US initial jobless claims have been above a million for 19 consecutive weeks and are expected to again top the million mark when last week’s data is published on Thursday.

Claims have risen in recent weeks as a number of states have delayed reopening plans amid the surge in new cases.

Over 54 million Americans have filed for jobless claims in the pandemic, a reflection of how the coronavirus has hit the US economy.

US jobless claims

US jobless claims are expected to hit 1.4 million in the week ended 1 August, according to analysts polled by Thomson Reuters. This follows the 1.43 million Americans that filed for claims in the week ended 25 July. The dismal reading along with the first quarter advance gross national product (GDP) numbers that showed a worst-ever 32.9% contraction in second-quarter GDP, spooked investors. The S&P 500 closed down 0.38% last Thursday.

Sarah House, senior economist at Wells Fargo Securities, said the numbers “confirm that the economy’s recovery has lost momentum in recent weeks”

The continuing claims or people who have already filed for jobless claims in the previous weeks and continue to file for claims were 17.018 million last week, falling 867,000 from the week before.

US jobless claims have now increased for two consecutive weeks. Prior to that, claims fell sequentially in every week. Also, in another worrying development, claims have been hovering near the 1.5 million level for eight consecutive weeks.

“The level of claims still remaining elevated and the rise in continuing claims definitely reflects the reclosings over the past few weeks [that] we’ve seen in some states where the virus has flared up in,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group. Large states such as Florida, Texas and California have all had to impose further restrictions after attempting to reopen their economies due to spikes in virus cases.

He added: “Bumpy and uneven will be the economic recovery until we have a vaccine where most of the world is mass inoculated.”

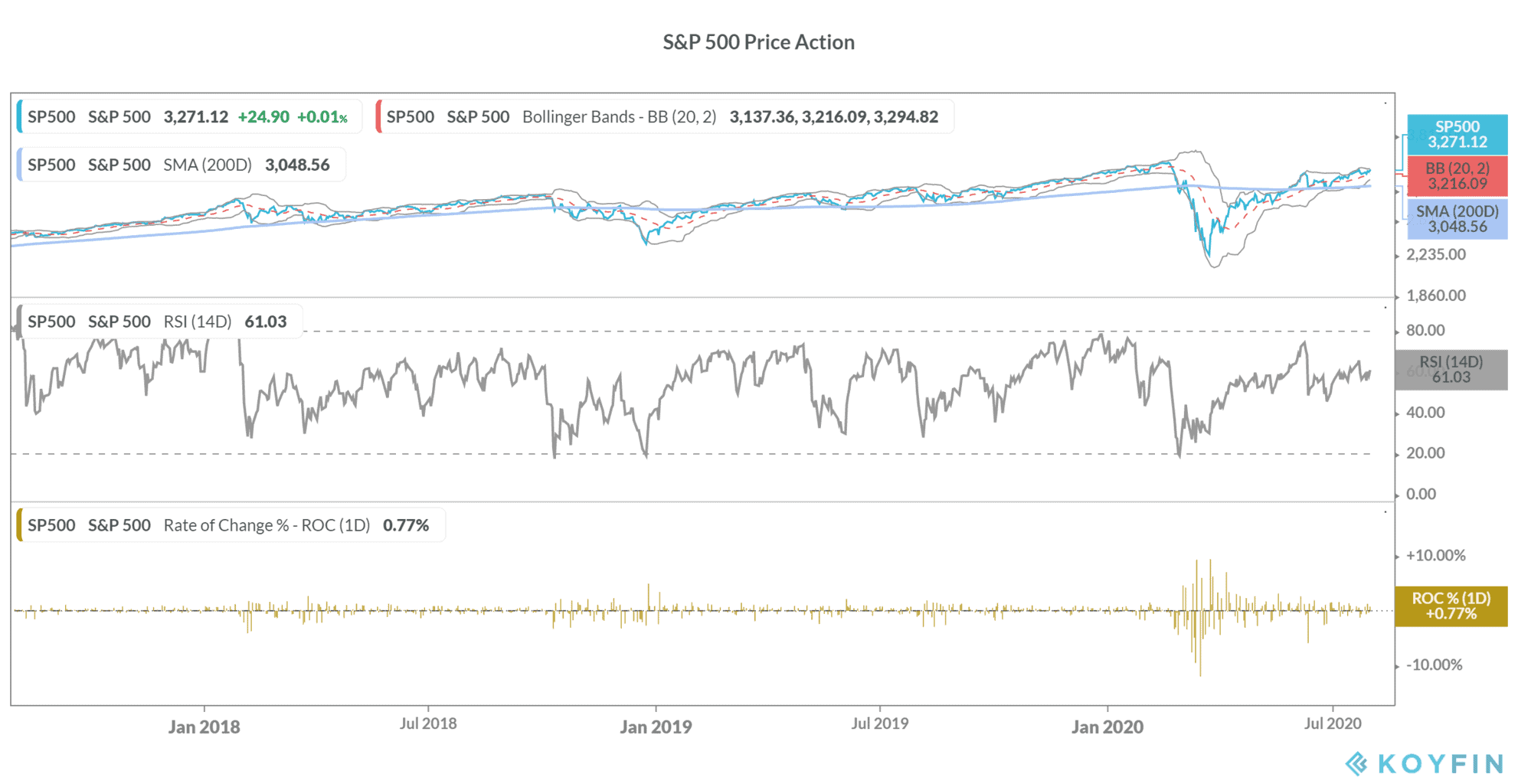

A disconnect between stock markets and the economy

The S&P 500 is now positive for the year and is up 1.3%. The sharp rise in markets from the 23 March lows has baffled investors including legendary fund managers like Paul Tudor Jones and Stanley Druckenmiller. Most fund managers are forecasting a US stock market crash arguing that stock prices have run far ahead of economic fundamentals.

We’ve compiled a handy guide on how to short stocks. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account