Acorns App Review 2021 – Is It Suitable For You?

The days when only a few people had access to investment opportunities

Today, almost anyone with a smartphone can take a plunge into the world of investing, without experience or knowledge about how the markets work, and more importantly, with less and less money. Most FinTech start-ups today are targeting small value investors and more specifically younger people who find it hard to save, let alone invest.

In this Acorns review, we look at a platform that allows you to invest using spare change by rounding up the purchases you make

-

-

What is Acorns?

Acorns is a micro-investment app that was founded by Walter and Jeff Cruttenden and launched in August 2014 with the aim of making investments accessible to everyone. The app mainly targets younger people, including college-aged students who are just getting started on investing. This is shown their 4-year free management program for college students with valid .edu email addresses.

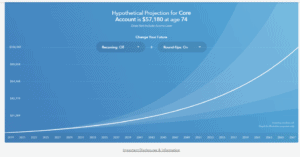

You may not get sizeable returns from investing with just your spare change. But it can be a great way of supplementing your other investments or for learning how to invest. Have a look at our list of best robo-advisors hereThe app combines the robo-advisor model with automatic saving to enable users to invest spare change in a growing account. It was one of the first apps based on the idea of saving roundups from your purchases.

That approach may prove useful especially for those saving for retirement using the platform’s retirement accounts called Acorns Later. The app deducts and makes the investments into a portfolio that makes sense for you. If you are new to investing, this may be the app for you

Acorns Pros- No minimum amount for opening an account. Then the platform only requires $5 to start investing

- You can set up an IRA account using your spare change

- Customized portfolios based on the information you provide when signing up

- There are no withdrawal fees

- The app is easy to use, this helps new investors who may be overwhelmed by the complexity of investing

- Free management for college students. The platform waivers management fee for up four years for students with valid .edu emails.

- Educational content

Acorns Cons- No tax loss harvesting or tax benefits of any kind. The platform only sends your 1099 if your account activity warrants it.

- Limited investment options.

- The monthly fees can be high for investors with small account balances. $1 a month is 12% a year for someone with $100 only. That is very expensive compared to other tools that charge 0.25%

- No human advisors

How does the Acorns Investing App Work?

Instead of funding your account through bank and electronic transfers, Acorns encourages you to invest using your spare change through ‘round-ups’. The company also advocates using other methods including Found Money, referrals and recurring investments. To use the micro investing strategy, you connect your bank accounts, PayPal or cards that you use for everyday purchases. The spending is then rounded off to the nearest dollar. The change is then used for investing.

The round-ups feature works by collecting all your change, when the amount reaches $5, it is transferred to your Acorns account for investing. If you pay $3.75 for a service or a product, Acorns will round off the price to $3.00 then collect the $0.25 ‘change’ for investing. The feature is the platform’s key selling point and it may help people who are unable to save their money.

The app also allows you to invest manually, however, this would require you to go through a list of all your purchases and decide which one you want to round up. You can also transfer funds into your Acorns account from your bank. The roundups are invested in real time.

Acorns’ IRA accounts allow you to save for retirement by making recurring contributions. The recurring investments allow you to invest any amount from $5 per day, week or month. The money is then distributed into over six ETFs through their partner Vanguard. This allows your investment to be diversified by being distributed into over 7000 stocks.

Getting Started with Acorns

Acorns is available for US residents with valid social security number and who are above the age of 18. When creating an account, the first step is entering a valid email and setting a password. This will be your login credentials for the app. The next step is linking your bank so that the platform can collect roundups. This step is skip-able and you can add the information later.

The next step requires you to fill in your personal information including name, social security number, date of birth and citizenship. You will also be required to fill in your address information, state, city and phone numbers before you can access the next form that requires you to set a security question for your account.

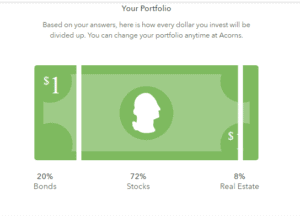

To find the right portfolio for you, you will be asked suitability questions that will be used to determine your risk tolerance and the perfect investments for you. They include employment status, yearly income, timeframe, reason to invest and net worth. Based on the answers you provide, the platform will show you how your portfolio is divided up; you can change this later in the app. It shows you the percentages every dollar is broken into and what they are invested in.

The platform will ask you to set a recurring amount that will be invested per week from $5 to $50 per week. Your account will be approved in 2 to 5 days and you will be ready to start investing.

Acorns portfolio recommendations

Depending on the answers you provide during signup, you will be recommended either of the following portfolios:

- Conservative and moderately conservative – these portfolios contain ETFs with greater percentages of bonds that decrease the effect of the stock market’s ups and downs. This means your money will not be able to grow faster but there will be less likely fluctuations in your account balance, and you are less likely to sell at a loss.

- Moderate – this portfolio includes a mix of stock and bonds to balance the growth of your balance with stability provided by bonds. This will be likely suggested to you if you chose a medium-term investing timeframe or if your investment reason was to save for a large purchase.

- Moderately Aggressive and Aggressive– these portfolios are suggested to those looking to invest for the long term, such as for large purchases over a 10 years plus term or to fund a comfortable retirement. The portfolios will have more stock ETFs to expose your investment to the wealth-creating potential of the market over long terms. However, these will have more fluctuations in the short term.

What Features does Acorns Offer?

Acorns Later – Acorns supports individual retirement accounts including Roth IRAs, SEP IRAs for self-employed people and the traditional IRAs. The costs for the accounts in the Acorns Later is $2 per month.

Acorns Spend – this is a debit account for those who would like to integrate their spending and their investing. Acorns markets the feature as ‘the only checking account with a debit card that saves, invests and earns for you’. That is because the roundups are deducted directly and you may also qualify for ‘Found Money’ depending on your location and where you shop. The feature also has unlimited ATM reimbursement. The cost is $3 per month, which is pretty high compared to other similar services.

Round-ups multiplier – if you want to boost your contributions, you can use the Acorns multiplier. It offers to multiply your roundups by x2,x3, or x10. With the x10, if your monthly contribution was $50, it will now be $500. This feature is available in all accounts but only in the app version.

Rebalancing – Acorns rebalances your portfolio automatically as you continue investing. When you deposit or withdraw funds from your account, the platform adjusts the proportions of the ETFs towards the preferred allocation.

The platform also reviews your portfolio quarterly, sells overweight ETFs, and use the funds to buy under-represented ETFs to ensure no ETFs fluctuate 5% above or below the target allocation. This is also done when you change your portfolio. The platform adjusts the allocation of each investment to match the new risk profile that you have selected. However, this may cause adverse tax consequences.

Found Money – these are rewards that you get when you shop with Acorns’ Found Money partners. It is like a cash back program. The company you make the purchase at will automatically invest in your Acorns portfolio. Currently, Acorns has over 200 partners including Nike, Mac’s, Apple, Amazon and Hulu. The Found money rewards will land in your account between 90 and 120 days after the purchase.

What Acorns does best?

- Education – the platform provides learning material through their online finance site called Grow. The platform provides content from how to save, spend and invest to student loans and other financial topics that may be useful to a beginner in investing. Grow content is also integrated into the mobile app.

- Automation – the platform handles your investment for you. You only have to link as many cards as you want and the app will round up purchases from all of them automatically, and give you the option of transferring the change into an investment portfolio. People who find it hard to save may benefit from this tool. You also have the option of transferring lump sums to boost your portfolio, either manually or automatically by setting recurring deposits.

- No minimum amount to open an account. Also, you only require $5 to start investing.

What are Acorns Fees?

The fee charged by Acorn may be an advantage or disadvantage depending on your account balance. The platform charges $1 per month for the Acorns Core account, $2 per month for Acorns Core and Acorns Later and $3 for Acorns Core, Later and Spend. These prices are up to $1 million. Those prices may seem as low but may be expensive for smaller balances.

The account fees are waived for college students below 24 an have valid .edu email addresses, however, it is only for the Acorns Core and Later accounts. If you want to use Acorns Spend, you will have to pay $3 per month.

Is Acorns right for you?

The platform targets the younger investor, someone who doesn’t know the market or who just wants to invest without having to figure it out. The platform works best for those who find it hard to save for investing, those with less money to invest with and want to get started or those who just want to invest completely hands-off. The platform will collect money and create a portfolio for you. The work should work great with extravagant spenders.

Acorns Review: Verdict

The idea of investing after every purchase may seem like a good idea for those that find it hard to start investing or saving. However, it may not be possible to get sizeable returns on just spare change, plus the monthly service charge may take away potential returns.

The platform is a great choice for students who don’t have to pay any fee and new investors looking for a quick and easy way to get started. For others, the platform is relatively expensive, especially if you are investing low amounts. The platform can also be a great way to supplement your other investments.

FAQs

What are round-ups?

This is spare change collected from your round-up accounts by Acorns. The platform rounds up any purchase to the nearest dollar and the change is collected from your funding source and invested in your portfolio.

Is my money protected?

Yes, Acorns is a member of the Securities Investor Protection Corporation. SIPC covers your investments up to $500,000 including $250,000 in cash claims.

How long does it take me to withdraw money from Acorns?

It takes between 3 to 6 business days. Because of the 2 day settlement periods mandated by the Securities and Exchange Commission. The platform may also hold your money for up to 5 days to prevent fraudulent activity.

Is Acorns available outside the US?

Currently, it is only available in the US for citizens and legal residents, Acorns is available in Australia on a different site. Exceptions are also made for Armed Service personnel temporarily outside the US.

Does Acorns have accounts for minors?

Currently, the platform only holds accounts for persons over the age of 18

How long does Acorns take to invest my money?

Investments may take between 1 and 3 days because they purchase ETF shares only when the market is open. Also, the transfer of funds may take up to 2 days to process

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up