You know FICO credit scores are important, but do you actually know how they work? There’s a lot of misinformation and a lot of misconceptions out there about them, so let’s cut through the clutter and get down to the truth.

The FICO score (created by Fair Isaac Corp.) is by far the dominant player when it comes to consumer credit scoring. In fact, 90% of the largest banks use it for credit decisions. So when you check your credit score, that’s the score you want to find out!

Unfortunately, the vast majority of websites that sell credit scores are not selling FICO. Instead they are selling either a score based on their own formula or the lesser used VantageScore (which runs on a 501-990 scale). This throws a lot of people off, because the score they’re getting is not the real FICO.

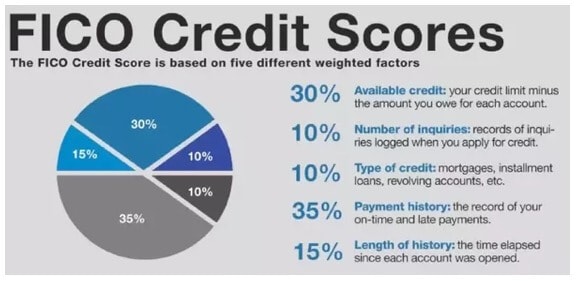

What Forms Up Your 100% FICO Credit Score?

- Amounts Owed (30%): This takes a look at the amount of debt you owe. It is largely relative to how much available credit you have (i.e. $1,000 on a $10,000 limit credit card = 10% utilization). Utilizing a smaller percentage of your available credit is better for your score.

- Payment History (35%): The largest chunk of the pie consists of your payment history. A positive track record will work in your favor. However if you have any delinquencies, late payments, liens, etc. those will adversely affect you.

- Length of Credit History (15%): Not only does this factor in how long your accounts have been opened, but also the time since last activity on each the account. This is one of the reasons you want to dust off an unused credit card once or twice a year, even if it’s just to buy a cup of coffee.

- New Credit (10%): This looks at several factors relating to any recently opened accounts. For example, the proportion of your accounts that were recently opened. When you apply for any form of credit (loan, credit card, quick cash loans, etc.) a “hard” credit inquiry is performed – these stay on your report for 24 months before disappearing. FICO will look at how many of these “hard” credit inquiries you’ve had in the 12 most recent months (hint: the less of them, the better).

- Types of Credit Used (10%): FICO likes to see different types of credit on your account. For example, if the only thing you have on your file are credit cards, that’s not ideal. Instead you want to have a mix – i.e. credit cards, mortgage, auto loan, and etc.

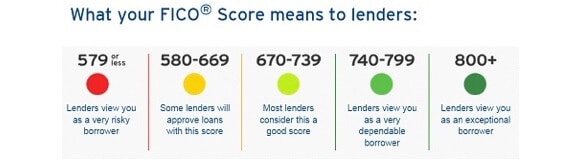

What’s an average, good, and bad FICO credit score?

The FICO score range is between 300 and 850. That being said, it’s almost impossible to achieve the absolute lowest (300) or highest (850). Only 2% of the population has a score between 300 and 499. On the other end of the spectrum, only 13% of the population has a score above 800.

So what’s the average? 692, but that number is largely skewed down by those who have bankruptcies and serious delinquencies. A more accurate representation of what’s typical would be the median score, i.e.: 723.

During the real estate bubble in 2008, practically anyone with a pulse could get approved for a mortgage or credit card. These days it’s much harder, obviously. People who have a score in lower 700’s get denied for some cash back and travel reward cards. In order to apply for any credit card and get approved – if I had to peg an estimate – I would say around 770 or higher would be the magic number. That being said, 710 to 730 are still good ranges and will probably be sufficient for the vast majority of credit card companies.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account