Best Dividend Stocks UK – Invest in Dividend Stocks

UK dividend stocks potentially give you the best of both worlds. Not only will you earn regular payments when the respective company makes a distribution, but you also stand the chance of increasing the value of your investment through capital gains. But how do you know which are the best dividend stocks for your portfolio?

In this article, we explore the UK’s best dividend stocks of 2021. We also give you some background information on how dividend stocks work, review the best brokers that offer dividend stocks, and show you what you need to do to make an investment today.

-

-

How to Buy Dividend Stocks in the UK in 3 Quick Steps

Don’t have time to read our guide all of the way through? Below you will find our three quick steps on how to buy the best dividend stocks in the UK right now!

[three-steps id=”6341″]Best Dividend StockBrokers in the UK

If you want to buy UK dividend stocks, you will need to find an online stock brokers that meets your needs. There are many trading platforms active in the space, so you’ll need to assess factors like fees, commissions, payment methods, and the number of shares you have at your disposal. And of course – you also need to ensure that your chosen broker is regulated by a licensing body such as the FCA.

Below we discuss some of the most popular platforms that allow you to buy and trade the best UK dividend stocks.

Plus500 - Trade Dividend Stock CFDs with Tight Spreads

Plus500 is a CFD provider that is home to thousands of financial instruments. In the equity department, this covers over 2,000 stock CFDs. Now, if you do opt for Plus500 and its CFD-offering, you will not actually own the underlying stocks that you trade. Instead, you will be speculating on the asset's future value. But, the good news is that dividends are still reflected in the underlying value of the stock CFD.

As a rough example, if a company distributed a dividend yield of 20p and you help 20 stock CFDs, then, in theory, £4 would be added to your Plus500 cash account. Crucially, opting for the CFD route comes with several benefits at Plus500. For example, the broker allows you to enter buy and sell positions. Regarding the former, this allows you to speculate on the value of the company going down. All trades at Plus500 are commission-free, too.

Furthermore, Plus500 permits leverage of up to 1:30 for UK retail traders. If opting for stock CFDs, this is limited at 1:5. In terms of the fundamentals, Plus500 is regulated by the FCA, and its parent company is itself listed on the London Stock Exchange.

You can get started with a minimum deposit of £100, and supported payment methods include a debit/credit card, bank account, and Paypal. Plus500 is also a great choice if you want to trade dividend stocks on your mobile, as it offers an excellent mobile app for iOS and Android devices.

Our Rating

- Regulated by the FCA and ASIC

- No commission and tight spreads

- Mobile app available

- No educational material

80.5% of retail investor accounts lose money when trading CFDs with this provider.FXCM - Trusted CFD Broker With Transparent Fees

Forex Capital Markets, more commonly referred to as FXCM, is a highly established online broker. Much like in the case of Plus500, FXCM is a specialist CFD provider. Once again, this means that you will be trading dividend stocks as opposed to owning them. But, any long positions that you have on the stock CFD will have the respective dividend payment credited.

On the flip side, if you are short on a company - meaning you are speculating on its value going down - then you will have the dividend payment deducted from your account. FXCM is also a good option is you are planning to trade stock CFDs with leverage. You will get a maximum of 1:5 when trading stock CFDs, so a £500 account balance would permit a maximum trade of £2,500.

You will have access to a plethora of financial markets at the broker, which includes thousands of companies from multiple exchanges. FXCM is also competitive in the pricing department, as it doesn't charge any trading commissions on stock CFDs. Similarly, you will find that major markets like the US and UK are home to tight spreads. Less liquid markets will, of course, some with slightly wider spreads.

FXCM is also popular with UK traders as it supports a full range of payment methods. This includes debit/credit cards, Skrill, Neteller Apple Pay, and Trustly. The broker is a member of the FSCS scheme, so your funds remain safe at all times - at least up to the first £85,000. When it comes to the trading platform, you can buy and sell stock CFD positions through your standard web-browser, through MT4, or via your mobile device.

Our Rating

- Maintains highly competitive trading fees and 0% commission fees

- FSCS protections from UK traders

- Thousands of stock CFDs to trade

- No traditional ownership of shares

80.5% of retail investor accounts lose money when trading CFDs with this provider.What are Dividend Stocks?

As the name suggests, dividend stocks are simply public companies that pay dividends. That is to say, by holding at least one share in the respective company, you will be entitled to dividends as and when they are paid. This allows public companies to share some of their profits with stockholders.

As the name suggests, dividend stocks are simply public companies that pay dividends. That is to say, by holding at least one share in the respective company, you will be entitled to dividends as and when they are paid. This allows public companies to share some of their profits with stockholders.In most cases, dividend stocks will release a payment every three months, although some do this bi-annually. With that said, not all companies pay dividends. This is especially the case with Big Tech stocks like Facebook, Uber, Netflix, and even Amazon.

Nevertheless, if you are holding dividend stocks in your portfolio, this allows you to supplement your investment. In other words, not only do you stand the chance of growing your wealth through capital gains (when the value of the shares go up), but also via quarterly/bi-annual dividends.

Nevertheless, below is a quick and easy example of how dividend stocks work in practice.

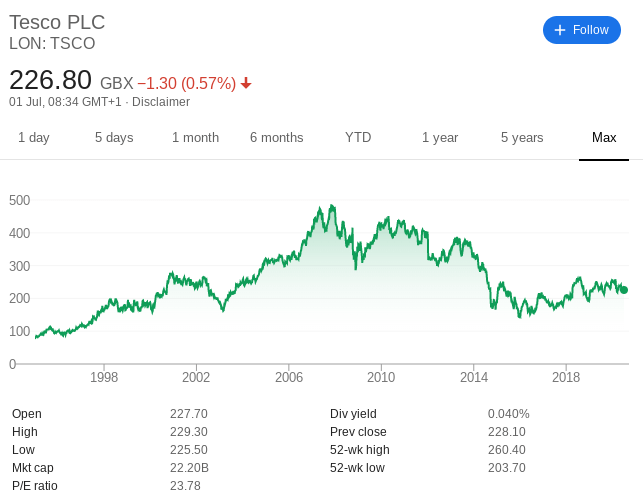

- You are holding 1,000 shares in Tesco

- The company announces that it plans to pay a dividend yield of 9p per share

- As you hold 1,000 shares, this means that you will receive £90 in dividend payments

- When the dividends are distributed, the £90 will be paid into your brokerage account

In terms of how much you should expect to receive, there really is no hard and fast answer to this question. This is because there are lots of variables to take into account. In theory, the better the company performs, the more you should expect to receive. However, this isn’t always the case – as the company might need to reinvest its profits into other ventures. In other cases, it might opt to initiate a buy-back scheme.

Investing vs Trading Dividend Stocks

As we briefly alluded to earlier, there is a distinct difference between ‘investing in stocks’ and ‘trading stocks’.

- If you invest in stocks, you own the underlying instrument. This means that (among other shareholder perks) you will be entitled to dividends

- If you trade stocks, you will be trading CFD instruments. This means that you will not own the underlying stocks and thus – have no right to any shareholder perks

The good news is that some CFD brokers have a dividend ‘adjustment’ policy in place. In simple terms, this means that those holding long positions on stock CFDs will be entitled to a dividend payment. This payment is deducted from traders that are short on the respective stock, meaning that your dividend payments are covered by other traders of your chosen CFD broker site!

Opting for the dividend stock CFD route comes with other benefits, such as:

- You can apply leverage to your positions – meaning that you can trade with more money than you have in your account. In the UK, this is typically capped at a ratio of 1:5.

- You can go both long (buy order) and short (sell order) on your chosen dividend stock CFD

- You will often benefit from tight spreads and zero-commission trades

With that being said, trading dividend stock CFDs won’t be for everyone. In fact, the process is arguably more suited for those of you with a bit of trading experience under your belt.

The Best Dividend Stocks in the UK

So now that you have a bit of background on how dividend stocks work, we are now going to discuss some of the best dividend stocks in the UK as of 2021. Of course, you are required to perform your own research. You are also advised to look beyond the dividend payment, as capital gains are equally (if not more) important.

After all, it is all good and well receiving a dividend yield of 10%, but if the company loses more than this in share value, you will not make money!

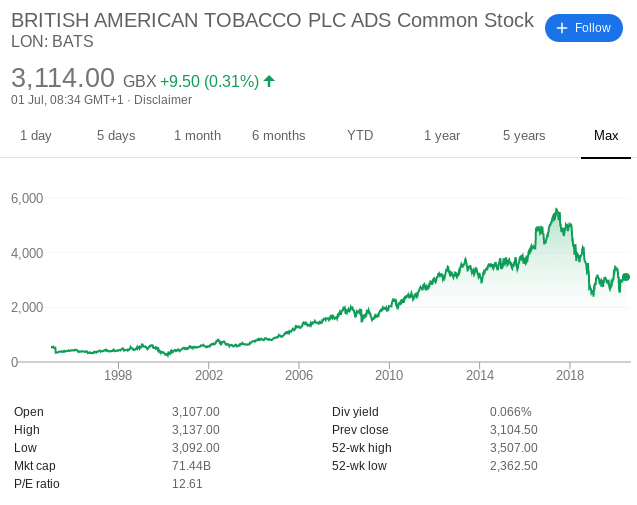

1. British American Tobacco – Recent Dividend Yield of 7.2%

British American Tobacco is one of the largest manufacturers of cigarettes globally. The firm, which is listed on the London Stock Exchange, recently paid an attractive dividend yield of 7.2%. British American Tobacco has a long-standing track record in paying dividends, with the size of its distribution increasing each year for two decades. This makes it one of the very best dividend paying stocks in the UK.

2. Tesco – 58% Increase on Most Recent Dividend

Tesco is the UK’s largest supermarket chain, with ventures into other sectors – both domestically and overseas. This includes everything from clothing, insurance, credit cards, and consumer banking. In terms of its dividend policy, the company’s most recent payment saw an increase of 58%. This takes the annualized yield of Tesco shares to just over 4%.

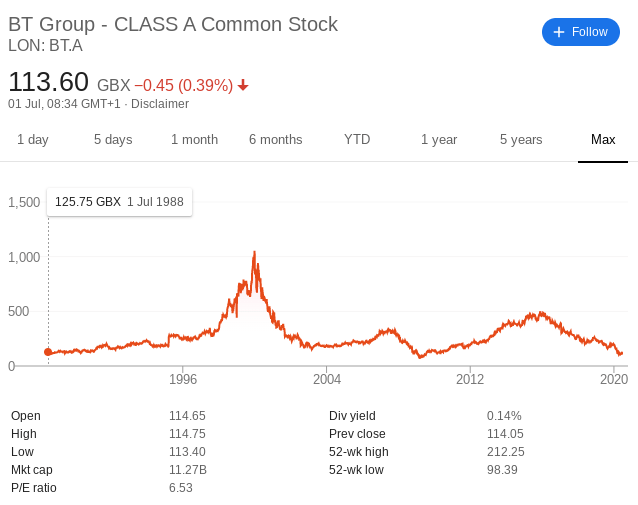

3. BT – Recent Dividend Yield of 9.5%

British Telecom (BT) is a UK leader in the telecommunications and TV media sectors, with a global presence that now spans 180 countries. This particular FTSE-100 stock rewarded shareholders with a juicy dividend yield of 9.5% in its most recent distribution. This makes BT shares one of the most generous dividend payers in the UK space. But, it does remain to be seen just how sustainable such a large yield is for the firm.

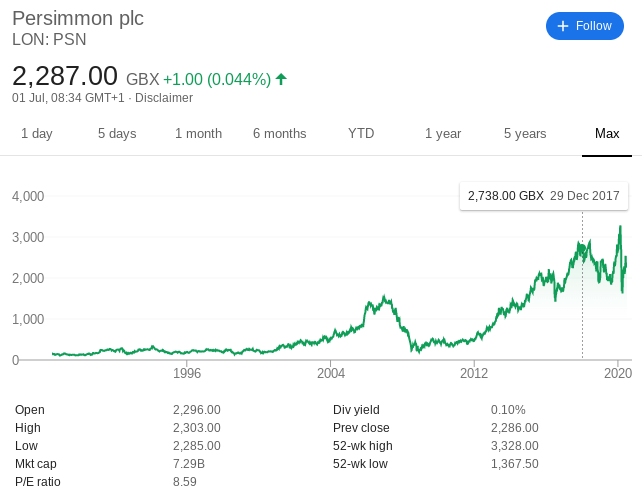

4. Persimmon – Recent Dividend Yield of 8.68%

Persimmon is a large UK-based homebuilder that was first formed in 1972. Its most recent dividend payment worked out to an annualized yield of 8.68%, which is huge and makes it on of the best UK dividend stocks for 2021. Take note, profits at Persimmon were down in its most recent earnings report, so this could have a negative impact on its future dividend payments.

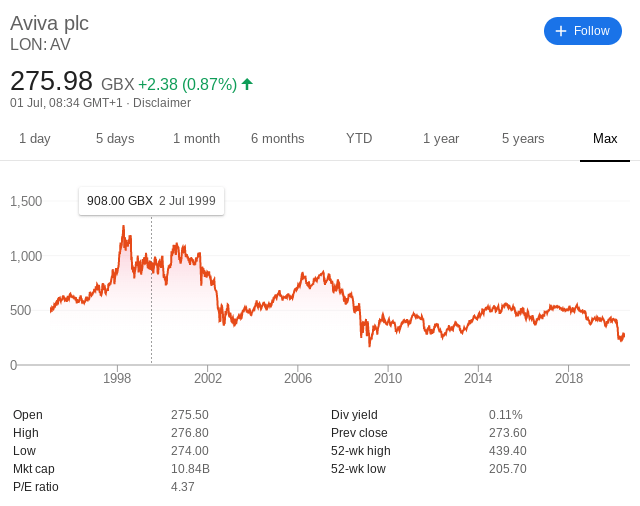

5. Aviva – Recent Dividend Yield of 9%

An additional high-yielding dividend stock that is worth considering is that of Aviva. The firm operates primarily in the UK and European insurance scene, and it also has a growing pension division. Although its stock price has been somewhat stagnant in recent years, Aviva does at the very least pay a juicy dividend. In its most recent distribution, this stood at a whopping yield of 9%.

How to Pick High Dividend Stocks

When it comes to picking high dividend stocks on a DIY basis, this can be a challenging task. After all, just because a UK company pays a high dividend in one quarter, this isn’t to say that it will continue to do so.

With this in mind, below you will find a few tips on how to pick high dividend stocks with ease.

Look at Historical Dividend Payments

Your first port of call should be to look at the company’s historical dividend policy. A prime example of this would be British America Tobacco. On the one hand, you might be somewhat sceptical about the sustainability of a 7.2% dividend yield.

But, in the case of BAT, the tobacco giant has increased its dividend payments every year for the past two decades. As a result, these are the sort of companies that you want to be targeting if you want to build a portfolio of the best dividend stocks.

Research at the Financials

On top of exploring the historical dividend policy of a company, you also need to look at the financials. In particular, spend some time looking at the relationship between the dividend yield and that of its share performance. For example, let’s suppose that you invest in a UK stock that pays an annualized dividend of 5%.

Although this is a healthy form of passive income, it defeats the object if the firm lost 10% in share value. On the flip side, you need to remember that stock investments should be viewed in the long run. In fact, the general rule of thumb is that you should avoid selling your shares for at least five years.

In doing so, you can ride out the volatile waves of market turbulence. Nevertheless, you should also look at the specific industry the dividend stock operates in. For example, if hold shares in an airline company, but the wider travel industry is suffering because of the COV-19 pandemic, the firm might be forced to suspend its dividend policy.

Consider a Dividend Stock ETF

When it’s all said and done, sometimes it is just easier to turn to an ETF. For those unaware, an exchange-traded fund (ETF) allows you to invest in a basket of dividend shares through a single trade. In other words, the ETF provider will actively buy and sell dividend stocks on your behalf.

This means that once you make an investment, the rest of the process is passive. This also means that you will not be required to spend heaps of time research dividend stocks on a DIY basis. Crucially, ETFs typically distribute your share of dividend payments every three months.

Conclusion

Dividend stocks allow you to grow your money in two forms – traditional capital gains and frequent dividends. While not all UK companies distribute dividends, many do. As such, seasoned investors will often allocate a proportion of their portfolio into dividend stocks.

But, it is important to remember that an investment should not be made just because the respective firm pays dividends. To find the best dividend stocks for your portfolio, you need to look at a range of other factors, such as whether the dividend payment is sustainable in the long run, and what the future growth of the company looks like in comparison to its sector counterparts.

References

To ensure we bring you the most reliable and accurate information possible, our writers use primary sources to support their content. These include studies, government resources and commentary from industry experts.

The European Securities and Markets Authority (ESMA). “Renewal of restrictions on CFDs, https://www.esma.europa.eu/press-news/esma-news/esma-renew-restrictions-cfds-further-three-months-1-may-2019“, Accessed July 1 2020.

Financial Conduct Authority (FCA). “Continuing obligations, https://www.handbook.fca.org.uk/handbook/LR/9/7A.pdf“, Accessed July 1 2020.

FAQs

What are the best dividend stocks?

One would assume that the best dividend stocks in the UK are those that pay the highest yield. Although the annualized yield is important, you also need to look closely at other metrics. For example, some companies will increase its dividend payments in response to a stagnating share price.

Do penny stocks pay dividends?

In most cases, penny stocks do not distribute dividends. The main reason for this is that penny stocks are typically new companies that are at the very start of their corporate journey, so they do not yet have the financial means to distribute profits.

Do CFD stocks pay dividends?

Yes, but this is ultimately at the discretion of your chosen broker. In most cases, CFD brokers will add the respective dividend payment to your cash account if you are long on the stock. But, if you are short-selling the respective firm, then the dividend payment will be deducted from your balance. In this sense, short-sellers cover dividend payments for those that have active long positions!

What is the average dividend payment in the UK?

Although the figure changes from quarter-to-quarter, the average UK dividend payments is in and around the 4% mark..

When will I receive my dividends?

Most firms pay dividends every three months, while others do this twice per year. Once the dividend is distributed by the company, it will be reflected in the brokerage account that is holding the shares.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up