Possible Finance Review 2020 – Read This Before Applying

When you have exhausted other loan procurement options or if regular lenders will not touch you, payday loan companies like Possible Finance sweep in for the rescue. Possible Finance specializes in offering short term installments.

But before you take out a loan, what makes this company special? Why should you get into a contract with them? Heck, are they even legal? These are some questions we seek to answer in this guide.

We have conducted a thorough analysis of the platform and seek to provide you with information you need to decide on the service.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

-

-

What is Possible Finance?

Possible Finance is a new age alternative to traditional payday loans, which are often costly. When you take a payday loan, you need to repay in a month or several months depending on the amount borrowed and the underlying terms of the loan.

Possible Finance is in the business of offering loans to individuals with bad credit loan history. You can borrow up to $500 without security. In addition to extending loans payable in installments, Possible Finance offers multiple repayment platforms, which makes it easier for users to repay on time and conveniently. Moreover, the lender provides more time to repay the loan. With more time, you can catch a breath and reorganize your finances. This way, you can conjure a plan and avoid a debt cycle that is common with payday loans.

Offering unsecured loans to individuals comes with the responsibility of helping them bounce back and grow their credit score, which in turn improves their loaning options. Possible Finance reports payments to major credit bureaus in the U.S. these include Experian, TransUnion and Equifax. With every good report, you increase your credit score and ability to qualify for bigger and better loan products.

Most Possible Finance customers use loans for various emergencies, including car repairs. However, some who are focused on the future use the loans to build their credit score in the hopes that it will come in handy when they need it most.

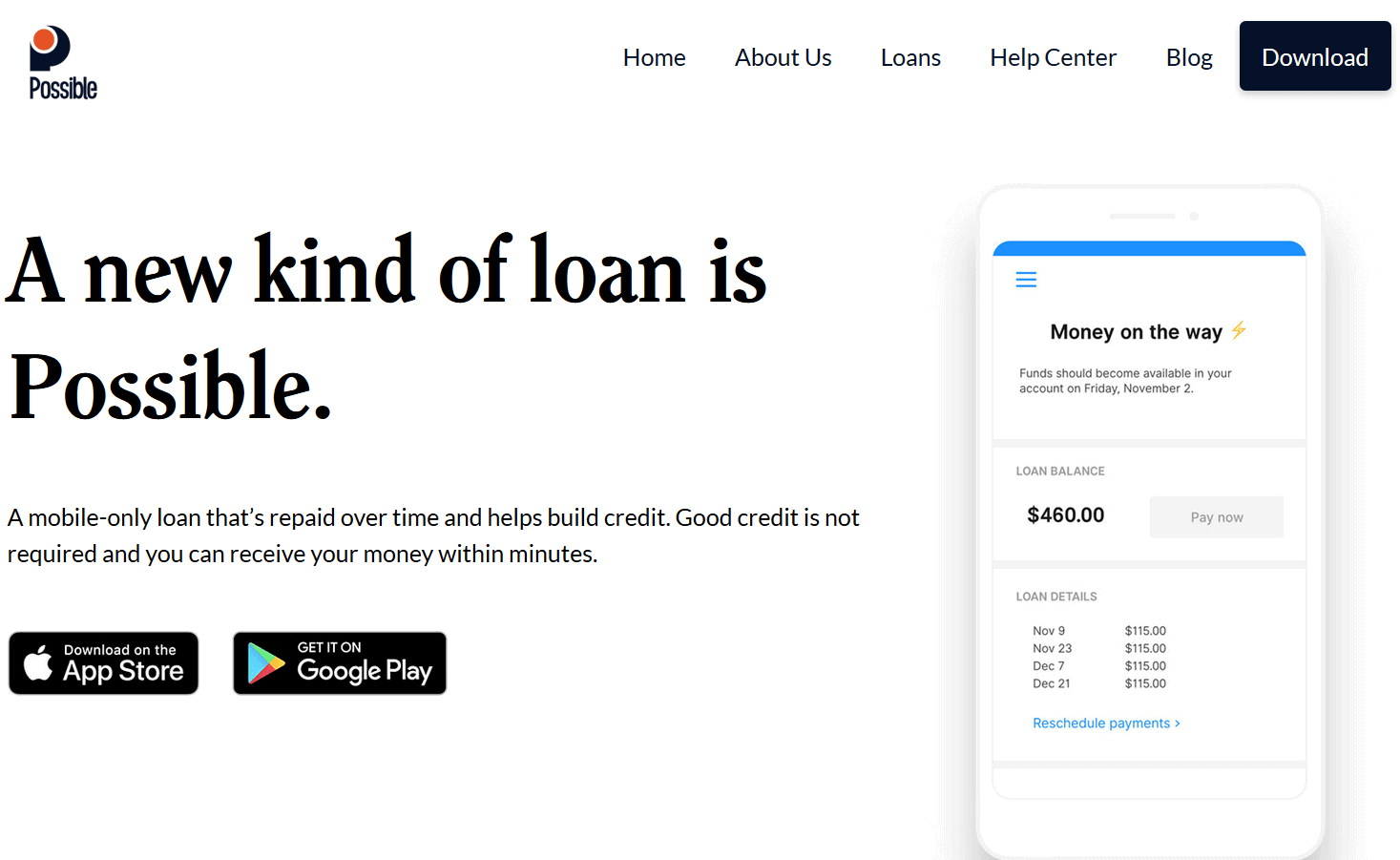

Possible Finance is a payday loan company that operates through an app. The loan application process and payments are all done through its app. You can download the app on their official website.Pros and cons of Possible Finance?

Pros:

A Loan from Possible Finance comes with several pros. These include:

- Repayments align with your payday (the one you provide on your application) – Possible finance sets up four repayments on days after your payday. This helps reduce the chances of defaulting

- Extend loans to anyone – it doesn’t matter if you have a bad credit score. Possible Finance is for you. You can get the loan with a poor credit score and if you are timely on your repayment, you can improve your credit score in the process. This is possible because Possible Finance reports repayments to top credit bureaus in the U.S.

- Has good customer support – many U.S borrowers have expressed their love for the customer support team. The team is polite and timely in resolving issues.

- Fast turnaround if you have Visa – borrowers with a visa card might get same day loans approved on the same day.

Cons:

Below are some cons of borrowing money from Possible Finance

- You need a checking account – Possible Loans requires that you have a checking account. The account you link should be active for the past three months and should receive regular deposits. You cannot repay loan installments with credit cards, PayPal, or prepaid debit card.

- Applications experience technical hitches from time to time – some borrowers have complained of technical glitches with the app. When this happens, you will have to get in touch with customer support through the phone.

- It doesn’t offer paycheck advances – although it operates through an app, Possible Finance doesn’t offer advances for paychecks. It still remains to be a short-term loan company with relatively high-interest rates.

- Its availability is limited – Possible Finance is available is in a few states despite payday loans being banned in only 13 states. However, if you are without the service states, you can still download the app and enter a waitlist.

How does Possible Finance Work?

As pointed out above, Possible Finance is an emergency loan company. It has a web presence but unlike other payday loans, the loan application is not done on the website – users have to download the application.

The loan application process takes less than 60 seconds on the mobile app, assuming you have all the necessary documentation at hand. The lender considers the details on the application to determine the affordability of the loan. According to Possible Finance, though they accept individuals with poor credit, only half of the applicants have their loans approved. Those whose loans are approved receive funds instantly through their debit card. Funds can also be sent through bank transfer in two business days.

Once the loan is secured, it’s time to repay. Possible Finance has flexible repayment periods since the loans are paid over eight weeks. The repayments are made bi-weekly. Possible Finance tries to have the due dates around the time you get your paycheck. However, if the due dates is before your pay date, you can push the payments up to 29 days without incurring additional fees or negatively impacting your credit score. To help you remain up to date with your payments, Possible Finance sends push notifications from its mobile app several days before the due date.

When you repay your loan on time, you improve your credit score. This is possible because Possible Finance shares the information with credit bureaus in the US. On the flip side, if you don’t make payments, the loan could be detrimental to your credit history.

You see, for repayments, Possible Finance automatically withdraws money from the account on the due date. This way, you don’t have to worry about forgetting to make manual payment (but even then, they send reminders). If you don’t have enough money in your account, you’ll have to deal with overdraft fees. And if you don’t have money at all, Possible Finance gives you some time (up to 30 days) to get up to date before they report the missed payment to a credit bureau and damage your credit score. Luckily, the company doesn’t charge late fees (more on this later on).

Let’s back up a little. How does Possible Finance know if you are good for the loan or not? Do they take the details on your application to be the gospel truth? Of course not. They perform a credit history check as well through reputable third-party credit companies.

What Loan Products Does Possible Finance Offer?

Possible Finance offers a couple of loan products. These include:

- Personal loans – these are called personal loans because they can be used for personal use. You can use them for entertainment and anything else you please. The loan is unsecured.

- Installment loans – these allow customers to borrow specific amounts that are determined during the application stage. You can make payments on a fixed schedule that is documented before you accept the loan.

The loans offered are unsecured. Because of this, the interest rates are high.

What Other Store Services Does Possible Finance Offer?

Possible Finance doesn’t offer store services aside from the loans mentioned.

Possible Finance Account Creation and Borrowing Process

The borrowing process is simple and straight forward. It’s nothing different from creating normal app accounts like Instagram (only that it has a couple more steps).

- Step 1: Visit the official Possible Finance website and download the application. Alternatively, you can search for the app on the Google Play Store or iOS app store.

- Step 2: Log in through your Google, Facebook or Microsoft account

- Step 3: Select the amount you need to borrow. Possible Finance displays the relevant fees along with the bi-weekly repayment installment for a better perspective of what you are getting into

- Step 4: Take a picture of your ID (front and back). You can opt to enter these details manually.

- Step 5: Enter your SSN and take a clear picture of yourself and link your current bank account.

- Step 6: Confirm the details you’ve entered and submit the application.

Once this is done, you will receive an update on the status of the application within 24 hours. After approval, you’ll have three days to accept the loan. If you do not, you will have to reapply after three days.

If the app supports your Visa debit card, you can receive the money in your account on the same day.

Eligibility Criteria for Possible Finance

Though Possible Finance is all about supporting its customers to improve their financial situation, they have strict criteria they adhere to. This criterion keeps all parties involved safe and helps mitigate the risk involved in offering unsecured loans.

To qualify for the loan, you need to

- Have a valid driver’s license and social security number for identity verification.

- You should live in sates the lender operates in. These states include Ohio, Idaho, Washington, Utah, Florida, and Texas.

- Have an account that has more than three months of financial history and a monthly income of not less than $750

- Have a positive cash flow. This means that you should have some leftover money after catering to your monthly bills. Though Possible Finance is not strict on this, a positive cash flow increases the odds of loan approval.

- Be older than 18 years

Information Borrowers Need to Provide to Get Possible Finance Loans

When you are applying for the loan, you need to provide specific and accurate information. Unlike regular loan companies, Possible Finance uses the information in your loan application to determine whether you are good for the loan or not.

To complete the application, you need to have the below documents;

- Bank account details

- Social security number

- State issued ID or a driver’s license

What States Accept Possible Finance Loans?

Out of the 50 US states, only 37 states have statutes allowing payday loans or its equivalent. And even from these 37 states, Possible Finance is only operational in a few. These states include:

- Florida

- Ohio

- Washington

- Utah

- Texas

However, Possible Finance is actively adding states to this list.

What are Possible Finance Loan Borrowing Costs?

The cost of the loan depends on the state you are in. But generally, Possible Finance has a flat fee and a monthly interest on the loan due.

If you take a loan while in Washington, Utah, or Idaho, you will be charged a flat origination fee of between $15 and $20 for each $100 loan. As for the interest rate, you’ll be charged between 151% and 200% APR. On the other hand, for Texas and Ohio, the interest is 215% and 230% respectively.

Why does the company charge an origination fee? Well, because it costs $10 to originate the $100. And since they are a business, they transfer the charges to you at a reasonable rate.

Below is an example to give you a better understanding of how much you’ll repay.

If you borrow in 4200 in Washington State, you’ll be charged between $15 and $22 as the flat origination fee for each $100. This translates to between $30 and $44 for the $200 loan. The payments are spread out to eight weeks and four installments.

Here is a breakdown:

- Loan amount – $200

- Bi-weekly repayment – $57.50

- The total amount repaid – $230

- APR – 151%

Possible Finance Customer Support

Possible Finance has received excellent customer reviews on their customer support. The team is fast and answers queries in a simple manner. You can reach the team through pone on 206 202 5115. The support team is available between 10 am and 5 pm PDT. You can also submit a request through their website.

Is It Safe to Borrow from Possible Finance?

Generally, Possible Finance is safe to use. The application is secure and adheres to the industry standards of security and privacy. Though the application requires a connection to the bank account provided, the connection is through Plaid. Plaid is a reputable encrypted service that doesn’t store user information. As such, you don’t have to worry about your information landing in the hands of third-party companies and agencies.

And in the event you outgrow Possible Finance and want out of the service, you can always unlink your bank account and delete the account. However, even after deleting the account, it will retain some information to identify you for security and legal reasons. Retaining this information is well within the law.

Possible Finance Review Verdict

After you consider your alternatives and decide Possible Finance is your best bet, you should carve out some room in your budget to repay the said loan with the set time frame. For a company that offers bad credit loans, its regulations and operations are geared towards improving your financial health even as it makes money.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

Is Possible Finance a good idea?

If you find yourself in an emergency, it is a good idea. However, it’s not always the best. Before you apply for a loan, you should exhaust other cheaper options. Also, if you don’t have enough residual income to repay the loan, don’t apply for the loan.

How does credit history improve?

When you get a loan, Possible Loan updates your current status with credit bureaus. The information contributes to building your credit history. How is it calculated? Some factors considered include the length of credit history and payment history. The best way to improve the credit score is to make timely repayments.

Does the company conduct credit checks?

Possible Finance can run a credit check when reviewing your application. They do this to protect themselves from fraud and also to improve their lending decisions. Credit checks are also part of responsible lending and also serve as a solid foundation for growth. The credit check doesn’t affect your credit score. However, the company expects you to provide accurate information.

How can I repay my loan?

You can make deposits and repayments manually using your Visa debit card. Alternatively, you can grant Possible Finance permission to deduct the installment from your bank account automatically.

Can I apply for a loan through the website?

No, you cannot. However, you can get all the information you need about the loan on the website. To apply for a loan, you have to download the app (the link is on the website).

Can I get an extension on my loan?

Yes, you can. You can push the payment date forward for up to 29 days. After this, Possible Finance will have to report the state of the loan to the relevant credit bureaus.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up