Best Investments UK 2021

If you’re based in the UK and looking to invest some money into the financial markets – you’ve got thousands of options at your disposal. This includes everything from stocks and shares, bonds, ETFs, mutual funds, and more. But, which investment type of right for you and your personal financial goals?

On this page, we explore popular investments available to UK residents. We’ll also guide you through the process of getting started with an online investment platform that is regulated by the FCA.

Popular Investments in the UK for 2021

Below you will find a snapshot overview of some common UK investments of 2021. You can read more on each investment by scrolling down.

- Amazon – One of the Best Performing Stocks of 2020

- Tesla – One for Long-Term Growth

- S&P 500 Index – Average Annualised Returns of 10% Since Inception

- Oil – Attempt to Profit From Diverging Demand and Supply Levels

- Bitcoin – Volatile Asset Class That is Perfect for Short-Term Trading

- iShares Core High Dividend ETF – 75+ Dividend Paying Stocks

- British American Tobacco – Popular UK Dividend Stock

- iShares 1-3 Year Treasury Bond ETF – Invest in Safe US Government Bonds

- Vanguard Total Bond Market ETF – Create a Diversified Portfolio of Bonds

Popular Stock Investments

Stocks and shares are by far the most popular asset class with UK investors that wish to enter the market for the very first time. In accessing this marketplace, you will be investing in companies that are publicly-listed.

In the UK, this will be firms listed on the London Stock Exchange – for example, British American Tobacco, HSBC, Next, and BT. Most online stock brokers also allow you to invest in international companies.

For example, if you want to invest in the likes of Apple, Disney, JP Morgan, Facebook or Amazon – you’ll need a platform that supports US-listed exchanges. Irrespective of which market you invest in, a lot of blue chip stocks pay dividends. This means that you stand to make a profit on two fronts.

Below you will find out how to buy shares.

Amazon – One of the Highest Performing Stocks of 2022

There is no getting away from the fact that it’s been a turbulent year for stocks and shares. Although most companies are now in and around pre-COV-19 levels as of Q4 2020, it’s been up, up, and away for Amazon. In fact, this particular stock is one of the best performing shares of 2022.

For example, the stocks entered 2020 at $1,898. Fast forward to September and the same stock have since reached 52-week highs of $3,552. As such – while the rest of the markets have been attempting to recover pandemic-related losses, Amazon stocks have increased by over 87%.

Tesla – One for Long-Term Growth

Although Tesla was only founded in 2003 – it is already one of the world’s largest companies in terms of market valuation. At the time of writing, this stands at well over $350 billion. Although Amazon is one of the best-performing stocks this year – it doesn’t get close to Tesla.

Starting the year at just $86 (adjusted price to factor in its recent stock split), Tesla shares hit 52-week highs of $502 just last month. This means that in less than 9 months of trading, Tesla stocks have rocketed by over 480%. While the growth of this magnitude won’t last forever, there is still a long way for the electric car maker to go.

Long Term Investments

In financial jargon, a ‘long-term’ investment is typically related to investments that are held for at least one year. However, this is at the lower end of the scale – as some long-term investors will keep hold of an asset for several years or even decades.

As a result, they have very little interest in short-term market waves. Instead, they invest in companies, bonds, funds, or whatever the asset class may be, with long-term objectives in mind.

If you’re wondering what long-term investments are popular with UK investors, you’ll likely want to explore the benefits of a fund. This is because the fund manager will personally buy and sell assets on your behalf.

Funds come in several forms – including but not limited to ETFs, index funds, mutual funds, and investment trusts. The key point here is that once an investment is made, there is nothing else for you to do until you decide to cash out your (hopefully) gains.

S&P 500 Index – Average Annualized Returns of 10% Since Inception

The S&P 500 Index was launched way back in 1926 as a means to track the performance of the wider US stock markets. As the name suggests, the Index comprises of 500 companies. These are large-scale firms that in most cases, have multi-billion dollar market valuations.

If you think about some of the most recognisable brands globally – there is a good chance that it forms part of the S&P 500. This includes the likes of Facebook, Google, Apple, Amazon, Ford, Disney, Nike, and JP Morgan. Crucially, the S&P 500 Index is regularly readjusted – not only in terms of constituents but weighting, too.

After all, in order to be reflective of the wider US markets, a higher weighting needs to be given to the large companies. Taking all of this into account, it makes sense that over the course of time the S&P 500 has performed well. In fact, since it was launched over 90 years ago, the Index has returned average annualised gains of over 10%.

This is why many investors will use the S&P 500 as a long-term retirement pot. There are many ways to gain access to the Index from the UK, albeit, ETFs are one way to go.

Other financial instruments that are popular with long-term investors include:

- ETFs

- Mutual Funds

- Index Funds

- Investment Trusts

- Stocks and Shares

- Bonds

Note: When investing over the course of many years, you will increase the speed at which your capital grows by reinvesting dividends. This is because you will earn interest on your interest, so to speak.

Short Term Investments

At the other end of the spectrum, there are certain investment opportunities that are suited for short-term cycles. This is generally considered to be any position that you open and close within a 12 month period. However, short-term investments can see the trade close a position just hours or even minutes after it was opened.

As a result, you will need to be much more active when making short-term investments. After all, you will be chasing much smaller gains over a shorter period of time – so both fundamental and technical research is paramount. Regarding the former, this refers to important news developments that can have a direct impact on your investment.

For example, if you were invested in oil and tensions in the Middle East were on the rise, then this would likely send the value of the asset down. In terms of technical analysis, this is the process of reading and evaluating charts. It can take years to truly master the art of chart analysis, which is why newbies will often stick to long-term investments that can be made passively.

Nevertheless, CFDs (contracts-for-differences) are highly conducive for short-term investments. This is because the CFD brokers in the UK offer commission-free trading, and the ability to go long or short on your chosen asset. Furthermore, UK platforms allow you to apply leverage – which can be as high as 1:30.

Oil – Attempt to Profit From Diverging Demand and Supply Levels

Oil trading is well worth considering if you are looking to profit from ever-changing market prices. This is because the value of oil is directly correlated to demand and supply. In other words, if supply outpaces demand, then the value of oil will in theory go down. Similarly, if demands outstrip supply, then the opposite will happen.

This constant battle between market forces allows experienced traders to enter buy and sell positions throughout the day. You will have the added benefit of being to apply leverage of up to 1:20 on oil, meaning that a £100 account balance would permit a trade value of £2,000.

Bitcoin – Volatile Asset Class That is Perfect for Short-Term Trading

If you have a higher tolerance for risk, then you might be suited for cryptocurrency trading. On the one hand, digital currencies like Bitcoin are a lot less volatile than they were just a couple years ago. However, market prices can swing up and down by over 10% in a single day of trading. These volatile market conditions are ideal for short-term investments.

Not only in terms of day trading – but swing trading, too. This is because Bitcoin often goes through bullish and bearish swings for weeks or months at a time. These swings are often parabolic in nature, meaning that double or even triple-digit movements can occur in a short period of time.

For example, Bitcoin went from highs of about $10,000 to just $4,000 in the space of a few weeks earlier in the year. However, the trend quickly reversed – subsequently hitting highs of $12,000 in August.

Other financial instruments that are popular with short-term investors include:

- Hard Metals

- Energies

- Options Trading

- Futures

- Peer-to-Peer Financing

Monthly Income Investments

If you’re looking to invest in assets that generate a monthly income – there are heaps of options available to UK investors. Crucially, the amount that you are able to get each month will be based on the ‘yield’ that the asset returns. This is essentially the amount of interest that you earn in percentage terms – relevant to the size of your investment.

For example, if the investment yields 10% per year and you have £20,000 invested – you’ll receive £2,000 over the course of 12 months. Some assets – such as real estate, will distribute this yield each and every month. In other cases – such as ETFs, mutual funds, or traditional stocks – you’ll receive your share every three months.

Some of the asset classes that allow you to earn monthly income include:

- Investment Funds (ETFs, mutual funds, investment trusts, index funds)

- Dividend-Paying Stocks

- Corporate Bonds

- Government Bonds

- Peer-to-Peer Financing

As with the case with all investment classes, the higher the yield – the higher the underlying risk. This is why peer-to-peer financing platforms often yield double-digits, while UK government bonds pay less than 1%.

iShares Core High Dividend ETF – 75+ Dividend Paying Stocks

iShares is a major investment fund provider with over 900 ETFs in circulation. One fund, in particular, that might interest those of you seeking regular income is that of its Core High Dividend ETF. As the name suggests, this ETF consists of 75 dividend stocks.

Each company within the portfolio can be described as strong and stable, and all come from either the NYSE or NASDAQ. To give you an idea of the types of firms contributing to its portfolio, 9.25% and 8.77% consist of AT&T AND Exxon Mobile. You then have the likes of Johnson & Johnson, Chevron, Coca Cola, Cisco, and Verizon.

As you can imagine, companies will declare and distribute dividends on different dates throughout the year. With this in mind, the iShares Core High Dividend ETF trading releases a payment every three months.

British American Tobacco – Top UK Dividend Stock

If you want to keep things domestic – and don’t fancy injecting capital into an ETF, then you might want to consider British American Tobacco. This FTSE 100 heavyweight has a long-standing track record of paying healthy dividends.

Owning to a stagnant share price since 2017, the firm’s trialing yield in recent years are been super generous. In fact, it’s most recent distribution worked out at just over 7%, which is huge.

ISA Investments

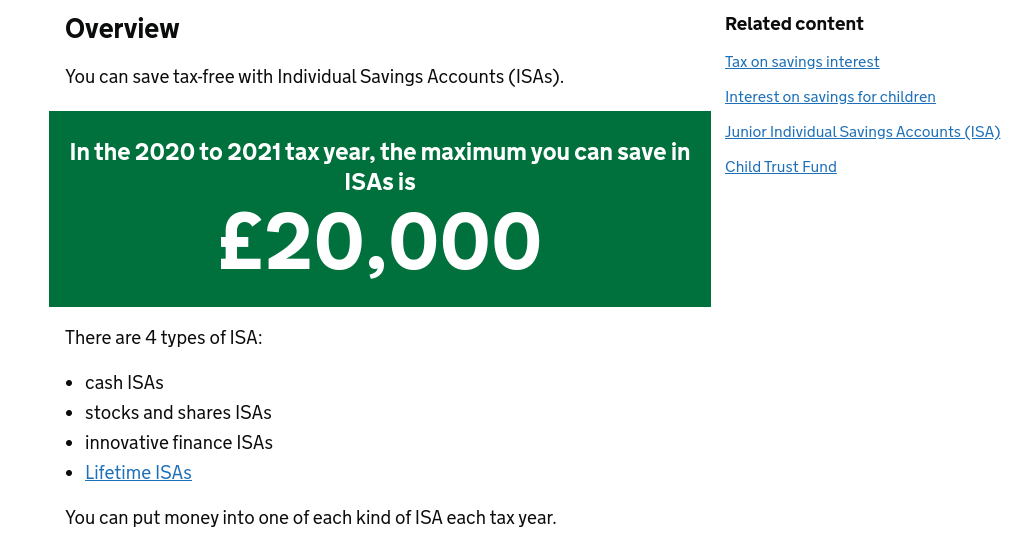

Let’s be clear here – there is no such thing as any ‘ISA Investment’ per-say. On the contrary, are simply investment accounts that allow you to shield some of your capital gains and dividend tax. After all, this is why ISAs are called Investment Savings Accounts!

With this mind, you’ll need to find a UK stock brokers that gives you access to ISAs, as not all do. In fact, you’ll specifically need a Stocks and Shares ISA, as this is what allows you to benefit from tax-efficient investments. Before we go into the brokers active in this particular marketplace, let’s clarify what asset classes you can add to an ISA.

- Stocks and Shares

- ETFs

- Investment Trusts

- Mutual Funds

- Unit Trusts

- Corporate Bonds

- Government Bonds

As you can see from the above, you are able to add a wide variety of assets to your ISA. However, the availability of investable assets will be determined by your choice of broker. In this sense, the broker is the bridge between your chosen asset class and your government-backed ISA.

So, which brokers offer the investment ISA accounts? Although there are many providers that offer ISAs, we would have to point you in the direction of either Hargreaves Lansdown or IG.

- Hargreaves Lansdown ISAs: This provider offers over 3,000+ investment funds – which covers a variety of trusts, mutual funds, and ETFs. You’ll also have access to an abundance of the UK and international stocks. Fees are on a higher side, as you’ll initially pay £11.95 per trade. Larger trading volumes will result in a lowered commission rate.

- IG ISAs: Launched in 1974, IG is one of the most popular brokerage platforms in the UK trading space. Much like Hargreaves Lansdown, you’ll have access to thousands of ISA-eligible assets. This includes heaps of investment funds, trusts, and shares. Fees are more competitive at IG, with an entry-level dealing charge of £8. This can, however, be reduced to £3 if you trade more than three times in a calendar month.

Ultimately, by investing through an ISA, you won’t pay any tax on the first £20,000 that you inject. This is reset each financial year, with the 2020/21 also set at £20,000.

Sponsored ad. Your capital is at risk

“Safe” Investments

There is no such thing as a risk-free investment, as all asset classes come with an element of risk. However, some asset classes come with much lower risks than others, which is why they are deemed as ‘Safe Investments’. With that being said, the investments with low-risk come with much less competitive yields, so you do need to weigh this up before taking the plunge.

For example, UK Gilts typically pay less than 1% per year in interest – which won’t even cover the impact of inflation! On the flip side, safe investments can protect your portfolio during times of economic hardship. Then, when it looks like the markets are due to recover, you might consider reallocating some of your capital.

iShares 1-3 Year Treasury Bond ETF – Invest in Safe US Government Bonds

You will be hard-pressed to find an economist that deems US Treasuries as high-risk. This is because they are bonds backed by the US government. In simple terms, the only way that you would lose money is if the US economy collapsed.

Until then, the Federal Reserve will continue to print more money as and when it needs to. As such, a short-fall in cash reserves to meet its bond obligations isn’t really a concern for investors. As a UK resident, it’s slightly more challenging to purchase US Treasury Bonds from the comfort of your home.

With this in mind, you might consider opting for the iShares 1-3 Year Treasury Bond ETF. As the name implies, this is an ETF that gives you exposure to US Treasury bonds that have a maturity of between 1-3 years. Crucially, as you will be investing in an ETF, you can exit your position at any given time during standard market hours.

Some of the other investments in the UK that are classed as safe include:

- Real Estate

- UK Gilts (bonds)

- High-Grade Corporate Bonds

- Blue Chip Stocks

- Gold

- Savings Bonds (FSCS Protected)

- Cash

Once again, no asset class is 100% immune from risk, so do bear this in mind. To invest, check out investment apps for UK users!

Bond Investments

Bonds are highly sought-after by UK investors that wish to grow their wealth passively. For those unaware, bonds are issued by governments and corporations as a means of raising finance. It’s essentially a loan from the investor to the institution.

In return, investors will be paid interest in the form of ‘coupon payments’. This interest is typically paid every 3 or 6 months. At the end of the bond term, the issuer will repay your initial investment – known as the ‘principle’.

There are some important points to note about bond investments:

- Bonds can be both low-risk and high-risk – depending on the issuer

- Examples of low-risk bonds include those issued by governments based in strong economic countries (like the UK or US)

- Examples of high-risk bonds include those issued by companies that have been performing poorly in recent years

- The yields on high-risk bonds will be significantly higher than those paid on low-risk bonds

- You typically need to hold not o your bond investment until they mature

If you’re keen to invest in a diversified portfolio of bonds at the click of a button, you might be suited for an ETF.

Vanguard Total Bond Market ETF – Vanguard Total Bond Market ETF

This bond ETF – which is managed by leading fund provider Vanguard, will give you instant access to just under 10,000 bond instruments. This covers a variety of bond types – including those issued by the US government, non-US governments, corporations, and mortgages.

At the time of writing, the bonds have an average maturity of 8.5 years, and an average coupon rate of 3%. In terms of risk, 58.2% of its portfolio contains high-grade US Treasuries. In total, the ETF has a net asset value of over $280 billion.

Choosing Investments for You

So now that we have covered the many different asset types that are popular in the UK, we now need to give you some guidance on how to choose investments for you and your financial goals.

- Income or Growth: You first need to assess how your chosen investment is going to yield a return. For example, bonds allow you to make money via quarterly or bi-annual coupon payments, while growth shares are suited for capital gains. You then have the likes of dividend-paying stocks and real estate – which provider both.

- Long-Term or Short-Term: Are you looking to invest on a short or long-term basis? It’s important for you to clarify this before you open the position.

- Risk: You then need to evaluate how much risk is associated with your chosen investment. At one end of the spectrum, investing in UK or US government bonds isn’t going to cause you any sleepless nights. However, the likes of cryptocurrencies likely will – as the asset class offers a super high-risk, high-return ratio.

- Research: In terms finding investments, it’s important for you to do lots of research. In order to obtain the required skills to be able to perform research on a DIY basis, you might want to consider reading some investing books or signing up to an investing podcast. Additionally, investing newsletters can be useful to keep up with current market trends.

- Yield: Explore what the expected yield on your investment is. In some cases – such as bonds, peer-to-peer lending or retail estate – there is a clear picture as to what you should get back. However, the yields on stocks and shares are unknown – as it is all dependent on market forces.

- Accessibility: Choosing an investment that you like the look of isn’t always enough. This is because you need to assess whether or not you will have the capacity to make an investment as a UK retail client. For example, buying corporate bonds isn’t an easy task if you’re looking to invest a small amount of money. Similarly, not all UK brokers give you access to foreign stocks or AIM-listed shares.

- Liquidity: One of the most important metrics to assess before making an investment is how liquid it is. This refers to the ease or difficulty in which you will have when it comes to cashing out the investment out. For example, stocks are highly liquid as they can generally be sold at any given time during standard market hours. However, the likes of real estate can only be financially realised when the property is sold (unless going through a REIT ETF).

As you can see from the above, there is much to consider when choosing the right investment for you.

Investment Platforms in the UK

Not only do you need to spend some time finding an investment that meets your long-term financial goals, but you also need to locate a suitable platform that can facilitate your trading needs. There are hundreds of FCA regulated brokers active in the UK space, so knowing which one to choose can be difficult. For example, you need to look at everything from fees and commissions, tradable assets, reliability, and user-friendliness.

To help point you in the right direction, below you will find the most popular investment platforms available to UK residents right now.

Plus500 - Low Cost CFD Broker

If you're looking to make some short-term trading moves, you might want to consider Plus500. This commission-free CFD platform is home to thousands of financial instruments. Whether you're keen on stocks, indices, commodities, bonds, interest rates, or forex - Plus500 has you covered.

As an FCA regulated CFD platform, all financial instruments can be traded with leverage. This goes up to 1:30 when trading currencies - meaning that a £500 account balance would permit a position worth £15,000. You can also choose from a buy or sell order - subsequently allowing you to profit from both rising and falling markets.

Plus500 can be accessed via your desktop computer or through the provider's native mobile app. This is supported on both iSO and Android devices. Getting started takes minutes, with both debit/credit cards and e-wallets allowing you to make an instant deposit. You'll need to find your account with at least £100, and no transaction fees apply.

- No withdrawal fees

- 0% trading commission

- FCA regulated

- No educational material

How to Invest Today

If you’ve read our guide up to this point – you should now have a good idea of:

- Which investment types you are interested in pursuing

- Which FCA broker or trading platform you wish to join

To conclude our guide, we are now going to show you to make an investment from the comfort of your home.

Step 1: Open an Investment Account

Visit a broker website and open an account. You will need to provide some personal information – such as your full name, home address, and date of birth. You’ll also need to provide your national insurance number and contact details.

Step 2: Upload ID

The broker will now ask you to verify your identity. You can do this within minutes by uploading a copy of the following:

- Valid passport or driver’s license

- Recently issued bank account statement or utility bill

Step 3: Deposit Funds

You will now be asked to find your investment account.

You can choose from the following payment methods which are common among UK brokers.

- Debit/credit card

- E-wallets such as Paypal, Skrill, or Neteller

- Bank transfer

Your deposit will come with a currency conversion fee of 0.5%.

Step 4: Make an Investment

Once your deposit is credited to your account – your set to make an investment. First, choose the asset you want to invest in.

Then, it’s just a case of specifying how much we wish to invest.

Finally, confirm the order to complete the investment process.

Conclusion

As we have discussed through this guide, investments in the UK come in a range of shapes and sizes. The key takeaway is that you find an investment that meets your personal financial goals. For example, if you’re looking to invest over a number of decades, then you might be suited for a mutual fund or ETF.

If you’re more keen on short-term opportunities, there are many CFD platforms that allow you to trade everything from gold, oil, and forex. Either way, just remember that all investments carry an element of risk.