Barclays Share Dealing Review

Barclays – the UK high street bank, allows you to easily buy and sell shares through its Smart Investor platform. Its online share dealing service is tailored to the average investor with little to no experience. Fees are somewhat competitive if trading low volumes and the process of investing is as simple as it gets.

In this article, we review the ins and outs of the Barclays Smart Investor platform. We cover everything you need to know before opening an account – such as fees, commissions, tradable shares, payment methods, and more.

-

-

eToro - Invest in shares with 0% commission

Our Rating

- 0% commission on stocks

- No markup, ticketing fees, management fees

- Fractional shares available

- Easy to use platform

75% of investors lose money when trading CFDs.

75% of investors lose money when trading CFDs.What is Barclays Share Dealing?

Branded as the Smart Investor platform, Barclays Bank allows you to easily invest in traditional stocks and shares from the comfort of your home. The platform is tailored to the newbie investor – meaning you that don’t need to have any experience to get started.

Branded as the Smart Investor platform, Barclays Bank allows you to easily invest in traditional stocks and shares from the comfort of your home. The platform is tailored to the newbie investor – meaning you that don’t need to have any experience to get started.Instead, you simply need to open an account, deposit some funds, and choose which companies you wish to invest in. If you don’t quite know which shares to buy, Barclays Smart Investor offers some ready-made portfolios. Each portfolio is based on a preferred risk level, so they are suitable for investors of all shapes and sizes.

You will also have access to investment funds and ETFs, which is ideal if you want to gain exposure to hundreds of assets through a single trade. The Barclays Smart Investor platform is also renowned for its top-notch research and education materials. This includes frequently updates market analysis and handy guides for those of you that want to improve your share dealing knowledge.

On the flip side, the Barclays share dealing platform might not be suitable for those of you seeking a more advanced trading arena. Not only can the fees begin to creep for high volume investments, but the availability of in-depth chart reading tools and technical indicators is also somewhat lacking. With this in mind, Barclays is primarily marketed as a long-term share dealing platform and not a day trading site.

Pros and Cons of Barclays Share Dealing

Pros:

- Perfect if you’re a newbie investor with little experience

- Gain access to heaps of stocks and shares

- The platform also supports funds and ETFs

- Choose from a set of pre-packaged share portfolios

- Fees are competitive for low volume traders

- Heavily regulated and trusted UK institution

- Great research and educational materials

Cons:

- Too basic for those looking to trade assets

- No international investments – UK only

- Fees on the high side if you plan to trade frequently

What can you Trade at Barclays Smart Investor?

Barclays offers a number of asset classes on top of its proprietary share dealing service. It also gives you the option of choosing your own investments, picking a pre-packaged portfolio, or simply investing in a fund or ETF.

Let’s break down your options in more detail.

Share Dealing

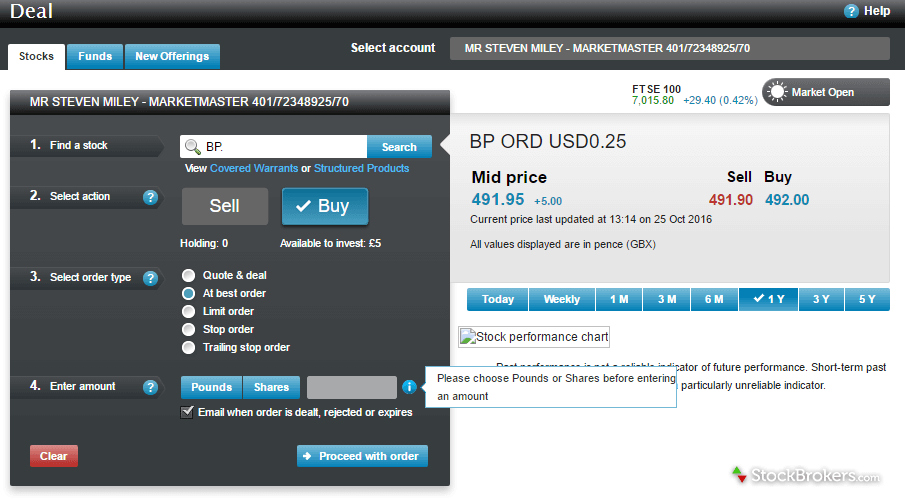

If you’re simply looking to find an online share dealing platform to buy UK stocks – Barclays is well worth considering. You will have access to most companies that are listed on the London Stock Exchange, meaning you’ll be able to invest in firms like BP, Royal Dutch Shell, British American Tobacco, Aviva, and Easyjet.

What you won’t have access to is international stock markets like the NYSE or NASDAQ. Well, not unless you want to open an account with Saxo Bank. If you do, this is an external service where Barclays itself notes will result in a commission for the bank! As such, the Barclays share dealing service is only suitable if you are happy investing primarily in UK stocks.

Take note, the share dealing platform at Barclays operates on a DIY (Do-It-Yourself) basis. This means that you will be responsible for choosing which companies to buy and sell. If you don’t like the sound of taking full control of your investment decisions, you might best off opting for a pre-made portfolio.

Pre-Made Portfolios

The Barclays Smart Investor platform offers five pre-made portfolios for you to choose from. Each portfolio contains a selection of companies from a range of different industries. For example, your basket is likely to consist of stocks from the financial, retail, construction, real estate, and IT sectors. This ensures that you are heavily diversified, and not overly reliant on a single company.

Each of the five portfolios is based on your appetite for risk. For example, if you want to take a super-conservative approach to investing, then the portfolio will consist of strong, stable, and highly established companies. At the other end of the spectrum, a higher-risk portfolio will contain companies that yet to fully established themselves. While the upside potential is obviously much higher, as are the risks.

ETFs and Funds

Barclays also gives you access to a range of ETFs and funds. Regarding the former, this is a great option if you want to invest in a group of assets through a single trade. And the latter – funds are suited for those of you that wish to have your money managed on your behalf.

Bonds and Gilts

You will also have access to traditional bonds. This includes bonds from the UK corporate sector, as well as UK government gilts. All of your coupon payments will be paid directly into your Barclays share dealing account.

No CFDs or Spread Betting

Barclays does not offer any CFD or spread betting services – so you won’t be able to engage in day trading at the platform. Similarly, this also means that leverage and short-selling opportunities are not available.

Payments at Barclays

When it comes to funding your Barclays share dealing account, you can do this with a debit card or external bank account. If you already have an account at Barclays Bank, you can simply initiate a transfer. Barclays also allows you to set up a monthly direct debit. This is a great option if you plan to invest a bit at the end of each month. If you have investments held at another broker, you can transfer the securities over to Barclays.

Account Types at Barclays

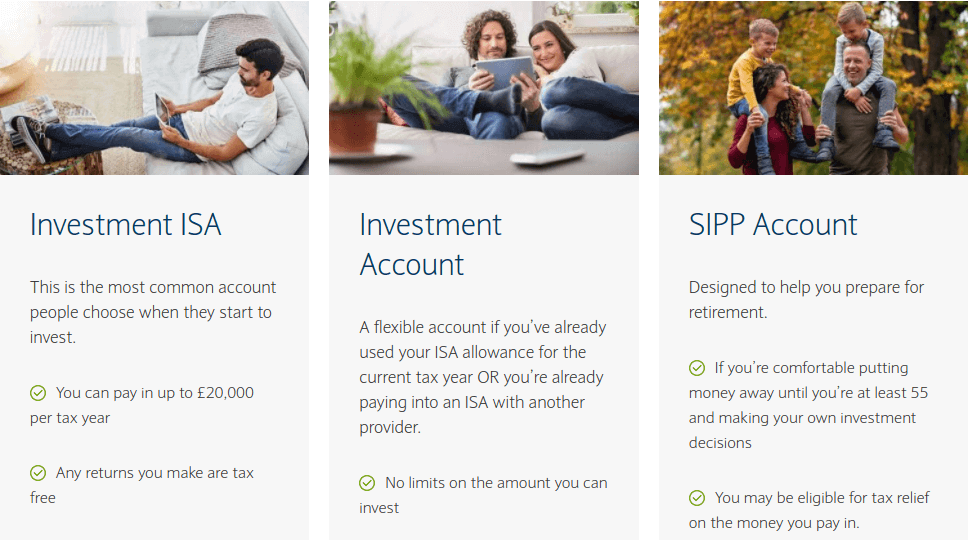

When you go through the registration process, Barclays will ask you which account type you wish to open. This includes:

Investment ISA

If you’re based in the UK and you are yet to utilize your annual ISA allowance, this is the best account type for you. In a nutshell, you will be able to buy, hold, sell your investments at Barclays in a tax-efficient manner. In fact, the first £20,000 that you invest in the 2020/21 tax year will be exempt from capital gains tax.

Investment Account

If you already have a stocks and share ISA elsewhere – and you’re not willing to transfer it over to Barclays, then you will need to open a standard investment account. There are no limits to the amount you can invest, and you choose from all of the asset classes that we discussed in the section above.

SIPP Account

A Self-Invested Personal Pension (SIPP) account is suited to those of you that are looking to save your retirement. This comes with a range of tax benefits and reliefs that are not available in the other account types. With that being said, you will not be able to touch your investment funds until you turn 55, so you need to be really sure that you are happy to lock the money away.

Fees and Share Dealing Charges at Barclays

You will need to pay a fee when you buy and sell assets at Barclays. The exact fee will depend on the type of asset you are investing in, so we’ve broken down the fundamentals below.

Customer Fees

Barclays charges a customer fee, which is an annual maintenance fee in all but name. The amount you will pay will depend on how much you have invested at the platform.

- Up to £24,000: If your investment portfolio is worth less than £24,000, you will pay a customer fee of 0.2% per year.

- £24,000-£48,000: If your investment portfolio sits between £24,000 and £48,000, you will pay a customer fee of 0.1% per year.

- Over £48,000: If you are looking to invest more than £48,000 at Barclays, you will simply need to pay a flat fee of £1 per trade – and no customer fee.

Take note, the minimum customer fee that you will pay is £48. In other words, an investment of less than £24,000 will attract a minimum fee of £38.

Dealing Charges

The dealing charges at Barclays come in to force every time you buy and sell an asset. This stands at £3 per trade if you invest less than £24,000 per year. For example, you will pay £3 when you buy 100 shares of BT, and then £3 again when you sell them.

If you have more than £24,000 invested at Barclays, the share dealing charge actually increases to £6 per trade. So, you’ll pay £6 when you buy shares and £6 when you sell them.

Example Costs

Combining an annual customer charge and flat dealing charge can be confusing at first glance, so let’s look at a couple of example of how much investments cost at Barclays.

- Let’s say that you buy £10,000 across six different companies. The buying process will cost you £18 (£3 x 6), and then £18 again when you sell the shares. Over the course of year, you’ll also need to pay the minimum customer fee of £48. All in all, your share dealing charges amount to £84.

- In another example, let’s say that you invest £48,000 into a single company. You pay £6 when you buy the shares and then £6 against when you sell them. Over the course of the year, you’ll pay an annual fee of £48. All in all, you pay £60.

Ultimately, the costs of buying and selling shares at Barclays are very good if you plan to buy and hold. On the flip side, if you’re looking to place heaps of trades throughout the month, the fees will end up costing too much.

Which Regulators Govern Barclays?

When it comes to the safety of your investments, the Barclays share dealing platform is as safe as it gets. As a UK based financial institution, Barclays is regulated by the Financial Conduct Authority (FCA). This means that the platform is required to keep client funds separate from its own working capital. This also means that each and every customer that uses the platform must provide some identification documents – such as a passport and proof of address.

If you already hold an account at Barclays, this won’t be necessarily as you will have already had your identity validated. The Barclays share dealing platform is also covered by the Financial Services Compensation Scheme (FSCS). For those unaware, this means that your investments are protected upto the first £85,000 in the event Barclays went bust. The FSCS protection will not cover you in the event you lose money through your trading endeavours.

Getting Started with Barclays Smart Investor

If you like the sound of what Barclays offers and you’re keen to get started with an account today, we are now going to show you the steps required.

Step 1: Choose Your Account Type

To get the ball rolling, head over to the Barclays Smart Investor website and choose which account type you wish to open. To clarify, this is a choice between a:

- Regular Investment Account

- ISA Investment Account

- SIPP Investment Account

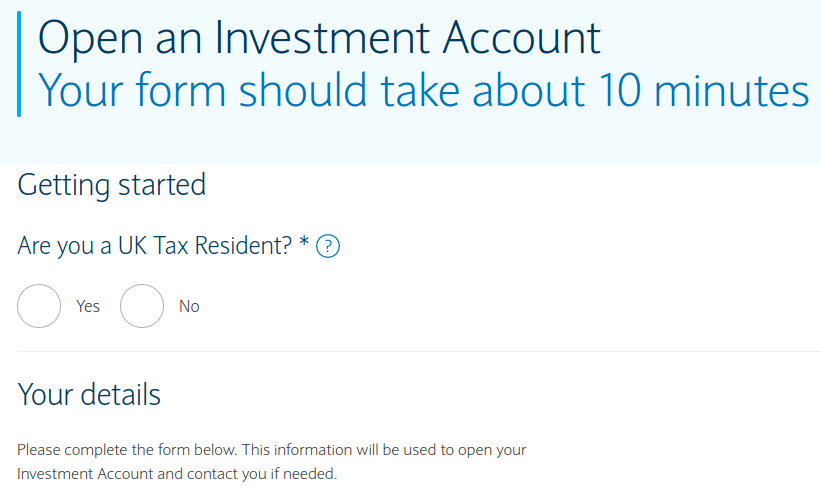

Step 2: Apply for an Account

If you already have a Barclays online bank account, you don’t need to go through the application process. Instead, simply login to your account and look out for the Barclays Smart Investor button. For everyone else, you will need to open an account as you normally would with an online brokerage site.

As such, Barclays will need to collect a range of personal information from you. This includes:

- First and Last Name

- Home Address

- Nationality

- Date of Birth

- National Insurance Number

- Email Address

- Mobile Number

Step 3: Verify Your Identity

Barclays will now run a credit check on you to verify the personal information that you provided. They will then ask for a couple of documents from you to ensure that the platform remains compliant with the FCA. This includes a clear copy of your passport, and a proof of residency. Regarding the latter, this can be a bank account statement or utility bill that was issued within the last three months.

Step 4: Deposit Funds

You will now need to fund your Barclays share dealing account. You can either invest a lump sum upfront, or sign up to a monthly direct debit. If you opting for the former, you can fund your account with a UK debit card or external bank account. You will also be given the option of transferring your investments over to Barclays from your current stock broker.

Step 5: Choose Your Investments

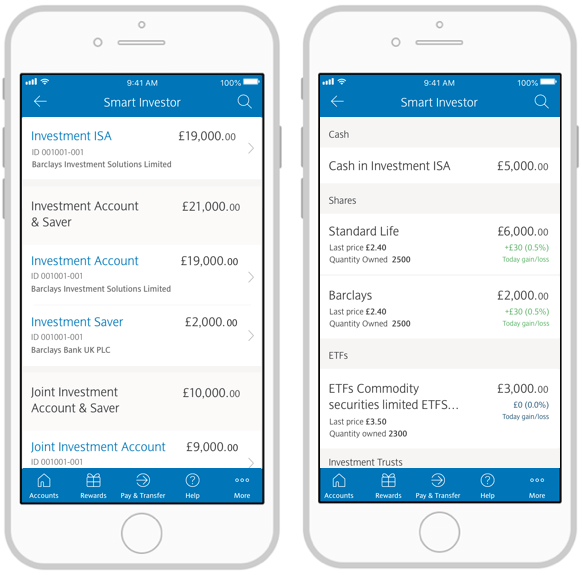

Once your account is funded, you will have full access to the Barclays Smart Investor platform. You will have a range of asset classes to choose from – such as traditional stocks and shares, ETFs, and funds. You can also invest money into a pre-made portfolio. If you have a specific investment in mind, utilize the search box.

Once you have made an investment, the funds will be debited from your available account balance. If the shares you buy pay dividends, this will be paid directly into your Barclays share dealing account as and when they are distributed. You can offload your investments at any time from with your account dashboard.

Platform Features

So now that we have covered the fundamentals, we need to take a close look at the main features offered by Barclays.

Web Trading Platforms

Everything at the Barclays share dealing platform is initiated via the main desktop website. This makes it super-convenient to buy and sell assets from the comfort of your home. In fact, the trading platform itself is super user-friendly, so you should have no issues finding and placing investments.

On the flip side, it is a bit annoying that you are constantly asked to log back into your account when you visit other tabs. While we understand that security is important, this isn’t something required at other platforms.

We should also note that although Barclays offer a mobile app for its share dealing platform, this is only available to shoe with a current account. Similarly, the app only allows you to view your portfolio balance anyway, and not place trades.This is a major pitfall, as you will need to access the platform via your standard mobile web browser if you wish to do this.

ISA and SIPP Accounts

Barclays is a good option if you are looking to invest in a tax-efficient manner. The platform is compatible with both ISA and SIPP accounts without any additional charges.

Chart Reading

Although Barclays does offer a small number of chart reading tools, you need to do this via the research page. As such, you can’t perform technical analysis via the trading screen. Similarly, the tools offered by the platform are likely to be too basic for seasoned investors.

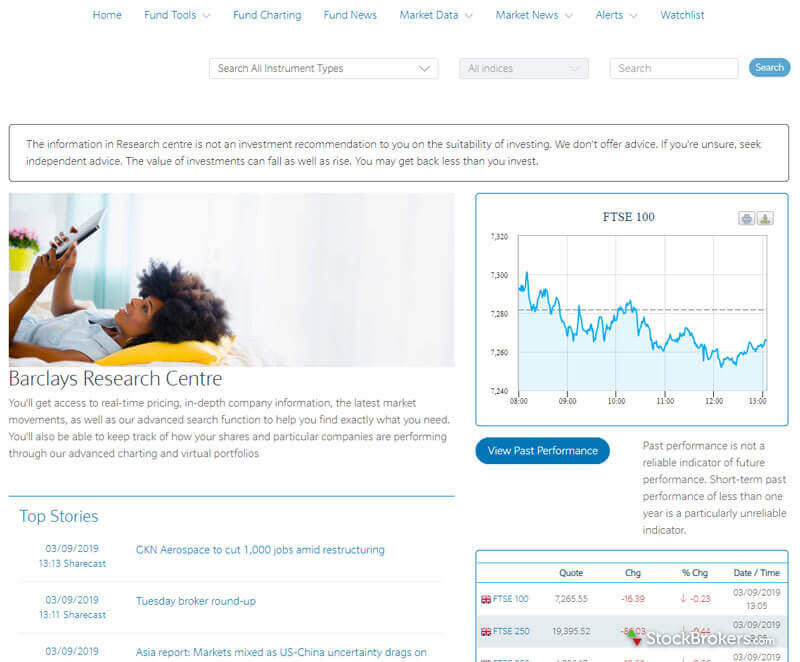

Research

While the platform lacks in the technical analysis and chart reading department, Barclays does excel in the fundamentals. In fact, it arguably has one of the most in-depth and valuable research departments in the UK share dealing space.

At the forefront of this is detailed publications on major companies, and whether or not they represent a good investment. Each publication comes with a buy/sell/hold rating, alongside fact sheets and industry data. Barclays Smart Investor also gives you access to market news and developments, which is great for keeping tabs on your chosen investments.

Education

The Barclays share dealing platform contains heaps of educational materials that would be very useful to the newbie investor. Not only does this include easy-to-understand articles but a number of handy videos, too.

IPOs

Barclays is one oft he few user-friendly share dealing platforms in the market that gives you access to IPOs (Initial Public Offering). For those unaware, an IPO is the fundraising process involved when a company goes from private to public. Ordinarily, IPOs are only accessible to the institutional space, meaning that the everyday investor misses out. But, by registering your interest when a new IPO is on the horizon, you stand the chance of getting a look in.

Customer Support

The Barclays share dealing customer support team works Monday to Thursday between 7.30 am and 7 pm, and on Friday between 7.30 am and 6 pm. Support is not available over weekends or public holidays. You have the choice from calling the team directly, or via a live chat facility.

Conclusion

Whether or not the Barclays share dealing platform is suitable for you will depend on your long-term investing goals. If you are simply looking to buy shares and hold on to them for a number of years, Barclays is ideal. This is because you will pay a flat dealing charge of £3 per trade (when investing less than £24,000) and an annual commission of 0.2%. This is actually very competitive.

On the flip side, the platform won’t be suitable if you are looking to trade regularly. This is because the flat-fee system will start to eat away at your profits. The platform is also unlikely to suffice if you are looking for more sophisticated trading tools. Whether its CFDs, margin trading, international stocks, or short-selling – Barclays won’t be able to help.

eToro - Invest in shares with 0% commission

Our Rating

- 0% commission on stocks

- No markup, ticketing fees, management fees

- Fractional shares available

- Easy to use platform

75% of investors lose money when trading CFDs.

75% of investors lose money when trading CFDs.FAQs

How much does it cost to trade at Barclays?

You will need to pay two separate fees at the Barclays share dealing platform. The first is an annual ‘customer charge’, which starts at 0.2% per year. If trading more than £24,000 – this goes down to 0.1%. The minimum annual charge is £48. The second fee is a flat trading charge. This works out at £3 per trade (both buy and sell orders) if your balance is less than £24,000. If it’s more than this you will pay £6 per trade.

Is the Barclays shares trading platform regulated?

Yes, the platform is regulated by the Financial Conduct Authority (FCA) and patterned with the FSCS. This means that were the platform to go bust, the first £85,000 would be protected.

Do I need to upload ID to trade at Barclays?

Unless you already have an account with Barclays, you will need to upload a copy of your passport.

What payment methods can I use at Barclays?

You can find your Barclays share dealing account with a debit card or external UK bank account. You can also set up a direct debit, which is great for investing a little bit at the end of each month.

Does Barclays offer international shares?

No, the Barclays share dealing platform only lists UK stocks. The platform has partnered with SAXO bank for non-UK stocks, but you will still need to join the broker so it kind of defeats the object!

See Our Full List of Brokers Reviews

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenLatest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up