Freetrade Review for 2021

Initially, trading stocks was an expensive, time-consuming and painful experience, which is why most people were not interested in it. Thanks to the proliferation of online trading platforms such as Freetrade, more people are now interested to try stock trading.

Established in 2015, Freetrade is a legitimate and secure stock broker that is regulated by top-tier agencies. Although it is a relatively young brand, it is increasingly gaining popularity around the world.

Read on learn what the Freetrade stock broker is, how its trading platform works, types of accounts it offers and many more.

-

-

Our Recommended Stock Broker - 0% Fees

Our Rating

- 0% Commission on Stocks

- Trade Stocks, Forex, Crypto and more

- Only $200 Minimum Deposit

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.What is Freetrade?

Freetrade is a famous UK-based stock broker that offers four main ways to trade. You can use its trading platform for forex trading, CFD trading, share dealing and spread betting.

Aside from requiring no minimum deposit for its users, there are no commissions or dealing charges involved when using Freetrade. This is because it aims to change the trading industry by making it easier and cheaper to buy and sell shares.

When choosing a stock broker like Freetrade, it is important to consider its administrative body and regulatory status. Freetrade is regarded as a safe and legitimate trading platform because it is regulated by the Financial Conduct Authority (FCA). This means it cannot engage in fraudulent activities like manipulating market prices. Also, if you request a withdrawal of your funds, you can be assured that it will be processed quickly.

In October 2019, the company got $15 million in Series A funding. The funds are intended for product development and further growth. It has over 100,000 customers in the UK and it is planning to expand into other parts of Europe such as Ireland, Netherlands, France and Germany. According to the CEO and founder of Freetrade, there will be an aggressive campaign to reach more millennial customers and educate them about the best stock trading strategies.

Freetrade is one of the few brokers that enable traders to purchase fractional shares. This means that you can buy a part of a share instead of the whole amount. For example, if a share costs £100 and you don’t have the full amount, you can pay £50 only and purchase 50% of the share.

Pros and Cons of using Freetrade

Pros:

- No minimum deposit required

- No withdrawal and inactivity fee

- Free stock and ETF trading

- User-friendly interface

- Lucrative affiliate program

Cons:

- Inadequate research and education

- No phone support

Freetrade – How Does it Work?

Freetrade allows you to invest in more than 600 stocks and ETFs for free.

When trading on Freetrade, you are responsible for the change in price between when you place the order and when it gets executed. You can avoid paying too much by initiating a price limit on every order. If the order surpasses the threshold, it is either cancelled or the number of shares will be adjusted to meet your maximum order value. This means that you cannot incur losses beyond the limit you have set.

This stock broker also offers the option to execute your trades instantly wherein you will be charged £1 per trade, which is much lower than the average in the industry. However, be mindful that this is the default investing mode. If you don’t want to incur the £1 fee, make sure to turn it off.

Freetrade supports GBP as the only base currency. You will incur a conversion fee when you trade with USD-denominated stocks and ETFs. Currently, the conversion fee is the FX spot rate of +/-0.45%.

Getting Started on Freetrade

The Freetrade app is available for free on Google Play for Android devices and Apple store for iOS devices. Once you have downloaded the app, you can create your account.

Creating an account on Freetrade is very easy and straightforward. For tax purposes, you need to be a UK resident and have a UK bank account. Some of the details you have to submit include your full name, date of birth, address and national insurance number.

Currently, Freetrade does not provide a direct portfolio transfer service from another broker. So, to start investing, you need to fund your account through a bank transfer or Google Pay.

Once you have funds in your account, use the ‘Discover’ button to find the stocks you want to buy. On Freetrade, you will only need to search the stock by name or ticker.

Go to the ‘Buy’ page of your preferred stock and submit details as to how much you want to invest. The app will give you an estimate of how many shares you can buy with the money your account currently has.

After your order has been approved, you will receive a contract note. The contract notes can also be accessed on the activity section of the app.

Tradable Assets on Freetrade

Most online trading platforms feature a wide range of assets to trade. However, on Freetrade, you can only trade with stocks and ETFs. The platform does not offer other asset classes like bonds, options and mutual funds.

Fortunately, Freetrade always adds new stocks and ETFs which are often suggested by its community of traders. Right now, its trading platform has over 600 stocks available to trade. Most of the companies are listed on the London Stock Exchange (LSE) and NASDAQ and New York Stock Exchange (NYSE).

- Stocks

- ETFs

Types of Accounts on Freetrade

There are only two types of accounts on Freetrade. These are the basic account and investment savings accounts.

Basic account

This is the main account on the app that will allow you to trade stocks and ETFs.It is free and only available to UK residents. On this account, after earning £12,000 in capital gains and £2,000 in dividends, you will start to pay the capital gains tax and dividends tax respectively.

ISA account

A stock and shares ISA is a tax wrapper that enables you to invest up to £12,000 per year without incurring any taxes. However, there are rules on what you can and can’t invest using an ISA. Luckily, there is a wide variety of stocks on the US and UK exchanges that are open to ISA accounts.Freetrade charges £3 a month for an ISA account. This means you will pay £36 per annum, which is a great value and one of the most competitive rates in the market. Remember that you can only have one active ISA account per year.

Features of Freetrade

No Minimum Amount

Unlike most brokers, Freetrade does not require you to have a minimum amount of balance to start trading. This means that you can start to invest even if you have £1 in your account.

Fractional Shares

This is an exceptional feature ideal for traders with little money to invest. Just like the name suggests, you can purchase part of a share if you don’t have the full amount to buy it as a whole. You can do this on a wide variety of US and UK stocks as well as ETFs available on Freetrade.

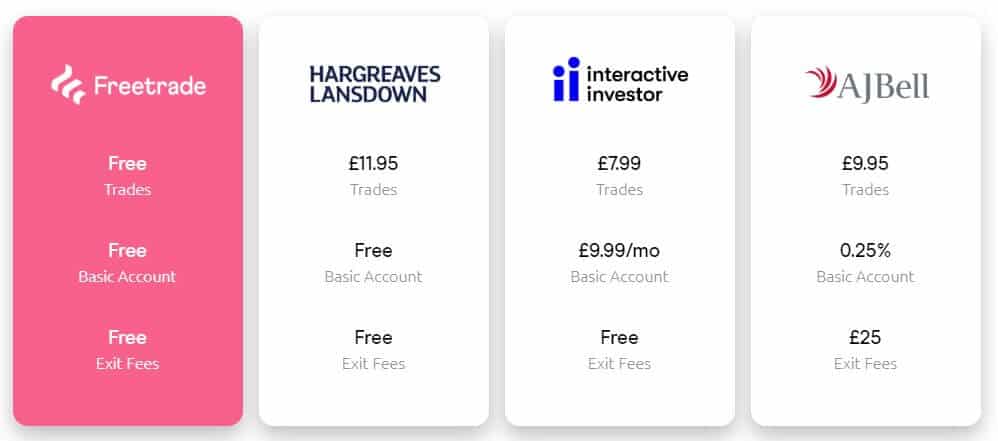

Zero Commissions

When it comes to investing, keeping costs to a minimum is always a good move. Although most brokerage firms charge a commission of between $10 and $20, Freetrade allows you to trade ETFs and stocks for free.

Regulated Stock Broker

Freetrade is regulated by the Financial Conduct Authority (FCA), which is one of the top regulatory agencies in the world. This is an indication that Freetrade is a legitimate and safe broker to invest in. Also, since it is listed in the London Stock Exchange (LSE), there is no dealing with third-party brokers that could otherwise add fees.

On top of that, you will be covered by the UK investor protection scheme called the Financial Services Compensation Scheme (FSCS). It can protect against the loss of cash and securities in case the broker goes bankrupt.

Wide Selection of Stocks and ETFs

Freetrade has a limited product portfolio where you can only invest in stocks and ETFs and trade stocks and ETFs listed on the London Stock Exchange (LSE), NASDAQ and New York Stock Exchange (NYSE).

Fortunately, Freetrade continuously adds new stocks and ETFs. At the moment, there are over 600 stocks and ETFs available to trade. According to the firm, new stocks and ETFs will be added in the next few months.

Intuitive Mobile Trading Platform

Freetrade offers a proprietary mobile trading platform with superb design. You can familiarize yourself with the app within a few minutes. The app is available on Android and iOS devices for free.

Logging into your account is very easy via a four-digit password or biometric authentication. The search function is handy since you can find an asset by typing its name or ticker. Also, the categorization makes it easy to search for assets.

Referral Program

Freetrade operates a referral program known as Free Share, where you can get up to £200 when you refer your friends. You can only get the referral link after you deposit funds in your account and fill the W-8BEN form. To start with, you will be given one referral link. However, once you have successfully invited a friend, you will be given multiple referral passes. Expect the share reward within 7-10 days.

Below are some of the terms of the referral offer.

- The referral program is only available for qualified customers.

- You cannot send a referral pass to an existing or previous customer.

- The stock is only awarded if the invited friend has used the referral pass to sign up and fund his account.

- The invited friend must fund his account with 30 days after receiving the referral link.

- The referral program is only available to UK residents. Unfortunately, it is not available for US nationals who reside in the UK.

Freetrade Fees

When choosing a trading app, you should look out for the trading and non-trading fees.

Trading fees occur when you trade. Trading fees include financing rates, commissions, conversion fees and spreads. Non-trading fees include charges that are not associated with trading like inactivity or withdrawal fees.

Trading stocks and ETFs on Freetrade is free. Recently, the stock broker removed the commissions on instant order execution as long as the basic order is executed by the end of the day at 4pm. An instant order is executed immediately you place the order.

On the other hand, non-trading fees are very low on Freetrade. If you choose the basic account, you won’t incur any monthly charges or inactivity fees. However, if you choose the ISA account, you will be charged £3 per month.

Deposits, Withdrawals and Supported Payment Methods

Deposit and withdrawal processes on Freetrade are free and user-friendly. At the moment, the broker does not charge deposit fees. Some of the accepted payment methods include bank transfer, Apple Pay and Google Pay.

The Apple Pay and Google options are instant while a bank transfer can take several business days to complete. Also, when using the bank transfer option, you must use accounts under your name.

There are no withdrawal charges on Freetrade if you choose the non-same-day option. The same-day withdrawal is charged £5. You can only withdrawal using bank transfer, which takes about two days to complete. Also, you can only send funds to accounts under your name.

Research and Education

Research tools and education on Freetrade are limited.

For instance, the charting is shallow, showing only basic information without any technical or appropriate tools.

Although there is no demo account, webinars or educational videos about basic stock trading topics are provided by Freetrade. Educational resources for professional stock traders are very limited.

Security

One of the biggest factors to consider when choosing a stock broker is whether it is licensed and regulated. Freetrade is being regulated by the Financial Conduct Authority (FCA), which is a reputable regulatory authority.

In addition, it is audited annually by PricewaterhouseCoopers (PwC), which is one of the biggest auditing firms in the world. Freetrade’s customers are also covered by the Financial Service Compensation Scheme (FSCS). This means that your funds will always be protected even if the firm faces financial issues in the future.

Customer Support

Freetrade has very reliable customer support.

In case you face any issue, you can contact the customer support through a live chat. Although it is fast and responsive, it is not available 24/7. Alternatively, you can contact them through email or phone.

Freetrade Review – The Verdict

While Freetrade does not offer a lot of assets compared to its competitors, it is still a great trading app that is continuously gaining popularity among millennials.

The stock broker’s main feature is the low fees that it charges for trading and non-trading activities. Aside from having no minimum account balance, it is also free to trade stocks and ETFs. Users are required to pay any monthly inactivity fee.

The only minor issue with the Freetrade app is that it only features US and UK stocks and ETFs. Also, it is only available as an app and only accessible by UK residents.

Nonetheless, Freetrade is a great stock trading app for new traders so make sure to sign up once you’re ready to start your stock trading journey.

FAQs

How much does it cost to trade on Freetrade?

Downloading the Freetrade app and creating a basic account is free. Also, there is no minimum amount required and no transaction costs involved when trading stocks and ETFs. Initially, the trade was only executed as a batch by the end of the day. Now, there is an instant trade feature on the basic account. Currently, it will cost you £3 a month to run the ISA account. With US stocks, you will incur a conversion fee of FX +- 0.45%. While withdrawing money from the bank is free, the same day withdrawal costs £5.

Is there a premium version of the Freetrade app?

Freetrade launched its proprietary brokerage platform dubbed as ‘Invest by Freetrade.’ The new trading app is expected to include robust features. Like the current version of the Freetrade app, the new version will also have the fractional trading feature. It will allow you to invest in big companies by buying a fraction of their shares. Aside from the new app, Freetrade is also planning to launch a premium account known as Alpha. However, it has not revealed yet the full details on when it will come and what it will include.

How do I win the free share worth £200 on Freetrade?

Freetrade operates a referral program that offers a free share ranging between £3 and £200. To earn it, you have to send your friend a referral link. If the invited friend downloads the app, sign up, fund his account and complete the W-8BEN form, you both get the share. It takes between 7 to 10 days to get the reward and is only available on the basic account. After successfully inviting the first friend, you can be given more referral links to invite more friends, although this is not guaranteed. Note that the chance of getting the high-value stock worth $200 is very slim.

How to open a Freetrade account?

The process of opening a Freetrade account is simple and fast and only takes 10 to 15 minutes to complete. Download the app on your device, add your details, select your account type and start trading. If you want to have a higher deposit and withdrawal limit, you will be required to upload your documents to verify your identity and address. Government-issued IDs such as your passport and driving license are accepted as proof of identity while utility bills and bank statements can be used as proof of address.

What taxes will I pay when I have a Freetrade account?

The first tax you will incur when trading on Freetrade is the 0.5% stamp duty (reserve tax), which applies to all UK-listed stocks traded electronically. It is paid at the point of purchase and applied to the total transaction cost. Capital gains tax (CTG) is the second tax you pay when trading on Freetrade. You pay it when you realize gains from selling stocks or ETFs. The dividends you receive are taxed as income and not as capital gains. You can avoid paying taxes by opening an ISA account. For every tax year, the maximum amount you can add to your stock and share ISA account is £20,000. All the returns you get from this account are not taxed. Dividends paid are also tax-immune.

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Freetrade is a famous UK-based stock broker that offers four main ways to trade. You can use its

Freetrade is a famous UK-based stock broker that offers four main ways to trade. You can use its