart platform

- Expert traders can access sophisticated features on the advanced StreetSmart Edge platform

- Plenty of robust research options from Schwab as well as third parties like Market Edge and Morningstar

- 24/7 customer support on phone or via online chat

- Over 340 brick and mortar branches in 46 US states for in-person assistance

- Vast selection of commission-free trading options

- Traders can use robo-advisor for automated investing at no fee

- Access to an account via multiple platforms, desktop, mobile and web-based

- Users can bank with Schwab and link their bank and brokerage accounts

Cons

- Though you can use Schwab robo-advisor for free, it requires a minimum opening deposit of $5,000, which is much higher than what competitors offer

- Buying a transaction-fee fund comes at a hefty commission at $49.95 per purchase

- Poor customer support on email

- The platform’s primary mobile app does not offer real-time streaming quotes

- Margin rates are comparatively higher

- Certain features are split between platforms

- The company pushes users towards getting a financial advisor

- High trade commissions

Final Thoughts

In answer to one of the most popularly asked questions, ‘Is Charles Schwab good?’ or ‘Is Charles Schwab reliable?’ the answer is yes. But like any other discount brokerage platform, it has its strengths and weaknesses. Among its top highlights are the low Charles Schwab account fee and $0 minimum balance. It is a versatile choice for beginners and pros alike and has extensive research facilities.

The platform also has a wide selection of trading options with different platforms for various users. In spite of the fact that some of its features are below par and some trading options are costly, it is overall a good platform, as the Charles Schwab rating reveals.

Glossary of Trading Platform Terms

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

How can I manage my own investments on Schwab?

You can do so by taking advantage of the extensive research, online tools, insights, education and customer support features on the site.

What are the benefits of banking with Schwab?

Banking with Schwab does not attract any ATM, account minimum or transaction fees and you can use Charles Schwab mobile to access banking features on the go.

Is Charles Schwab regulated?

Yes. Charles Schwab is currently regulated by the US SEC and the UK FCA.

Is Charles Schwab legit?

Charles Schwab is a legit discount brokerage company with years of experience and a reliable track record of performance. Therefore, in answer to the question ‘can you trust Charles Schwab?’ the answer is yes. The firm has not given any reason for lack of trust.

What are stocks?

Stocks represent shares in the ownership of companies, including their assets and earnings. Therefore, if you hold stocks in a company, you are a partial owner.

See Our Full Range Of Broker Reviews – Broker Reviews A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up