Bonds have traditionally always had a place in retirement portfolios because they provide a reliably steady source of income while securing the invested capital with minimal risk. However, many retirees don’t fully take advantage of the relative financial security that bonds guarantee and their attention is always fixated on equities investments or real estate assets. For people on the verge of retirement, this piece provides insight on how to invest in bonds, with guidance on why bonds should be central to the retirement portfolio of an investor that places a premium on minimizing risks.

What is a Bond?

A bond is simply a form of debt, issued by a corporation or government to raise funding for operational expenses or specific project financing. When you invest in a bond, you are simply loaning money to the bond issuer – it doesn’t make much difference if the bond issuer is Tesla Inc , the Government of California, or the United States Government.

How are bond investments different from stocks?

A bond is fundamentally different from a stock in that investing in a bond make you a lender while investing in stocks makes you a shareholder. When you invest in a bond, you lend money to the issuer, who pays you back an interest (coupon) for the duration (term) of the bond until maturity, after which they pay you back the full amount you invested (lent) in the bond. Conversely, when you invest in stocks, you become a shareholder who gets a share of the profits (or losses) of the company.

How much money can I expect to make on bond investments?

The general principle of low-risk, low-returns; and high-risk high-returns is applicable to bond investing. Bonds traded AAA are considered the most reliable and least risky while bonds rated BBB and below are typically riskier. The returns on a bond investment are usually calculated in terms of its coupon interest rate and its yield. The coupon rate on a bond is expressed as a percentage of the bond for every $1000 dollar (par) invested. Hence a bond with a $1000 face value and a coupon rate of 5% will pay investors $50 for every $1000 invested annually (or biennial). In addition, the term of a bond also influences the interest rate payable, longer-term bonds tend to have higher returns than similar short-termed bonds.

What is the performance of bonds relative to stocks?

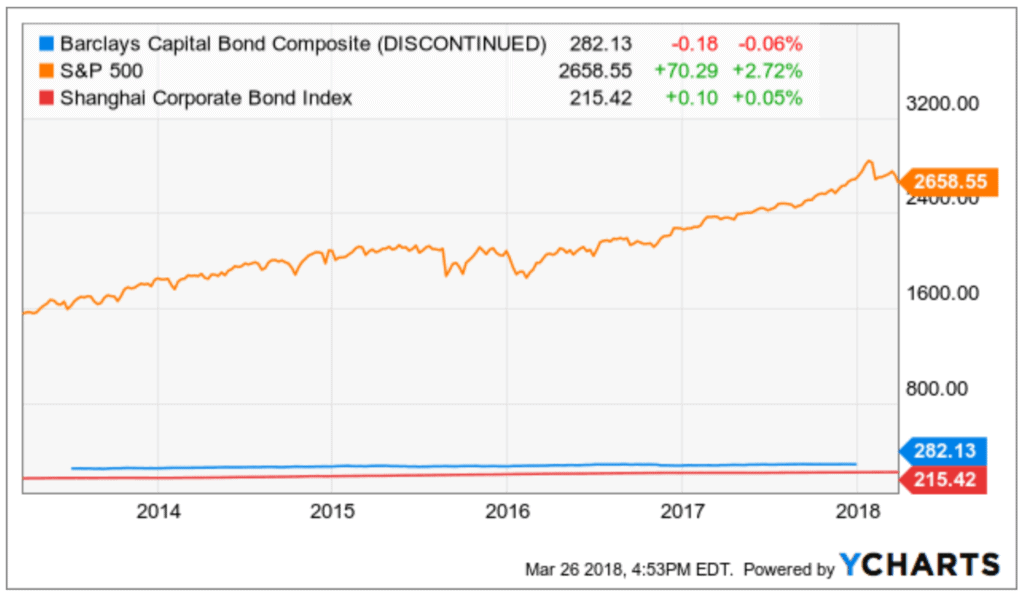

To be honest, stocks generally outperform bonds in terms of price gains and returns.

In the last five years, the S&P 500 index has gained 2,658%. In contrast, the Barclays Capital Bond Composite Index has only climbed 282% and Shanghai’s Corporate Bond Index has only climbed 215% in the same period

Why should I invest in bonds if it underperforms stocks?

Bonds don’t seem to deliver as much returns as a stock; yet, the fundamental benefits from investing in a bond are enough reason to include bonds in your retirement portfolio.

Firstly, bonds offer a higher dimension of stability relative to equities. The value of a bond is not likely to fluctuate as much as the price of a stock —however, the stock of the best companies on Wall Street can tank overnight in response to bad news. Facebook Inc and its massive price drop in the last two weeks comes to mind.,

Secondly, a bond can provide investors with a reliable source of income in the form of regular interest payments. With a bond, you can predict a steady stream of income but you can never tell how much earnings or dividend a company will report even after collating the consensus analysts’ estimates.

Thirdly, they are about the smartest way to secure your wealth. Other than cash, buying Federal Government bonds or T-bills are probably the most liquid asset in the market. If you bought highly-rated bonds, you can be sure that your investment is practically guaranteed.

Lastly, bonds can also deliver impressive tax savings when properly managed. Some of them are exempted from state and municipal taxes and other’s provide investors with higher after-tax income than other safe assets such as real estate.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account