FBS Review 2021 – Is this the Right Forex Broker for You?

FBS is a global broker operating in over 150 countries with an ever-growing customer base of over 17 million. The exponential growth of FBS has attracted the interest of investors who are curious to learn about the unique offerings on the platform.

This FBS review guide discusses everything you need to know to make trading on the platform easy.

What is FBS?

FBS is an international forex and contract for difference (CFD) broker.

It was founded in 2009 in Belize and had operational headquarters in Cyrus, with offices spread through Europe, Asia, and South Africa.

FBS is one of the most user-friendly platforms in the industry, offering traders a multitude of easy-to-use trading experiences. Also, traders can choose their preferred trading platform from the duo of MetaTrader 4 or MetaTrader (MT4/5).

It also provides a Web Trader, in addition to supporting mobile trading through the FBS Trader App. Like other brokers we’ve reviewed including the UFX review and the NordFX, the FBS platform features rich and advanced trading and charting tools alongside real-time market data and price movements.

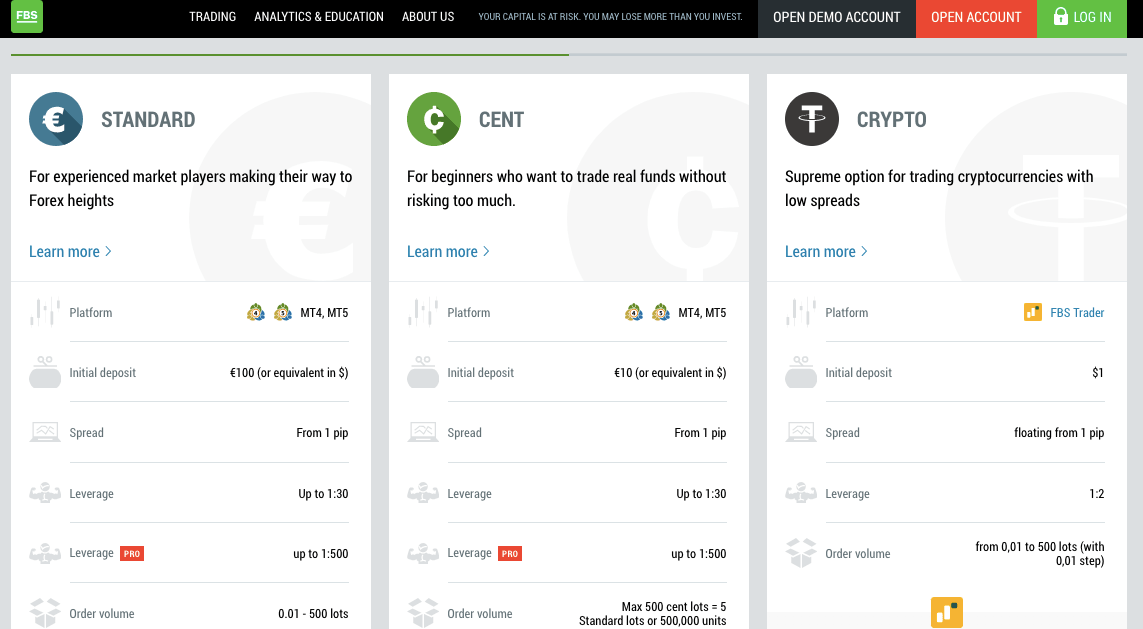

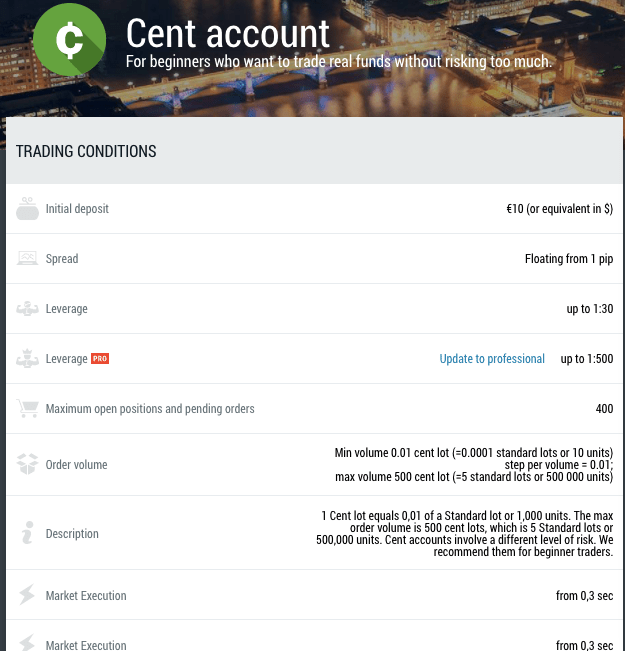

Another stand out feature of FBS is that it has the options for the use of various accounts. Traders can choose between Cent, Micro, Standard, Zero Spread, and ECN accounts.

Each account comes with a separate minimum deposit, requiring traders to meet the deposit bar of $1, $5, $100, $500, and $1000, depending on their preferred account choice. Deposits can be done with a bank wire transfer, credit/debit cards, Skrill, Neteller, SticPay, Perfect Money, and BitWallet.

Millions of investors use the broker’s flexible platform to trade major FX currency pairs, stocks, commodities, indices, cryptocurrencies, and CFDs. The global broker also has a CopyTrade functionality which allows users to replicate successful trades of more experienced traders.

The firm doesn’t charge newbie traders any trading fees for their first three trades using the CopyTrade feature. The traders will keep their returns if they turn in a profit while using CopyTrading. If their copied trades result in a loss, FBS will return them to their initial deposit amount.

Like most CFD brokers, FBS offers a demo account for users to test-run and learn with virtual money.

The firm runs a tutorial and webinar series for new and experienced traders; during these sessions, users are introduced to the latest trends in the market and are given relevant trading materials.

The fee structure on FBS is fixed because of the multiple account types the broker offers. For the EUR/USD FX pair, FBS charges a 3.0 pip spread on Micro account, 1.1 for Standard, Cent, no pips for Zero spread and ECN accounts.

However, it charges a flat commission of $20 per lot on the Zero Spread account and $6 for ECN accounts.

Stock trading fees are pegged at $3 and $25 for CFD trades. Commissions for entering and exiting the market will see you charged 0.05%.

Regarding leverage, FBS also operates a flexible framework based on a user’s account type. Users on the Cent account can get maximum leverage of 1:1000; those on ECN get 1:500, while all other account types are entitled to 1:3000.

The broker also offers negative balance protection for all account types and has a margin call of 40%, in which a trader’s position will be closed automatically.

In Europe, the best forex brokers are regulated by top-tier authorities, and FBS is no exception.

The forex broker operates under the trademark of Tradestone Ltd while it is still under the umbrella of the global FBS Markets Inc.

FBS has operational licenses from the Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investment Commission (ASIC), International Financial Services Commission (IFSC) of Belize, and the Financial Sector Conduct Authority (FSCA) of South Africa.

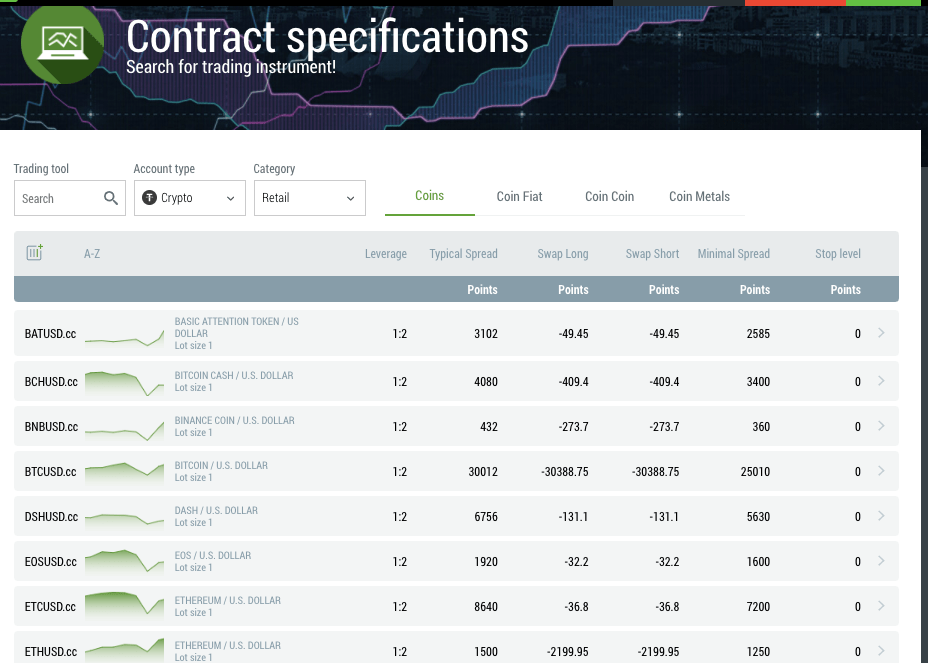

Supported Cryptocurrencies

FBS offers cryptocurrency trading for investors who may be interested in the crypto industry. Investors can use the FBS Trader app to trade the digital assets directly or against 35 other pairs with crypto-to-crypto or crypto-to-fiat trades supported.

However, FBS supports a small number of virtual currencies such as Bitcoin, Ethereum, Litecoin, XRP, and Bitcoin Cash. If you are on the lookout for a more dynamic crypto offering, you will need to look at other brokers or exchanges like eToro, Coinbase or Binance.

FBS Fees

The section below gives a breakdown of the fee structure of the FBS stockbroker.

Trading Fees

The FBS trading fees are heavy as users have to pay for almost every activity on the platform. For starters, FBS charges a brokerage fee of 0.05% for entering and exiting a position. Depending on your account type, you will pay $20 or $6 for each trade. In addition, FBS charges $3 for trading stocks and $25 for every CFD trade.

Overnight And Cancellation Fees

FBS charges overnight fees if you hold your position beyond the expected timeframe. This charge will see you pay €5 overnight and a cancellation fee if your transaction is leveraged on price latency during the period of trading.

Inactivity Fees

FBS has an inactivity window of 180 days, after which you will be charged €5 per month till you reactivate your trading account.

Deposit/Withdrawal Fees

Deposit and withdrawal fee charges depend on the payment system a user prefers. SticPay deposit option attracts a 2.5% and $0.3 commission, while other payment methods also come with requisite fees and commissions.

Withdrawal requests on FBS are processed depending on the withdrawal option picked by the user. Using a credit card or debit card from Visa will take up to 20 minutes with a maximum of 2 days while going the banking route will take up to 5-7 days.

The breakdown of charges on withdrawals are as follows:

- Visa (Credit/debit card) – $1 commission

- Neteller – 2%, minimum $1, max comes with a $30 commission

- SticPay – 2.5% plus $0.3 commission

- Skrill – 1% plus $0.32 commission

- Perfect Money – 0, 50% commission

FBS Mobile App

Like several trading platforms, FBS offers mobile trading support through the FBS Trader App for those on the move. There were no marked differences between the app and the web version when we went through the app. We discovered that users can still access the same level of information and tools as the web trading software.

User reviews have also been positive towards the app. On the Google Play Store, FBS Trader has a 4.6/5 from over 200,000 reviews by users.

FBS Regulation & Licensing

Our FBS review discovered that the broker takes regulation seriously. The platform has operational licenses from the European Union’s subsidiary regulatory body CySEC which stipulates that all brokers separate user funds from the broker’s own and maintain an insurance cover for all traders using its platform. Other top bodies supervising FBS are ASIC, IFSC, and South Africa’s FSCA. This heavy regulation means that FBS takes the issue of safety seriously.

FBS Customer Support

FBS offers 24/7 customer support through a callback service, chatbot, and social media platforms like Telegram, Facebook Messenger, and Live Chat. Its customer support service assists in several languages, including English, French, Spanish, French, Portuguese, Indonesian, Thai, Arabic, Malay, Hindi, Burmese, Filipino, Russian, Turkish, Pakistani English, and Chinese.

Aside from this, customer support staff respond to all logged queries within minutes, ensuring that every user enjoys a seamless trading experience.

How to Create an Account on FBS

If you are interested in creating an account on FBS, the step-by-step guide below will teach you how to complete your registration in minutes.

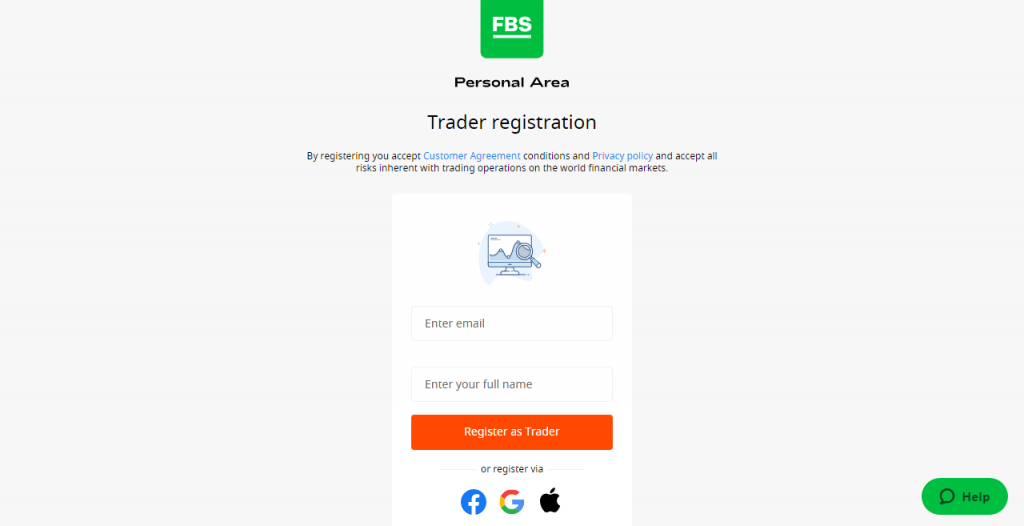

Step 1. Open an account

The first step is to register on the FBS platform. To do this, head over to the FBS website and click on the ‘Open Account’ button on the top right-hand corner.

This icon will take you to a simple signup page to provide your email and your full name. Once you fill in the required details, click on the ‘Register as a Trader’ to proceed to the next stage.

Or you can fast-track this process by either signing up with your Facebook, Google or Apple account details by clicking on the applicable icon below the registration button.

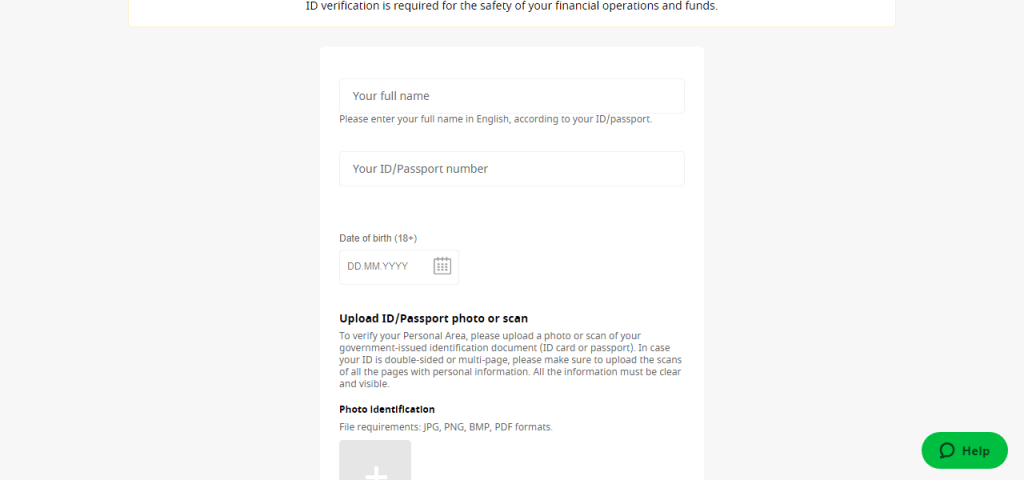

Step 2. Upload ID

As a regulated broker, FBS requires completing the Know Your Customer (KYC) process before funding your account. To identify yourself, upload a copy of your driver’s license or national ID card. Also, a recent copy of your utility bill or bank statement will be required for proof of address. Once these documents are uploaded, FBS will proceed to verify your account.

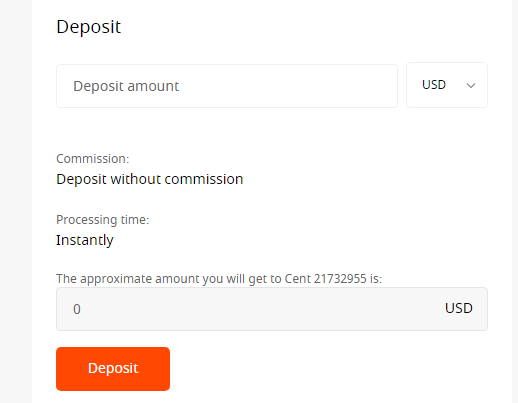

Step 3. Deposit

After you scale through the verification process, you can fund your account. Depending on your chosen account type, you are allowed to deposit as little as $1 or $1000.

To do this, click on ‘Deposit’ and choose a preferred payment provider.

You can make deposits on FBS through bank wire transfer, credit/debit cards (Visa only), SticPay, Skrill, and Neteller. Fill in the amount you want to put in and click on ‘Proceed’ to complete your deposit.

Step 4. Place your Trade

When your deposit is complete, you can now buy any asset or place a trade. You can do this by clicking on the search bar and typing the instrument you want to trade.

Conclusion

The huge userbase of FBS shows that it is a top destination for investors looking to make profits in the financial markets.

The regulation of the broker by tier-one bodies indicates that the platform has a measure of safety. Also, the CopyTrade functionality in FBS is one unique feature that’s extremely beneficial to their customers. The expensive fee structure might be a turnoff for some, but the platform is regulated, has low minimum deposits and a range of promotions that would keep you at the edge of your seats trading all week long.