Stock Trading UK Guide 2022

One of the most popular online trading sectors is stocks and shares. The process involves making an educated prediction on whether the value of a stock goes up or down in the short-term. If your judgement is correct, you make money. If you don’t, you lose money.

With some online brokers now hosting tens of thousands of stocks across multiple markets, there are plenty of opportunities to generate consistent profits. However, you need to have a firm understanding of how the stock markets work before taking the plunge.

In this guide to stock trading for beginners, we explore what online stock trading is and how it works. We’ll also walk you through the process of opening a UK stock trading account, placing an order, and deploying a strategy.

-

-

What is Stock Trading?

Put simply, stock trading is the process of buying and selling stocks. You will be speculating on whether you think the value of a stock is likely to go up or down.

Put simply, stock trading is the process of buying and selling stocks. You will be speculating on whether you think the value of a stock is likely to go up or down.If your decision to buy shares is correct, you will make a profit. For example, let’s suppose you are trading Amazon stocks. If the current price of the stock is $350 and you place a buy order, this means that you think the value of the shares will increase.

Similarly, if you place a sell order on Amazon, this indicates that you think the price will go down. In most cases, seasoned stock traders will target short-term positions. That is to say, they might enter a stock trading order in the morning, and then close the position a few hours later.

Some stock traders – such as those involved in ‘scalping’ (exploiting small price gaps quoted by the broker), might keep a position open for just a few minutes. Either way, stock trading is different from that of a traditional investment in shares. The latter will see an investor purchase shares in a company and hold on to them for a number of months or years. They are less concerned with short-term pricing swings, as they are in it for the long run.

CFD Stock Trading

In order to trade stocks online, you will need to use an online platform that offers CFDs (contracts-for-differences). In a nutshell, CFDs are financial instruments created by online stock brokers. They are tasked with tracking the value of an asset in real-time. This allows you to access thousands of markets without you needing to take ownership of the underlying asset. CFDs can track everything from gold, oil, indices, ETFs, bonds, and of course stocks.

For example:

- Let’s suppose you want to trade HSBC stocks

- On the London Stock Exchange, HSBC is currently priced at 317p per share

- Your chosen broker offers HSBC stocks via CFDs, which are also priced at 317p

- You place a buy order, meaning that you think the value of the shares will increase

- A few hours later, HSBC shares have increased by 1.75% on the London Stock Exchange

- As CFDs tracks the real-world price of assets, your buy order is now worth 1.75% more

As you can see from the above example, as and when the underlying stock changes in value, so will the CFD – like-for-like.

There are several benefits that CFD trading offer over traditional shares, which we are going to elaborate on below.

- Commission-Free: Many online trading platforms allow you to trade stock CFDs without paying any commission. This is a far cry from the likes of Hargreaves Lansdown, which charge up to £11.95 per trade.

- Short-Selling: Traditional share-dealing platforms only allow you to go ‘long’ on a stock, meaning that you buy a share with the expectation it will rise in value. Stock CFDs, however, also allow you to go ‘short’. This means you can profit when a stock price falls.

- Leverage: Most stock CFD platforms allow you to apply leverage. This means that you can trade with more money than you have in your account. In the UK, this is capped at 1:5 for retail clients. Put simply, you only need to put 20% of the order value up, meaning you can trade with 5 times the value of your account balance. Leverage magnifies gains – but losses too.

- Global Markets: Share dealing platforms are limited in the markets they can give you access to. After all, they will need to personally source the respective shares. However, as CFD instruments are merely tasked with tracking the price of a stock, you will have access to dozens of domestic and international markets.

Ultimately, stock trading via CFDs offers you much more in the way flexibility when compared to a traditional share dealing site.

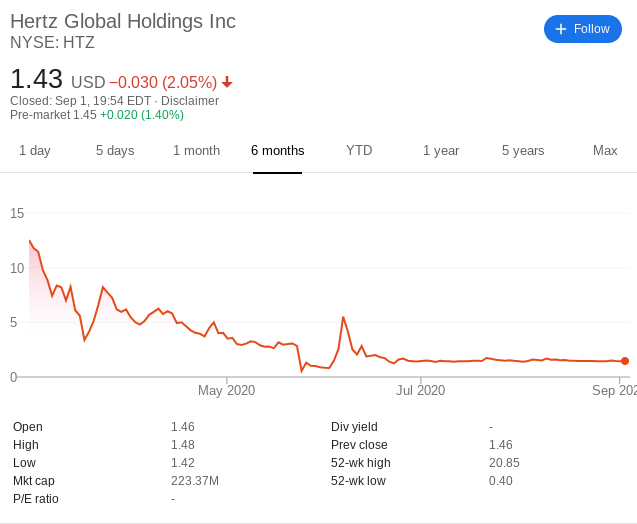

Penny Stock Trading

Penny stocks (or penny shares in the UK) is somewhat of a broad term. In the UK, this typically refers to a company that has a stock price of less than £1. As you might know, this covers a significant number of UK firms, not least because the London Stock Exchange is priced in pence, as opposed to pounds.

However, a more fitting way to look at penny stocks is that they are usually associated with the following:

- Publicly-listed companies with a small market capitalisation

- Newly launched companies with an unproven business model

- Companies operating on the AIM (Alternative Investment Market)

- Firms that trade on the OTC (over-the-counter) markets

Irrespective of the above, penny stocks are typically super-volatile. In other words, it is not uncommon for a penny stock to increase or decrease in value by double – or even triple digits in a single day of trading. This is because penny stocks have a small market capitalisation, so a large order can influence its share price by some distance.

As a result, penny stocks are best left for those that have a higher appetite for risk. On the flip side, if you are able to find a ‘hidden gem’ that one day makes it big, penny stocks do have the potential to return huge margins. But, such investments are few and far between.

Stock Market Trading Hours

When trading stocks online, you will likely have access to heaps of markets. In the UK, this might include the London Stock Exchange and AIM.

When trading stocks online, you will likely have access to heaps of markets. In the UK, this might include the London Stock Exchange and AIM.In mainland Europe, there are stock markets in Germany, France, Sweden, Spain, the Netherlands, and more. Over in the US, you have the world’s two largest exchanges – the NYSE and NASDAQ.

Then you have the likes of the Tokyo Stock Exchange, and markets in Hong Kong, Singapore, Australia, and even Saudi Arabia. The key point here is that there are tradable markets in every corner of the world.

As such, you have the opportunity to trade 24 hours per day, as there is always a marketplace open. In the vast majority of cases, stock markets are open for business between Monday morning and Friday afternoon. The specific opening times will vary from exchange-to-exchange.

Nevertheless, below we have listed the opening and closing hours of some of the most traded global stock markets.

- London Stock Exchange trading hours: 8.30 am to 4 pm

- New York Stock Exchange: 9.30 am to 4 pm

- NASDAQ: 9:30 am to 4 pm

- Tokyo Stock Exchange: 9 am to 3 pm (closed for lunch between 11:30 am and 12:30 pm)

- Euronext: 9 am to 5 pm

- Toronto Stock Exchange: 9.30 am to 4 pm

The above times are, of course, based on the respective stock market. We should note that some online brokers give you access to extended trading hours. This allows you to access the market just before or after the official opening/closing times. Trading volumes are much lower during extended hours, which offers both risks and opportunities.

Why People Trade Stocks

The overarching purpose of trading online is to make money. UK stock trading is no different in this respect. With that said, there are a number of specific benefits that the stock trading market offers, such as:

- Large Trading and Liquidity Levels

The global stock markets are responsible for billions of pounds worth of trading volume each and every day. This is good news for you as a stock trader, as it ensures that there is plenty of liquidity available.

In simple terms, this means that you will never struggle to find a buyer when it comes to selling and exiting a position (and visa-versa when short-selling, where you buy to exit the position).

- Access to Global Stock Markets

When using a traditional UK-based broker, you might only have access to the London Stock Exchange. This won’t suffice for seasoned stock traders, as it’s more desirable to have access to a highly diversified number of markets.

As we noted earlier, stock trading platforms will utilise CFD instruments. This means that they can offer you markets from heaps of stock exchanges.

- Profit From Falling Markets

One of the biggest plus-points of stock trading in the UK is that you can profit no matter which way the markets go. This is because you will always have the option of placing a buy or sell order.

The former means you think the stock will increase in value, and the latter means the opposite. This is hugely beneficial, as you have the ability to short-sell a company.

- Trade With a Small Amount of Capital

Online stock trading platforms are increasingly targeting their services to retail clients. With this in mind, you can also get started with a minimum deposit of just £100 – sometimes less.

This won’t, however, be enough for you to make a full-time living from your stock market trading endeavours. With this in mind, online brokers usually offer leverage facilities.

As we briefly covered earlier, this allows you to trade with up to five times the size of your account balance. As such, a £100 balance would permit a maximum order value of £500.

Is Stock Trading Potentially Profitable?

On the one hand, stock trading can potentially be very profitable if you know what you are doing. However, most newbie stock traders either end up blowing their account balance on more risk-management strategies or simply give up. Crucially, if you want to make consistent profits in the space, you need to dedicate a lot of time to mastering your trade.

In terms of how you make money in the stock trading space, this largely centres on capital gains. This is where you sell a stock for more than you paid for it. If short-selling a stock, you make money when you buy back the asset at a lower price than you originally sold it for.

Buy Order example:

- You place a £500 buy order on BT shares

- You pay 100p per stock

- A few hours later, BT is priced at 105p

- This represents an increase of 5%

- You place a sell order to cash out your gains

- On a stake of £500, you made a profit of £25

Sell Order example:

- You place a £500 sell order on Nike shares

- You sold the shares at $80 per stock

- A few hours later, Nike is priced at $72

- This represents a decrease of 10%

- You place a buy order to cash out your gains

- On a stake of £500, you made a profit of £50

The profits outlined above are your capital gains. In the UK, this is liable for capital gains tax. If you want to avoid paying capital gains tax on your stock trades, you might want to consider spread betting.

Dividends

There is often a misconception that stock CFDs do not yield dividends. On the one hand, you are not entitled to dividends per-say, as you do not own the underlying stock. Instead, you are trading CFDs. On the other hand, some CFD brokers do give you the opportunity to have the stock dividend payment reflected in your account.

Here’s how it works.

- When the respective company distributes a dividend, the CFD broker will make two adjustments.

- For those that are short on the stock, the dividend payment will be negatively adjusted on your account balance.

- If you are long on the stock, your account will be positively adjusted to take the dividend payment into account.

In simple terms, this means that short-sellers cover the cost of the dividend payment, which is then paid to those going long on the stock!

Stock Trading Risks

Whether it’s bonds, stocks, indices, ETFs, or cryptocurrencies – all forms of trading come with risk. Crucially, there is no guarantee that you will make any money at all.

On the contrary, there is every chance that you will make a loss. This is why regulated CFD brokers are required to clearly outline the risks of trading. In fact, the FCA now requires CFD brokers to display the percentage of traders that lose money on their platform. In most cases, this figure sits within the 75%-85% region.

In particular, if you decide to apply leverage to your stock trades, you stand the chance of losing your entire margin. This is the amount of money that you are required to pay upfront to access the trade.

For example:

- If you trade with leverage of 1:5, this means that you need to put a 20% margin up (1/5 = 20%)

- So, if the value of your leverage trade is £2,000 – your margin is £400

- Put simply, if the trade goes against you by 20% or more, your position will be liquidated

- This means that the broker will be forced to close your trade automatically

- In doing so, you will lose your margin. In this example, that would be £400.

This is why you may want to tread with caution when using leverage. In fact, if you’re just starting out in the world of online stock trading in the UK, it’s may be better to avoid it until you become more comfortable.

Stock Trading Strategies

Leading on from the above section, the small percentage of stock traders that are able to make consistent profits do so because they have a strategy in place. There are many strategies to consider when trading stocks – so spend some time researching one that meets your investing goals.

This includes:

- Scalping: Scaling is highly conducive for UK stock trading. For those unaware, this is a strategy that targets ultra-small profits when a stock sits within a tight pricing range. The scalper might place dozens, if not hundreds of trades per day.

- Day Trading: Most stock traders will deploy a day trading strategy. In doing so, you will keep a stock market trading position open for a number of minutes or hours, but rarely more than a day. This allows you to avoid overnight financing fees.

- Swing Trading: This stock trading strategy is all but following the trend. With this in mind, swing traders are happy to keep a position open for a number of days or weeks. In other words, for as long as the trend remains in play, swing traders will keep the position open.

No-two strategies are the same when trading stocks, so do your homework to find one what is right for you.

Stock Trading Tips

If you’ve read our guide up to this point, then you’ll know that stock trading in the UK can be challenging. As such, below you will find five tips to help point you in the right direction.

Tip 1: Try Stock Trading Courses

If you’re planning to go gung-ho by opening a trading account and placing buy/sell positions without an ounce of investment knowledge – think again. This is a recipe for disaster, as you are almost certain to lose money. Instead, take a step back and learn your trade.

The most effective way of doing this is to take a stock trading course. The internet is your best friend in this respect, as there are heaps of educational resources available in the public domain – both free and paid-for.

Tip 2: Read Stock Trading Books

To broaden your educational journey, it is also a good idea to read some stock trading books. Once again, there are many options in this respect.

Ultimately, popular stock trading books will show you everything you need to know to be able to invest on a DIY basis. This will include key metrics like technical and fundamental analysis, trading strategies, and risk management.

Tip 3: Try a Stock Trading Demo Account

The popular trading platforms in the UK space offer fully-fledged demo account facilities. This allows you to trade with ‘paper funds’ before you upgrade to a real-money account.

The trading facility will often mirror that of the real-world financial markets. This is crucial, as it allows you to get a feel for how the stock market trading scene works before risking your own capital.

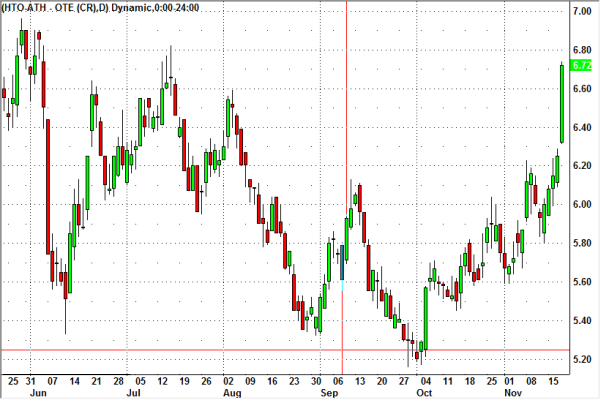

Tip 4: Learn How to Read Charts

When investing in stocks, you don’t really need to have an understanding of pricing charts. After all, you will be investing in the company for a number of months or years, so short-term price movements are somewhat irrelevant.

However, this isn’t the case when ‘trading’ stocks, as you will be looking to make short-term gains. This is especially the case when engaging with day-trading or scalping, as positions are rarely kept open for more than a day.

With this in mind, it’s crucial that you learn how to read stock trading charts. In order to do this, you will need to gain an understanding of technical indicators, as this will help you identify pricing trends.

Tip 5: Stick With Major Stocks

Once you begin trading with real-world capital, you may want to to stick with major blue chip stocks. By this, we mean large-cap companies listed on the London Stock Exchange, NYSE, or NASDAQ.

Think more along the lines of AstraZeneca, HSBC, Facebook, Apple, Amazon, and Disney. The reason for this is that major stocks are typically stable. Which means that they rarely move by more than 1-3% in a single day of trading.

Penny stocks, on the other hand, will often move by double digits. Such large volatility levels are something you’ll want to avoid as a newbie stock trader, so ensure you are selective in the markets you target.

Popular Stock Trading Platforms

With so many UK stock trading platforms to choose from, knowing which provider to sign up with can be challenging. With that in mind, below you still find a selection of the popular stock trading platforms of 2022.

Plus500

Plus500 is an online trading platform that offers thousands of markets. On top of stocks, this includes indices, bonds, commodities, digital currencies, and more. Each and every asset is represented by CFDs, meaning that you have the option of entering buy and sell positions, as well as apply leverage.

Regarding the latter, you'll be capped to 1:5 on stock CFDs as a UK retail client. This goes up to 1:30 when trading major forex pairs. Nevertheless, Plus500 allows you to trade stock CFDs without paying any commission. Spreads are also tight, and there are no deposit or withdrawal fees.

This is why the platform is regarded as the go-to provider for low-cost trading. There is no requirement to download any software to trade at Plus500, as the platform offers its trading arena via the main website. You can, however, also trade via the Plus500 mobile app. This is available on iOS and Android devices. You can get started at Plus500 by opening an account and meeting a £100 minimum deposit.

Our Rating

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored ad

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored adHow to Start Stock Trading

So now that you know the ins and out of how online stock trading in the UK works, we are going to conclude our guide by showing you how to get started today.

The guidelines outline below are based on a FCA broker which is a great entry-level broker for first-time traders and is one of few platforms to offer free stock trading in the UK.

Step 1: Open a Stock Trading Account

In order to trade stocks at a regulated broker, you will first need to open an account. The process takes minutes and simply requires some personal information from you.

This includes your full name, home address, date of birth, contact details, and national insurance number.

You will then be asked to upload some ID as part of the know-your-customer process. This includes your passport/driver’s license and a proof of address. The latter needs to be a utility bill or bank account statement dated within the prior three months.

If you don’t want to upload the documents right now, you can proceed to make a deposit anyway. But, you won’t be able to deposit more than £1,800 until you do.

Step 2: Deposit Funds

Once your account is open, you can start trading straight away via the demo account facility. If you want to trade with real-world money, you’ll need to make a deposit. This needs to be at least $200.

You can deposit funds with a:

- Debit card

- Credit card

- Paypal

- Skrill

- Neteller

- Bank Transfer

Your deposit will be credited to your stock trading account instantly – unless opting for a bank transfer.

Step 3: Place a Stock Trade

You are now ready to place your first-ever stock trade. If you know what stock you wish to trade, enter the name of the company into the search box. In our example, we are looking to trade Aviva shares.

Once you click on the result that loads up, hit the ‘Trade’ button.

You will then see an order box. You need to select from a buy or sell order and then enter your stake. If you want to apply leverage, select your multiple. By default, your order will be executed at the next available price. But, if you want to enter the market at a specific price, change this to a ‘limit order’

Finally, confirm the order. You now have a stock trading order live in the markets! It will remain active until you close it.

Conclusion

By reading our guide in full, hopefully, you now have a firm grasp of what online stock trading in the UK entails. We have covered both the good and bad points of online trading to ensure you are able to make an informed decision.

If you are ready to start trading stocks right now, top regulated FCA brokers offer over 1,700 shares across 17 international markets. It takes just minutes to open an account and you can instantly deposit funds with a UK debit/credit card or e-wallet.

CFD trading is highly speculative. You may not get back the full value of your initial investment and may lose more than you originally invested.

FAQs

How does Stock trading work?

Stock trading is the process of buying and selling stocks with the view of making a profit. Most stock traders will keep a position open for no longer than a day – meaning that you will be chasing small, but frequent gains.

What is a popular online stock trading site for a beginner?

If you are trading stocks online for the very first time, you may want to use a newbie-friendly platform is simple to use.

What is a popular Stock trading app in the UK?

Most UK brokers now offer a stock trading app, so you’ve got lots to choose from.

How much money can you make in Stock trading?

There is no one-size-fits-all answer to this, as it really depends on you. For example, profits are determined by the number of successful trades you place, and how much you typically stake. Leverage will also have a major say in how much you make (or lose).

Is stock trading haram?

There are competing viewpoints on this question, so you would be advised to perform independent research on the matter.

Can you do stock trading for free in the UK?

If by ‘free’ you mean buying and selling stocks without paying any fees – then yes, this is possible in the UK. Most of the brokers listed on this page allow you to trade stocks commission-free, so it’s only the spread that you need to take into account!

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up