FinBee Review 2022: Are 20% Returns Safe?

P2P Lending platforms have been using various techniques and business strategies to offer higher returns to investors.  Some of them are allowing investors to directly fund the project while others are offering personal loans, mortgages and business loans. These platforms have also developed auto investing tools and income funds to attract investors who generally don’t have time to watch the market.

Some of them are allowing investors to directly fund the project while others are offering personal loans, mortgages and business loans. These platforms have also developed auto investing tools and income funds to attract investors who generally don’t have time to watch the market.

Similar to the brokerage industry, choosing the right P2P lending platform is significantly important. This is because the majority of risks are directly correlated to these platforms. The P2P platforms are responsible for checking the credit quality of borrowers along with the repayment options.

To help you in selecting the right P2P platform, we review FinBee – which is among the popular names in the emerging industry.

What is FinBee?

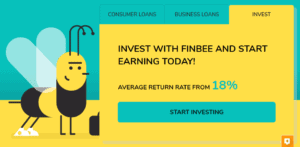

The Lithuania based platform was established in 2015. This P2P platform aims to create profitable opportunities for both borrowers and lenders. The platform connects borrowers with lenders in order to create business opportunities for both sides. The platform has gained popularity amid its higher interest rates. It currently offers close to 20% return on invested capital – which is standing at the higher end of the industry average.

What are FinBee Pros and Cons?

FinBee Pros:

✅Provides legal debt collection service.

✅High returns.

✅AutoLend portfolios.

✅Signs every contract in person.

✅Two types of loans

FinBee Cons:

❌ No buyback guarantee.

❌No contract modification

❌Unclear fee structure

❌No insurance in case of default

How it Works?

Like other P2P platforms, it’s business model helps in connecting borrowers with lenders. FinBee has created easy to use website and a user-friendly dashboard to track investments, interest rates, and scheduled payments. In order to create diversification, the platform offers various products such as consumer loans and business loans.

Unlike other platforms that are using strong evaluation techniques before accepting loans, this platform permits investors to place a loan request if they are 18 years old with the debt to income ratio of less than 40% along with regular income. On the other hand, a low minimum investment of 5 euros allows the platform to attract small investments as well. They also offer auto invest feature – which is best for investors who don’t have enough time to gauge every investment opportunity.

What are Accepted Countries?

The platform accepts clients from all over Europe. Clients from the United States and other regions are not eligible for this platform unless they have permanent residency status along with banks account in a European bank. Anyone who is above 18 years can invest through this platform. Below are the few countries that are accepted on this platform:

- Austria

- Belgium

- Bulgaria

- Croatia

- Italy

- Netherlands

- Norway

- Poland

- Cyprus

- Czech Republic

- Denmark

- Finland

- Greece

- Hungary

- Ireland

- Malta

What is Account Opening and Investing Process on FinBee?

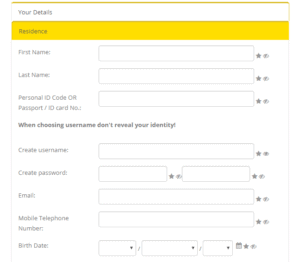

The account opening process is simple. The investor needs to fill the registration form to create an account on this platform. You don’t need to provide scan documents and other personal information in the registration form. The registration form only requires basic information such as name, date of birth and phone number.

Once you are registered on the platform, you are required to select your investment preferences. The investor can select between manual and auto investment feature. If you select to invest through auto investment feature, you are required to fill in the KYC questionnaire.

Once you are done with the questionnaire, you need to add funds to your FinBee account. The investor can only transfer funds through a bank account to FinBee account. Payments through electronic wallets are not accepted. It could take a couple of days for transferring funds to FinBee account. Once your funds become available in FinBee account, you are free to invest in any loan category according to your investment preferences.

What Type of Products FinBee Offers?

FinBee offers two types of investment products: Business loans and Consumer Loans. The platform strongly suggests investors distribute their investment into several loans to reduce risk and increase returns. Below are the two main loan categories:

Business Loans

After initially operating consumer’s loans only, FinBee also started providing investment opportunities in small business loans. It offers business loans in the range of €1000 to €500,000 for the duration of 1 month to 60 months. For the majority of business loans, the rates could be fixed. It’s business loans are unsecured and the firm doesn’t take collaterals to protect the loan. They also don’t offer any insurance on investment in business loans. The buyback guarantee and contract cancellation are also not possible for investors.

The platform, however, claims that they closely evaluate each loan application; they assign risk grade from A+ to D, where A+ is a low-risk loan, D – high risk loan, based on reputation of the management (20% of risk grade), financial sustainability (60% of risk grade), market situation (20% of risk grade).

The investor can invest in various categories of business loans:

- Working Capital

- Inventory

- Growthfunding

- Employment

- Marketing

- Premises

Consumer Loans

FinBee platform is popular for offering several types of consumer loans. Indeed, the platform also offers refinancing of expensive loans with lower monthly installments that are easier to cover. The investor can invest in several types of consumer’s loans with the loan amount ranging from €300 to €10,000. The time duration for consumer loans is 12 to 60 months. These loans are unsecured and there is no insurance in case of default.

Below are the types of loans that an investor can invest in:

- Car

- TV set

- Wedding

- Tuition fee

- Refinance your expensive credit cards or consumer loans.

What is FinBee Autolend Feature?

FinBee has designed autolend facility to facilitate lending on a larger scale. This feature reduces the burden of manually searching and selecting loan requests and manually placing bids on those loan requests. Its autolend portfolio will robotically place all the lending bids according to the parameters that you have described in questioners. Autolend portfolio enables investing in a more structured manner when compared to manual investing.

The lender can create up to three different lending portfolios; each lending portfolio is configured by different parameters. This type of strategy permits lenders to invest money on a portfolio basis. Below are the three types of portfolio’s that you can choose for investing:

- Conservative: When you select a conservative portfolio, you can expect the system to lend money to a higher rating and low-risk loans. This portfolio might offer lower returns, but the rate of risk is also almost zero. The investor can expect the average interest rate in the range of 12-15%.

- Balanced: By choosing a balanced portfolio, you expect the system to lend money to various size and rating loans. The rate of risk related to a balanced portfolio is slightly higher than the conservative portfolio. By choosing a balanced portfolio you can expect returns in the range of 15-19%.

- Progressive: This portfolio carries a higher risk than the other two portfolios. This is because the system will lend money to lower rating and higher risk loans. The projected average interest rate stands in the range of 19-23%.

Once you select one of three portfolios, you just need to set the amount you want to invest. After that, FinBee autolend feature will robotically split your investment into various loans according to your preferences. The investor is eligible to change portfolio settings anytime.

Does FinBee Offers Buyback?

No, FinBess does not offer a buyback facility. The investors cannot sell their investment to the platform. The platform also does not offer modification in agreement once you funded the borrower. However, it is possible to sell the investment to another lender on this platform.

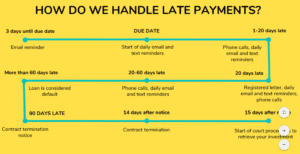

In the case of borrowers default, FinBee will not refund your money. Instead, it helps you in getting back the money through legal procedure and courts. They will not charge an additional fee related to legal settlements.

What is FinBee Fee Structure?

There is no fixed fee structure related to investing in this platform. They charge fee based on the nature and length of loans. The unclear fee structure always raises investors concerns. The platform charges 1% commission on the sale of an investment to other investors. They also don’t charge any fee on deposits while the withdrawal of funds is also free of cost. They, however, deduct 15% income tax from the interest amount that you earn through this platform.

What Deposit and Withdrawal Methods FinBee Supports?

FinBee only accepts payments through bank accounts. They do not accept payments through online payment services companies and electronic wallets. This is due to its compliance with anti-money laundering policies. In addition, they only accept payments from European bank accounts. Payments coming outside the European region are not accepted. The smallest investment in any single loan is 5 Eur. Please find details for money transfer to Client’s Money account:

Receiver: UAB „Finansų bitė“

Company code: 304051511

Bank name: AB „Citadele“ bankas

SWIFT code: INDULT2X

Bank account number: LT857290000000141859

Unique reference: Your username

They also don’t permit an investor to withdraw funds to online payment services companies and electronic wallets. The investor is only eligible to withdraw fund to bank accounts.

Is FinBee Customer Support Good?

FinBee does not offer a live chat feature – which is one of the best ways for investors to reach customer support team when it comes to P2P lending. The investors can only contact the support team through email. They usually respond to each query within three business days. They have also highlighted their phone number on the website. But it is always difficult to reach the support team through phone call unless you have some urgent issue.

What are the Risks Associated with Investments Through FinBee?

The firm claims to employ technical and fundamental measures before accepting borrower’s loan requests. It has rejected more than 500 loan requests while the acceptance rate is higher at 9398. The firm has set up an easy process for loan requests. Anyone can place a loan request if the person is 18 years old with the debt to income ratio of less than 40% along with regular income. It also doesn’t require collaterals from borrowers – which increase risks to investments.

But it appears that unlike other platforms, FinBee does not put a lot of efforts in evaluating loans. This is evident from higher rate of defaults in different categories. The default rate of 27% and 13% in D and C categories is significantly higher when there is also no buyback guarantee. On the positive side, the default rate is significantly lower in A and B categories.

Besides these risks, there are also industry related risks that one need to understand before investing in this platform. The platform clearly suggests investors evaluate your personal and family finances as well as your business financial situation before investing in unsecured loans. In addition, the investments through FinBee platform are not insured or secured in any other way. In addition, there is no guarantee that a borrower will meet his financial commitments.

Conclusion

FinBee is a perfect platform for both lenders and borrowers. It allows lenders to make an investment in various consumer and business loans. The average interest rate of close to 20% looks significantly attractive. The platform’s autolend feature is also strong amid three different types of portfolio styles. On the negative side, the platform lacks basic features such as buybacks and refund of capital in case of borrowers default. Lack of protection related to invested capital is the biggest drawback of this platform.

FAQ:

What is FinBee?

What fees are applicable?

What is FinBee debt collection fee?

What happens if FinBee bankrupts?

How much time does it take to withdraw money from FinBee?

What is secondary market?

Peer 2 Peer – A-Z Directory