How To Invest In Bitcoin (BTC) in 2025

In 2010, around the same time Bitcoin and Cryptocurrency terms were peering into the world of finance, the most you could do with 10,000 BTC was buy a Pizza.

10 years later, the value of a single bitcoin has soared to peak at $20,000. The success of the digital currency has inspired the formation of a new global industry, the cryptocurrency industry, which threatens to take on the mainstream banking and finance sector.

And in its wake, it has left a trail of successful investment tales. Numerous individuals and institutions have amassed considerable wealth because they stuck with the legacy alternative coin from early on.

-

-

About Bitcoin

The past few years have seen the legacy digital currency assume numerous roles, key among them being an acceptable payment method adopted by leading ecommerce as well as main street stores.

It has, on one hand, sparked national and international debates around the viability of the coin and the ramifications of its adoption as a legal tender. On the other, it has birthed an investment rush where every investor now wants a piece of the highly lucrative coin. The uncontrolled demand and the ever condensing supply of the commodity have in turn led to never-seen-before market volatility that saw bitcoin gain 10000%+ in value in one year and shed as much in the next.

Industry experts, however, believe that the most unpredictable phases of bitcoin as an investment tool are over and that it is nearing stabilization. In such a case, and with the proliferation of ways in which you can acquire the coin safely, one might argue that there probably will never be a better time to invest in Bitcoin.

Why invest in bitcoins?

- Portfolio diversification:

A good investment portfolio should be carefully spread to include virtually every investment vehicle. And this includes bitcoin investments. The portion of your investment that you allocate to the high-risk/high-reward bitcoin should, however, be determined by such factors as your risk averseness and age. This age factor is premised on the fact that younger investors who have more than enough time to recover from bad trades and the negative market turns. They, therefore, have the luxury of risking more compared to seniors who will probably be gambling their pensions and retirement savings.

- Huge potential for growth:

Every new day opens Bitcoin to more expansive horizons. It brings forth news about a new ecommerce store or legacy institution embracing bitcoin payments, another country acknowledges crypto trading or another multinational seeking to leverage the digital coins anchor blockchain technology.

Without downplaying any negativity associated with the coin like the threats of governmental regulation and bans in countries like China, every investor can agree that the strides achieved by Bitcoin far outshine any possible threats. The fact that it still has more ground to cover in this quest to replace modern fiat currencies makes it an excellent long term investment choice.

- Ease of liquidation:

Unless you are investing in Bitcoin futures, Bitcoin investments may turn out to be the most liquid asset class in your portfolio. This means that it doesn’t tie your funds in long-term and highly complicated projects with painfully sluggish opt-out processes.

It also means that should you suspect an impending significant downturn you can quickly liquidate your investments, shielding you from massive losses. This is not possible with such other investments as shares and stocks.

- Above-average gains in the shortest time possible

Real Estate investments have for the longest time been considered the golden child of investments. In 2018, however, this considered lucrative industry reported a 5% annual growth. Bitcoin has, on the other hand, reported an average 200% gain in the past five months.

You will, therefore, want to invest in bitcoin if you are looking for above-average gains within the shortest time possible. The only caveat being the fact that you are also faced with the threat of above-average losses over the same period.

- Hedge against ordinary investments and fiat currencies

The cryptocurrency industry is so far removed from the national economies that an economic mishap that results in near-catastrophic impacts on the shares and equity markets have little to no impact on bitcoin prices. This makes it the perfect hedge for your shares and equity investments. You can also learn how to leverage significant shares and equity losses with short term gains trading bitcoin.

How to trade bitcoins in 2025

Buying bitcoins is not an event but a four-part process that starts with identifying where to buy the digital coin, the buy/sell approach, and how to keep it safe. A well-calculated trade strategy must also involve constantly watching over the bitcoin markets for hints on the selling point.

Step 1: Identify where to buy bitcoins

There are several approaches to bitcoin trading. Some of the most popular, however, include buying from a reputable crypto exchange like Binance, through a peer to peer crypto exchange site like LocalBitcoins, or through a multi-asset brokerage. And while buying from an acquaintance may easily pass as one of the quickest approaches to acquiring the crypto assets, it is hardly safe, especially when dealing with online strangers.

Understand that the biggest and most impactful bitcoin scams today are conducted by the ’sellers’ you meet online and promise to sell you the digital coins at discounted rates. In such a case, there is no way of vouching for their legitimacy or verifying the existence of their coins.

The proliferation of bitcoin trading scams also demands that you thoroughly vet the authenticity of any of these trading approaches before creating a trader account with a particular broker. Start by checking whether they are licensed by the financial regulatory agencies in the jurisdictions within which they operate. A bitcoin broker in the USA, for instance, should ensure that their preferred bitcoin company is licensed by the SEC and registered with the FDIC.

Additionally, go through their user reviews from independent customer review websites like BBB and TrustPilot to check their customer satisfaction scores. You would do well to avoid exchanges and P2P platforms with a history of hacks and irrecoverable loss of the client’s bitcoin assets.

Step 2: Decide on your trading approach ( long, short or buy and hold)

I. Buy and holdBuying and holding onto bitcoins for a long term with the hope of profiting from its long term prosperity remains one of the most popular approaches to bitcoin trading. This strategy is largely adopted by individuals who believe that Bitcoin prices will continue to soar in the foreseeable future. This group of traders isn’t bothered by the short term volatilities that are synonymous with the trade. They will just shrug them off as a blip with some viewing it as a necessity in the coins path towards stability. If you are buying and holding onto the coins for the long term, chances are you will be buying bitcoins in bulk. And in such a case, we advise that you consider buying from a highly regulated exchange and store your coins offline in a secure hardware wallet.

II. Buying Bitcoins and disposing them at a higher price

Going long on a bitcoin position can be considered part of day trading and involves buying bitcoins at a low price and selling them off as soon they turn a profit or at the end of a bullish price rally. It involves taking advantage of bitcoins volatility to score the highest returns on investment in the shortest time possible. And while you could try this and in a conventional bitcoin exchange, the slow processing speeds recorded by most of them make the process painfully tedious. You, therefore, are better off investing in the more flexible bitcoin CFDs that guarantee near-instant transaction processing speeds.

III. Investing in a Bitcoin CFD

One of the main advantages of dealing with a Bitcoin CFD over the other forms of Bitcoin trades is the ability to short sell. Short selling is an advanced form of online trading that involves speculating on the decline in price or the ultimate collapse of a stock or any other financial instrument. If you wish to short-sell bitcoins, you will want to first register with an exchange that provides for bitcoins CFDs or crypto-related EFTs. Like taking long positions, short selling involves taking advantage of the bitcoin volatilities and profiting from a bearish run.

Step 3: Learn how to keep it safe

Planning for the safety and security of your bitcoins involves identifying a crypto wallet where you can secure your bitcoins. You have the option of settling for the bitcoin hardware wallet or the convenient online and mobile wallet. However, if you chose to trade bitcoin CFDs, you won’t need a wallet. Ideally, CFD trading involves price action trading and, therefore, doesn’t trigger the generation of transactional private keys. Neither does it involve the distribution of actual bitcoin tokens.

Step 4: Identify the price influencers to watch out for

Prudent bitcoin trading demands that you hold onto an asset for no longer than is necessary. You need to keep an eye out for any factors that may necessitate the liquidation of your bitcoin wallet. These include:

- Changing market sentiments

- Major negative news

- Direct government interference

How to increase your bitcoin investments efficiency

i) Follow the news:

In the highly unregulated crypto world, major news, whether positive or negative has the biggest impact on the price of the legacy coin. It is, therefore, critical that you keep up to date with the global news and learn how to interpret the impact every political or economic event has on bitcoin price.

ii) Avoid leveraged trades:

Leverage is by far the most attractive and also the most destructive aspect of CFD trades. It may lead to above-average profits as well as above-average losses and lead to negative balances. We advise bitcoin investment beginners to shelve the idea of maxing out leverages or practice moderation until they have mastered the trade.

iii) Remove emotion from the equation:

The biggest investment mistakes most people make is skipping on thorough analyses and investing emotionally. Take time to study such market dynamics as whether the asset is over- or under-valued, consider investors and global sentiments, and possible price influencers like impeding major events or announcements.

Challenges rocking bitcoin investments

- Cyber threats:

The surge in price for bitcoin and a ready market has attracted investors, scammers, and hackers in equal measure. The latter are always trying to infiltrate investor’s computers and crypto exchanges’ cold wallets in an attempt to gain unauthorized access to the coins stored therein. You can, however, minimize the incidence of hacks by embracing strong antivirus, firewall settings, and investing in an impenetrable hardware bitcoin wallet.

- Uncertainty over impeding crypto regulation:

The threat of global governments stepping in to regulate critical aspects of bitcoin investments has been dogging the industry for years. Developed nations, like the United States, are always sending mixed signals about bitcoin regulations while others like China have already imposed a total ban on any form of crypto investment and trade. Every time any of this happens, it sends the bitcoin market into a panic mode, causing disastrous volatilities that take months of rebalancing for the market to recover from.

- Uncontrollable volatilities:

By now, only the most risk-tolerant investors have dared try the bitcoin investments. The huge volatilities that see the coin gain and lose significant values in minutes have seen most conservative investors shy away from this market. This doesn’t, however, translate to lack of interest, they are only waiting for the market to gain stability while seeking clarity on the uncertainties rocking the industry.

- Rouge exchanges:

The absence of regulation has birthed numerous crypto exchange crooks out to fleece bitcoin investors. Most will set up shop using pseudo names and addresses and fall off the grid later with investor funds and coins. Others have employed underhand tactics like manipulating bitcoin trade volumes aimed at attracting investors barn while others have been accused of engineering self-hacks in order to swindle investor funds and bitcoins stored in their vaults.

Bottom line

In February 2016, Bitcoin’s price was trending around $800, three years earlier one coin was worth no more than a few dollars. Today, however, a single coin has shot well above $8,000. This translates to a 10 folds gain in less than three years and 40,000%+ gain in the last six years. No other asset in the history of investments has ever been able to pull off similar growth rates in such a short period of time. And while you may be tempted to look at this from a conservative investor’s point of view and write such growth as unsafe, you first need to appreciate the fact that none of the investments in your portfolio is immune to volatilities either.

More importantly, you need to understand that the above-average volatilities the bitcoin investments are exposed to also serve as its biggest benefit. The fact that you can also short a bitcoin price ensures that you can use this volatility to multiply wealth in the industry regardless of the market direction.

Glossary of Investment Terms

BondsA bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. It can be advanced to the national government, corporate institutions, and city administration. It is an investment class with a fixed income and a predetermined loan term.

Mutual FundA mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

P2P LendingPeer-to-peer lending (p2p lending) is a form of direct-lending that involves one advancing cash to individuals and institutions online. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers.

BitcoinBitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. It is virtual (online) cash that you can use to pay for products and services from bitcoin-friendly stores.

Index FundsAn index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

ETFsAn Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets – much like shares and stocks. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

RetirementRetirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. In the United States, the retirement age is between 62 and 67 years.

Penny StocksPenny Stocks refer to the common shares of relatively small public companies that sell at considerably low prices. They are also known as nano/micro-cap stocks and primarily include any public traded share valued at below $5.

Real EstateReal Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes – like building a family home.

Real Estate Investment Trust (REIT)REITs are companies that use pooled funds from members to invest in income-generating real estate projects. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls.

AssetAsset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business.

BrokerA broker is an intermediary to a gainful transaction. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service.

Capital GainCapital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Hedge FundA hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally.

IndexAn index simply means the measure of change arrived at from monitoring a group of data points. These can be company performance, employment, profitability, or productivity. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health.

RecessionA recession in business refers to business contraction or a sharp decline in economic performance. It is a part of the business cycle and is normally associated with a widespread drop in spending.

Taxable AccountsTaxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year.

Tax-Advantaged AccountsA tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Roth IRA and Roth 401K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Traditional IRA, 401K plan and college savings, on the other hand, represent tax-deferred accounts. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes.

YieldYield simply refers to the returns earned on the investment of a particular capital asset. It is the gain an asset owner gets from the utilization of an asset.

Custodial AccountsA custodial account is any type of account that is held and administered by a responsible person on behalf of another (beneficiary). It may be a bank account, trust fund, brokerage account, savings account held by a parent/guardian/trustee on behalf of a minor with the obligation to pass it to them once they become of age.

Asset Management CompanyAn Asset Management Company (AMC) refers to a firm or company that invests and manages funds pooled together by its members. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments.

Registered Investment Advisor (RIA)A registered investment advisor is an investment professional (an individual or firm) that advises high-net-worth (accredited) investors on possible investment opportunities and possibly manages their portfolio.

Fed RateThe fed rate in the United States refers to the interest rate at which banking institutions (commercial banks and credit unions) lend - from their reserve - to other banking institutions. The Federal Reserve Bank sets the rate.

Fixed Income FundA fixed-income fund refers to any form of investment that earns you fixed returns. Government and corporate bonds are prime examples of fixed income earners.

FundA fund may refer to the money or assets you have saved in a bank account or invested in a particular project. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects.

Value InvestingValue investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It involves buying these shares at the current discounted prices and hoping that a market correction pushes them up to their intrinsic value effectively resulting in massive gains.

Impact InvestingImpact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

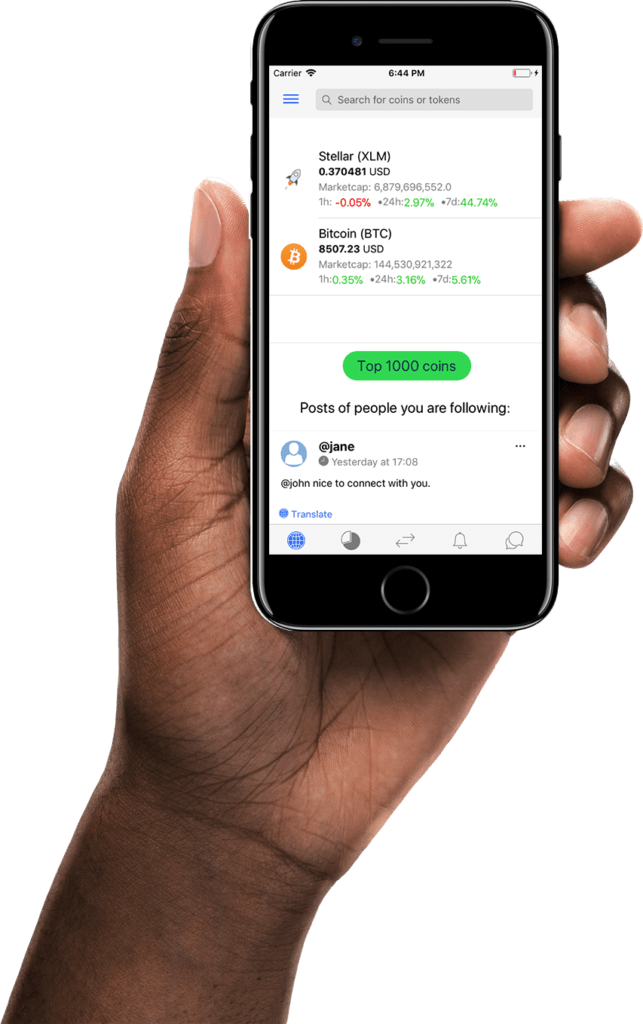

Investing AppAn investment App is an online-based investment platform accessible through a smartphone application. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance.

Real Estate CrowdFundingReal Estate crowdfunding is a platform that mobilizes average investors – mainly through social media and the internet – encourages them to pool funds, and invests them in highly lucrative real estate projects. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors.

FAQs

How do I buy my first bitcoin?

As different bitcoin exchange sites try to outdo each other, they have oversimplified the process of buying your first bitcoin. You only need to sign up with one of these bitcoin trading sites, link it to your bank account and wire in cash. After this acquiring the all-popular digital currency is no more than a few screen taps away.

What determines the price of bitcoin?

To a large extent, Bitcoin price is influenced by the forces of demand and supply. The supply has for the largest part been influenced by the speed at which miners have been able to generate new bitcoins while demand is influenced by numerous independent factors. Positive demand has for the most part been influenced by positive news and announcements as well as the adoption of bitcoin by more entities and institutions. Negative demand has on the other hand been influenced by such factors as governmental regulation threats and the rise of bitcoin-related scams and hacks.

How can I convert my bitcoin investments into cash?

You can only convert your bitcoin investments into cash by selling it. The sale can be to a friend or acquaintance or established bitcoin exchange sites. These include reputable crypto exchanges that allow for fiat to crypto exchanges and vice versa. We, however, advise that you use the more reputable and highly reliable platforms. Here you can easily sell your coins for cash that you can then invest in profitable and less volatile markets within the platform.

Is it too late to invest in Bitcoin?

No. Looking back at Bitcoin’s price history, you will note that the price of the legacy coin rose from a few cents to more than $20,000 in less than five years. While this implies that most early investors already made a fortune investing here, it doesn’t mean that you are too late, you just need to figure out the best entry point. In January 2020, for instance, the price of the coin had dropped to $3,000 but has shot up over 250% in five months to hit the highs of $8,000 in May.

What can I do with the bitcoin that I already own?

You can choose to sell it at the current market price or keep it and wait for further price appraisal. Your decision to sell or keep should, however, be informed by a thorough analysis of the bitcoin industry.

When is the government going to regulate Bitcoin investments?

This remains to be seen, especially in the United States and Europe. Asian countries have been bolder in making their stand about the digital coins known, with China banning its use within its borders while Japan and South Korea embrace more relaxed legislation that allow it to thrive. This uncertainty and mixed reaction can be attributed to the price volatilities being experienced in the industry.

See Our Full Range Of Cryptocurrency Resources – Cryptocurrency A-Z

Edith Muthoni

Edith Muthoni

View all posts by Edith MuthoniEdith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. She holds a Masters degree in Economics with years of experience as a banker-cum-investment analyst. She is currently the chief editor, learnbonds.com where she specializes in spotting investment opportunities in the emerging financial technology scene and coming up with practical strategies for their exploitation. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up

Prudent bitcoin trading demands that you hold onto an asset for no longer than is necessary. You need to keep an eye out for any factors that may necessitate the liquidation of your bitcoin wallet. These include:

Prudent bitcoin trading demands that you hold onto an asset for no longer than is necessary. You need to keep an eye out for any factors that may necessitate the liquidation of your bitcoin wallet. These include: