There are many similarities and differences between the housing market back in 2006 and 2007 with the current housing market. According to Daniel R. Amerman, prices and effective federal funds rate are showing some interesting things about the real estate market.

Similarities and Differences in the Housing Market

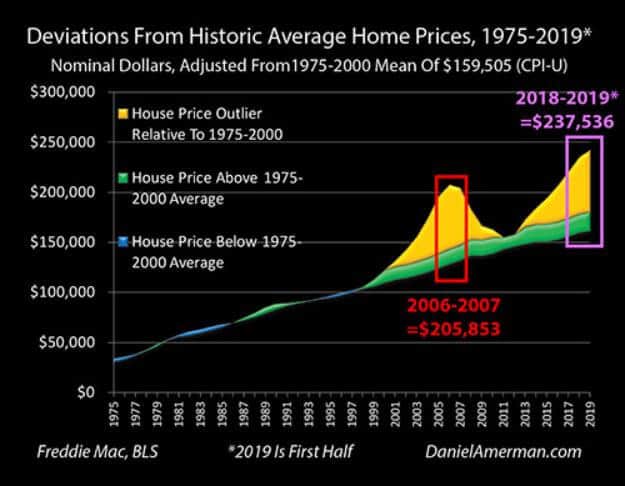

According to a recent report released by Mr. Amerman, there is a surprising similarity in terms of prices in the housing market comparing 2006-2007 and 2018-2019.

However, the main difference between these two markets is that current home prices are substantially higher than 11-13 years ago.

At the moment, the average housing price is by far the highest ever seen in history, close to $238,000 in the United States. This represents an increase of 15.5% since the peak real estate bubble years of 2006 and 2007.

However, things are different if inflation is taken into account. In 2018 dollars, the average price for a home in 2006-2007 was $253,000, which means that the 2018 and 2019 spike is 6% below the 2006-2007 peak rather than being 15% higher, as mentioned before.

At the same time, the monthly payment on a $200,000 30-year mortgage loan with a rate of 8% is currently $1,468.

According to Mr. Amerman, the same payment at a 4% rate will support a $307,391 mortgage, meaning that it could be possible for homeowners to afford a home 54% higher in price without increasing their monthly payments.

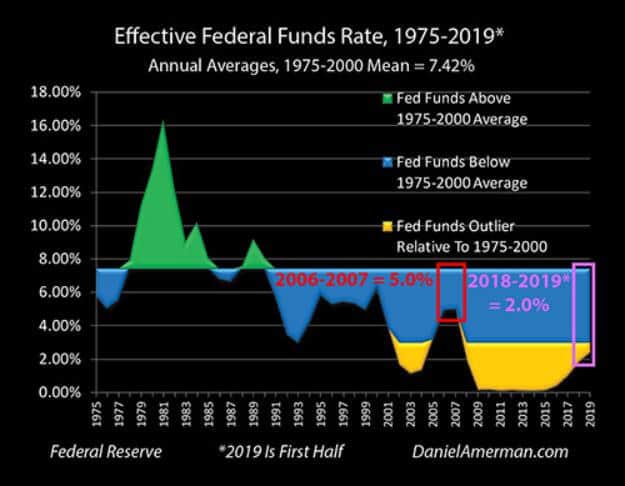

In addition to it, the author of the report explains that the Federal Reserve (FED) decided to cut interest rates to fifty-year lows to contain the damage of the stock bubble and the recession in 2001.

This allowed for the real estate stock bubble of the 200s, and it became affordable to pay high prices for homes, due to low rates.

On the matter, the author commented about the consequences of this housing bubble:

“The collapse of that bubble was one of the leading causes of the Financial Crisis of 2008, and the resulting Great Recession. The Fed then responded with zero percent interest rates and massive monetary creation and the end results were a second round of the highest real estate prices in history, even higher than the first round.”

It is possible to see that Fed Funds rates bottomed at the outlier of 1.13% in 2003, rose to 1.35% in 2004, and went to 3.21% in 2005. With these record low rates, it was possible to create record high prices.

Finally, having a look at 2018 and the beginning of 2019, there is a different situation. Fed Funds were much lower for a more extended period. The FED is trying to keep interest rates down to prevent recession and crisis.

That means that mortgage rates are going down much faster, and the difference between 2006-2007 and 208-2019 will be much more significant by the end of 2019.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account