Minnesota Payday Loans Lender 2020

Are you based in Minnesota and wondering what your short-term financing options are? The good news for you is that payday loans are perfectly legal in the state. With that said, state legislators have installed a range of restrictions to protect borrowers from unethical lending practices.

This includes a maximum interest rate of 200% APR, and a loan size that cannot exceed $350. Moreover, while there are no minimum loan terms, Minnesota payday loan companies can not issue loans for more than 30 days. As such, if you need to borrow more than this – or you need longer to repay the money, you’ll need to consider an alternative funding source like a personal loan.

Nevertheless, in our guide on Minnesota Payday Loan Lenders in 2020, we are going to explain everything you need to know. This includes the laws surrounding payday loans, how much you will likely pay in interest, and how you can get started with an application today.

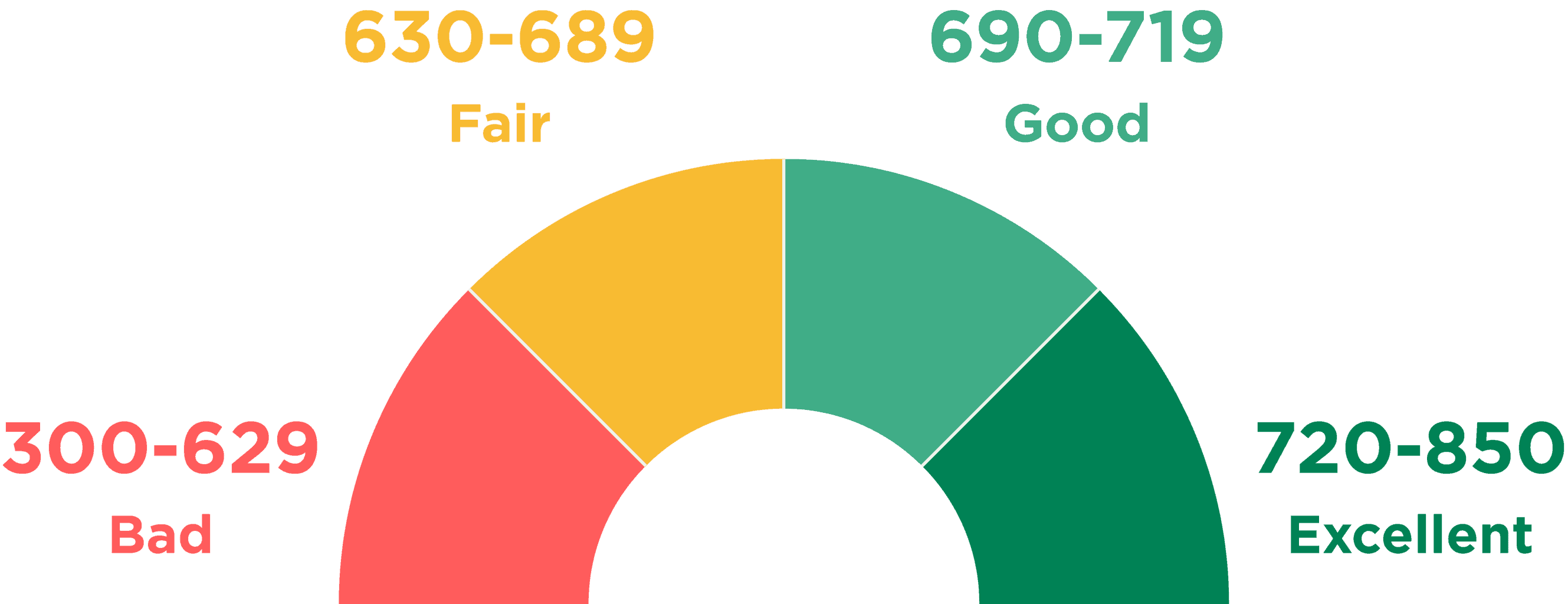

Although state legislators in Minnesota are happy to allow payday loans, they have installed a number of restrictions. First and foremost, the largest loan size that can be taken from a payday loan company is $350. This ensures that consumers in the state do not borrow too much money and thus – are not financially crippled by online payday loans. Secondly, you cannot borrow the funds for more than 30 days. Furthermore, you are unable to roll over or extend the loan, so you’ll likely need to repay it in full when you next receive your salary. With that being said – and unlike a number of other states with strict lending laws, there is no limit to the number of payday loans that you can take out. This is on the proviso long that the loans are with different lenders. When it comes to interest payments, the specific limit will depend on the amount that you wish to borrow. For example, Loans of up to $50 cannot come with an interest rate of more than $5.50. Between $100 and $250, this is increased to a flat fee of $5, plus 7% of the total loan amount. At the upper end of the scale, a loan of between $250 and $350 would attract a fee of 6%, plus the flat $5. As great as the protections are, it is important to note that a number of lenders bypass these rules. Known as ‘Tribal Lenders’, such companies do not abide by state lending regulations. Instead, they operate under their own codes of practice. This not only means that they facilitate payday loans for Minnesota residents for a surplus of $350, but they can charge as much interest as they like. Tribal loans are typically sought after by borrowers that have been turned away from other lenders due to bad credit. Pros: Cons: There are more than 100+ payday loan companies operating in Minnesota and countless more in the form of Tribal lenders. As great as consumer choice is, this can make it difficult to know which lender to go with. For example, while a lender might be great for fast funding times, it might not excel in the customer support department. Nevertheless, we’ve listed some of the most important metrics that you need to look out for when choosing an online payday loan company in Minnesota. No Visit Required You should initially check whether or not the lender allows you to complete the entire application process online. This should include the initial application form, having your personal data electronically verified, entering your bank account details, and then signing the digital loan agreement. Some lenders in Minnesota will ask you to visit their nearest branch to hand-in documents and sign the loan agreement, which is far from convenient. As such, stick with 100% online lenders. Representative APR Rates The maximum APR that can be charged by online payday loan lenders in Minnesota is 200%. With that said, 200% is still quite a lot of interest to be paying on a loan. As such, you should target lenders that offer a much lower interest rate. The best way to gauge the types of interest charged by the lender is to check the platform’s representative rate. While you won’t know the exact APR charged until you submit an application, you will at the very least be able to get a ballpark figure. Funding Times Check the lender’s platform to see what their policy is on funding. Most Minnesota payday loan lenders will transfer the loan funds into your account as soon as it is approved. This allows you to obtain same-day funding to cover a financial emergency. However, some lenders will need to ask you for additional documentation – such as a state ID or proof of address. If they do, this will delay the process – so be sure to check this before applying. Loan Size and Term The maximum loan size that Minnesota payday loan companies can offer is $350. However, if you need to borrow more than this, then you might need to consider an alternative funding source. Moreover, you should also check when you will be required to make your repayment. This is limited to 30 days in the state, although most lenders will ask you to repay the funds when you next get paid. Are you based in Minnesota and looking for a payday loan today? If so, follow the quickfire guidelines outlined below. To get the payday loan ball rolling, you will need to find a lender that meets your personal financing needs. As we briefly noted earlier, there are more than 100+ licensed payday loan firms operating in the state, so the choice is plentiful. Nevertheless, the best way to find a suitable lender is to go through the guidelines we have outlined in the section above. If you don’t have time to perform your own due diligence, it might be worth considering one of the recommended lenders we have listed on this page. Now that you’ve found a lender, you will need to start the application process. Head over to the provider’s homepage and enter your loan requirements. Once you are taken to the main application page, you will be asked to enter some personal information, as well as information surrounding your financial standing. This will include: When you submit the application at the provider’s website, the lender will then attempt to verify it electronically with third-party sources. If your loan is approved, you will then be shown your personal lending terms. This will include the APR rate and the date in which you need to repay the funds. Don’t forget, state lending terms dictate how much lenders can charge you. The amount is based on the size of the loan, so be sure to check this before proceeding. If you want to proceed with the loan terms offered, then you will need to enter your US checking account details. This is where the loan funds will be deposited into. Moreover, the lender will likely ask you to sign an electronic debit agreement, which allows the provider to collect the repayment from your bank account automatically. Once you have read through and signed the digital loan agreement, the lender should transfer the funds. On the one hand, state lending laws cap the maximum APR rate to 200%, which is good for you as the consumer. However, this also has the undesired effect of tightening the eligibility threshold. This is because lenders in Minnesota have less flexibility in what they can charge you – meaning they are unable to offset the risks of loaning money to bad credit profiles. Check out the minimum eligibility requirements that Minnesota payday loan companies typically ask for: Regular Source of Income You will need to demonstrate to the lender that you have the financial means to repay the loan. As such, you’ll need to have a regular income of some sort to be eligible. Lenders prefer full-time employees, although some providers will consider other forms of income, too. Minimum FICO Credit Score If the lender runs a full credit check on you, then you might need to meet a minimum FICO score. A lot of lenders in Minnesota will not approve applications made from bad credit profiles – which covers FICO scores of between 300 and 629. With that said, there is also a small number of no credit check lenders operating in the state. Such lenders will look at other areas of your financial standing, such as your income and history with debt. History With Repaying Debt Minnesota payday loan firms will want to know what your historical relationship with debt is like. Crucially, this will look at whether or not you have previously missed repayments on loans or worse – defaulted. Minnesota Resident and 18+ You will also need to be a resident of Minnesota to get a payday loan and be aged at least 18 years old. State ending laws on payday loans are very strict in this state. As such, if you require a loan of more than $350, or you simply need more time to make your repayments, it might be worth considering an alternative funding source. Personal loans, for example, allow you to borrow much more and over a longer period of time. It is hoped that you now have a firm understanding of the laws surrounding payday loans in Minnesota. In a nutshell, you will not be able to borrow more than $350 from a payday loan in the state, nor can the term exceed 30 days. Moreover, the maximum amount of interest that lenders can charge you is 200% APR. With that said, it is interesting that state legislators did not impose a cap on the number of payday loans you can take out at the same day. For example, there are no laws in place preventing people from taking out multiple payday loans with different lenders. Although the legislation does state that you can’t take out a new loan with the purpose of repaying an outstanding loan, it remains to be seen how state legislators can enforce this. Ultimately, it’s crucial that you have the financial means to repay your payday loan. As such, only take out a payday loan if you are confident you can repay the funds on time. Apply for a Payday Loan Now! | Best Payday Lender 2020 Our Rating Yes, payday loans are legal. However, there are a number of restrictions in place – such as how much you can borrow and for how long. The maximum amount of interest that Minnesota payday loan firms can charge you is 200% APR. The specific amount will also depend on how much you borrow. Payday loan companies operating in Minnesota cannot lend out more than $350. If you need more than this, you’ll need to consider a personal loan. Payday loans cannot be taken out for more than 30 days. You will also be prevented from rolling over the payday loan. Kane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications. WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site. Copyright © 2026 | Learnbonds.com

What are the Laws Surrounding Payday Loans in Minnesota?

Pros and Cons of Payday Loans in Minnesota

Best Online Payday Loan Companies in Minnesota 2020

How to Choose a Payday Loan Lender in Minnesota?

How can I get a Payday Loan in Minnesota Today?

Step 1: Choose a Minnesota Payday Loan Lender

Step 2: Apply Online

Step 3: Review Loan Terms

Step 4: Bank Details and Digital Loan Agreement

Am I Eligible for a Payday Loan in Minnesota?

Alternatives to a Payday Loan

Conclusion

FAQs

Can I apply for a payday loan online if I live in Minnesota?

How much interest can the payday loan companies charge?

How much can I borrow on a payday loan in Minnesota?

How long can I take out a payday loan for?

Kane Pepi