US initial jobless claims are expected expect to fall to 0.89 million when they are released on Thursday, meaning that unemployment claims will stay under a million for the second week in a row.

The date covers the week ended 15 August, according to the consensus estimates compiled by Trading Economics.

Jobless claims fell below 1 million last week: Time to go bullish on markets?

US Jobless claims were above a million for 20 consecutive weeks. They peaked at 6.9 million in the last week of March and fell gradually since then. There was a blip in this downtrend and US jobless claims rose sequentially in the week ended 25 July and 18 July.

However, in the week ended 8 August, US jobless claims were 0.96 million, far below the expected 1.14 million, and below the psychologically-important one million level for the first since March.

“Another larger-than-expected decline in jobless claims suggests that the jobs recovery is regaining some momentum but with a staggering 28 million workers still claiming some form of jobless benefits, much labour market progress remains to be done,” said Lydia Boussour, senior US economist at Oxford Economics.

Gus Faucher, chief economist at PNC said: “The labor market continues to improve, but unemployment remains a huge problem for the U.S. economy.”

He added: “The number of people filing for unemployment insurance, both regular and PUA (Pandemic Unemployment Assistance) benefits, continues to steadily decline as layoffs abate. But job losses remain extremely elevated, far above their pre-pandemic level.”

How analysts view US jobless payments?

However, over the last 21 weeks, over 56 million Americans have filed for initial jobless claims

The continuing claims for people who have already filed for jobless claims in the previous weeks and continue to file for claims were 15.5 million in the most recent filing, falling 604,000 from the week before, according to the Department of Labor.

Furthermore, the $600 a week additional benefit expired last month. Republican lawmakers have argued that the benefit was acting as an incentive for people to not look for work.

Earlier this month, President Trump signed an executive order providing an additional $400 per week unemployment benefit.

Commenting on the decline in initial jobless claims over the last two weeks, Jefferies’ analysts said that the data “provides some fuel for the argument that the enhanced benefits were providing an incentive for people to stay away from returning to work if they had the option.”

They added: “The data of the past two weeks will not help the arguments of lawmakers fighting to extend the expired benefits.”

Can you make money during the coronavirus pandemic?

The coronavirus pandemic has brought about a high cost to the US as well as the global economy. But that does not mean that there aren’t any investment avenues during the pandemic.

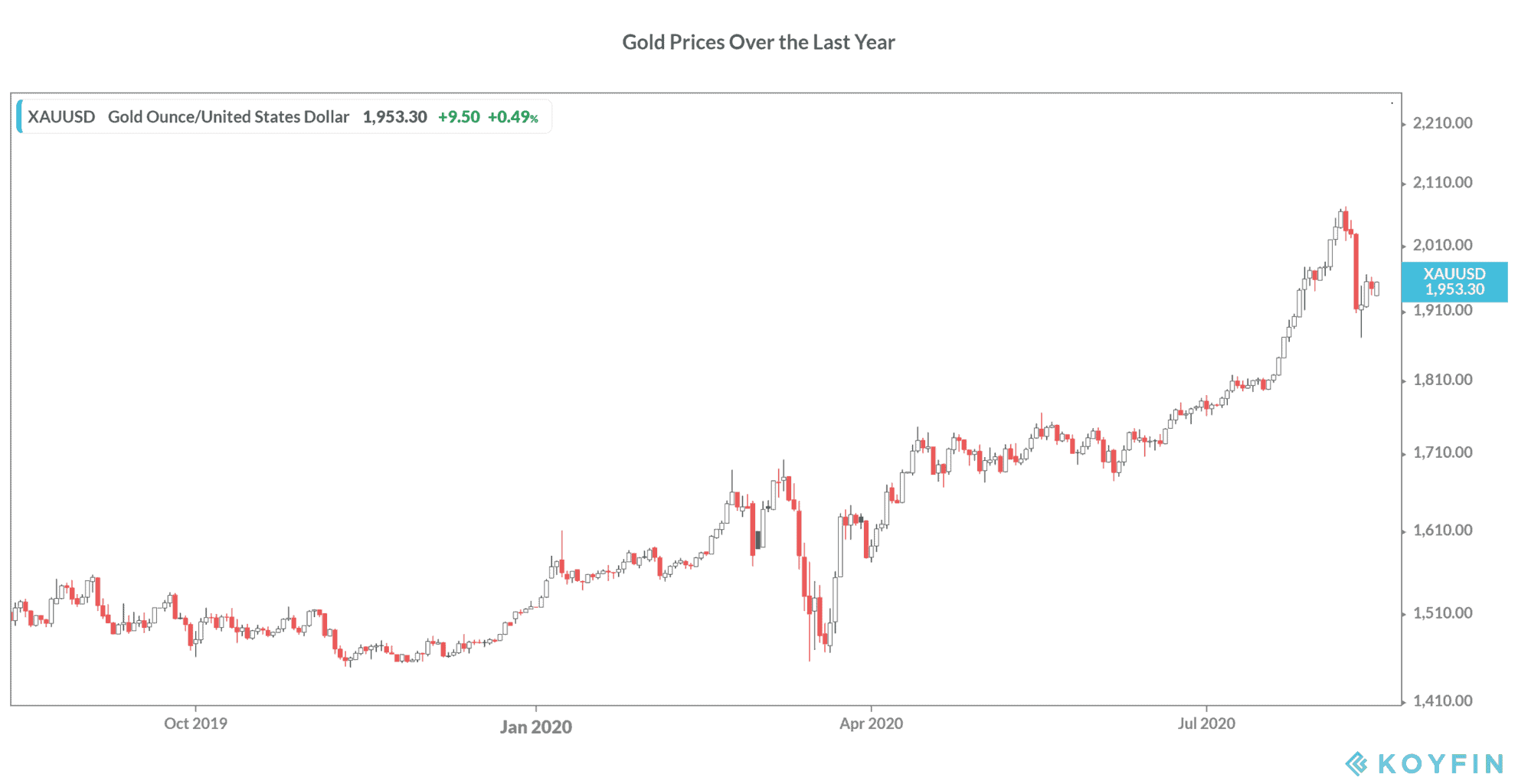

US tech stocks have soared this year and the tech-heavy Nasdaq index is up almost 25% for the year. Gold has been another beneficiary as investors have sought solace in the safe-haven asset amid the economic turmoil.

While gold came under pressure last week on reports that Russia has come up with a vaccine for the virus, most analysts are positive on gold especially given the expected fall in the US dollar.

Frank Holmes, chief executive at investment firm US Global Investors expects gold prices to rise to $4,000 per ounce, doubling from the current levels. Goldman Sachs and Bank of America also expect gold prices to rise from these levels.

You can buy gold through any of the reputed brokers for gold. You can buy tech stocks through any of the best online stockbrokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account