ROTH IRA Accounts Explained 2021

A ROTH IRA account is an individual retirement account that pays taxes when you pay into it so it can offer tax-free growth and tax-free withdrawals in retirement. ROTH IRA is named so after the creator, William Roth, a previous Delaware Senator. Usually, if you’ve owned a ROTH IRA account for over 5 years and are over 59 years old, you are able to withdraw your money without any taxes or fees.

An individual retirement account or IRA is a type of savings/investment vehicle that receives tax incentives from the US government and the IRS, in synthesis it allows individuals to either defer tax or benefit of tax-free capital gains from their investments.

In order to understand better what a ROTH IRA is, it is important to have an overall notional of what a Traditional IRA is and why it is key for individuals to take advantage of its benefits at an early stage in their life/career.

Just like with most investments, time will be an important factor for success and performance. Early investors usually receive a considerable advantage since earnings from contributions are reinvested into the account, resulting in a powerful compounding cycle. It’s easy how as the years go by the value of both an IRA and ROTH IRA can grow exponentially.

-

-

1. Vanguard Group

Our Rating

- Open an account Free of charge

- Hardship withdrawals allowed

- Get a free portfolio management

- Make your retirement plans in an easy and straightforward process

While an IRA might not be enough for an individual to cover all of their retirement expenses, it offers space as a complementary model that also allows for savings and the ability to invest in the financial markets with a tax incentive that otherwise wouldn’t be possible. Most individuals commit the mistake of leaving their retirement plans for later in their life and this usually hinders their possibilities taking full advantage of a ROTH IRA.

In this article, we will cover the key differences and factors that differentiate a ROTH IRA to any other type of IRA. Even though most types of IRAs offer a basic principle, it is important for individuals and investors to be aware that no two individuals are the same and this goes for ROTH IRA accounts too. Choosing an account can’t be taken lightly and requires for any individual to do their own research and analyze deeply their risk profile and also their taxes.

What are the Pros and Cons of a Roth IRA?

One of the best parts about a ROTH IRA is that even though the model of the account is not perfect, there are many different alternatives to choose from. If you take your time to review the different ROTH IRAs and you know what your necessities are, it is highly probable that you would end finding an option that will fit most your profile and your needs as an investor.

If we focus on the ROTH IRA alone, there are many advantages that can easily lure an investor into choosing it but once again and just like with any other investment vehicle, it is not perfect. Here are some of the most important pros and cons of choosing a ROTH IRA as your complementary retirement account:

Pros of a ROTH IRACons of a ROTH IRA- There’s no need for required minimum distributions: This means that even if you are age +70½ you won’t be mandated to withdraw from your ROTH IRA account as in a regular or Traditional IRA.

- You can withdraw your contributions: Even though we do not advise in taking early withdrawals from a retirement account unless it is ultimately necessary, a ROTH IRA will allow investors to withdraw their contributions since the money used in the first instance was already tax-free. It is important to keep in mind that this does not take into consideration profits or earnings generated by the ROTH IRA investment of any contribution; any performance withdrawal will incur in a penalty unless it is done after retirement.

- Earnings and performance are tax-free at retirement: Imagine being lucky enough to invest in a startup with your ROTH IRA capital and seen the stock of company easy doubling itself several times before your retirement. The best part of this scenario would be to know that you don’t owe a dime in capital gains to the government! The reason for this would be that you paid the taxes for your ROTH IRA contributions upfront, this is why it is very important to take your time before choosing your retirement account.

- Low Maximum contribution: Just like with any other IRA, the max contribution level to a ROTH IRA is actually pretty low as it only allows individuals to contribute up to $6,000 a year and with an additional extra $1,000 once you are over 50 years old.

- Taxes are paid upfront: The most important asset of a ROTH IRA is its also its major pain for many individuals, as mentioned above ROTH accounts for both IRA and 401K requires the investor to pay its taxes upfront in exchange of waiving any income tax from capital gains. This can either be the reason for you to choose the ROTH IRA over a Traditional or will be the deal-breaker.

- Eligibility for a ROTH IRA is based on income: Not all individuals are eligible to open or contribute to an existant ROTH IRA once their annual income surpasses as a predetermined level. For example, if you are single and you earn more than $137,000 a year you would not be eligible for contributions.

What are the Limitations of a ROTH IRA?

Not every individual or married couple is eligible to start a ROTH IRA, this is due to a very strict limitation for individuals with a high annual income. Even though there are many limitations, the structure is pretty straightforward:

Please note that Filing status is the major denominator for these rules/limitations for opening a ROTH IRA.

1. Married filing jointly or qualifying widow(er)

- Less than $193,000 | Max contribution of $6,000 or 7,000 if 50+

- Between 193,000+ to $202,999 | Contribution is Reduced

- More than $203,000 | Not Eligible

2. Single, head of household or married filing separately

- Less than $122,000 | Max contribution of $6,000 or 7,000 if 50+

- Between 122,000+ to $136,999 | Contribution is Reduced

- More than $136,999| Not Eligible

3. Married Filing separately

- Less than $10,000 | Contribution is Reduced

- More than $10,000| Not Eligible

Define your Investment Style

One of the many questions I usually receive when talking to a new investor or someone who is starting to do their first steps in the financial markets is about which investment style is better? I usually like to answer by asking them back which style is better for who? Many individuals usually forget that before choosing an investment method or style it is important to understand your goals, risk appetite, and even your personality first.

Luckily for many, the financial markets offer a vast range of investment vehicles and assets to choose from, without any hesitation, I can say that there is an asset class for most individuals and that a style will depend on the risk aversion of the individual.

Without getting into the heavy detail about investment strategies and risk profiles, I recommend most individuals to decide between hands-on and hands-off styles respectively. Even though these two styles might seem too simple, in reality, the cover an important range of the market.

Hands Off

Not all individuals have the intention or the desire of spending hours doing research and reviewing their portfolios actively. It is actually pretty common to see investors looking for professional asset and fund managers to take control of their accounts in exchange for a percentage fee. While this might be a relatively expensive option, it offers a passive model that allows individuals to lay back a bit more.

Hands-On

Just like you can find individuals with no intention of participating actively, some others do not have what it takes to let a third-party manage their investments. This is a key point where personality is truly a show stopper for certain personalities and styles. Unless you are a professional trader or you have a vast knowledge and experience in the financial markets, you might be better off with an asset manager as it will take a lot of responsibility off your shoulders.

This model brings back the notional that a ROTH IRA is a retirement account, while the main goal many individuals have in mind is to profit, in reality, they should be a focus on capital conservation and saving as much for retirement as possible.

ROTH IRA vs. Traditional IRA Explained:

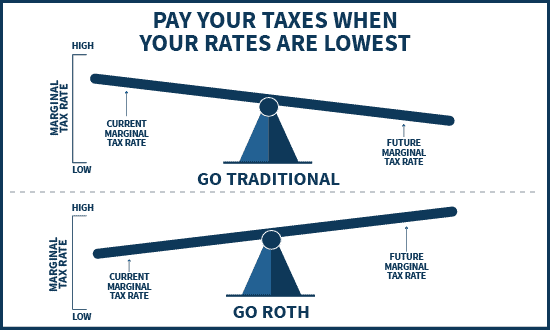

In a traditional IRA the tax incentive is, in reality, a tax deferral, this means that individuals would be able to defer their taxes until the funds are withdrawn from the account. With this model taxes will be paid based on the final funds, meaning that you would also be paying taxes over the contributed capital and any earnings incurred.

While this model benefited investors that later in their life would be in a lower tax bracket, it did the opposite for individuals whose bracket was higher. In order to provide a relief mechanism and a fair ground for individuals that were suffering from this situation, the Taxpayer Relief Act of 1997 established the ROTH IRA.

The ROTH IRA is a newly created vehicle that offered individuals the ability to contribute after-tax money, this means that any contribution made to the account has already paid its due taxes. With this model, taxes were paid upfront instead of being deferred towards retirement. Another key element of a ROTH IRA is that any profit or earnings generated from investing the contributions and the balance of the account are tax-free.

Even though tax-free capital gains seem like a better option than deferring the tax, it is important to consider and keep in mind that the amount contributed which is technically the seed capital that will eventually be invested and compounded will be smaller and this can affect returns. It is not the same to invest $6,000 consistently and receive the return generated by the full six thousand, to paying taxes upfront and only investing $4,000 after paying 25% on taxes.

To understand which one is the best option for an individual, it is necessary to understand and plan based on the overall picture and not just the ROTH IRA. In other words, investors should consider and run both scenarios and select the one that represents the best model in the long run.

At the end of the day, a ROTH IRA is supposed to be fully enjoyed at retirement, planning considering the time until retirement age is only appropriate in order to take full advantage and avoid expensive mistakes like choosing the wrong taxation model.

Best ROTH IRA Providers and Brokers of 2021

Continuing with the same structure, these are the best providers and brokers for a ROTH IRA in 2021. In order to provide better detail, we’ve separated the names between both hands-on and hands-off models.

Best ROTH IRA Accounts for Hands-On Investors:

1. TD Ameritrade

The Thinkorswim platform was created in the late nineties by Tom Sosnoff, a veteran investor and trader who believed that investing in stocks and derivative instruments could become popular to retail investors with the help of a completely dedicated software. After a decade of its founding, Thinkorswim was sold to TD Ameritrade. Officially becoming the spearhead over which the broker was renewed.

TD Ameritrade is one of the most important brokers in the US, with total assets exceeding $1 Trillion in more than 11 million client accounts. Even if you are new to the financial markets or simply to investing, the name Thinkorswim might be one of the first ones you heard or read about online as it is one of the best overall brokers available in the market. With more than 11 million active clients and assets under management exceeding $1 Trillion in the US alone, TD Ameritrade is one of the most respected options available today.

Investors should be aware the TD Ameritrade is definitely not the cheapest option when it comes to opening a ROTH IRA, but the firm surely compensates their high price with a first-class experience to its users. One of the main reasons investors should look into this broker is due to all the service they provide besides brokerage and retirement planning. In order to ease some of the costs associated with trading fees, the company offers to charge on their ROTH IRA, meaning that no other commission besides trading fees will be charged. In today’s fast world it is very useful to be able to consolidate many important services under one single environment.

Most notable services available in 2021 are:

- Banking

- Life Insurance

- Retirement and Wealth Management

- Annuities

- Commercial Banking

- Auto Financing

- Direct Investing

- Active Portfolio Management

Technical and fundamental analysis are the two elements over which most investors develop their strategies, and structure their portfolios. Thinkorswim exceeds expectations with a swiss knife application that not only is powerful but is also intuitive and friendly to all investors. If you have used a Bloomberg Terminal in the past, you will find yourself close to home with Thinkorswim. On the other hand, if you have never been close to a terminal it might take you some time to understand how to use it, but it is definitely not difficult. In order to mitigate the impact on new users, the firm offers a vast library of educational content which makes it even easier for new users.

Minimum Requirements: No minimum deposit

Recommended for: Active Traders and Hands-on Investors

Asset Coverage: All publicly traded securities (Stocks, CFDs, Bonds, ETFs, Funds, Commodities, REITs, FX)

Account Types: TD Ameritrade offers access to all major ROTH IRA typesOur Rating

- Thinkorswim has some of the best charting tools among brokers

- Over 400 technical studies and 20 drawing tools available

- Sophisticated enough for advanced traders but also simple enough for any new beginner

- Slightly higher commissions

- Broker-assisted trades are more expensive than in any other broker

- The ROTH IRA application has many different windows, this could be overwhelming for some users

2. Fidelity

Fidelity is one of the most powerful brokers in the world, managing more than $2.46 Trillion in assets as of May 2019. One big concern I typically have when choosing a broker is to understand the history behind the company, I want to know that my money is backed by years of experience and never by a new broker.

With 75 years of existence, it is easy to see that Fidelity has survived several market crashes and economic recessions, this can only prove even more how stable and seasoned the company really is.

If you are looking to manage your ROTH IRA on your own, Fidelity is a good option for anyone interested in following a passive investment methodology/strategy. Even though the company provides access to a vast range of financial indicators and technical analysis tools, they still lag behind names like TOS or Individual Brokers.

Just like TD Ameritrade, the firm looks to improve its expensive image by not charging any account management fee. With this model investors only have to focus on the fees charged by the broker due to trades execution and regular brokerage business.

If you are interested in the US markets, you should consider fidelity as they offer other products besides brokerage, making it a full package for international and local investors.

Some of the complementary services are:

- Retirement and Wealth Management

- Cash Management

- Derivatives Products

- Robo-Advisors

- Active Portfolio Management

Fidelity might not be the cheapest option but it delivers access for both active and passive investors, making it a well balanced and safe option.

Minimum Requirements: No minimum deposit of a ROTH IRA account

Recommended for: Active Traders and Hands-on Investors

Asset Coverage: All publicly traded securities (Stocks, CFDs, Bonds, ETFs, Funds, Commodities, REITs, FX)

Account Types: Fidelity offers access to all major ROTH IRA typesOur Rating

- Low-cost trade commissions

- Commission-free ETFs

- Large Selection of Investment Options

- High Margin Rates, while Fidelity states its margin rates are low, other brokerage houses like Interactive Brokers have much lower rates

- Trade minimum for active trader platform

3. TradeStation

TradeStation is a top-notch platform that covers most of the necessities a trader might have. Even though the firm started as a broker focused only on institutional and heavy players, the company has changed its model allowing retail investors to gain access to their state of the art service.

The company offers access to the major financial markets and asset classes in the world, allowing investors to diversify into other markets besides the US.

Investors should keep in mind that TradeStation does not offer portfolio management services, leaving investors under their own management and execution for their ROTH IRA accounts.

Trade Station is the cheapest option of the hands-on category, the company currently charges only $4 per trade and offers free real-time market data which has a cost of about $120 a month with any other broker.

Minimum Requirements: $5000 minimum balance

Recommended for: Active Traders and Hands-on Investors (Technical Analysis)

Asset Coverage: All publicly traded securities (Stocks, CFDs, Bonds, ETFs, Funds, Commodities, REITs, FX)

Account Types: TradeStation offers access to all major ROTH IRA typesOur Rating

- Comprehensive Features and Tools: many of TradeStation’s tools were previously available only to brokers

- Low commissions

- Comprehensive research

- Commission-free ETFs

- Minimum balance requirement for active trading platform

Best ROTH IRA Accounts for Hands-Off Investors:

1. The Vanguard Group

The vanguard group is a giant multinational with over $5.3 trillion in assets under management. The company is the largest provider of mutual funds in the world and the second ETF provider, only behind BlackRock’s iShares.

Since its inception, the founder of the company, Jack Bogle, preached for financial markets and investment opportunities to work in the most straightforward and efficient way as possible. This is the exact same vision the company follows until today, as they focus on delivering the best possible return in the most transparent way.

Vanguard model works like a top tier Robo-advisor enhanced specifically for investors looking to allocate large sums of capital in the markets. Professional advisor services aren’t cheap, but the services and performance delivered are worth for any investor to pay the high fees.

For 2021, the average expense ratio is 1.01% of the value of the account, while for Vanguard is only 0.18% making it considerably cheaper than the overall market.

The company understands that every investor is different and that all portfolios should be developed based on every investor profile, goals, and tolerance. For this reason, the firm takes extra steps in order to assign a profile to each investor after an examination, this profile will take into consideration goals, risk appetite and sophistication of the investor in order to determine the best course of action.

Minimum Requirements: No minimum deposit

Recommended for: Passive Investors with a macro investment philosophy

Asset Coverage: Access to global markets and all major asset classes via ETFs and Mutual Funds

Account Types: The Vanguard Group offers access to all major ROTH IRA typesOur Rating

- Outstanding Investment Pedigree

- Diverse Range Of Investment Options

- Unlimited Access To Human Financial Advisors

- Expensive option with cost per trade of more than $7

- Vanguard charges account management fees

- No Fractional Shares

2. Betterment

Betterment is not a broker but the company offers its services as an online financial advisor and portfolio manager. Their business model is simply perfect for anyone interested in a handoff ROTH IRA. With more than ten years of service, the company has proven to be a reliable option for anyone looking to passively profit from the markets and to pass the responsibility of managing the portfolio to a third party.

An important characteristic to mentioned about Betterment is that any investor with an account under $100k won’t have access to investing in single stocks and instead would have to go for specific ETFs that deliver a more robust return at a smaller unit of risk.

Over the past couple of years, Betterment has worked in a joint venture with the giant asset manager BlackRock, to design a low-risk high dividend portfolio specially developed to generate income.

This portfolio has become a solid option for retirees looking to receive stable, income as well as a method to preserve their capital.

In January 2019, the company had +$115 Billion in assets under management and more than 400,000 active users worldwide, making it one of the most important and fully automated advisors worldwide.

Minimum Requirements: No Minimum Deposit

Recommended for: Low maintenance and goal-based investors with no interest in actively managing their portfolio Asset Coverage: Stocks, ETFs, Bonds (Passive Investment)

Account Types: Traditional, SEP and ROTH IRAOur Rating

- Low, fixed management fees with no transaction fees

- Easy, passive, hands-off investing

- Plan upgrades available

- Fixed investment portfolio

- Required higher fees and balances to access expert help and management

- Betterment Misses “Hot” Investment Opportunities

3. Wealthfront

WealthFront is another option for anyone interested in delegating their portfolios to a third-party for management. It is common to see individuals that are too afraid to invest their money or that simply do not have the experience either the knowledge on how to do it. The firm offers portfolio management services through a Robo-advisor model under which the portfolios are rebalanced automatically based on the parameters of an algorithm.

One of the key features of the company is its user-friendly platform, the overall environment is easy to easy and it was designed specifically for new investors with little to no experience in the financial markets.

Minimum Requirements: $500

Recommended for: Passive macro investors Asset Coverage: ETFs, Mutual Funds

Account Types: Wealthfront offers access to all major ROTH IRA accounts and other retirement accounts like 401KsOur Rating

- Tax-loss harvesting

- Free and advanced financial planning

- Free management fee under $5000

- Fractional shares can’t be reinvested

- Suitable for non-experienced investors

- No human consultant

IRA Conversion

An IRA is a very dynamic type of account, to the point where individuals are allowed to convert their accounts between IRA Types. For instance, lets picture an individual with a Traditional IRA; after doing his own analysis he realizes that he should have open that account as a ROTH IRA instead many years back. In his current account, he has only deferred taxes, meaning that his contributions have not been taxed at all. In order for him to proceed with a conversion, he would have to pay the upfront taxes of his contributions to be able to switch to a ROTH IRA account. The amount to be paid will be calculated on the current tax rate of the individual.

This is the simplest model; you haven’t paid taxes and will have to pay them in order to do the conversion. On the other hand, if you are a ROTH IRA owner, and you would like to convert your account into a Traditional IRA, then it would be a different story. Under this model you have already paid taxes for your contributions, this means that you would be spending an account that will be taxed again later in the future.

In my experience, individuals usually commit the mistake of avoiding the tax talk or truly understand their tax situation going forward. But if you have made the right choice and you opened an IRA, it is key to see the big picture before many any decisions. At the end of the day, you don’t want to look back in the past and realize that the choice you made is costing you a significant amount in the future.

Conclusion

As mentioned before, there are not many reasons for an individual to pass on a ROTH IRA if they are eligible for one. If you choose the right investment vehicle your future self will truly appreciate the effort of saving and investing as the chances of improving your retirement increases dramatically.

Look at your ROTH IRA as a long term investment, it will help you avoid the temptation of early withdrawals and the boredom of watching paint dry. If you have the right approach it can become exciting to see how your contributions compound with the earnings and your money grow.

A ROTH IRA will be as good as your commitment to it and to your account selection. There are no perfect investment vehicles, but with enough research, it is easy to see which ones fit better to an individual’s profile and expectations.

Take your time understanding how your ROTH IRA works and specifically if that ROTH IRA account is what suits your needs better over a Traditional IRA.

1. Vanguard Group

Our Rating

- Open an account Free of charge

- Hardship withdrawals allowed

- Get a free portfolio management

- Make your retirement plans in an easy and straightforward process

Glossary of Investment Terms

BondsA bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. It can be advanced to the national government, corporate institutions, and city administration. It is an investment class with a fixed income and a predetermined loan term.

Mutual FundA mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

P2P LendingPeer-to-peer lending (p2p lending) is a form of direct-lending that involves one advancing cash to individuals and institutions online. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers.

BitcoinBitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. It is virtual (online) cash that you can use to pay for products and services from bitcoin-friendly stores.

Index FundsAn index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

ETFsAn Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets – much like shares and stocks. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

RetirementRetirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. In the United States, the retirement age is between 62 and 67 years.

Penny StocksPenny Stocks refer to the common shares of relatively small public companies that sell at considerably low prices. They are also known as nano/micro-cap stocks and primarily include any public traded share valued at below $5.

Real EstateReal Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes – like building a family home.

Real Estate Investment Trust (REIT)REITs are companies that use pooled funds from members to invest in income-generating real estate projects. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls.

AssetAsset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business.

BrokerA broker is an intermediary to a gainful transaction. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service.

Capital GainCapital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Hedge FundA hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally.

IndexAn index simply means the measure of change arrived at from monitoring a group of data points. These can be company performance, employment, profitability, or productivity. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health.

RecessionA recession in business refers to business contraction or a sharp decline in economic performance. It is a part of the business cycle and is normally associated with a widespread drop in spending.

Taxable AccountsTaxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year.

Tax-Advantaged AccountsA tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Roth IRA and Roth 401K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Traditional IRA, 401K plan and college savings, on the other hand, represent tax-deferred accounts. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes.

YieldYield simply refers to the returns earned on the investment of a particular capital asset. It is the gain an asset owner gets from the utilization of an asset.

Custodial AccountsA custodial account is any type of account that is held and administered by a responsible person on behalf of another (beneficiary). It may be a bank account, trust fund, brokerage account, savings account held by a parent/guardian/trustee on behalf of a minor with the obligation to pass it to them once they become of age.

Asset Management CompanyAn Asset Management Company (AMC) refers to a firm or company that invests and manages funds pooled together by its members. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments.

Registered Investment Advisor (RIA)A registered investment advisor is an investment professional (an individual or firm) that advises high-net-worth (accredited) investors on possible investment opportunities and possibly manages their portfolio.

Fed RateThe fed rate in the United States refers to the interest rate at which banking institutions (commercial banks and credit unions) lend - from their reserve - to other banking institutions. The Federal Reserve Bank sets the rate.

Fixed Income FundA fixed-income fund refers to any form of investment that earns you fixed returns. Government and corporate bonds are prime examples of fixed income earners.

FundA fund may refer to the money or assets you have saved in a bank account or invested in a particular project. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects.

Value InvestingValue investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It involves buying these shares at the current discounted prices and hoping that a market correction pushes them up to their intrinsic value effectively resulting in massive gains.

Impact InvestingImpact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

Investing AppAn investment App is an online-based investment platform accessible through a smartphone application. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance.

Real Estate CrowdFundingReal Estate crowdfunding is a platform that mobilizes average investors – mainly through social media and the internet – encourages them to pool funds, and invests them in highly lucrative real estate projects. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors.

FAQ

What are the Tax Advantages of a ROTH IRA ?

Tax advantages will differ between the type of the IRA. In synthesis an IRA will permit an investor to defer their taxes until the money is withdrawn from the account, effectively parking and reinvesting the money. On the other hand, a ROTH IRA will need an upfront payment over the money invested, making any profit made with the capital tax-free.

- Tax-free growth potential

- Tax-free withdrawals at retirement

- No minimum required distributions

- Tax-free money for heirs

- No age limit for contribution as long as you are working

- Hedged against future tax hikes

- Contributions are not mandatory Contributions and earnings are compounded

Please take your time investigating and doing your own research before choosing an IRA account, this is especially important as returns from different account types can vary significantly based on the tax bracket of the owner.

How much does a ROTH IRA cost?

In order for any individual to start a ROTH IRA, it is needed to contribute a one-time fixed fee of $500. After this initial payment, all contributions will be open to each individuals capacity and the overall limit annually. When it comes to the operation and the cost associated with the account, there is no fixed rate and it will depend based on the broker and the services that you would be using from them. Many investors that are interested in the cheapest option usually go for a hands-on broker as the only charge will be the fees from the transactions. While this might be a relatively cheap option unless you have the right knowledge and experience over how to manage your portfolio it would be recommended for any individual to choose a broker that offers portfolio management. Usually, a ROTH IRA is sponsored by the federal government, it is fairly common to see brokers offering their products at cheaper price than it would cost for a regular investment account. Top tier asset managers charge on average up to 2% of the value of the account for their services. This might sound like a lot but once you consider the returns they are offering and the ability to pass the wheel to someone else it is actually a very good deal.

Should I own a ROTH IRA?

This is usually a tricky question, if you were asking broadly if you should own an IRA I would immediately say yes without any hesitation. On the other hand, owning a ROTH IRA would ultimately depend on your profile and goals. Keep in mind that with this model you would be contribution after-tax cash, this means that you will be paying taxes up front for any contributions. While this is strategy broadly used, it also has its own problems or simply negatives since the contributed money that will act as seed capital is being reduced due to taxes. Since the main logic behind an IRA is to be able to benefit from compounding and savings, a higher contribution will improve your chances to receive higher returns as your capital grow and reinvest its own earnings.

Should I consider converting to a ROTH IRA?

Conversions can be costly as in many cases you would have to pay taxes on the balance of the account as a whole. In order to decide if it is suitable or even a good idea it is important to understand deeply the tax profile of the person and to do the right calculations. Life is not stationary, your living condition can improve as you got older and this can also mean that your tax rate can become higher. If this is the case and you are expecting to be ruled by a higher tax rate than you are now, you might wanna consider doing a conversion as you would be paying taxes on your contributions at a lower rate and earnings and performance would be tax-free. Please note that if for any reason the money contributed for a traditional IRA was post-tax money, then you wouldn’t be accountable for paying taxes in order to convert to a ROTH IRA account. It is extremely important to talk to a financial or tax advisor before making a decision like this, it might not be cheap but compared to the money it can save you, in the long run, it is totally worthy.

Can I contribute to both a Traditional and ROTH IRA?

There is no restriction for individuals in terms of the number of IRAs they can own and contribute to, but the limitations and max contribution number of $6,000 will have to be respected. It is recommended for an individual to understand their risk profile, age, goals, and retirement age expectancy as well as tax rates in order to develop the most suitable strategy. It is fairly common to see individuals splitting their contributions between Traditional and ROTH IRA accounts balancing in order to gain the best possible usage of their taxation benefits. Most Brokers and Providers will offer consultation as part of their initiation process, I highly recommend anyone interested in any type of IRA to ask for a profile review in order to determine the best line of action and the right approach to their investments.

For how long can I make contributions to my account?

Traditional IRAs do not allow individuals to contribute after age 70½, it is at this point when they are instead supposed to start using their capital in order to compensate for their retirement cost. The ROTH IRA, on the other hand, allows individuals to continue contributing as long as they are working or employed. While the basic principle of an IRA is to save for when retirement age comes, many individuals also have other principal retirement plans, making an IRA an extra and not really a full necessity in order to cover expenses. For more wealthy individuals a ROTH IRA will allow them to continue contributing and investing their money for as long as they work.

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up