This quarter is expected to be the most important earnings season of the decade for US banks with the Bank of America posting results on Thursday, with nervous investors eyeing credit losses as a result of the coronavirus pandemic.

As analysts anticipate a 44% drop in S&P 500 profits, the worst decline in 12 years, US banks’ performance may be a turning point both for capital markets and the economy.

The mass unemployment, surging bankruptcies, near-zero interest rates, catastrophic disruptions across entire sectors and looming health crisis are the biggest drivers of shrinking profits for US banks and financial service companies. As the US begins to lift lockdown and attempt to return to life post-coronavirus, Bank of America and other banks are preparing to deal with a pile of toxic loans caused by the pandemic.

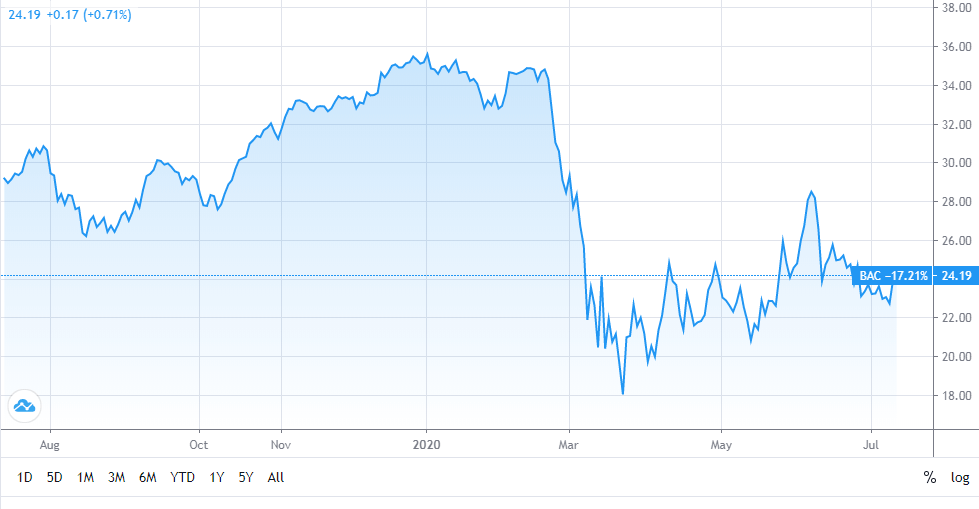

Bank of America’s shares are down 31% this year. The consensus estimates prior to its earnings report are earnings per share of $0.27 and $22.01bn in revenue. Shares in the Main Street bank, led by chief executive Brian Moynihan (pictured), were changing hands at $24.02 on last look. The consensus price target is $28.53, and the stock has a 52-week range of $17.95 to $35.72.

Analysts agree that banks will be forced to further increase loss-absorbing reserves — but the question remains by how much.

“It’s going to be really ugly,” said Kyle Sanders, a banking analyst at Edward Jones.

S&P Global Ratings warned last week that banks around the world will ultimately suffer credit losses of about $2.1trn between this year and next. During the first quarter, Bank of America, JPMorgan, Citi, Wells Fargo and US Bancorp have collectively set aside an additional $35bn to cushion against loans that go bust.

Bank of America held $591bn in deposits in the top 50 counties across the US that have seen the newest coronavirus infections over the last month, according to a Morgan Stanley analysis. It is followed by JPMorgan ($427bn), Wells Fargo ($389bn) and US Bancorp ($151bn) as the banks with the most exposure in dollar amounts to these counties.

As banks remain at a critical juncture, investors looking to short stocks at this time, can open an account with a stock broker or try one of the free trading apps available.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account