Sharekahn Review for 2021

Sharekhan is one of the biggest full-service brokers in India. It is a subsidiary of BNP Paribas, which is listed on the Euronext Paris Exchange.

At the moment, the brokerage is present in 575 cities with over 2800 physical offices and franchises across the country. It is regulated by the Securities and Exchange Board of India (SEBI).

Read on to find out what it Sharekhan is, how its trading platform works, what tradable assets it offers, the fees involved and many more.

-

-

Our Recommended Stock Broker - 0% Fees

Our Rating

- 0% Commission on Stocks

- Trade Stocks, Forex, Crypto and more

- Only $200 Minimum Deposit

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.What is Sharekahn?

Founded in 2000, Sharekhan is the third-largest stock brokerage in India. It offers brokerage services through its online trading platform and in more than 2800 offices spread across 575 cities.

Founded in 2000, Sharekhan is the third-largest stock brokerage in India. It offers brokerage services through its online trading platform and in more than 2800 offices spread across 575 cities.In the last decade, the firm has seen considerable growth with its services spreading to most parts of the country. On top of that, it has opened offices in Oman and UAE. This stock broker provides its services to all customers, such as individual investors and traders, corporate, institutions, etc. Right now, it has over 1.7 million customers.

Trade execution facilities for derivatives segments and equity cash are available on NSE and BSE while commodity trading facilities are available on NCDEX and MCX. Also, the firm provides a Demat account and the opportunity to invest in IPOs and mutual funds.

Moreover, its trading platform is one of the finest investment portals in the Indian online trading industry. It is well-designed with a wide range of investment options. It also features research reports, stock market news, stock quotes, fundamental and statistical information across mutual funds, equity and many more.

Moreover, the newly launched app is user-friendly and intuitive. Apart from a fresh look, it comes with remarkable features for both investors and traders. The app will allow you to execute orders efficiently, manage your portfolio and track your stock on the go.

The firm also provides TradeTiger, which is one of the most robust trading platforms for retail investors. On this platform, you have all the tools you need to place and execute trades at high-speeds. Furthermore, it offers live data and other meaningful tools on the same screen to improve your trading experience.

Some of the services offered include trading in mutual funds, equity, F&O and commodity, insurance, NCDs and bonds. The firm offers four main account types with varied features to suit a wide variety of customer needs. These accounts are first step account, classic account, TigerTrader account and HNI account.

Sharekhan has a research team that frequently publishes stock tips, investment advice, result analysis of listed companies and news alerts via email or SMS. Also, there is a remarkable knowledge centre on the official website to help all types of investors. In addition, it provides free online seminars and physical classroom workshops. Each account gets a Sharekhan representative.

Pros and Cons of using Sharekahn

Pros:

- Low trading fees

- Reliable customer service

- State of the art trading platforms

- Top-notch research

- User-friendly interface on web and app

- Full range of investment options

- Wide reach across India

Cons:

- Few order types

- Limited customization

- Credit/debit card not supported

How Sharekahn Works

Sharekhan operates a 2-in-1 account that includes a trading account and Demat account.

The receipts and payments for trading shares, commissions and charges involved are posted in the trading account. On the other hand, the stocks you buy or sell on your trading account are received or delivered from your Demat account.

To make your account active, you will be required to fill and sign all the forms in the registration process, and submit the relevant legal documents. Once the team approves your application, Sharekhan will open an account for you. The company reserves the right to either accept or reject your application.

Getting Started on Sharekahn

You need a trading account to start trading currencies and commodities. However, if you want to invest in equity, where you hold shares for a few days or months, you must open a Demat account.

The process of opening an account on Sharekhan is straightforward; there are numerous local offices spread across India, especially in neighborhoods where the firm has prospective customers.

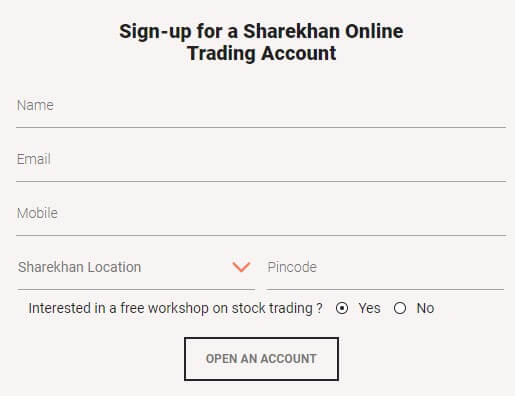

To open an account, you need to follow the process below:

First, make an online request. Go to the official website and click the ‘Open an account’ button. Submit your contact information such as your name, email address and phone number. Within a few hours, you will be contacted by a Sharekhan advisor to arrange a meeting to visit your home or office. Before you even meet, you can ask for a demo account to familiarize yourself with the platform.

Second, visit a local office or a sub-broker. Find a local Sharekhan branch or sub-broker near you and visit them personally. Apart from getting help to open an account, you will get a detailed demonstration of the products they offer.

The last step is verification where you will be required to provide the following documents:

- Pan card copy

- Copies of your Aadhar card, passport, ration card, passport and driving license as proof of identity and address

- Saving account details

- Latest passport size photographs

If you want to trade futures and options, you will also be required to provide any of the following documents:

- Bank statement from the past six months

- Latest salary slip

- Acknowledgement ITR copy

- Copy of Form 16

Tradable Assets on Sharekahn

Although Sharekhan allows you to trade in a wide variety of asset classes, the selection is not competitive in each class. Apart from stocks, these are the other investment options offered.

- Forex

Sharekhan supports forex trading but only as futures. The only problem is that it only features a few currency pairs that include EUR/USD, JPY/INR, USD/JPY, EUR/INR, USD/INR and GBP/USD. Although other brokers have a wider forex offers, most of them do not provide currency paired with Indian Rupee.

Lot sizes are fixed and defined by the exchange. Sharekhan requires you to trade in a minimum of 1,000 quantity in corresponding currency pairs. The minimum quantity required is also called lot size. Therefore, 1 lot is equal to 1,000 quantity. For instance, if the USD/INR exchange is Rs 63, you will have to trade with 1 lot, which means $1,000. This means that you will be buying a minimum of $1,000 to anticipate the movement of the currency pair. This applies to all the currency pairs on the service.

There is margin trading which means you will not need to pay the full amount of the currency pair you want to invest in but enjoy the gains of the total buying amount. For instance, when you buy 1 lot of a USD/INR future contract that costs Rs 63, it means you are buying it at Rs 63,000. Since this is future trading, you will get a margin facility of 3% of the total investment. So, instead of buying a single lot at Rs 63,000, you will only need to pay Rs 1900.

- Mutual Funds

Sharekhan features a wide selection of mutual fund providers. A mutual fund is an investment vehicle that consists of a pool of funds to invest in various assets such as bonds, money market instruments, currency, etc. It is run by a money manager who has the responsibility to invest the funds to produce gains and income for the investor.

There are various types of mutual funds offered here which include equity MF, hybrid MF, debt MF and solution-oriented scheme MF. Equity mutual fund is suitable for investors with small amounts. In many cases, these individuals have little or no knowledge about the stock market and do not understand how to study and track stocks. A fund manager will sort out these needs. The wide range of equity mutual funds include multi-cap fund, large-cap fund, mid-cap fund, value fund, small-cap fund, contra fund, focused fund, etc.

A hybrid mutual fund is a type of mutual fund that involves two or more asset classes. Most hybrid funds involve a mixture of bonds and stocks. Some of the hybrid funds available here include conservative hybrid fund, aggressive hybrid fund, balanced hybrid fund, arbitrage fund, etc.

In most cases, debt funds have a lower expense ratio than equity funds. This is because of lower management costs involved. Also, they pay a fixed interest rate and have a fixed maturity date. Some of the debt mutual funds include overnight fund, liquid fund, low duration fund, money market fund, etc.

The solution-oriented schemes involve a portfolio that is made up of a mixture of equity bonds and stocks. Subcategories include retirement funds and children’s funds.

- Bonds

A bond is a debt instrument offered to raise capital. It can be issued by a government, financial institution or company. Those issued by the government are considered to be the safest. Bonds are grouped based on credit rating, tax status and maturity period. There are certain tax free-bonds offer tax benefits.

According to section 54 EC of the income tax Act of 1961, all tax categories of taxpayers are eligible to save tax, especially for long-term capital by investing in certain prescribed bonds. These bonds are classified as ‘long-term specified assets’ and issued by REC, NHAI, NABARD and SIDBI. There is no clear information on the types of bonds you can trade on Sharekhan.

- Options

An option is a contract that will enable you to trade underlying assets such as security, ETF or even index at a predetermined price before the contract period expires. Options are bought and sold on the options market where contracts are based on securities. An option that allows you to buy shares at a later time is known as ‘Call option’ while an option that enables you to sell shares later is called ‘Put option’.

Options are considered low-risk because you can withdraw it at any time before the contract expires. Alternatively, you can call a representative to request him/her to make trade orders on your behalf.

Types of Accounts on Sharekahn

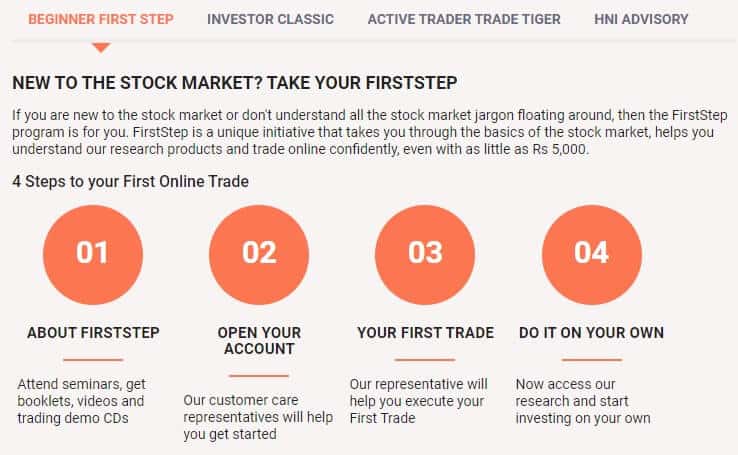

First Step Account

This is an excellent option for those starting in the stock market world. On this account, you will get immediate assistance, even for the small issues you face when trading.It offers extensive research in the form of booklets, demo CDs and seminars. There will be Sharekhan executives to guide you through all the steps involved when starting. In fact, even if you don’t know how to execute a trade, they can assist in your first trade and show you how to do it.

Investor Classic Account

The classic account provides an easy way to invest by just clicking a button. You will be able to start using the live account without going through a lot of formalities and paperwork. This account allows you to execute orders instantly and get real-time prices. In addition, you will be able to access live analysis before and after market hours conducted by experts.On this account, you will get notifications when the sale of share is available and for cash transfer on purchase. In addition, it comes with a Demat account and a digital contract to create a real-time portfolio to track your trade status as well as levy your trust.

There are numerous benefits of using this account. First, you contact a Sharekhan representative and get valuable advice before risking your money on the live trades. Also, you can trade on phone and get a confirmation via email. If you have a bank account in HDFC or Citibank, there is also an auto-transfer feature.

TraderTiger Account

This account is ideal for active traders who want to invest in the stock market. It is an integrated account where you can invest in the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), IPOs and mutual funds.The account’s layout has a professional look, allowing you to keep watch on multiple indicators using a single screen. Moreover, you can customize the alert settings based on the changes in the stock market.

The benefit of this account is that you can execute multiple trades. Also, it features a graphical presentation to enable you to study KST, RSI, MACD, etc. In addition, you will get access to a range of professional tools that include span calculator, action watch, market summary, tick query and many more.

HNI Advisory Account

The HNI Advisory account is intended for people seeking personalized investment advice. You will get a relationship manager who will keep constant communication and send updates and alerts regularly. One of its key features is the Portfolio Doctor tool that can analyze, rearrange and design a model portfolio.Features of Sharekahn

Investment Cart

This is an enhanced watch-list feature with advanced functions such as comparable stock suggestions and bulk buy option. It also enables you to have quick access to a relationship manager.

InstantMF

This is a lifetime free account for investing in mutual funds. The process of opening this account is simple and only takes a few minutes to complete. It has various remarkable features such as lumpsum investment option and SIP option.

NEO

NEO enables you to make investment decisions that match your financial goals. It is an automated investment support tool that suggests mutual fund investments based on your risk profile.

Sharekhan Classes

Sharekhan offers several online classes for both traders and investors. The classes are categorized as follows:

- Trading basics, mutual fund investment and wealth creation

- Advanced concepts involved in trading such as positional trading, technical analysis and common trading tools

- Investment strategy courses and workshops

Dial-and-Trade

This is a free phone-based service that allows you to place orders. A tele-broker will be assigned to advise you and execute orders on your behalf. To use this service, you will need to have a phone ID (IVR Code) and TPIN.

Sharekhan Mini

This is the miniature version of the main Sharekhan trading platform. It is accessible on your mobile browser even with low internet bandwidth.

Sharekhan App

Although Sharekhan has a history of releasing apps, most of them have received negative attention.

Recently, the firm introduced a new trading app that is getting a lot of positive responses because of its performance, accuracy and speed. The app comes with numerous features such as live reports, news and market trends, etc.

Sharekahn Fees

Even though Sharekhan trading fees are low, they are not transparent.

The website does not have any official information about the fees involved. Instead, you are required to contact customer support to get information.

Non-trading fees are relatively fair. There is no withdrawal or inactivity fee. Also, you will not incur any Depository Participant (DP) transaction charges. However, you will be charged a maintenance fee of INR 400 from the second year onwards.

Deposits, Withdrawals and Supported Payment Methods

Sharekhan does not charge a deposit fee. However, you can only use a bank transfer because the platform does not support electronic wallets and credit/debit cards. The only issue with the bank transfer is that it takes several business days to process. Also, you can only use an account with your name.

There are no withdrawal fees involved, and you can only withdraw through bank transfer. Also, you can only withdraw using an account with your name. The withdrawal process takes approximately one business day, which is better than most of its competitors.

Research and Education

Sharekhan offers various research tools and extensive educational materials. For instance, you will get trading ideas from reports based on your requested company.

In addition, the stock broker provides fundamental data such as financial statements, cash flow statement, balance sheet, etc. In terms of education, Sharekhan provides tutorial videos, free workshops and educational videos and articles.

How Safe is Sharekahn?

Sharekhan is a subsidiary of BNP Paribas, which is a reputable company listed on the Euronext Paris Stock Exchange.

It is regulated by the Securities and Exchange Board of India (SEBI), which is a clear indication that Sharekhan is a safe broker with reliable services.

Customer Support

Customer support at Sharekhan is very impressive. You can get in touch with support through telephone, live chat or email. Alternatively, you can visit their offices spread across India.

Sharekahn Review – The Verdict

Sharekhan is a well-known broker with a long history.

On the bright side, it features a robust trading platform, low trading fees, reliable customer service, extensive education material and a variety of research tools. However, there are a few drawbacks such as its non-transparent trading fees and the fact that it is only available in India.

If you’re an aspiring Indian stock broker, it’s highly recommended that you try out its services.

FAQs

Is Sharekhan a discount broker?

Sharekhan is not a discount broker but a full-service broker that offers a wide range of services such as retail trading, mutual funds, investment, portfolio management services, etc.

What is the meaning of Sharekhan Flexi Invest?

This is a plan that offers the flexibility to change the SIP amount without incurring the electronic clearing system (ESC) fee. It saves you from the complicated process of changing ESC every time you want to change the SIP amount.

Is it good to trade on Sharekhan?

Sharekhan is ideal for all types of investors. Those that trade in high volumes will enjoy extremely low fees. Also, it is a good option for new traders because of its extensive educational materials and research tools. Senior traders who are not tech-savvy can use the free dial and trade facility where they can place their orders through the telephone.

How much is Sharekhan’s annual maintenance fee?

The annual maintenance charge (AMC) for a trading account is zero. However, you can be charged Rs 300 for the Demat account, which is affordable compared to its competitors.

How much does Sharekhan charge for intra-day trades?

Also known as Margin Intraday Square-up (MIS) orders, Intra-day trades on Sharekhan are charged 0.1%. All open intraday orders are auto squared-off by the end of the day.

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up