ETRADE Review 2021 – Is it the Right Broker for You?

E-Trade financial corporation (E*TRADE) is an electronic trading platform where investors can trade the widest variety of financial assets. Here, you can trade futures contracts, common and preferred stocks, ETF, options, mutual funds and a host of fixed-income investments. Etrade fees start from $6.95 per trade. This doesn’t make it the cheapest among the reputable stock brokers. However, Etrade compensates for the high fees by providing its clients with a wide variety of trading tools as well as educational and wealth management resources.

But who does the broker appeal to most? What are the trading fees on its different platforms and where does it shine and shilly-shally? We have broken all this down in this etrade review.

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Etrade stock brokerage overview?

First off, understand that etrade is a discount broker – implying that it offers more of a stock and financial products trading platform and less of investment advice. It is available in three trading platforms that are free to open for all their customers. You don’t even need a minimum trading activity or operating balance to maintain one. These include:

First off, understand that etrade is a discount broker – implying that it offers more of a stock and financial products trading platform and less of investment advice. It is available in three trading platforms that are free to open for all their customers. You don’t even need a minimum trading activity or operating balance to maintain one. These include:- E-trade web: The web-based online platform allows you to stream live market data, access real-time trading quotes, and commentaries for free. It also gives you access that helps you spot emerging markets for free. Not to mention it also features highly intuitive and and resource-rich dashboard that you can use to track your accounts and investments.

- E-trade Pro: is a desktop app that boasts of all the features of the web platform. Additional resources that you will most likely find here include the strategy scanner and complex options market strategies. It also allows you to backtest different strategies to assess their capabilities.

- Power E-trade: This is by far the most sophisticated and innovative free trading platform by etrade and within the larger discounted brokerage markets yet. It is a web-trading platform that features a compressive list of both basic and advanced trading and analysis tools for the stock, options and futures markets. Some of the power features included on the platform include automated technical analysis and charting tools, risk analysis tools, 30+ drawing tools, different chart layouts, and 100+ trading studies. Plus they are all availed in plain and easy-to-understand English not the usual financial market jargon.

- Etrade mobile trading platforms: We also found out that etrade discount broker is one of the few – if not the only one – with two mobile trading apps. And according to their website, the ETRADE APP is designed to help you stay in touch with the markets and open accounts while on the move. The POWER ETRADE APP, on the other hand, features al the pro trading tools and resources of the power etrade platform and the app is only meant to help brings the platform closer to the trader.

What is Etrade best for?

Etrade and its multi-layered trading platform that caters for all the different types of traders:

- The basic trading tools, plain and easy to understand trading language, backtesting tools and educational and training resources make it suitable for BEGINNER INVESTORS.

- The sophisticated and highly advanced analysis and trading tools make it most adapted to ELITE INVESTORS

- The attractive welcome bonuses and discounted trading fees and commissions make it suitable for ACTIVE/FREQUENT TRADERS.

How does it work?

ETrade is a discount broker specializing in the buying and selling of such financial investment products like etrade stock, options, and futures. The three-decade-old brokerage firm and an industry pioneer in the electronic trade has over the years come up with innovative trading platforms. These make it possible for investors and traders alike to not only follow different markets but also make more informed decisions when entering into positions. Plus an Etrade account isn’t discriminative and can be used by both the day traders and position takers.

The comprehensive etrade platforms support different kinds of trades including buy (long) and short (sell) positions. It also gives you access to the real-time stock and commodity markets. And you don’t always have to execute trades at the prevailing market conditions. The advanced range of trading tools available here makes it possible for you to enter into limit orders. This implies that you can open a trade for a stock or commodity at rates higher or lower than the prevailing rates, and have Etrade systems hold back on its execution until your desired price is reached.

How to make your first trade on ETrade:

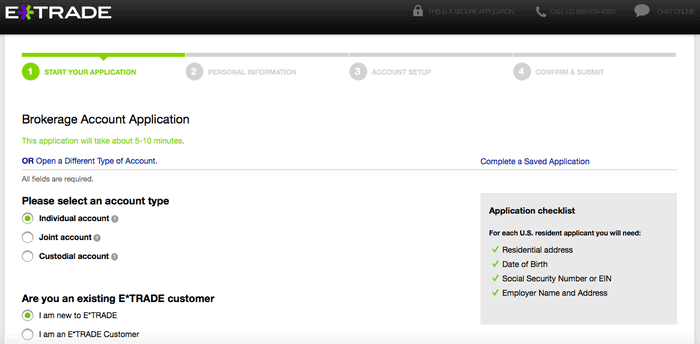

Step 1: Create an etrade account:

On the etrade homepage is the ‘Open an account’ that directs you to the account creation page. Here, you will need to fill in such personal details as your name, email address, social security number, D.O.B, and address as well as your employer’s name and address.

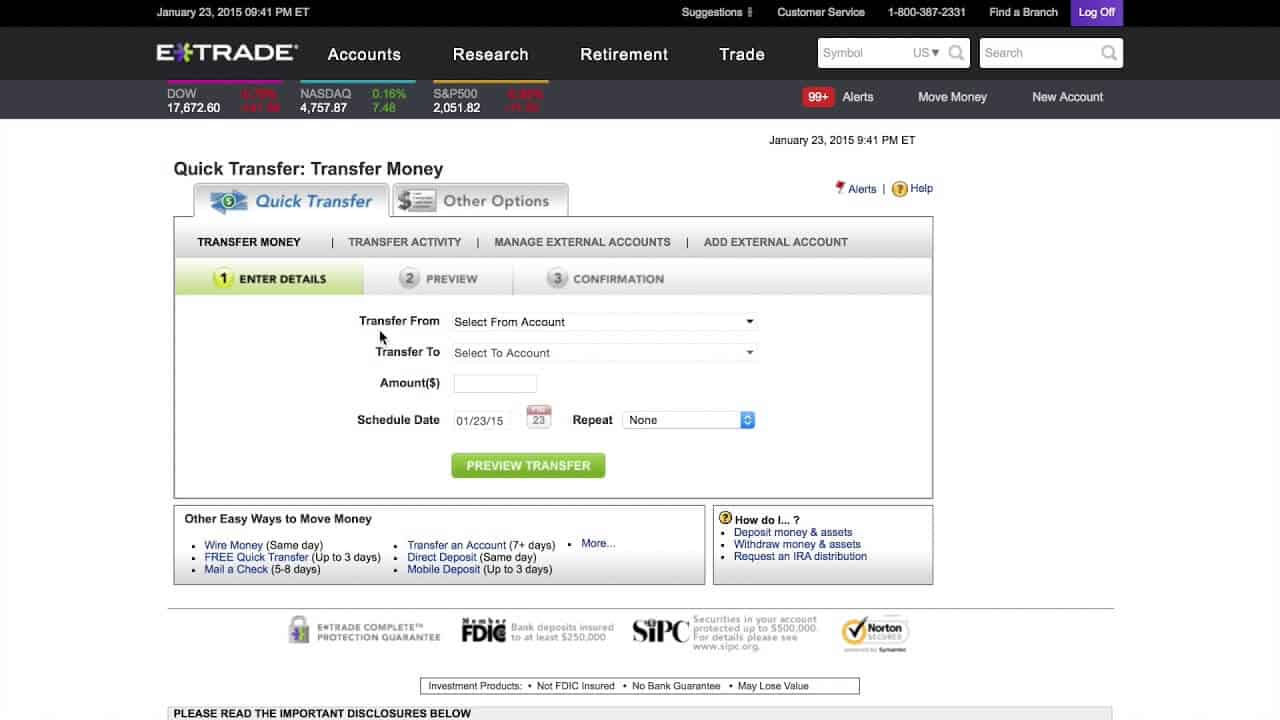

Step 2: Fund the account

There are three primary ways of making your initial deposit into your etrade account. You can write a check, pay through bank wire transfer or transfer funds from another brokerage account. However, the discount broker doesn’t support credit and debit card deposits or direct purchases.

Step 3: Use the screeners to identify a viable trade

These first two steps give you access to the etrade dashboard and all its trading and analysis tools and indicators. What we find most interesting at this stage are their screeners . Use the screeners to identify and vet different etrade stocks and financial products. Then identify a strategy whose risk management settings best align with your trading style.

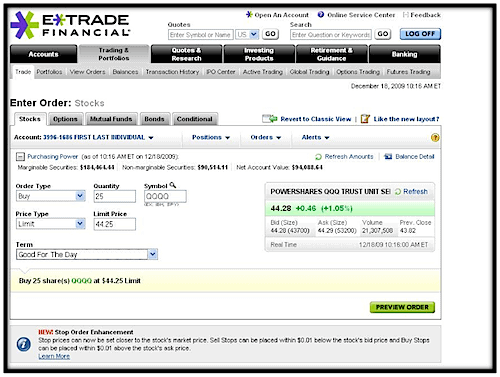

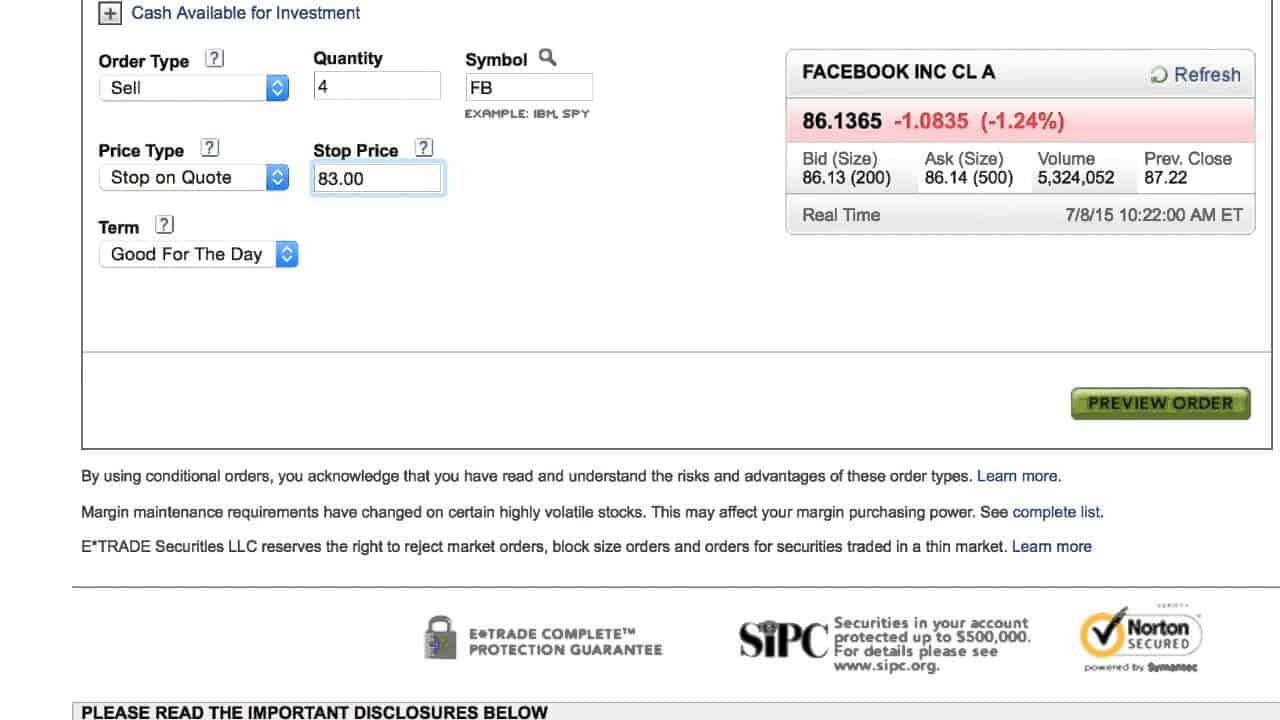

Step 4: Customize your order entry

One of the things we find most interesting about the etrade account dashboard is the level of customization that goes into entering a trade. You can, for instance, settle for immediate trades by choosing to enter into a trading position using the prevailing market rates. Alternatively, you can enter into a ‘limit’ order that gives you a chance to set a desired trade entry position. These can be higher or lower than the prevailing market rates. And the discount broker won’t execute the trade until these market position-entry conditions are met.

Step 5: Preview and take it live

The last step to trading etrade stocks and other financial instruments is the ‘preview order’ stage. This gives you a chance to review the order conditions before you can click on the ‘place order’ that takes the position live.

Etrade fees and trading charges

First off, it is important to point out that E*TRADE isn’t the cheapest discount broker out there.

To open an Etrade account and gain access to the Etrade dashboard and all its accompanying tools and resources, you will need a minimum of $500.

The first 30 trades per quarter will then cost you $6.95 each after which they rescind to the discounted rate of $4.95 per trade.

A broker-assisted trade, on the other hand, costs $25 per trade.

Etrade also treats every new account to 100 free ETF trades. Note that while you aren’t being charged a commission for these 100 trades, you will still have to pay the annual expense fee that ranges from between $0.19 and $0.75 per annum.

Plus if you are more inclined to managed trades and robo advisors, Etrade has an in-house automated trade platform referred to as the Etrade Adaptive Portfolio. It is a portfolio management platform that blends the power of both algorithmic and elite human traders. And to hold an account here, you need a minimum of $5,000 and its annual advisory fee starts from 0.30% per annum.

What are some of E*TRADE’s key strengths and weaknesses?

Strengths

- Multiple and quite comprehensive trading platforms:

Etrade is one of the discount brokers with the highest number of proprietary trading platforms. Its members are free to use one or all three platforms. These come with a long list of comprehensive and highly advanced trading and analysis tools and indicators for free. Some popular innovative tools available here include etrade stock screeners, strategy scanners and 100+ technical studies. They all are highly customizable, plus there are demo etrade accounts that let you test and practice trades on each platform.

- Wide range of financial trading instruments:

Etrade further maintains the widest and most competitive list of tradable financial instruments. It, for instance, hosts 250+ commission-free ETFs and over 4,400 no-transaction-fee mutual funds. The Etrade analysts are also regularly monitoring these mutual funds and ETFs markets to come up with the in-house All-Star Fund Report. This highlights all the leading no-load funds and ETFs available on their platform.

- Wide collection of educational and training resources:

Etrade can be viewed as an emerging hybrid discount broker. This implies that while being a discount broker ideally means that it should only offer trading and not advisory services, etrade is dedicated to stock/ forx education and training. Its elite analysts are constantly holding online webinars and in-person events at their branches.

- Reliable customer support:

Etrade also maintains a highly competent customer support team. You can access them online 24/7 via email, phone, and the website’s live chat. It also is one of the few online brokerages offering in-person customer support and advice in one of their 30 physical branches across the country.

- Highly versatile:

We consider etrade quite versatile because they aren’t just available on a web-trader platform but also as a mobile app. The discount broker currently runs two specialist apps – available for both android and iOS users.

Weaknesses

- Fees and commissions:

At $6.95 per trade plus $0.75, %1.50 and $1.0 for options, futures, and bonds respectively, we consider Etrade fees rather uncompetitive. And our conclusion is informed by the downward trending trading prices in the industry. It is not uncommon to see discount brokers like Robinhood impose relatively low and even free trades.

- No forecasting tools:

One of the most interesting things about etrade is their support for limit orders. This allows you to enter the market at rates higher or lower than the prevailing market rates. There is however one huge limitation to this type of trade. Etrade doesn’t provide its traders with forecasting tools to help them assess the market direction. And they have to rely on third-party – often paid – forecasting analysis tools.

- Uncompetitive account minimums:

In an industry where brokerage firms are looking to woe more traders with low account minimums, etrade remains uncompetitive. The platform demands a $500 initial deposit. We consider this expensive given that equally popular discount brokers like Merill Edge and Fidelity don’t call for a minimum operating balance.

- You will have to use different platforms to access all tools:

It also is frustrating to note that no single platform has unified the etrade innovative trading and analysis tools. You, therefore, will need to use all the trading platforms if you hope to enjoy all tools and indicators.

Bottom line

Etrade is and remains one of the most innovative discount brokers around. And this claim has the backing of its highly innovative trading/analysis resources and comprehensive trading platforms. We particularly appreciate that it takes into account the trading needs of the different classes of traders. Beginners, slightly experienced and elite traders have a near equal chance of making it here. Not to mention that the broker also has the managed Etrade Adaptive Portfolio for passive investors. If you are looking for a discount broker to invest with, start by comparing etrade’s strengths and such weaknesses as high trading fees. And only register with them if you believe the perks outweigh the downsides.

Glossary of Trading Platform Terms

Platform Fee

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per trade

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

Margin

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social trading

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy Trading

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instruments

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

Index

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

Commodities

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investment

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limit

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day traders

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

How do I open an Etrade account?

There are three primary ways of opening an etrade account. You have the first option as completing their online registration form on the etrade website. You can also open the etrade account via phone call or by downloading the registration form from the site, signing it, and sending it back via email.

What are the etrade account fees and commissions?

Etrade charges $6.95 for the first 30 trades relating to stocks, options, and ETFs. Any other trade after that is charged a subsidized fee of $4.95. However, options contracts attract an additional fee of $0.75 per contract for the first 30 contracts and $0.50 for everything else above that.

What do I need to open an account with Etrade?

Etrade has a relatively straightforward account opening process that starts by choosing the type of account you wish to open either individual, joint or custodial and filling in your details. The broker also expects you to fund the account with a minimum of $500 within 60 days of account opening.

Is Etrade a broker?

Yes, etrade is considered a discount broker. Simply put, it is a brokerage firm that offers discounted prices on trades by cutting down on some brokerage services. Here, you only get access to a trading platform and trading advice from a human expert comes at a fee.

What financial products can I trade on etrade?

Etrade gives you access to a full range of financial trading instruments ranging from stocks, futures, ETFs, Options, mutual funds, bonds, and CDs.

See Our Full Range Of Broker Resources – Brokers A-Z

See Our Full Range Of Broker Reviews – Broker Reviews A-Z

Edith Muthoni

Edith Muthoni

View all posts by Edith MuthoniEdith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. She holds a Masters degree in Economics with years of experience as a banker-cum-investment analyst. She is currently the chief editor, learnbonds.com where she specializes in spotting investment opportunities in the emerging financial technology scene and coming up with practical strategies for their exploitation. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up