PayPal UK – How to Open an Account and Deposit Guide

PayPal is one of the leading digital payment methods that is around in this day and age. It has developed into a well-respected offering since it first launched back in 1998. It is the de facto payment option for countless people across the globe and is extremely simple to use.

From start to finish you will be facing minimal steps when using PayPal to fund an online forex broker account or when adding funds to your preferred online casino. This guide will walk you along the entire process in an easy to digest manner so you can get started using PayPal in the UK today.

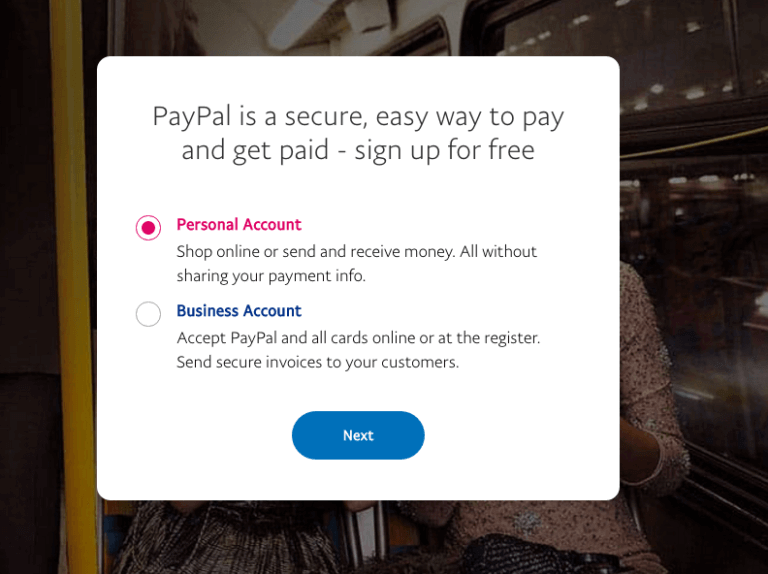

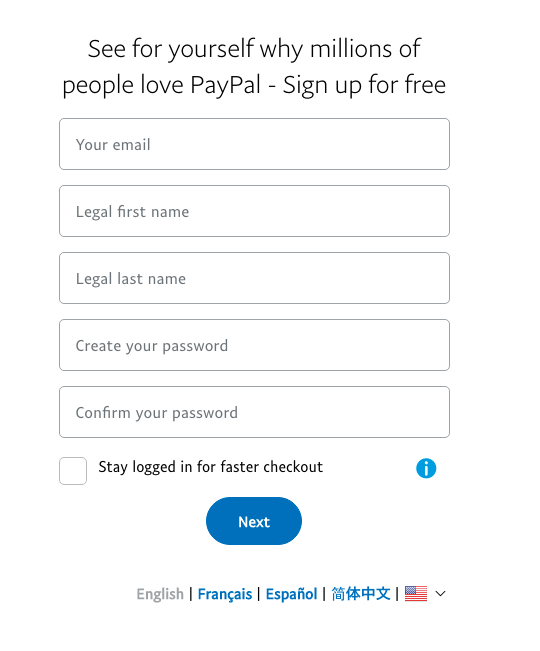

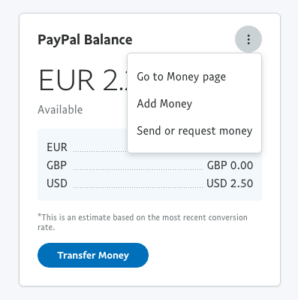

The advantages of PayPal are many. It was a frontrunner of the e-wallet market that started to emerge at the beginning of the 21st century. Millions of people in the UK now use PayPal on a regular basis to conduct transactions. This is thanks to its great security features and being extremely easy to use. When you first use PayPal to conduct a transaction, you will see just how simple and straightforward it can be. Opening an account does not take long at all and the method of depositing and transferring funds through PayPal is so easy almost anyone could do it. When transferring funds to or from a PayPal account, the only information you need is the destination email address for the funds. If you are receiving the money, this is the only info you need to provide. For sending money, you will just have to enter your PayPal password to confirm the transaction. Therefore, you do not have to worry about the sharing of extensive financial info and addresses when making or receiving payments, all you need is a simple email address and you will be good to go. The highlight of PayPal’s offering is the security it provides account holders. The company has a very strong reputation thanks to being a key part of the digital payment sector for so long. When you are making transactions through PayPal, there is no requirement for you to share any personal data with the person on the other end of the transaction. All you need to do is provide your PayPal email address and you can then receive funds. For sending money, simply enter your PayPal email address and password, with this transaction then being processed. It provides you with great peace of mind. Another great aspect of using PayPal as a payment method is its speed. Funds will process nearly straight away, which is ideal. This goes for sending and receiving money. A lot of other payment methods can often be a lot slower, taking a few extra days for your funds to process than when you use PayPal. You also have the option to utilize a quality PayPal mobile app to manage and conduct transactions when you are away from your desktop copter, which is ideal. Once you are happy that PayPal is the payment method for you, open a UK PayPal account. Visit the PayPal website and click the ‘Sign Up’ button. If you are planning to add funds to one of the online casinos that accept PayPal or you want to add trading funds to a forex account, you should select the ‘Personal Account’ account type. You will then have to fill in a standard information form with the likes of your full name, email address, home address, nationality, date of birth and then set a password for his new account. When you add your phone number, you will receive a PIN code that has to be entered to confirm this number. There will also be a verification email sent to you that will allow you to activate this account. As soon as your PayPal has been created, you will be ready to get some money into this new account. A checking account will have to be linked initially. A test transaction will be conducted by PayPal once you do so. A few pennies will be deposited by PayPal to your linked bank account. To verify your account payments section, you will need to confirm the exact sum or transaction code that was used as part of this transaction. The amount of time it takes for this test transaction to reach your bank account will usually depend on your bank. Sometimes it can take up to 24 hours, sometimes longer. For most leading banks, PayPal transactions will process normally inside of a few hours. As soon as this process has been completed, you can then get started adding funds to PayPal. Click on ‘Add Money’ and you will be able to add funds by using a debit card or through a bank transfer. Select your preferred method and your preferred currency of choice, deposit sum and the details needed to approve this transfer. As soon as you confirm this transaction, the funds should reach the PayPal account nearly straight away. As soon as the funds have reached your PayPal account, you should be ready to deposit these funds to a PayPal online casino or forex broker. You have countless options for both of these types of offering to chose from. We have chosen the leading options for those people looking to use PayPal to add funds to an online casino or forex broker account.

32Red Casino has been a part of the online casino space since the beginning. Over the years it has constantly improved its offering to stay up to date with the latest trends and to remain at the top of the game.

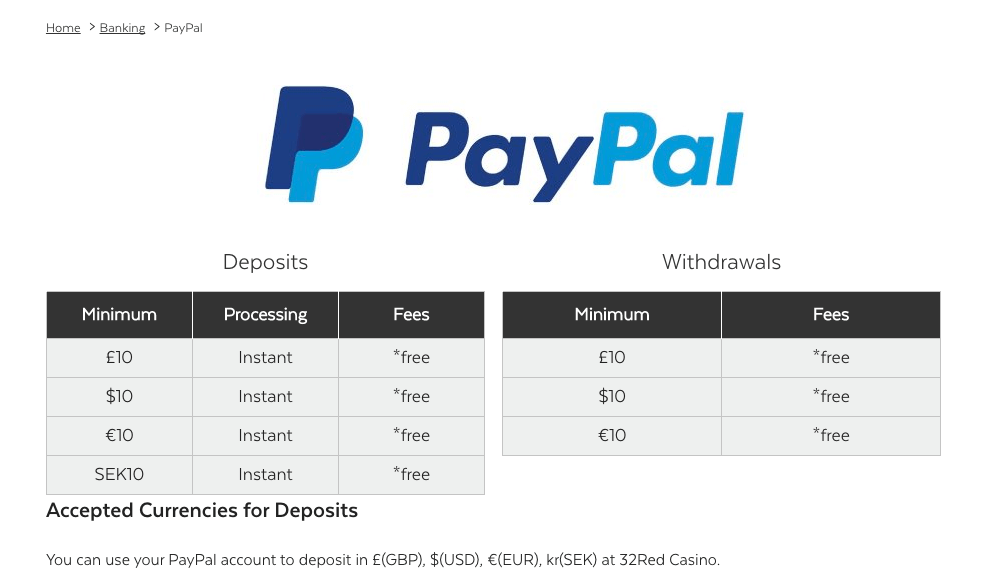

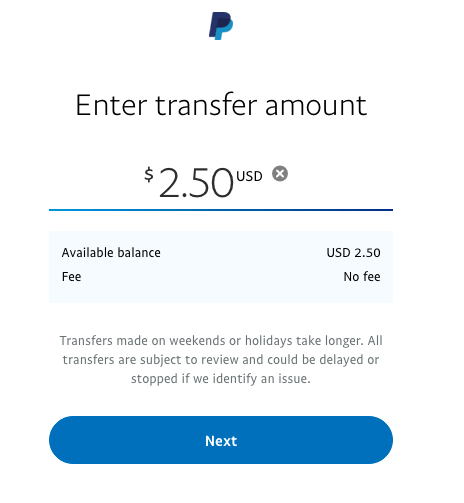

Our Rating As soon as you have chosen the online casino or forex broker that you want to sign up for, you will then register for an account and use PayPal to add funds to these respective accounts. On the 32Red Casino website, choose the ‘Register’ option and add your required personal info, such as full name, date of birth and home address. You then select a username, password and agree to the terms and conditions of 32Red Casino. Completing the verification process at this stage is a good idea as you cannot make a withdrawal without doing so. Photo ID and proof of address will need to be submitted, with these usually get approved quickly. You are ready to then add funds to your account by going to the ‘Banking’ section and choose PayPal as your preferred option. Enter how much you wish to add and then enter your PayPal email address and password to confirm this deposit. If there is a welcome bonus code to use, this is the stage to enter it. If you have had some success through online betting with PayPal on 32Red Casino or you’ve made some profitable forex trades, you may want to withdraw funds to your PayPal account. Go to the ‘Banking’ section and select ‘Withdraw’. You will be shown the available balance that can be withdrawn. Select PayPal as your withdrawal method and then enter your PayPal email address and how much you want to withdraw. As soon as 32Red Casino has approved this withdrawal, the funds should hit your PayPal within a few hours. You may decide to withdraw some funds out of your PayPal account and put them into your bank account. Select the ‘Money Out’ option on your PayPal account. You can then see what bank accounts you have previously linked. Choose one of these accounts or enter a new option and select how much you want to withdraw. This withdrawal can process within a few hours a lot of the time, depending on the bank you are using. Usually, there will be no fees charged for using PayPal to add funds to an online casino or forex broker account. Oftentimes when making a withdrawal to PayPal from your respective accounts, there will be a 5% fee charged on the transaction. There is usually a cap on the size of this fee. Overall, PayPal is a cost-effective way to conduct digital payments in a quick, easy and safe manner. As you can see, PayPal is an ideal way to quickly and safely add or remove funds from an online casino or forex brokerage account. It is the preferred option of countless people across the UK and it is very easy to get started with today. You can add funds using PayPal to an online casino account or forex broker in a matter of minutes. Our Recommended PayPal UK Casino Our Rating No, there are a lot of online casinos and forex brokers that do not accept PayPal as a payment option. There are some online casinos that will require you to withdraw using PayPal if you made your original deposit using PayPal. The platform can take some time to process a withdrawal request, but once this step has been done, a PayPal withdrawal will usually see the funds hit your account within a few hours at most and often almost instantly. This will depend on the bank you are using. If the bank processes PayPal transactions within a few hours, this is how long it will take to complete this verification process. If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of... The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home... WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site. Copyright © 2022 | Learnbonds.com

Why use PayPal?

Simple to Use

Great Security

Fast and Versatile

Step 1: Open a PayPal UK Account

Step 2: Fund Your PayPal Account

Step 3: Select Your PayPal Casino or Forex Broker

1. 32Red Casino - Best Online Casino in the UK using PayPal

The casino is powered through Microgaming software, one of the best software companies in the sector these days. Most of the various games on the platform are powered by Microgaming, in addition to a couple of other companies. You have endless amounts of different slots to check out, with classic options, ultra-modern choices and progressive jackpots all being on offer.

The process of playing these games is great, with the graphics popping out and the gameplay experience being very smooth. This is the case whether you are playing on a desktop computer or through your mobile device.

You will also find one of the leading selections of table games in the UK sector today. All of your favorites will be catered for, as well as a number of different niche options. There is a live dealer casino that also covers all bases, allowing for a truly immersive experience.

If you want to venture away from 32Red’s online casino offering, there is also a sportsbook, poker and bingo platforms that you can explore; the options are endless. The cherry on top is the welcome offer for new signups at 32Red Casino. Your first deposit will be matched 150%, allowing you to get a bonus of up to £150 right off the bat.

Overall, 32Red Casino is a quality choice if you are in the UK and looking for an online casino that accepts PayPal.

Step 4: Fund your Casino or Forex Broker Account

For 32Red Casino

Step 5: How to Withdraw Your Funds

For 32Red Casino

To Your Bank

PayPal Fees & Other Expenses

Conclusion

FAQs

Do most online casinos and forex brokers accept PayPal?

Are there limitations on using PayPal for an online casino?

How fast will a PayPal withdrawal from an online casino or forex broker take?

How long does the PayPal payment verification process take?

Andrew O'Malley

Andrew O'Malley

Latest News

Halifax Share Dealing Review

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago