Interactive Investor Review for 2021

Are you looking for more information about Interactive Investor?

Interactive Investor is one of the stock brokers that you can rely on. Established in 1995, it is an online investment and brokerage service provider. It is licensed and regulated by the Financial Conduct Authority (FCA) in the UK.

Below is our comprehensive analysis of Interactive Investor. We uncover everything there is to learn about this stock broker. By the end of it, you should be well-placed to decide whether or not it is suitable for your trading and investment needs.

-

-

Who owns Interactive Investor?

Interactive Investor offers a variety of tools for trading and investing, however, as it is only a trade execution stock broker, it does not offer investment advice and is thus ideal for DIY traders.

Interactive Investor offers a variety of tools for trading and investing, however, as it is only a trade execution stock broker, it does not offer investment advice and is thus ideal for DIY traders.The platform is majority-owned by funds advised by J.C. Flowers & Co, a leading private equity firm. Following its acquisition of Alliance Trust Savings in July 2019, it now has upwards of £30 billion in assets under its administration. This cements its position as the second-largest investment firm in the UK, after Hargreaves Lansdown.

Prior to this acquisition, it had purchased Moneywise, a finance magazine, from Reader’s Digest in 2004. And in 2008, it acquired Money Observer, an investment magazine, from Guardian Media Group. It also acquired a major rival, TD Direct in June 2017.

As a result of these acquisitions, it now has one of the most engaged investor communities in the world. Its client base currently consists of over 300,000 active customers as well as over a million registered users. Its headquarters are in Manchester with offices in London, Leeds and Dundee, having over 500 people in active employment.

Pros and Cons of using Interactive Investor

Pros:

- Competitive costs for large investors

- Great for share dealing

- Offers a wide range of investments

- Offers an account for expatriates and international investors

- Money management in up to 9 currencies

Cons:

- Due to the flat-fee pricing model, it might be costly for small investors

- Limited charting and analytics tools

- Limited educational resources for newbies

How Interactive Investor Works

Interactive Investor offers the tools, ideas, information and analysis that DIY traders need to make informed decisions. Though it is primarily a stock broker, it also provides a wide selection of funds. It has an excellent trading platform with access to numerous accounts, markets, currencies and trading instruments.

The service works using a unique subscription model with transparent plans. Starting June 2019, users pay a flat fee every month and in return, they get a pre-specified amount credited into their accounts. The flat fee and credit amount depend on the pricing plan. Using the monthly credit, the user can trade in any of the accessible accounts depending on the pricing plan they choose.

Another interesting aspect about the way it works is that you can have multiple accounts on its trading platform without having to pay extra. For instance, you can operate an ISA account, trading account and junior ISA under the same flat fee plan.

When you open an account here, you get access to a free research account. On the trading account, you can view all the relevant investment documentation under the Document History section. Other handy tabs include Transaction History, Research Account and the Interactive Investor Forum. The forum section is where traders can freely discuss their trading strategies.

In the past, the trading platform’s design was tailored to the needs of advanced traders, who have always been Interactive Investors’ key customers. But following a recent revamp, the trading platform now also gets the attention of less experienced users thanks to features such as Quick-Start Funds and Super 60 which are discussed in detail below.

Getting Started on Interactive Investor

Opening an account here is a fairly straightforward process. Before you get started, you need to determine the type of account that you want to open. Once you select the account type, enter your personal details, choose a service plan and submit to the verification process. The entire verification process takes place online and could take as little as 10 minutes.

However, if you have lived outside the UK, you may fail the online process as there is no option to provide a non-UK address. In that case, you will need to send your certified copies of proof of identity and proof of residence. These can be a passport or driver’s license for the former and a utility bill or bank statement for the latter. They should take 1 to 2 business days to process these. Once the verification process is over, you can start using your trading account.

Tradable Assets on Interactive Investor

Below is a list of assets you can trade on Interactive Investor.

- Stocks

- CFDs

- Currencies

- Retail bonds

- Investment trusts

- Gilts

- Bonds

- Unit trusts

- OEICs

Types of Accounts on Interactive Investor

Trading Account

On this dealing account, you get access to a vast array of investment options, including popular tradable assets and complex financial instruments.In order to keep your currency costs to a minimum, you can manage your cash in up to 9 currencies. Holding cash in the form of foreign currency eliminates the need for forex transactions and associated costs.

Company Account

Using this account, you can trade in the name of a limited company based in the UK and access similar benefits as those in a trading account.You may nominate up to four individuals to manage the account and place trades on behalf of the company.

Self-Invested Personal Pensions (SIPP) Account

This type of account is ideal if you want a tax-efficient way to invest with retirement in mind. Currently, all investments under such accounts qualify for up to £40,000 for tax relief per year or your entire annual income.The typical taxpayer qualifies for a 20% uplift on any investment. Thus, if you invest £5,000, the total invested in SIPP will be £6,000. For anyone who pays an additional or higher rate, you can get more tax relief on the annual tax return.

Junior Individual Savings Account (ISA) Account

Parents looking for a tax-efficient way to invest in their children’s future can do so under this account. Once a parent opens this account, anyone can make contributions.The minimum amount for starting the Junior ISA is £25 monthly or a £100 lump sum. Once the children get to the age of 18, proceeds from the accounts become the child; they may either convert it to an adult ISA or make a withdrawal.

Individual Savings Account (ISA) Account

Anyone operating this account qualifies for an investment of £20,000 tax-free during any tax year. You can invest this amount in a wide range of assets such as shares, investment trusts, funds and ETFs.The minimum amount required to start the account is £25 monthly or a £100 lump sum.

Expatriate and International Investment Account

This is one of the few services that allow expatriates to operate accounts from outside the UK. However, in order to be eligible, you need to be a resident of the UK, the Isle of Man or the Channel Islands.Pension Trading Account

Under this account, you can invest in assets that are not accessible on the SIPP account such as property. You could set up the account in association with an SSAS or SIPP that your preferred pension provider administers.Features of Interactive Investor

Trading Platform

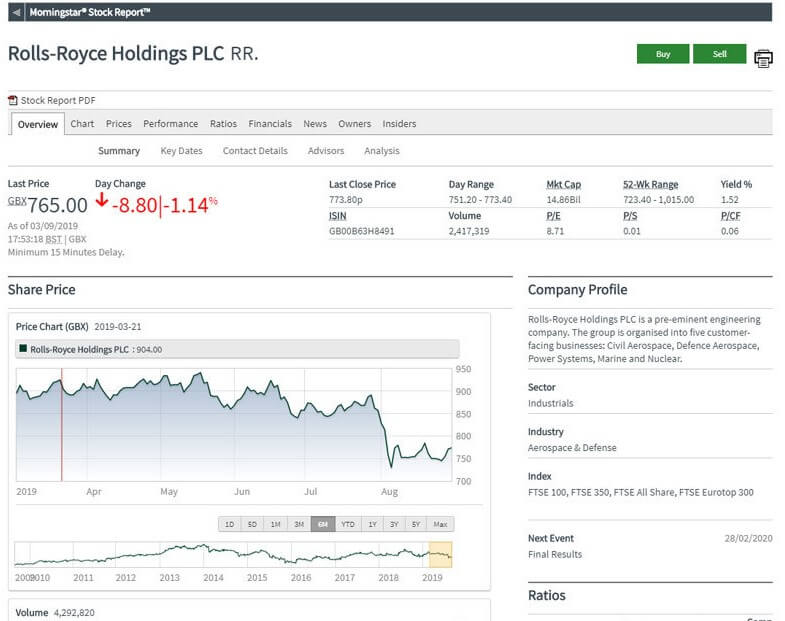

Interactive Investor does not have a standalone platform for trading. Rather, it makes use of a web trading platform that sports a sleek design and is incredibly easy to use. One of its highlights is the access to automated technical analysis from Trading Central (Recognia) it offers to all traders. Traders who value technical analysis like using Trading Central as it provides technical insights. It is also a great tool for the analysis of chart patterns to display potential trading signals for bullish and bearish market trends.However, charting features are limited as the charts come directly from Morningstar. Morningstar is known to offer extensive fundamental research but limited technical analysis. There are no drawing tools and only 10 indicators are available. Consequently, it could be ideal for casual investors, but seasoned experts may want more.

Another major limitation is that when it comes to spread betting, trading with CFDs and forex, you have to use partner apps. Customizability is also quite limited.

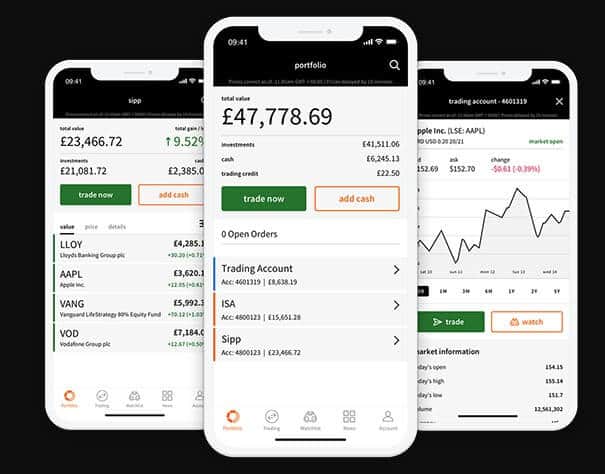

Mobile App

The mobile app which is accessible on Android and iOS offers tons of functionalities. To begin with, all the investment options that you can access on web app are also accessible on the mobile device app for trading. You can also view order status as well as open new orders and cancel existing ones.

On the app, it is possible to view account summaries and add funds as well as get access to the newsfeed, watchlists and market overview. For security purposes, it makes use of touch and face ID during login.

Virtual Portfolio Service

Under the research section, you can create a virtual portfolio, complete with watchlists. Here, you can track a portfolio of any tradable assets and even make notes. The best part about this feature is that it helps you get a thorough understanding of risk and reward before you actually invest.

Investment Offerings

- Super 60 Rated Investments

Wondering how to decide what to invest in? The Super 60 is a wide array of 60 passive and active funds, ETFs and investment trusts covering a wide range of regions. All the assets under this program have a good track record and there is plenty of information on each one. In case you cannot decide which one to go for, you can choose on the basis of your risk appetite.

- Quick-Start Funds

Interactive Investor has created a set of three pre-made Vanguard funds, categorized on the basis of risk appetite. These are ready-made investment options, ideal to get you started. They cost between 0.26% and 0.28%. Consequently, they provide the ideal opportunity for one to get exposure to a wide range of expert-recommended low-cost assets.

- International Trading

Traders can access up to 17 international exchanges including some in Europe, Asia and North America.

- Ethical Investments

There are 140 ethical investments on this site, specifically meant to help users invest in assets that are socially responsible. Each of these bears a label that denotes its ethical focus.

Discussion Boards

As the name suggests, these are discussion forums where investors and traders can exchange insights and strategies.

On this forum, you can join discussions on a wide range of topics that are of interest to you. It is also possible to follow other users and have private conversations on private boards. To get started, simply set a nickname on the ‘My Profile’ screen and pick a conversation to join. You can also start one yourself.

Model Portfolios

In the past, Interactive Investor offered 12 model portfolios from the editorial team of the Money Observer. Currently, the list is down to 4 model portfolios which include:

- Low-Cost Growth

- Low-Cost Income

- Active Income

- Active Growth

The names explain accurately what each portfolio aims to accomplish. Each of these packages includes a blend of passive funds and actively managed ones. They also offer investment funds, trusts and ETFs. You can take a look at these portfolios and their contents even without registering an account.

Interactive Investor Fees

The service makes use of a flat-fee model for pricing; costs for various services differ depending on the plan you choose. Take a look:

Investor Plan – £9.99 monthly fee

Investment Cost Regular investment Free UK shares and ETFs £7.99 US shares £7.99 Other international shares £19.99 Funds and investment trusts £7.99 Dividend reinvestment £0.99 Free monthly trades 1 free trade Funds Fan Plan – £13.99 monthly fee

Investment Cost Regular Investment Free UK shares and ETFs £7.99 US shares £7.99 Other international shares £19.99 Funds and investment trusts £3.99 Dividend reinvestment £0.99 Free monthly trades 2 fund trades Super Investor Plan – £19.99 monthly fee

Investment Cost Regular investment Free UK shares and ETFs £3.99 US shares £4.99 Other international shares £9.99 Funds and investment trusts £3.99 Dividend reinvestment £0.99 Free monthly trades 2 ETF/ UK/ fund trades Account inactivity fee – £0

Notably, you can get one or two free trades every month, which to a great extent negates the price for using the plan. The more you trade, the higher the value you get from each plan. For those who trade three times or more per month, the Super Investor plan offers the best value.

Deposits, Withdrawals and Supported Payment Methods

As mentioned before, there are 9 base currencies to pick from on the site. These include:

- EUR

- GBP

- USD

- AUD

- CAD

- SGD

- CHF

- SEK

- HKD

Users in Ireland cannot access SEK and CHF. If you are planning on using multiple currencies to save on conversion fees, consider opening a multi-currency account at a digital bank.

Making deposits is free of charge and you can use a debit/credit card or bank transfer. When using a debit card, you can transfer a maximum of £99,999. If you wish to make a deposit in a currency other than EUR or GBP, be sure to notify Interactive Investor. Its customer support team will give you bank details for where the deposit should go.

Note that while debit/credit card transactions are instant, bank transfers could take a number of days.

Withdrawals are also free, provided your request is for EUR or GBP and it is not urgent. But the only payment option here is via bank transfer. If you want an instant bank transfer into your account, you will need to pay for the convenience. For an amount up to £100,000, the fee is £15, and for amounts above this, the fee is £25.

Withdrawals in CAD and USD are accessible online but for all other non-GBP and EUR currencies, you have to make the request on phone.

Withdrawal will take 1 day to reflect in your account if you make the request before 2pm. Otherwise, it will take 2 business days.

Research and Education

When it comes to research, Interactive Investor has room for improvement.

The fundamental research tools, drawn directly from Morningstar, are splendid to say the least. The majority of assets have institutional-grade reports in PDF format. Furthermore, there are plenty of articles and a podcast. The articles look into individual funds and shares, examining how various events are likely to affect the market. On the other hand, podcast content varies and provides updates on different financial subjects.

Another great research feature is the Quickrank Tool that offers comprehensive screening capabilities for various assets. These include ETFs, funds, shares and investment trusts. There is also another screener designed purely for stocks. It filters them by data such as dividend yield and market capitalization.

Miscellaneous tools include market news, heat maps, fallers and risers and many more. Overall, the research tools are top-notch.

The education resources, on the other hand, are quite limited, especially in comparison to other high-ranking brokerage sites. For new users, there are some articles that aim to provide training on buying and selling of shares. On the News Hub, a handful of articles focus on retirement education. There is also no material about how to trade and what various asset classes are on offer.

How Safe is Interactive Investor?

Based on its long and scandal-free track record, it is safe to assume that Interactive Investor is relatively secure. The company which owns its majority of shares, J.C. Flowers & Co, is an equity firm that is a well-established player in the financial industry and a highly reputable entity.

Furthermore, the brokerage firm has a number of worthwhile safety measures in place to protect its users. Interactive Investor operates under the Financial Services Compensation Scheme (FSCS). The program protects investor assets up to a maximum of £85,000 per individual. The company pools together all cash deposits and deposits them with various financial institutions. If any of these institutions fail, every investor gets a maximum of £85,000 per institution.

The service also functions under the regulatory authority of the FCA, which is a top-tier regulator in the UK.

On the trading platform, when you log in to your account using a new device, you have to go through two-step authentication. It will ask you to provide the last four digits of your phone number and then send a code to this number via text.

The only downside is that its financial information is not publicly available. But based on the above features, there is no doubt concerning its security.

Customer Support

You can access the customer support team using two main methods:

- Phone – 0345 607 6001 (from the UK) or +44 113 346 2309 (from abroad)

- Email – [email protected]

There is no live chat feature on the site. Fortunately, it has a record for fast responses on both phone and email. The customer support team is courteous and highly knowledgeable. However, you can only reach them during work hours, between 07:45 and 17:30 GMT.

Interactive Investor Review – The Verdict

Interactive Investor has a compelling set of services and features and a reputable name in the market. It has been around long enough to figure out what the customer wants and it seeks to reflect this in its investment offerings. It also has plenty of research-related tools and resources to help guide both investors and traders on their respective journeys.

While in the past it specifically targeted expert traders, it has now attempted to balance out the service to appeal both to pros and newbies. The major areas in which it falls short include its limited analytics and charting capabilities.

All in all, it is a superb stock broker with a lot more advantages than downsides; so it’s one of our recommended stock brokers.

FAQs

Who is the owner of Interactive Investor?

The majority owner is a private equity firm known as J.C. Flowers & Co.

What would happen if the company collapsed?

Interactive Investor offers an investor protection program under which every user qualifies for a compensation maximum of £85,000.

Can I trade on the go on Interactive Investor?

Yes, you can use the mobile app, which is available for both iOS and Android devices, to trade on the go and manage your account.

Will I need to pay taxes on the profits I make from investments made on Interactive Investor?

To a great extent, this will depend on the type of account you operate. On the investment ISA account, you can invest a maximum of £20,000 tax-free. On the pension account, the tax benefits will depend on your personal tax rate.

How can I contact the customer support team?

You may do so by emailing [email protected] or calling 0345 607 6001.

Haydn Squibb

Haydn Squibb

A journalist, with experience writing across the UK financial and professional service sector. Haydn holds a degree in Media Writing and enjoys covering about a wide range of topics from financial markets and current affairs to home, health and lifestyle. Haydn's work has been published on a number of top tier websites.View all posts by Haydn SquibbLatest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up