Golden Valley Lending Review – Read This Before Applying

The reason you have these doubts and questions is that you’ve heard sad and horrifying stories of lending companies taking advantage of borrowers at their worst. To help you beat the statistic and come out ahead of this situation, we’ve decided to do the groundwork for you. In this guide; we shall disclose everything you need to know about Golden Valley Lending. You will know what makes the company tick and if it’s truly worth your time.

So without wasting time, let’s dive into the heart of the review.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

What is Golden Valley Lending?

The first thing you should note is that Golden Valley Lending is a tribal lender that has its base in California. Wait, what is a tribal lender? And are their loans any different from payday loan lenders?A tribal lender is a financial institution that operates on tribal land, is owned and operated by the Native American Financial Services Association. Just like the casinos that are built on tribal land, the tribal lenders are under the sovereignty of the tribal laws instead of the state laws. Although they are required to adhere to consumer finance and lending laws as stipulated under federal laws, they are exempted from following specific state laws.

The NAFSA (Native American Financial Services Association) was started in 2012 and represents about twelve tribes in the short term loan lending business. In case you are wondering, tribal loans are different from payday loans. How so? Well, with conventional payday loans, you are required to repay the loan amount in a single repayment, and usually with your next paycheck. For many who are in financially tight situations, this can be prohibitive and end in a disaster. If they are unable to repay the loan on the due date, the interest and fees pile up and they find themselves stuck in a financial avalanche.

Tribal lending helps to solve this problem by offering borrowers installment loans. They calculate the cost of the loan, add it to the loan amount and then divide it by the loan term to find the amount payable every month or every fortnight. The number of payments is dependent on the amount you borrow and the specific terms of the lender in question.

In the case of Golden Valley Lending, you can borrow a loan amount between $300 and $1,000 if you are a first-time borrower. The amount increases to $1,500 for subsequent loans. With every loan, you get five months to repay. During this period, you will make a constant payment every two weeks.

At the time of writing this guide, Golden Valley Lending offers services to borrows from different states including;

- Alaska

- Alabama

- California

- Arizona

- Hawaii

- Delaware

- Florida

- Indiana

- Idaho

- Illinois

- Louisiana

- Iowa

- Kentucky

- Michigan

- Maine

- Missouri

- Mississippi

- New Hampshire

- Nebraska

- Nevada

- North Dakota

- New Jersey

- New Mexico

- Rhode Island

- Ohio

- Oregon

- Tennessee

- South Carolina

- South Dakota

- Washington

- Texas

- Wyoming

- Utah

- Wisconsin

When applying for the loan, Golden Valley Lending doesn’t disclose the fees or the interest rates before-hand. As such, you don’t get to know the cost of the loan before applying. This is something that worries borrowers, especially when you factor in the fact that as a tribal lender, it doesn’t have to abide by state payday loan regulations. Golden Valley Lending doesn’t have a limit to how much they can charge you for the loan.

Note: If you are in Washington DC, Oklahoma, Vermont, Virginia, New York, Maryland, Georgia and other states not listed in the above checklist, you will not have access to Golden Valley Lending loans.Pros and Cons

Pros:

- It is available in 35 states – given that Golden Valley Lending is a tribal lender, it can work in more states than regular payday lenders can. Yes, very few emergency loan lenders are in those many states.

- Discount for return borrowers – if you repay your loan successfully and come back for another, you qualify for a loan. This discount acts as an incentive to increase customer retention.

- Increased loan amounts on subsequent loans – in addition to getting rate discounts, you can access higher loan amounts capped at $1,500 on your subsequent loan applications.

Cons:

- Potentially high APRs – since it is a tribal lender (yes you will hear this a lot on this guide), it is immune to some state laws including regulation on short term loan fees and regulations.

- May perform a credit check – unlike other payday lending institutions, Golden Valley Lending may perform a hard credit check to confirm your financial status. Though you might get your loan when you need it, it means that defaulting on the loan will hurt your credit score.

- Loan fees and rates aren’t transparent – Golden Valley Lending claims they are transparent. However, this claim doesn’t hold when it comes to its fees and rates. You will not see the loan cost (APR) until you apply for the loan. This takes away your chance to make an informed comparison with other payday lending options in your state.

How Does Golden Valley Lending Loans Work?

Like many payday loans, Golden Valley Lending operates through a website. Technically, the website can be accessed from any part of the world. However, the loan services are only available to those in the US (and specifically those living in the states we listed above). The websites contain everything you need to know about the loan and the company albeit a few mishaps.

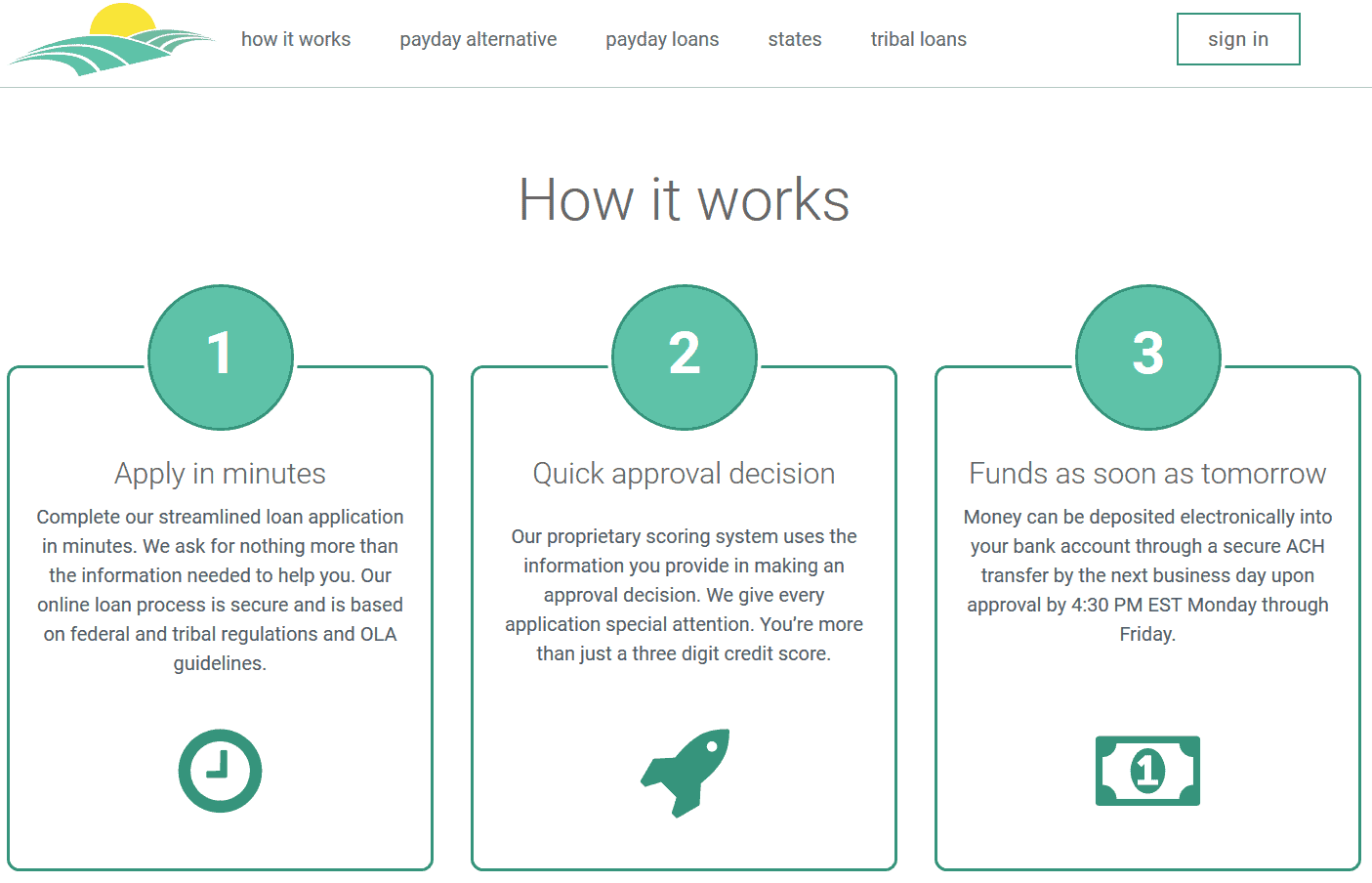

The process of getting the loan starts by filling out a form on the website. As a first-timer, you can apply for a loan amount between $300 and $1,000. However, if you come back for another loan, the loan limit is increased to $1,500.

Though you’re at liberty to state the loan amount you need, the company has the final say on the actual amount you get. If your finances are strong – meaning you are left with a substantial amount every month after catering to your expenses, Golden Valley Lending might grant you a loan closer to the loan limit. You see, payday loan companies shouldn’t provide loan amounts which will require borrowers to pay more than 25% of their income every month. They are required to be responsible lenders. If the lender doesn’t make this consideration and continues to give a high loan amount and you default, they are held liable for the loss if you ever go to court.

Aside from the loan amount, you provide personal details, including your bank account information (where Golden Valley Lending will deposit the loan). With most same day lending companies, you know how much the loan costs before applying. But with Golden Valley Lending you will only know when signing the loan contract. Because of this, you must take your time to consider the details and terms of the loan carefully. Do some quick math to check if you can afford the loan or not. If you can’t, then terminate the process.

Regardless of the loan amount, you will have five months to repay the loan. Payments are due every two weeks. And there is no grace period for loan repayment. So far, Golden Valley Lending sounds like a bad idea, right? Well, it’s not. It’s available in more than 30 states which is more than what same day lenders offer. Moreover, the loans are ready and in your bank account within a day.

What loan products does Golden Valley Lending provide?

Golden Valley Lending specializes in providing short term installment loans. With these loans, you have the luxury of paying back within a couple of months. This eases the pressure of having the loan and reduces the chances of defaulting and ruining your credit score.

Does Golden Valley Lending offer store services?

Some payday lenders with store locations offer extra services to borrowers who walk into their stores. Unfortunately, Golden Valley Lending doesn’t provide extra services, but this is not necessarily a bad thing. One can choose to look at it in a different light – the company has more time to offer a better experience and a great loan service.

How does one open a Golden Valley Lending account?

Opening a Golden Valley Lending is easy and will take you less than 5 minutes. Once you have the account, you can proceed to fill out a loan application form and get your loan.

Note: Golden Valley Lending also has the option of an over-the-phone loan application.To start the process, visit the official website and select how much you want to borrow and click ‘Sign In’ or Apply Now’.

Enter your full names, email address and then declare your military status.

Read through the privacy policy and other important documentation and click ‘Next’. Alternatively, you can skip reading these documentations if you are familiar with how payday loans work.

Enter information about your income and bank account details. If you have a promotion code, paste it on the space provided.

Once you submit the application, the lender will start the verification process. Golden Valley Lending will let you know if the application is successful or not.

Note: Typically, Golden Valley Lending processes loans within a day. However, this is assuming you submit your application before 4:30pm between Monday and Friday. If you don’t, you will have to wait for about two business days for Golden Valley Lending to process the loan and release funds into your account.Eligibility Criteria

Golden Valley Lending offers bad credit loans, but even it has some requirements. Not every application sent qualifies. Some of the factors Golden Valley Lending considers include:

- You should be 18+ years

- You should have a regular source of income

- You should have a valid bank account

- You should be a US citizen and live in the states that Golden Valley Lending offers its short loan services.

What information does Golden Valley Lending need to grant you a loan?

There is basic personal information you need to be able to provide in order to get a loan. These include:

- Your next two pay dates

- Your bank account details

- Your social security details

- Your driver’s license or your state ID number

- Your monthly income

Golden Valley Lending has approved your loan, now what?

By now, you know two things, Golden Valley Lending doesn’t offer a grace period for loan repayment, and the installments are payable every two weeks. In this section, we’d like to add the fact that the loan agreement will contain everything you need to know about the loan, including the repayment schedule.

This schedule is designed to ensure you have enough money before every due date. If you don’t, Golden Valley Lending will charge you $20 for insufficient funds. And if you miss multiple repayments, you risk having your account shut down.

On the flip side, if you happen to get some extra cash, you can repay the loan before the due date. No, you don’t have to worry about a prepayment fee because Golden Valley Lending doesn’t have one. But why should you prepay a loan you could conveniently repay in five months?

Well, it’s simple. You get to save money on the interest that accrues. Though Golden Valley Lending doesn’t disclose the APR until you’ve applied for the loan, one thing is true; they charge the interest rate every day.

If for some reason you anticipate not having cash on the due date, rather than waiting for time to elapse, it’s better to contact Golden Valley Lending instead. They will help you through the rough patch while keeping both parties happy.

How good is Golden Valley Lending customer support?

Judging from the reviews posted online, the support team has a lot of changes to make. Though it’s unlikely you will get stuck on the loan application, a competent customer support staff is important to improve your experience with the company. Poor customer service often results in bad experiences and losing money.

But even with the misses, Trust Pilot gives Golden Valley Lending’s support team a 9.2/10 rating. This is based on the high number of positive reviews on the platform. So which is which? Is the support exemplary, or could it use some improvement?

Well, it’s both. The company could use some improvement in some sectors, but so far, it is good enough. You can reach the support team through;

- Email – [email protected]

- Phone – 855-214-8144.

You can only reach the team through work hours as detailed below;

- From Monday to Thursday – between 8 am to 9 pm ET

- On Friday – from 8 m to 5 pm ET

Is Golden Valley Lending safe and secure?

Golden Valley Lending is a legit tribal lender. In line with this, Golden Valley Lending also pulls all the stops to ensure that it is secure. It does this by using 128-bit SSL encryption on all information you enter. Moreover, as part of its privacy policy, it agrees not to share your information with third-party companies (though if we’ve have learned anything from the internet is to take such claims with a pinch of salt).

But on the bright side, Golden Valley Lending allows you to limit the information they can share with affiliate companies.

Verdict

So how does Golden Valley Lending stack up against other payday companies in the US? Is it worth your time, or does it expose you to the possibility of a being in a vicious debt cycle?

Here’s the moment of truth. First, Golden Valley Lending holds its own against popular same-day loan institutions. Where it beats most of them is the fact that its services are available in 35 states. Most payday lenders are available in single states which is quite limiting for them. But on the flip side, the fact that they do not disclose the loan cost (APR) makes borrowers feel like they have something to hide (even if they disclose it later).

Second, yes, Golden Valley Lending is worth your time. Why? Well, it is a legitimate company that has been running for several years. It grants you the ability to repay the loan in installments, and the process eases the financial burden.

Though the initial loan amount is low, you can borrow a higher amount on subsequent loan applications and you get a discount if you do return. Lastly, judging from the positive reviews it has on Trust Pilot and the 9.2-star rating, we can conclude that Golden Valley Lending knows what it’s doing and is definitely worth your time.

FAQs

Does Golden Valley Lending check my credit score?

Unfortunately, it does and this might affect the score slightly in case you default on the loan. They check the credit score to ensure you are creditworthy (it’s part of being a responsible lender as required by the law).

What if I cannot repay the loan on the specified due date?

If you anticipate this, you should make a point of contacting the support team before the due date (preferably two days before. The team will go through your case and come up with alternative arrangements to help you repay the loan without being flagged. Remember if you miss multiple due dates your account is closed.

Can I repay the loan using my credit card?

Unfortunately, credit cards are not an option with Golden Valley Lending. They used to, but they stopped in May 2019. Now Golden Valley Lending only accepts debit or ACH cards.

Can I take multiple loans simultaneously?

Wouldn’t it be great if it was a possibility? But no, Golden Valley Lending doesn’t allow this. One loan is a huge risk as it is; they cannot afford to extend two loans at the same time. Actually, even if you have an outstanding loan with another lender, Golden Valley Lending will not grant you the loan. And quite frankly, it’s not wise for you to do so. Even if you are contemplating debt consolidation, payday loans are not the best loans for such moves because they are the most expensive.

Should I be a tribal borrower to get a tribal loan?

No, you don’t. Tribal lenders extend their services to both tribal and non-tribal borrowers.

How fast can I have the money?

Short term loans are for emergencies. As such, they are usually processed within minutes. But even then, it’s highly unlikely that you will get your money within an hour. If you consider the approval and deposit process, you will understand why it takes a business day to have money in your account. In the case of Golden Valley Lending, if you apply for a loan late, you might have to wait for two business days and this is excluding the weekends.

US Payday Loans A-Z Directory

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

Scroll Up

Like many payday loans, Golden Valley Lending operates through a website. Technically, the website can be accessed from any part of the world. However, the loan services are only available to those in the US (and specifically those living in the states we listed above). The websites contain everything you need to know about the loan and the company albeit a few mishaps.

Like many payday loans, Golden Valley Lending operates through a website. Technically, the website can be accessed from any part of the world. However, the loan services are only available to those in the US (and specifically those living in the states we listed above). The websites contain everything you need to know about the loan and the company albeit a few mishaps.