Coinbase Review 2021 – Is it Legit?

On their website, Coinbase describes itself as an online marketplace where you can buy and sell all the popular cryptocurrencies “and more with trust.” And on the coinbase pro website, it further claims to run an “insurance-backed” and the “Best Bitcoin exchange platform”.

But how true are these statements from the San Francisco, California, based crypto exchange company?

We sought to clear the air with this coinbase review that vets their services, security measures and also checked out consumer satisfaction from their current and past clients to vet the exchange’s legitimacy.

And here is everything a crypto trader must understand about coinbase before creating a trader account on their platform:

-

-

eToro wallet

Our Rating

- Highly regulated BTC wallet

- #1 cryptocurrency platform

- Accepts Paypal

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.How does coinbase work?

First off, it is important to note that Coinbase and its sister company Coinbase Pro are more of brokerages than exchanges. Ideally, most exchanges on the decentralized blockchain network create a platform where buyers and sellers interact and exchange coins for cash or other coins. Coinbase, on the other hand, buys from the sellers and sells to buyers at a margin. The company places itself at the center of every transaction. When transacting on the platform you, therefore, will be dealing with their systems and not directly with the larger crypto market.

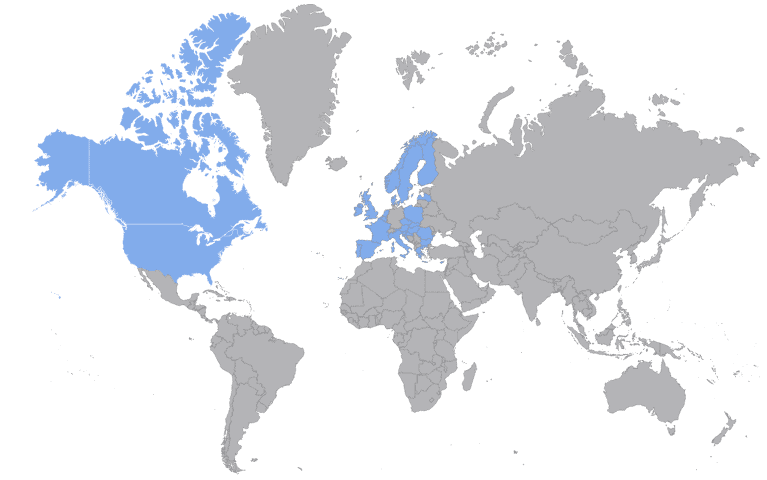

Established in 2012, Coinbase accepts clients from 103 countries across the world – including the United States. These can register and deposit cash into their trading accounts through wire transfers, debit, and card transfers, as well as PayPal. One can then use their deposits to buy or trade the over 17 cryptocurrencies available on the platform. And this includes all popular coins like Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, and Ethereum Classic.

The site supports traders who are actively involved in exchanging coins in the market, and investors who adopt a “buy and hold” strategy.

You will also do well to remember that Coinbase is also one of the few crypto exchanges that offer free crypto wallets to their customers. After coin purchase, you can withdraw them into a private wallet. Alternatively, you can deposit them into your free crypto coinbase account. One of the perks of using their wallet is that they are FDIC registered to imply that you will be compensated for up to $250,000 should the firm lose your money.

Is coinbase same as coinbase pro?

Coinbase Pro is a San Francisco based crypto exchange and sister company to Coinbase and both are headed by Brian Armstrong.

Coinbase was established as in 2015 as the exchange arm of the Coinbase platform to serve the retail traders. The key difference between Coinbase and Coinbase pro is the fact that while Coinbase operates like a brokerage, Coinbase Pro is more of an exchange. Here, traders can engage in crypto-to-crypto as well as crypto-to-fiat exchanges. And also get to interact with other traders more directly.

We have also noticed that Coinbase Pro has more tradable crypto coins compared to coinbase and that it is not shy to list relatively new but hugely popular coins and pair them with the likes of Bitcoin and Ethereum.

Who can use coinbase?

Coinbase appeals most to the individual and institutional investors, not everyday traders. Its design best appeals to investors looking to buy and hold while hoping to benefit from market fluctuations. This is opposed to direct traders who are looking to capitalize on short market gains. Here, all trades are against the exchange platform. This makes it possible to enter into large buy or sell positions – like buying or selling a significant number of coins – at once. This wouldn’t have been possible in a fully decentralized exchange where you are interacting with retail traders.

How to register as a trader on coinbase?

Step 1: The first step to registering with any of the Coinbase crypto exchange outfits should be checking if they accept traders/investors from your country. And they have a pinned list of all the supported countries on their website.

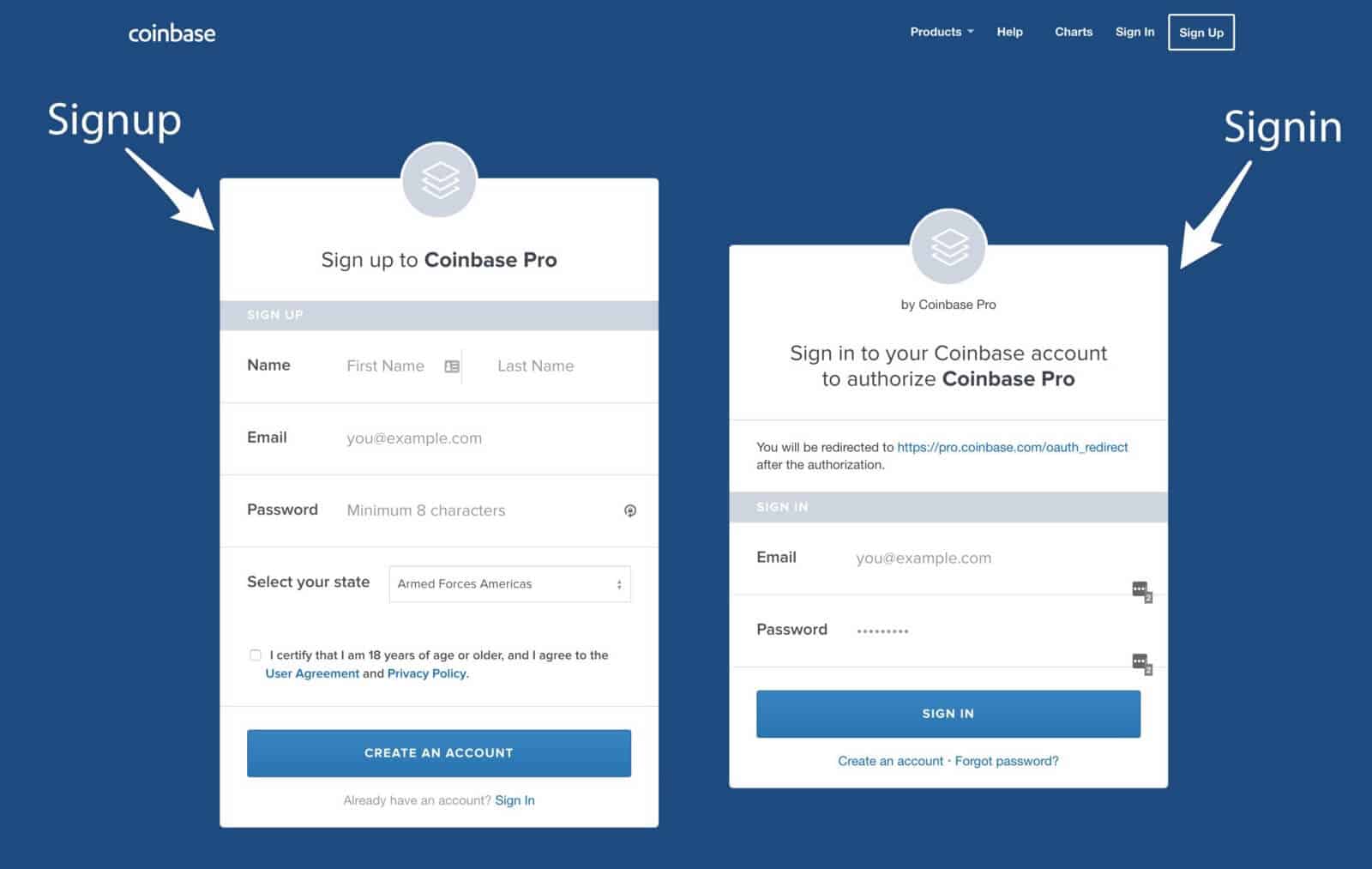

Step 2: You will then have to fill in the rather simplistic registration form on their account creation page. Critical details here that you must give keen attention to include the email address and phone number. The exchange employs a two-factor authentication for all accounts here and it, therefore, is only important that you key-in valid credentials. You will also need to confirm the email and phone number via the links and codes sent to both.

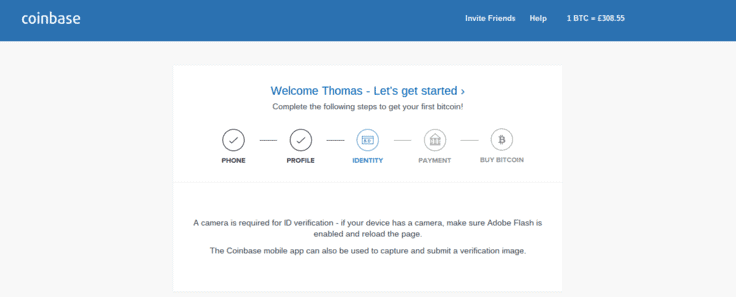

Step 3: In line with the Know Your Client (KYC) policy, Coinbase will require that you verify your identity. This involves uploading a copy of your government-issued document be it a passport or a driver’s license as well as a selfie photo of yourself to confirm that you are the owner of the ID.

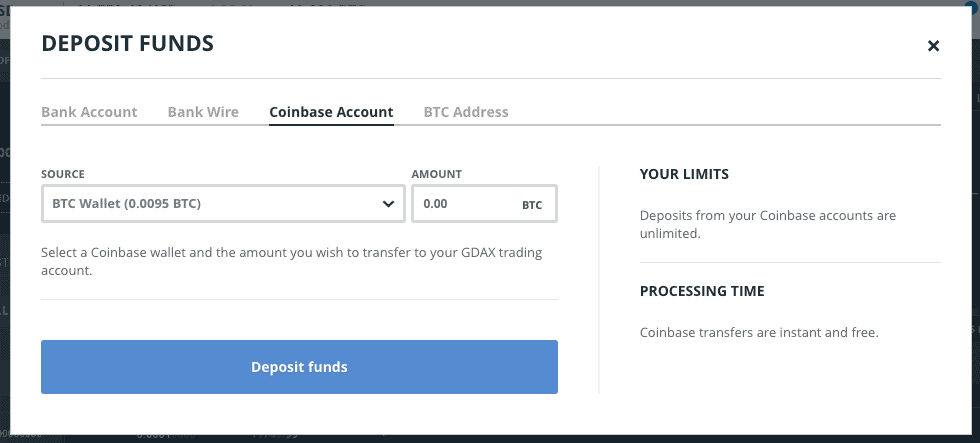

Step 4: After verifying the email address, phone number, and your identity, its now time you made your first deposit. The good thing with coinbase trading platforms is that it doesn’t maintain a minimum initial deposit. Plus they support a myriad of payment processing services like banks and credit/debit cards as well as the online payment processor – PayPal.

Step 5: You are now free to buy and sell cryptocurrencies freely on their platform. Coinbase presents you with 17 cryptocurrencies while coinbase pro supports over 25 crypto coins and numerous trading pairs.

How much does trading at Coinbase cost?

In this coinbase review, we look at the three types of fees and commissions making up the total trading costs on the Coinbase and coinbase pro trading platforms. These include the deposit, withdrawal and transaction costs.

☑️ Deposit costs: How much you pay for deposits on the brokerage platform is highly dependent on your country of residence and payment processing method. For Europe residents using SEPA network deposits are free. In the U.S all deposits are free save for bank wire deposits that attract a fixed $10 fee.

☑️ Withdrawal fees: Like deposits, withdrawal costs are heavily dependent on your location and withdrawal option. SEPA network in Europe charge €0.15 per transaction for withdrawals while bank wire transfers attract a $1 charge. In the United States, Withdrawals via any other method are free but bank wire transfer attracts a fixed $25 charge per transaction.

☑️ Transaction charges: First off, we find Coinbase transactions rather complicated. Transactions under $200 carry a laddered but fixed transaction charge. In this case, any transactions under $10 attract a fixed $0.99 while the rest attracts a $2.49 charge. Buy and sell transactions above $200 will, on the other hand, attract a fixed 1.49% charge of the value of their transaction.

Note: Debit and credit card funded transactions cost higher – up to 4.99% of the total transaction value. Plus you can use your credit/debit card balance to create a trading balance on the coinbase account. You can only use it for direct purchases.

What are the strengths and weaknesses of trading crypto coins on Coinbase?

Strengths

- Highly secure: One thing sticks out every time we address security cases on the blockchain, especially when we look at the major crypto exchanges. And that is Coinbase is one of the very few exchange platforms that haven’t had major hacking challenges.

- A free crypto wallet that comes with every trading account: Another unique and attractive feature about Coinbase is their free wallet. The access to a multicurrency wallet ensures that their investors and traders don’t have to further invest in a secondary wallet.

- Accepts multiple payment processing services: The fact that Coinbase can process payments from virtually every payment processing company – from credit to debit cards, wire transfers, and even PayPal ensures that it caters for all classes of investors and traders.

- Simple registration and friendly interface: Coinbase has one of the easiest registration processes. They have a simplistic web registration page that only captures the most relevant personal data like name, email address, and phone number.

- Highly regulated: In the highly unregulated blockchain industry, Coinbase stands out as it has made significant strides towards becoming the first SEC-regulated crypto broker.

- Insured by FDIC: Investors deposits with the crypto exchange are also protected by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per user account.

Weaknesses

- Complicated fees and charges structure: Both coinbase and coinbase pro maintain a relatively complicated pricing structure. They impose multiple fees – deposit, withdrawal, and transaction charges– at varied rates for different amounts making it hard to calculate the total trading costs on the platform, especially for new customers.

- A limited number of cryptocurrencies available: Unlike other equally popular crypto trading networks that host tens of both popular and newly launched crypto coins, coinbase supports 17 coins, while Bitcoin pro supports 25.

- Limited trading options – no shorting trades: There is a limit to the number of trading options available to both coinbase investors and clients. Among the most obvious is the fact that you cannot short trades. This denies day traders the opportunity to benefit from both uptrends and downtrend price movements.

- Delayed withdrawal processing: Withdrawals on the platforms, especially bank wire transfers, will often take as much as 7 days before the withdrawn amounts reflect on your bank account.

How does it fare when compared to equally popular crypto exchanges?

In checking its competitiveness on the global blockchain industry, we compared coinbase with an equally formidable crypto exchange – Binance. We took into account such factors as their trading costs, number of currencies supported, trading volumes, and user-friendliness. Let’s see how the exchange faired.

☑️The number of crypto coins supported: Coinbase and coinbase pro support 17 and 25 cryptos respectively. Binance supports over 150 coins including their native coin Binance Coin.

☑️Transaction services: Coinbase supports both crypto-to-crypto and crypto-to-fiat trades while Binance will only process crypto-to-crypto transactions.

☑️Trading costs: Coinbase charges 1.49% for normal buy/sell transactions and 4.99% for direct purchase made with debit/credit cards. Binance charges 0.1% for standard transactions, credit card purchases are at 3.5%, and treats you to a 25% discount if you chose to pay via BNB coins.

☑️Trading volumes: Coinbase reports average transaction volumes of above $150 million. Binance reports daily transaction volumes well above $500 million.

☑️User-friendliness: Coinbase has a highly intuitive interface with all the basic features making it most suitable for beginners. Binance interface is rather crowded with highly sophisticated features and trading tools that don’t make it easier to trade for newbies and even experienced traders new to the binance platform.

Verdict:

Coinbase and coinbase pro are definitely legit crypto exchanges. Though you might be tempted to think of coinbase pro as the exchange and coinbase as a brokerage. And this is not just because of the nature of their operations but also due to the fact that coinbase is actively engaging the SEC seeking to be registered and licensed as a fully-fledged financial markets broker.

eToro wallet

Our Rating

- Highly regulated BTC wallet

- #1 cryptocurrency platform

- Accepts Paypal

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs:

Does coinbase support PayPal deposits and withdrawals?

Yes, Coinbase is one of the few crypto exchanges that still supports PayPal transactions.

What is the difference between coinbase and coinbase pro?

Coinbase is more of a brokerage where the institution places at the center of every transaction. Here, buyers and sellers interact directly with the platform and not the crypto market. Coinbase Pro, on the other hand, is a more decentralized exchange where buyers and sellers engage each other and the larger crypto market in real-time.

Does coin base support leveraged crypto trades?

Yes, coinbase supports margin trading. However, unlike most crypto exchanges that have a limit to the number of cryptocurrencies and trading pairs whose trades can be leveraged, Coinbase will only support margin trades for Bitcoin and Ethereum. The margin for BTC/USD and ETH/USD pairs is 3x up to $10,000 and 2x for the BTC/EUR pair up to €3,000.

Who can register a user account on Coinbase?

Both coinbase and coinbase pro are available in over 103 countries across the world. Majorly in North America and Europe and they appeal to both institutional and retail investors.

How many crypto coins can I trade on Coinbase?

Currently, you can trade in 17 cryptocurrencies including bitcoin on the coinbase platform and 25 cryptocurrencies on the Coinbase Pro platform.

How much do I need to start trading on Coinbase?

Neither coinbase nor Coinbase Pro has a minimum initial deposit amount required to activate their account or start trading. You, therefore, can enter into trading positions with as little as $1.

Edith Muthoni

Edith Muthoni

View all posts by Edith MuthoniEdith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. She holds a Masters degree in Economics with years of experience as a banker-cum-investment analyst. She is currently the chief editor, learnbonds.com where she specializes in spotting investment opportunities in the emerging financial technology scene and coming up with practical strategies for their exploitation. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up