Best $1,000 Loans – Where to Apply Now?

Are you on the lookout for a $1,000 loan? If so, you’ve got heaps of online lenders to choose from – meaning that you can complete the entire application process from the comfort of your own home. However, with so many lenders now active in the market, knowing which provider to go with is no easy feat.

You also need to think about the type of $1,000 loan that you want to opt for. For example, if you’re happy to repay the funds in-full when you next get paid, you might be best to opt for a payday loan. Alternatively, if you need to stretch the repayment out over a number of months or years – then a personal loan or short-term loan might suffice.

As such, we would suggest reading this guide on How to Get a $1,000 Loan Online. We cover the ins and outs of what you need to know – such as the types of loans on offer, how much you’ll likely pay, how quickly you can get your hands on the funds, and more.

-

-

"}" data-sheets-userformat="{"2":15233,"3":{"1":0},"10":2,"11":0,"12":0,"14":{"1":2,"2":0},"15":"Calibri, sans-serif","16":11}">"}" data-sheets-userformat="{"2":15233,"3":{"1":0},"10":2,"11":0,"12":0,"14":{"1":2,"2":0},"15":"Calibri, sans-serif","16":11}">

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FundsJoy Personal Loans - Best For High Limits

Our Rating

- Borrow Between $200 - $5000

- Approval Time is Exceptional

- Easy Application Process

How do I Get a $1,000 Loan?

Regardless of which loan type you decide to go with, you’ll be able to complete the entire application from your desktop or mobile device. Not only does the process take just a few minutes, but you might receive the funds later in the day. As such, this makes online loan applications ideal if you need to funds super-fast.

Below we have listed the main loan types that can facilitate a $1,000 loan.

$1,000 Payday Loan

If your credit isn’t in the best of shapes, then you might need to consider a payday loan. This is because payday loan companies usually market their products to those with bad credit who have nowhere else to turn. As a result, the interest payments are typically sky-high.

On the flip side, payday loan lenders have a very low eligibility threshold, so credit profiles of all sizes are considered. This includes borrowers that are on a very low income or who have previously defaulted on a loan. Either way, as long as you can prove that you have the financial means to repay the $1,000, you should be suitable for a payday loan.

In some cases, payday loan lenders will limit the amount that you can borrow as a first-time applicant. This is why you need to check the lender’s website before applying, just to make sure that you will be able to borrow the full $1,000. Payday loans are typically credited into your bank account on a same-day basis.

$1,000 Short-Term Loan

If you would prefer to repay your $1,000 loan over a great length of time, it might be worth considering a short-term loan. This loan type typically covers a term of between 1-12 months. Unlike a payday loan, short-term loans are not designed for a specific credit profile. On the contrary, they can suit financial standings of all shapes and sizes.

For example, if you’ve got an ‘excellent’ credit rating and you only need to borrow the $1,000 for a few months, you’ll likely be offered a highly competitive interest rate. Similarly, if your credit profile is less than ideal, lenders will charge you handsomely for a short-term loan. It is important to remember that the longer you take the short-term loan out for, the more you could end up paying in interest. As such, try to keep the loan to the shortest term that you can afford to repay.

In states such as Arizona, Arkansas, Connecticut, Georgia and Maryland, payday loans are no longer illegal. As such, be sure to check whether or not payday loans are allowed in your respective stated before making an application.$1,000 Personal Loan

For those of you that need to borrow the money for a lot longer, then you might need to take out a $1,000 personal loan. These are typically loans of at least 1 year, although some lenders have a higher minimum. Personal loans work much in the same way as a short-term loan. You will need to meet your repayments on the same date of each month, and they will usually be at fixed amounts.

On one hand, personal loans are usually the cheapest loan product in the lending space. However, if you borrow the $1,000 for too long, then you might end up paying a huge amount of interest over the course of the loan. Personal loans usually require you to make your repayments via an electronic debit agreement, meaning that the funds are taken directly from your bank account.

$1,000 Auto Title Loan

An auto title loan is another option available to you. This is where you borrow funds against the value of your car or motorbike. Lenders will base your available loan size on the current market value of the vehicle, up to a certain percentage. For example, if an LTV of 60% is offered, and your car is worth $10,000 – then you would be able to borrow up to $6,000.

In some cases, you might need to opt for an auto title loan if your credit is really bad. This is because the lender will be much more willing to offer you financing if you put an asset up as collateral. Additionally, an auto title loan might also be a wise option if you have a reasonably good credit score. This is because you might be able to get a more favorable interest rate because you’ve put your car up as security.

To assess how much you can borrow against your car or motorbike, simply head over to an auto title loan website and enter your vehicle registration number. Most platforms can give you a quote on the spot.Best Online Loan Providers

Reviewers Choice

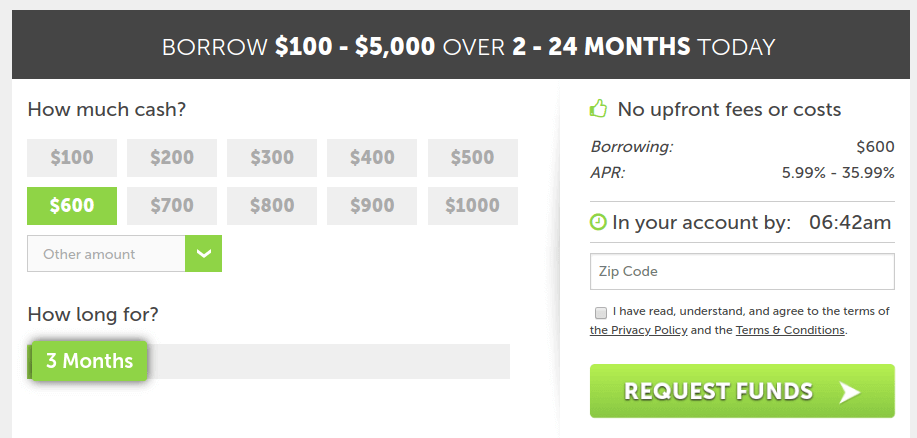

Viva LoansRatingAvailable Loan Amount$100 - $5,000Available Term Length3 monthsRepresentative APR5.99% to 35.99%Product Details- Appeals most to individuals looking for fast loan processing

Pros- Considers all types of credits in loan processing

- Available throughout the country

- Low interest rate to high credit score borrowers

- Hard inquiry may hurt your score

Key Facts- Fast loan application and approval process

- Highly responsive customer support

- Connects borrowers to a wide range of lenders

Loan SoloRatingAvailable Loan Amount$100 - $1,000Available Term Length6 - 9MonthsRepresentative APR200% - 2290%Product Details- Best for on-phone payday loan application processing

Pros- The huge number of lenders increases your chances of qualifying for a loan

- Fast application processing with next business day disbursement

- Maintains competitive loan interest rates

- Maintains a relatively low maximum loan limit - $1,000

- Some lenders will pull out your credit report

Key Facts- Specializes in different types of loans – including payday loans

- Matches your loan request with numerous low-credit lenders

- Processes both online and on-phone loan applications

Extra lendRatingAvailable Loan Amount$100 - $ 3,000Available Term Length6 months - 2 yearsRepresentative APR4.99% - 1386%Product Details- Best for the protection of the borrower’s persona information

Pros- Borrowers with relatively attractive credit scores benefit from competitive loan APRs

- It’s a loans marketplace and thus higher chances of qualifying for a loan

- Most lenders will only conduct a soft check of your credit history

- Huge loan amounts and competitive interest only available to good credit borrowers

- One may consider the $3,000 loan limit quite low

Key Facts- Specializes in advancing installment loans

- Fast loan application and processing with next business day funding

- Lends to all borrowers regardless of the credit score

CashUSA.comRatingAvailable Loan Amount$500 - $10,000Available Term Length6 monthsRepresentative APR5.99% to 35.99%Product Details- Best for borrowers looking to boost their success rate by seeking loans from numerous lenders

Pros- High number of lenders increases your chances of succeeding

- Advances high loan limits – up to $10,000

- Encourages extended repayment periods – up to 5 years

- Not a lender but an intermediary

Key Facts- Fast loan approval and processing times – 48hours

- Lends to all types of credit borrowers

- Easy to use interface

My credit advanceRatingAvailable Loan Amount$ 100 - $ 5,000Available Term LengthVaries with the lenderRepresentative APR4.99% - 1386%Product Details- Best personal loans specialist

Pros- Helps you rebuild your credit report by reporting repayment progress to reference bureaus

- Advances high loan limits of up to $5,000 to borrowers with attractive credit scores

- Presents your loan application to a wide range of lenders

- Its hard to qualify for high loan limits and competitive interests

- Fines borrowers for late payments

Key Facts- Lends to all regardless of credit score if they earn a minimum $1,000 per months

- Maintains relatively fast loan application and funds disbursement process – within 24 hours

- Wholly online loan application and e-signing processes

Am I Eligible for a $1,000 Loan?

Wondering whether or not you are eligible for a $1,000 loan online? Well, this will depend on a full range of factors. At the forefront of this is the strength of your credit profile, as well as your overall affordability levels. With that said, some lenders will allow you to apply on a no credit check basis, which is ideal if you’re in possession of a bad credit profile.

Here’s what lenders will look at when assessing your application for a $1,000 loan:

FICO Score

In the vast majority of cases, lenders will need to run a credit check on you to assess your eligibility for a $1,000 loan. Some lenders will initially execute this as a soft credit check. This means that regardless of whether or not you are approved, the application won’t be posted to your credit report. If a hard inquiry takes place, then this will appear on your file. Crucially, some lenders will stipulate a minimum FICO credit score for you to be eligible.

Income

In order to assess whether or not you have the financial means to repay your $1,000 loan, lenders will need some information on your income. For example, they’ll look at how much you earn after tax, how long you’ve been with your current employer, and the frequency in which you receive your salary. Most lenders will ask for a minimum monthly income amount, although this will vary from provider-to-provider.

Affordability

On top of your monthly income, lenders will need to assess your affordability. This places a strong focus on how much you spend each month on key expenses. This will include the likes of gas, utilities, and your monthly rent or mortgage payments.

The lender will then need to assess your debt-to-income ratio. This is the amount of debt that you currently have outstanding in relation to your income. If the ratio is too high, then you might get rejected for a $1,000 loan.

Security

As we briefly discussed above, you might have the option of taking out a $1,000 loan via an auto title loan. If your credit isn’t too damaged, this might allow you to reduce the APR rates on the loan. However, in some cases putting up security will be a requirement as opposed to an option. If it is, you might need to put your car or motorbike up as collateral to get the loan.

US Resident and Aged 18+

You will need to be a US resident or US citizen living overseas to get a $500 loan. You’ll also need to be aged at least 18 years old, although some states are higher.

How Does the $1,000 Loan Process Work?

Looking to get a $1,000 loan arranged today? If so, we’ve outlined the general step-by-step process that you will need to follow.

Step 1: Choose a Loan Type

Your first port of call will be to assess the type of loan that best fits your needs. As we noted earlier, the cheapest loans are offered to those with an excellent credit rating. If this sounds like you, then your best option might be a short-term loan, as a number of lenders specialize exclusively in healthy credit profiles. On the contrary, if your credit score falls within the ‘poor’ or ‘bad’ range, then you might need to go with a payday loan.

Step 2: Choose an Online Loan Provider

Once you’ve chosen the loan type, you then need to find an online lender. You’ll need to look at a range of variables, such as how much the lender offers, loan terms, eligibility, and crucially, the interest. Although you won’t know how much you’ll pay on the loan until you actually apply, it’s always worth checking the published representative rate.

Alternatively, it’s also worth using a loan comparison platform that gives you access to hundreds of lenders at a click of a button. As most platforms allow you to search on a soft credit check basis, you can find out your rates without it impacting your credit score.

Step 3: Apply Online

Once you have identified a lender that meets your needs, you can begin the $1,000 loan application. You’ll need to head over to the lender’s homepage, enter $1,000 as the loan amount, and then choose how long you want to borrow the funds for. Next, you’ll then be asked some personal information so the lender knows who you are.

This will include your:

- Full Name

- Home Address

- Date of Birth

- Social Security Number

- Government-ID Number

- Contact Details

You’ll also need to supply information about your income. This will include:

- Annual Salary

- Name and Address of Employer

- Time at Current Employer

Step 4: Review Loan Terms

Once you’ve entered your personal information and employment details, the lender will then run a credit check on you. If it’s a soft inquiry, this means that the search won’t be posted to your credit file. The lender will also cross-reference your details with third-party sources, which it needs to do to verify your identity. If everything can be validated electronically, you’ll receive a decision within less than a minute.

If you are approved for a $1,000 loan, you’ll get to view your loan offer on-screen. This covers your APR rate and what your repayments will amount to. If you’re happy to proceed, move on to the final step.

Even if you are using a no credit check lender, the provider will still need to verify your information. In some cases, it might do this with companies that fall outside of the main three credit bureaus. You’ll likely need to upload some supporting documentation too – such as recent payslips and a bank statement.Step 5: Set-Up Bank Details and Electronic Debt Agreement

You will now be asked to enter your bank account details. This is for two reasons. Firstly, this is the account that your $1,000 loan funds will be paid in to. Secondly, it’s like that this is where the lender will take your monthly repayments. If it does, it will ask you to set up an electronic debit agreement. Finally, you will need to read through the digital loan agreement.

Take as much time as you need here, as it’s crucial you look for any hidden fees that may have been inserted into the agreement. If you’re happy with the terms, sign the digital loan agreement to complete the process. In most cases, your $1,000 loan will be funded the next day, although it could be sooner if you were approved in the morning.

What to Consider When Choosing a Lender?

- Interest Rates

- Eligibility

- Minimum and Maximum Loan Term

- Origination Fees

- Late Payment Policy

Conclusion

If you’ve read through our guide all of the way through, you should now have a firm understanding of how to apply for a $1,000 loan online. Whether you’re looking to go the payday loan route – or borrow the funds via a personal loan, everything can be completed from the comfort of your own home. In most cases, the lender will be able to give you a decision in less than a minute. If you are approved on the spot, you could receive your $1,000 later that day.

However, you still need to make some serious considerations regarding the interest on your loan. This is especially the case if your credit profile is less than ideal and you are forced to use a bad credit lender. The good news is that state lending laws typically limit the amount of interest and fees that loan providers can charge. Ultimately, just make sure that you can afford the repayments before taking out a $1,000 loan. Failure to do so could lead to further financial difficulties.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQs

How much interest will I pay on a $1,000 loan?

This can vary widely depending on a number of factors. For example, if you’ve got an excellent credit profile, alongside a good financial standing and income, then you’ll benefit from rock-bottom rates. At the other end of the spectrum, you’ll pay an extortionate amount of interest if you’re forced to use a payday lender because of bad credit.

What credit profile do I need to get a $1,000 loan?

$1,000 loans are available to credit profiles of all shapes and sizes. As such, you’ll likely find a lender even if you’ve got bad credit.

How long does it take to apply for a $1,000 loan?

Filling out the application form online should take no more than a few minutes. If your information is verified on the spot, you should get an instant decision from the lender.

What is the cheapest way to get a $1,000 loan?

The cheapest option available to you is going to be a short-term loan from a lender that charges competitive interest.

How long can I take out a $1,000 loan for?

This is completely up to you. The shortest loan term comes via a payday loan, and will require you to repay the funds when you next get paid. If you need much longer, personal loans allow you to make your repayments over a number of years.

What documents will I need to provide to get a $1,000 loan?

You might not need to provide any documents if the lender can verify your identity electronically. If it can’t, then you might be asked for payslips, bank statements, and/or a proof of identity.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

If you would prefer to repay your $1,000 loan over a great length of time, it might be worth considering a

If you would prefer to repay your $1,000 loan over a great length of time, it might be worth considering a

An auto title loan is another option available to you. This is where you borrow funds against the value of your car or motorbike. Lenders will base your available loan size on the current market value of the vehicle, up to a certain percentage. For example, if an LTV of 60% is offered, and your car is worth $10,000 – then you would be able to borrow up to $6,000.

An auto title loan is another option available to you. This is where you borrow funds against the value of your car or motorbike. Lenders will base your available loan size on the current market value of the vehicle, up to a certain percentage. For example, if an LTV of 60% is offered, and your car is worth $10,000 – then you would be able to borrow up to $6,000. Reviewers Choice

Reviewers Choice