Best Trading Sites for 2020

Looking for a platform to kick off your private trading portfolio? There are a wide variety of trading software available, but picking the best trading site for your needs is not always straightforward.

In this article, we review the best trading sites in the industry as well as those that are regulated by the appropriate authorities. All the trading sites we have listed offer innovative trading tools, premium research, and advanced trading platforms.

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Our criteria for the best trading sites

We assessed the top trading sites in the world based on aspects such as user-friendliness, cost, mobile access, reputation, fees, and trading tools.

- Broker’s Reputation

- Charges and Fees

- trading platform functionality

Below are the top trading sites that may suit your needs. We’ve explained the specific features as well as pros and cons of each trading site so you can quickly identify which one best suits your needs.

Top 8 Trading Sites

1. eToro - Best for Beginners

eToro is one of the most reputable trading sites, boasting over 10 million clients worldwide. It is regulated by highly regarded financial authorities such as the Financial Conduct Authority (FCA), Australian Securities and Investment Commission (ASIC) and Cyprus Securities and Exchange Commission (CySEC).

On eToro, you can easily implement copy trading. This feature enables you to copy the exact trades and trading strategies of the most successful traders on eToro in real-time. While other online trading sites have a similar feature, none has integrated it perfectly as eToro. However, it is important to note that copy trading is not a guarantee that you can quickly gain profits so don’t blindly follow the exact trades of others. You should always try to do your own research and analysis first.

The fees that you need to pay depend on what kind of asset you’re trading with. For instance, since cryptocurrency prices are highly volatile, the trading spreads are wider. In most cases, the spreads are between 0.75% and 3.45%. Bitcoin is the cheapest to trade because it is more stable. On the other hand, commodities pricing on eToro is much simpler compared to its competitors. The site does not involve commission or deposit fees. Instead, it makes money on spreads, which is very low at only 0.09%.

Our Rating

- No commission and deposit fee

- Impressive copy trading mechanism

- Fully regulated

- Little customization

CFDs are complex financial instruments and 75% of retail investor accounts lose money when trading CFDs.3. CryptoRocket - Best for Cryptocurrency Trading

Cryptorocket is a popular multi-asset online trading site that was founded in 2019. Its users can trade 37 cryptocurrencies on its platform.

Apart from forex and cryptocurrencies, it also offers indices, stocks and commodities trading. You can have a leverage of up to 1:500 and access to deep liquidity.

Its users can get access to the MetaTrader 4 trading platform, which is the most popular and reliable trading platform that is also being used by other popular trading sites.

This trading site employs the Straight through Processing (STP) execution model. You only need to place trades, and the platform will deal with the desk intervention and re-quotes. Additionally, all trades are quickly processed through an aggregator, which means you can always get the best rates available on the market.

It keeps things simple by offering only one account type. Also, it does not require any minimum deposit amount. Like other trading sites, all of its users can access its free demo account.

Our Rating

- Up to 1:500 leverage

- 24/7 customer support

- No deposit and withdrawal fee

- No MetaTrader5 trading platform

Stash Invest is designed to make investing simple and accessible.

It is a good option for new traders because it does not require any minimum deposit. Also, it’s very easy to use Stash Invest. After signing up, it will help you create a portfolio based on your investment goals and risk tolerance. A section dubbed as Stash Learn can also provide you with an extensive library of educational materials.

The Stash Invest app is an automated app that can allow you to invest even $5 in bonds, stocks and funds.

Initially, Stash offered a single account that was based on an expense ratio scale. Now, it offers three subscription plans. The Beginner account costs $1 per month, the Growth account costs $3 per month and the Stash+ account costs $9 per month.

Unlike other trading platforms, its customer support team is reliable. Its phone support is available Monday through Friday between 8:30 am ET and 6:30 pm ET. During the weekend, it is available between 11 am and 5 pm ET.

OUR RATING

- Perfect for new investors

- No minimum amount required

- Extensive educational material

- Monthly fee

Create a Trading Site Account on eToro

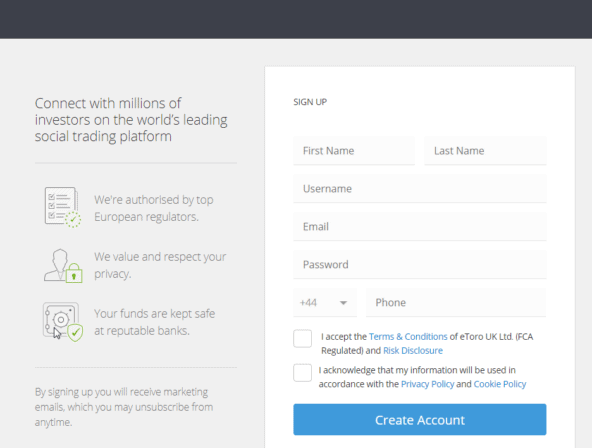

Step 1: Open an eToro account.

Signing up on eToro is free and very simple. You are only required to enter your basic personal information such as name, email and phone (optional). Alternatively, you can sign up using either your Facebook or Google account.

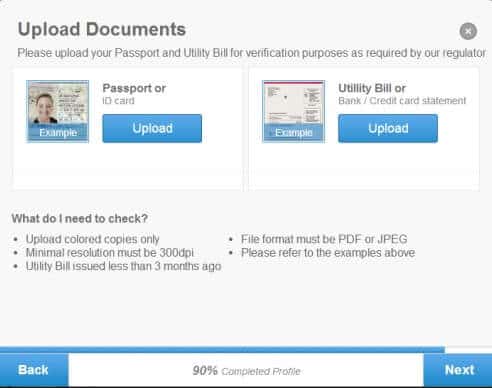

Step 2: Verify your account.

To comply with regulatory policies, eToro requires its users to verify their accounts by providing proof of identity and a proof of address.

You can submit a picture or a scanned copy of any government-issued ID such as your driver’s license and passport. Your proof of address should not be older than six months. You can use your utility bill, phone bill or electricity bill. These documents will not be shared with third parties and will only be used by eToro to verify your identity so there’s no need to worry about the security of your data.

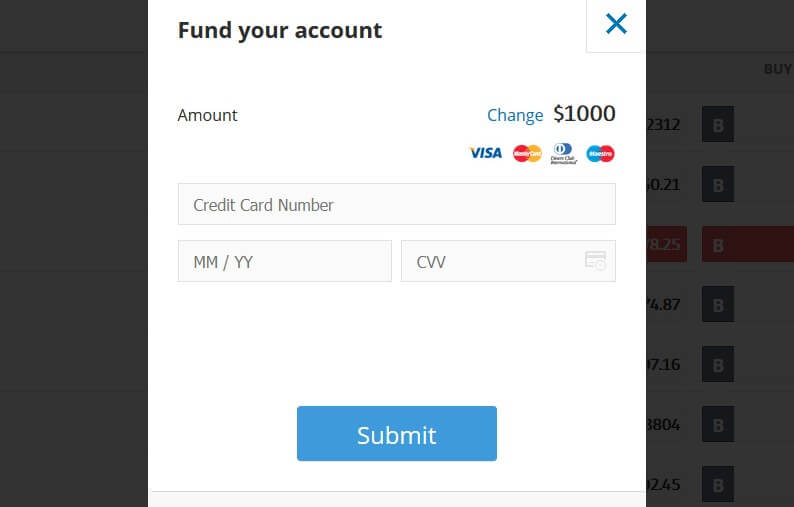

Step 3: Deposit funds.

On the bottom left of the page, click the ‘Deposit funds’ button. The minimum you can deposit is $200, which is ideal for beginners. It is important to note that the US dollar is the main currency on the eToro platform. Nonetheless, you can still use other currencies such as EUR, GBP, AUD, etc.

Step 4: Familiarize yourself with the eToro platform.

Here are some of the main sections featured on eToro.

-

Watchlist

This section will enable you to organize the markets and people you are interested in investing in and copying. The best part is that you can create multiple lists such as ‘People to copy’ and ‘Favorable stocks.’

-

Portfolio

The portfolio section is the epicenter of the eToro platform. This is where you view your open trades and analyze your trading performance.

-

News feed

This is similar to the news feed section on Facebook where you will see what the traders you have followed are saying and doing.

-

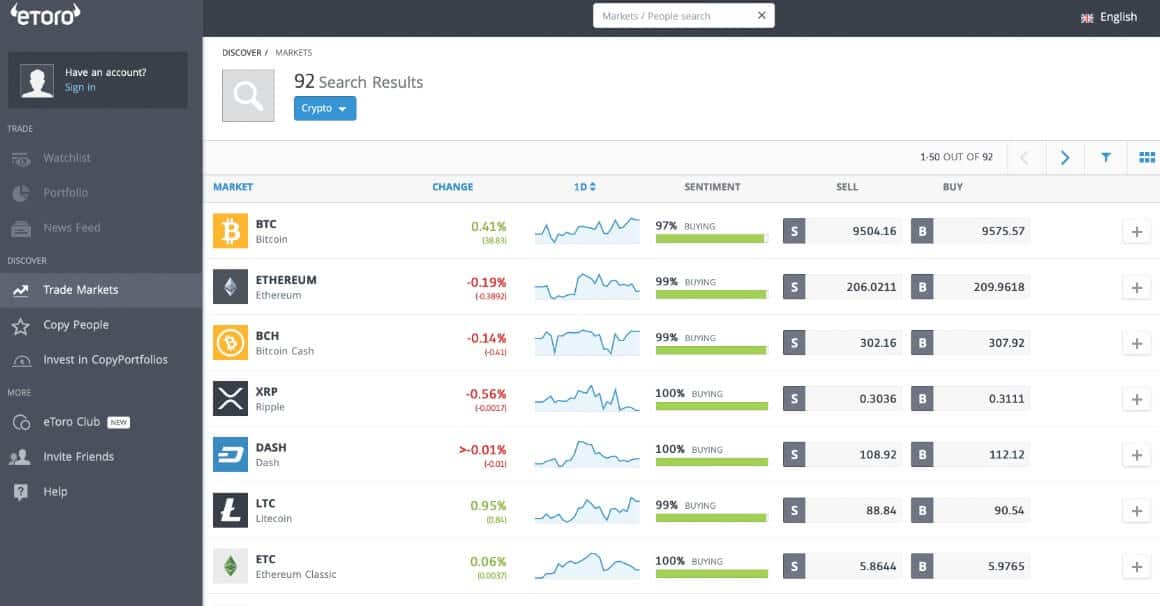

Trade markets

In this section, you will able to research and trade in the markets available. eToro offers a wide range of trading options such as stocks, currencies, commodities and indices.

This is the heart of the platform. You will be able to search traders who you want to follow and copy. Fortunately, there are various filters that will help you narrow down the searches.

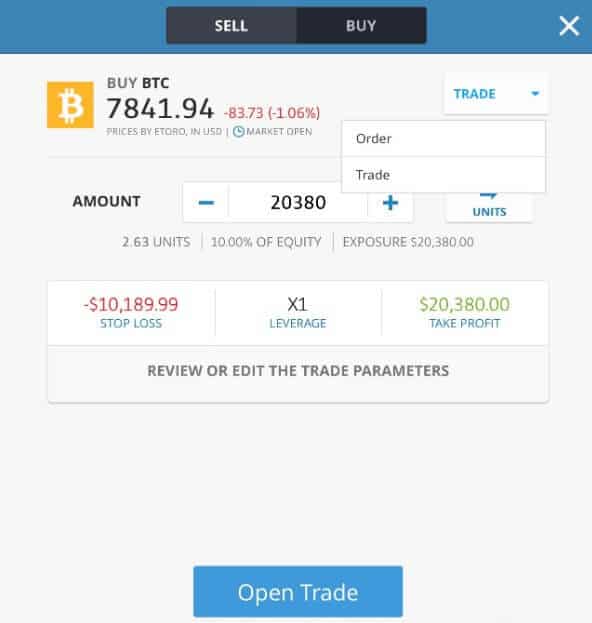

Step 5: Trade your chosen financial assets.

Once you’re ready to trade, simply click “Trade Markets” then click the “Industry” section. You will then see a list of all tradable financial instruments as well as their corresponding prices.

Features to Look Out For When Choosing a Trading Site

-

Regulated by financial authorities

The first factor that you need to consider when choosing a trading site is whether it is regulated or not.

After all, you would not want to invest your hard-earned money on a site that is not legitimate. A good online trading site should be authorized by a reputable regulatory agency. Some of the most popular regulatory agencies around the world include the Financial UK’s Conduct Authority (FCA), US’s National Futures Association (NFA), Australian Securities and Investment Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), etc.

If a trading site is regulated, then it means that it abides by standard practices and can keep your money safe.

-

Secure trading platforms

Most online trading platforms will require you to submit vital financial and personal data when opening an account.

For instance, you may be required to provide copies of your passport, utility bills as well as bank and credit/debit card information. If the broker platform does not feature proper security measures, your personal and financial information may be at risk. So, it is important to conduct thorough research to ensure the trading site has excellent security measures.

-

Low transaction costs

No matter the kind of trading you will participate in, you will be subjected to transaction costs. Every time you enter a trade, you will incur either a commission or a spread.

High transaction costs can hugely impact your overall profitability. This is a critical factor, especially for high volume traders. Take note that a good trading site does not have to be expensive. So, take the time to thoroughly search for online brokers that offer quality services at affordable spreads and commissions.

-

Quick deposit and withdrawal processes

A good trading site should allow you to deposit and withdraw funds without any difficulties.

There is no reason why a Futures, CFD or Forex Broker should make it hard for you to withdraw your funds. The only reason why a trading site holds your money is to facilitate trading transactions. So, the withdrawal process should be quick and smooth.

-

Fast trade execution

You must choose a trading site that employs excellent trade execution practices. A reliable trading platform should also fill your trades at the best market rates.

Under normal market conditions, there is no reason why a trading platform should not fill your trade at or very close to the market rate. For instance, if the EUR/USD market rate is at 1:3000, your trade should be filled at that price or equivalent micro-pips. A slight difference can make it difficult to win that trade. The speed at which the platform fills your trade is also essential, especially if you are a scalper.

-

Reliable customer service

Since you are investing your hard-earned money, it is advisable to choose a trading site with reliable customer service.

You should be able to quickly contact a customer support agent in case you face any problem. Some trading platforms can be kind and helpful during the account opening process but very terrible once you have already deposited funds. Make sure to avoid this kind of trading sites.

-

User-friendly & Intuative

You should choose a trading site with a user-friendly and stable interface.

MetaTrader 4 is the most popular trading interface and is perfect for both beginners and advanced traders. It is also better if the trading site you’re interested in offers a demo account. This will enable newbie traders to get acquainted with the platform first before they start trading real money.

Tips To Maximize The Potential From Your Trading Site

-

Create a trading plan.

A trading plan is a written set of rules that indicate your entry and exit strategies as well as some points on how you want to manage your money. Even though it is a time-consuming endeavor, it is a vital step that can help you become a successful trader.

Due to the advancement of technology, it is now easy to test a trading strategy before executing it using free demo accounts. This practice is commonly known as backtesting, where you use historical data to test trading ideas. It helps determine whether a trading strategy is viable or not. If the backtesting shows good results, you can apply the approach in real trading.

After backtesting, you will be able to a good trading strategy. The most important thing is to stick to this trading strategy. Going outside the trading plan is a poor trading practice and can lead to significant losses.

-

Take trading seriously.

To become a successful trader, you must approach online trading as a business and not as a hobby or a permanent job.

If you treat it like a hobby and not make real commitments, trading can be very costly. Also, if you see it as a stable job, it can be frustrating because most markets are volatile, and you can’t expect a monthly paycheck. For those wishing to trade but without the time, or financial flexibility you may wish to consider mutual funds or ETFs as a less risky place to put your money.

Since it incurs losses, expenses, taxes, stress, risks, and uncertainties, you must conduct proper research and strategize smartly to maximize your potential returns.

-

Take advantage of available tools and resources.

You should make use of charting platforms that can offer you numerous ways to view and analyze the markets. Also, getting regular market updates on your smartphone allows you to keep tabs with how the financial markets are doing.

Most trading sites offer free educational resources so make sure to study them.

-

Keep practicing.

If you want to become a successful trader, you should remain focused and try to learn more each day. You should also familiarize yourself with other trading strategies.

Remember that understanding the markets and all the intricacies involved in trading is an ongoing process.

-

Risk only what you can afford to lose.

It is advisable only to risk the money you can afford to lose.

You should never commit money meant for other important obligations such as your kid’s school fees or mortgage payments. You must never allow yourself to think that you are ‘borrowing’ from such critical commitments. Most markets are very volatile, and there is always a possibility that you can lose money.

Conclusion

One of the best ways to grow your wealth is by investing in and trading stocks, currencies, commodities, indices and other financial instruments.

Thanks to the advent of the internet, trading has become cheap and more accessible. You simply need to open a trading account and you’re all set. Wait no more and start trading now!

FAQs

What is online trading?

It is the method of trading financial instruments online. In most cases, you will need to access a brokerage website. On the trading site, you can log into your account to place orders and monitor your trading performance.

What is the difference between online investing and day trading?

Online investing is the method of placing orders through the internet instead of speaking directly to a broker by phone. On the other hand, day trading is a trading strategy where you can trade securities within a short time in an attempt to benefit from the small movements in prices.

How can I open a trading account online?

It is effortless to open a trading account online. Most trading sites will only require you to provide basic information to activate your account.

Is there a difference between a cash trading account and a margin account?

Traders who use cash trading accounts can pay for the full cost of the trade. However, margin accounts are used by traders who are authorized to borrow part of the trade purchasing cost from the brokerage firm. Most people use margin accounts to increase their purchasing power.

Can trading sites execute my trade orders immediately?

In most cases, online trade orders are executed quickly. However, there is no guarantee that this will always happen. It is important to understand that high trading volumes can be executed quite slowly. Delays in execution and market volatility because of the trading volume can result in prices considerably different from the quoted price.

See our range of additional trading resources

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up