WSB crowd attempts to pull short-squeeze on silver, metal up 10%

The WallStreetBets community, a group of retail traders that shares investment ideas in a Reddit channel, has been attempting to pull a short-squeeze on silver in the past few days, with the price of the metal advancing as much as 17.5% since Thursday after the phrase #silvesqueeze started to gain traction within the community.

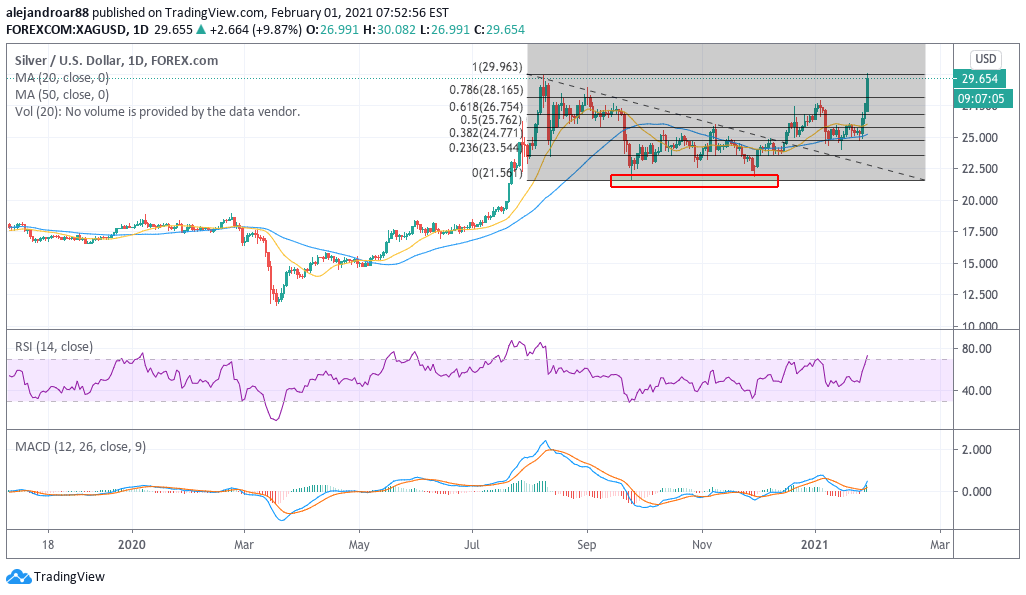

Today’s uptick has been the strongest so far, as the price of the metal is jumping 10% at $29.7 per ounce, once again hitting its post-pandemic high from last August on a high-volume session.

Meanwhile, mining stocks are reacting positively to the spike in the price of the metal, with the iShares MSCI Global Silver and Metal Miners ETF (SLVP) advancing as much as 24% at $20 per share in pre-market stock trading action while the Global X FDS Silver Miners ETF is also up 15% at $43.78 per share as investors seem to be betting on the success of this strategy.

The fact that gold prices are not reacting in a similar way reinforces the view that the latest price action is the result of a targeted move from the so-called ‘Reddit’ investors, as the precious metal is only trading 1% higher at $1,866 per ounce.

That said, gold could be next in line if retail traders manage to pull a successful short-squeeze on silver.

To some extent, short positions in silver don’t seem to be as pronounced as those seen by the stocks that were lifted by the first squeezes such as GameStop (GME) and AMC Entertainment, as speculative traders are net long on silver by a total of 52,000 contracts according to data from the Commodity Futures Trading Commission (CFTC).

However, non-commercial traders have currently sold short a total of 29,984 silver contracts – corresponding to 5,000 troy ounces each – for a total of 150 million ounces currently being shorted. This amount of silver accounts for roughly 15% of the 2020’s forecasted global supply based on statistics from The Silver Institute.

In that context, although the market is net long, the size of short positions is as high as to permit a short squeeze if the price moves high enough to force short sellers to cover their positions to avoid further losses.

What’s next for silver?

Although WSB pumpers have managed to push the price to its August 2020 all-time highs, there has been some selling at that point as long contract holders may have taken this opportunity to liquidate a portion of their holdings.

Given the fact that the market is net long on the metal, it is possible that the short-squeeze can end up being short-lived if enough sellers show up to cash in their profits – a situation that would put strong downward pressure on the price while possibly reversing the uptrend if retail traders run out of ammo.

For now, the price seems headed to close the session near or at the $30 per ounce threshold. If the price were to move above that level then a fresh new rally could unravel, possibly accelerating the short squeeze as short-sellers might quickly move to cover their positions before the losses get too hot.