Amscot Loan Review – Read This Before Applying

When you find yourself in a tough financial situation, you can bail yourself out using a payday loan company like Amscot. Wait, before you beat yourself up for being in that position in the first place, we should stress that money can be elusive. And most people, yes, even millionaires find themselves in tight financial positions from time to time.

But before you take the loan, is Amscot a company worth getting in a financial bed with? Are they a scam? Are their loan fees exorbitant? Is the customer support team understanding and quick to respond to queries?

These questions are essential because scam companies hide in the crowd and are notorious for taking advantage of borrowers in their low moments. So to help you answer this and more questions about Amscot, we have compiled a comprehensive guide of everything you should expect from the company.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

What is Amscot?

Amscot was born out of a passion for taking care of clients’ financial needs. This noble course led to the invention of a different new-age financial service company.

The journey started in 1986 when Ian MacKechnie relocated to Tampa, Florida. He ran a small bakery at the time. Not long after that, he noticed that his employees make long queues at local convenient stores to cash in payroll checks. This didn’t sit well with him, and in three years, Amscot (a combination of ‘America and Scotland’) came to life. The company at the time paid homage to the old country with the hope of introducing a new way of doing things.

What started as a small company solving employee problems is now a big company raking in revenues of $220 million and serves over 2.5 million customers. Amscot now offers several services, including cash advances (payday loans), wire transfers, free money orders and check cashing.

The financial services have competitive rates in the industry, and the company is open every day of the week. But though the company has changed over the years, they still insist on offering convenient financial services to borrowers.

Since you are looking for payday loans, Amscot offers loans of between $50 and $500 payable on your next payday. They charge a small fee and an interest to keep the business running and profitable.

And because it was formed back in the 80s, some aspects of the company are still old-school. For instance, borrowers still have to hand in applications and writer postdated checks to cover the loan, fees, and interest on your next payday.

Amscot is a different payday loan company. The application is completed in a physical store, and a check is written for repaying the loan on the next payday. The loan process is more old school than ’21st century’.What are the Pros and Cons of Amscot?

Pros:

- They are open every day – unlike most emergency loan companies, Amscot has not only a website but also physical stores that are open seven days a week. Some stores are open 24 hours. The convenience of the opening hours offers business owners the benefit of last-minute loan applications.

- Multiple payment arrangements – if you cannot pay back the cash on time, you can apply for a grace period or get an extension for the loan. Amscot is a member of the CFSA and therefore has the obligation of offering reasonable payment plans without additional costs. However, Amscot doesn’t have automatic renewals. You need to contact customer support for help.

- It doesn’t negatively affect your credit score – with other same-day loan companies, if you fail to repay the loan 30 days after the loan repayment deadline, the information is updated on US credit bureau websites and it affects your credit score. Though Amscot will not ‘snitch’ on you, they recommend making payments on time and reading through late payment policies before accepting the loan.

- Flexibility – if you change your mind about the loan or find a better source of money after taking the loan, you can return the loan without incurring any fees on the following day.

- The verification fee is lower than the recommendation by the state – Amscot charges $2 for verification. This is way lower than the legal fee limit set by the State of Florida.

Cons:

- Online applications- while you can start the application online, you can’t complete it online. Amscot doesn’t extend online loans. You have to visit a local branch to complete the application process. Because of this process, it means that the customer service you receive and the overall experience you have will affect your decision of taking the loan or not. This could act against the company, especially if the customer support slacks.

- Only available in Florida – unfortunately, Amscot is only available to borrowers living in Florida, the state where the company was born.

- Costly – when you compare Amscot bad credit loans with those by other companies, Amscot payday loans are expensive. Amscot loans attract a verification fee of $2 and a 10% finance charge of the loan amount.

- You need a checking account – if you do not have a bank account, Amscot will not work for you.

- Arbitration agreement – when you sign Amscot’s contract, you are essentially signing away your right to a jury or suing the company in the event of a dispute. But before you freak out, these kinds of conditions are common, and you have signed off on them on your phone or internet plan. They basically limit your recourse if your relationship with the company goes sour.

How Amscot Works

First, Amscot doesn’t check your credit score. It, therefore, offers bad credit loans. This is a plus but, on the other hand, it’s a con because bad credit loans are riskier for the business. As such, Amscot charges high fees for small loan amounts.

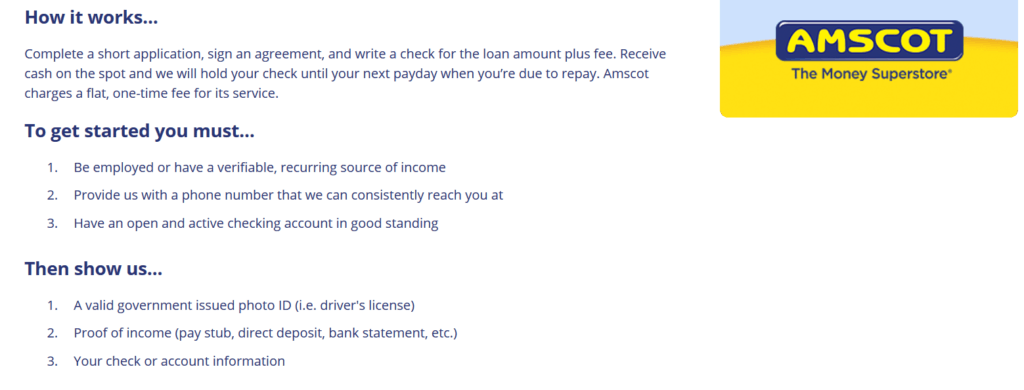

Once you start the application process online, Amscot reviews it in minutes, gets back to you for any questions you might have, and offers more direction on the process. They require you to write a check for the total amount you owe (they will hold onto the check until repayment).

The amount you can get for a loan is dependent on whether it’s your first or subsequent loan. The loan amounts increase with $50 with every subsequent loan to a maximum of $500. If you cannot repay the loan on the due date, request for an extension until your next payday.

Aside from the payday loans (cash advance), Amscot offers several store services including; Money wiring, check cashing, fax services, stamps, copy service, bill pay-services, Amscot prepaid MasterCard, low-fee ATMs.What is the Loan Application Process?

To get started on the cash advance application, visit Amscot’s website. Click on ‘Get Started’ and select your location. If you are outside the US, the page will not pop up. After all, it doesn’t work for those outside Florida.

After, answer several questions and then submit the form. When you finish, a company representative will call you in 20 minutes assuming you apply during business hours (until 9:30 pm). This call is a follow-up and they answer any questions you might have.

You are eligible for the loan if you are;

- Over 18 years

- A Florida resident

- Have a bank account in good standing

- Verifiable recurring source

- A phone number

After the call, visit the nearest Amscot branch and carry the following documents;

- Identification – a Valid government I.D

- Proof of Income – like the latest bank statement and pay stub

- Checkbook – or a bank statement with the information

If everything checks out, you will sign an agreement and write a check for the loan plus 10% of the amount and a $2 verification fee. You will then receive money on the spot, and the check will be held until the next payday when you’ll repay the loan.

But wait, are you sure you want to take a no-credit-check loan? It is true Amscot’s fees are lower than those of most same-day loan companies. But in comparison to traditional loans, they are expensive and can leave you in a vicious debt cycle. Amscot suggests looking for alternatives to payday loans by federal institutions including;

- South Florida Educational Federal Credit Union

- First Coast Federal Credit Union

- FRSA Credit Union

- Compass Financial Federal Credit Union

What Types of Loan Borrowers Get Through Amscot?

Payday loans

Amscot is a company with lots of financial services under one roof. Of all the financial services, the loans offered include but are not limited to payday loans. Payday loans are an example of unsecured loans. The interest rates are higher than that of traditional loans because the company takes a high risk of offering a loan to you without checking your creditworthiness. The maximum loan limit is $500. You can only have a single loan at a time.

These payday loans can be used for anything. The only thing Amscot is concerned about is when you repay the loan. If you can repay the loan on time, they will offer another one almost immediately.

What is the Fee Structure of Amscot?

As aforementioned, Amscot operates under the laws of the state of Florida and those of the federal government. As a company based in Florida, Amscot adheres to strict protection laws In the US. Adherence to the laws means that the company doesn’t go against the cost laws. They are committed to charging a $2 verification fee and not the maximum $5 fee limit specified by the State. In addition to the verification fee, they charge 10% of the loan amount.

For a better perspective on the charges, say you borrow $100. On your next payday, you will pay back a $2 verification fee and $10 for the cash advance. This totals to $112 for 31 days.

What Countries does Amscot Accept?

Currently, Amscot accepts borrowers from Florida. It has not yet spread to other destinations in the country.

Is Amscot’s Customer Support Good?

Customer support is crucial for a company with a business model like Amscot’s. Most payday loan companies thrive on the reputation of their customer support.

Amscot has a team of professional customer support that is praised by many past clients. It responds to calls and queries fast and ensures your needs are met before they move on to the next ticket on the line.

If you have a question not covered in the FAQ section of the website, you can contact support through a toll-free line – 1-800-801-4444.

And if your question is not related payday loans, you can call support on other toll-free numbers including (813) 637-6100. You can also send an email through a couple of different toll-free numbers.

Is Amscot Safe?

Generally, the website is safe, mainly because you don’t have to submit personal information through an online form. Though payday loan websites are kept secure through SSL and encryption technology, nothing beats old-school paper applications.

In addition to this, Amscot is a member of CFSA (the Community Services Association of America) and has a Finance Regulation license in Florida.

With that said, Amscot also warns against creative hackers. They acknowledge that their efforts to keep your details safe are not 100% and advise that you remain on high alert for hackers using creative phishing methods on their website.To protect yourself from such a situation, you should not click links to unsolicited emails or unsolicited answer unsolicited calls. They also warn against logging into another website aside from Amscot’s official website, even if the caller claims to be a representative of the company. Last but not least, don’t give up account information via the phone.

Conclusion

Amscot has several requirements. The fact that it offers payday loans also means that its interest rates are hefty. And if you are not careful, you will find yourself in a vicious debt cycle. Before you apply for a loan, think of what the company offers and compare it to alternative loans. For instance, the government has a couple of cheaper loans that you can take advantage of.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ

How can I find an Amscot location near me?

Go to the official Amscot website and scroll to the ‘Branch Locator’ enter the ZIP code or your city and use the resulting map to find a branch close to your location.

Are all branches open for 24 hours?

No. different branches open for different hours. Some open between 8 am, and 9 pm and others are open all day. Get in touch with the local branch for more details on this.

How do you determine the loan amount?

The amount Amscot offers as a loan depends on your income, how well you repay previous loans, and other financial information you provide. Amscot doesn’t conduct a credit check.

If I have another payday loan with a different company, can I still get one with Amscot?

According to Florida loan laws, you can only have one outstanding loan at a time. If you want to take a payday loan with Amscot, you should repay your current loan or terminate the payday loan your provider offers. After you pay off the loan, you have to wait for 24 hours before another payday loan is processed.

What happens if I change my mind about the payday loan?

Ascot adheres to the CFSA rules and Florida state rules – especially those about rescission. You can rescind your payday loan without incurring extra costs if you return the loan a day after the loan was offered.

Can the loan affect your credit score?

Amscot doesn’t report its clients to credit bureaus in the US. Because of this, it doesn’t affect your credit score. This is a bad thing if you pay your loan on time and would want an important on the credit score.

US Payday Loans A-Z Directory

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

WARNING:

För att använda sidan måste man vara minst 18 år. Om du behöver hjälp eller rådgivning angående spelproblem, vänligen kontakta Stödlinjen.

Vi kan ibland inkludera affiliatelänkar i vårt innehåll. Genom att klicka på dessa länkar kan vi erhålla en provision – utan extra kostnad för dig.

Det är viktigt att notera att innehållet på denna webbplats inte ska betraktas som spelråd. Spel är en spekulativ verksamhet där ditt kapital är i risk. Vi erbjuder denna webbplats gratis, men vi kan få provision från de företag som vi presenterar här.Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up